Three dairy producers. One expanded. One optimized. One sold. All three are winning. Here’s why your path matters more than your size.

EXECUTIVE SUMMARY: A perfect storm is reshaping dairy: heifer inventory at historic lows (3.9M—lowest since 1978), processors desperately seeking milk with $150K+ annual premiums, and global production hitting environmental and biological walls. This convergence creates an 18-month window in which your decision determines whether you thrive, survive, or exit by 2030. Three proven paths exist: strategic expansion ($3.5-4M investment yielding up to $731K annually), optimization without debt ($200-300K profit improvements), or planned exit (preserving $400-680K more wealth than distressed sales). The window is real—processor premiums evaporate after 18 months, and with heifers requiring 30 months from birth to production, today’s decisions lock in your 2027-2028 position. Your farm’s future isn’t determined by size or history, but by making the right choice for YOUR situation in the next 90 days.

You know that feeling when you’re at the co-op meeting and everyone’s dancing around the same question? “Is something big happening here, or is this just another cycle?” Well, here’s what’s interesting—I think we’re all sensing the same thing because this time actually is different.

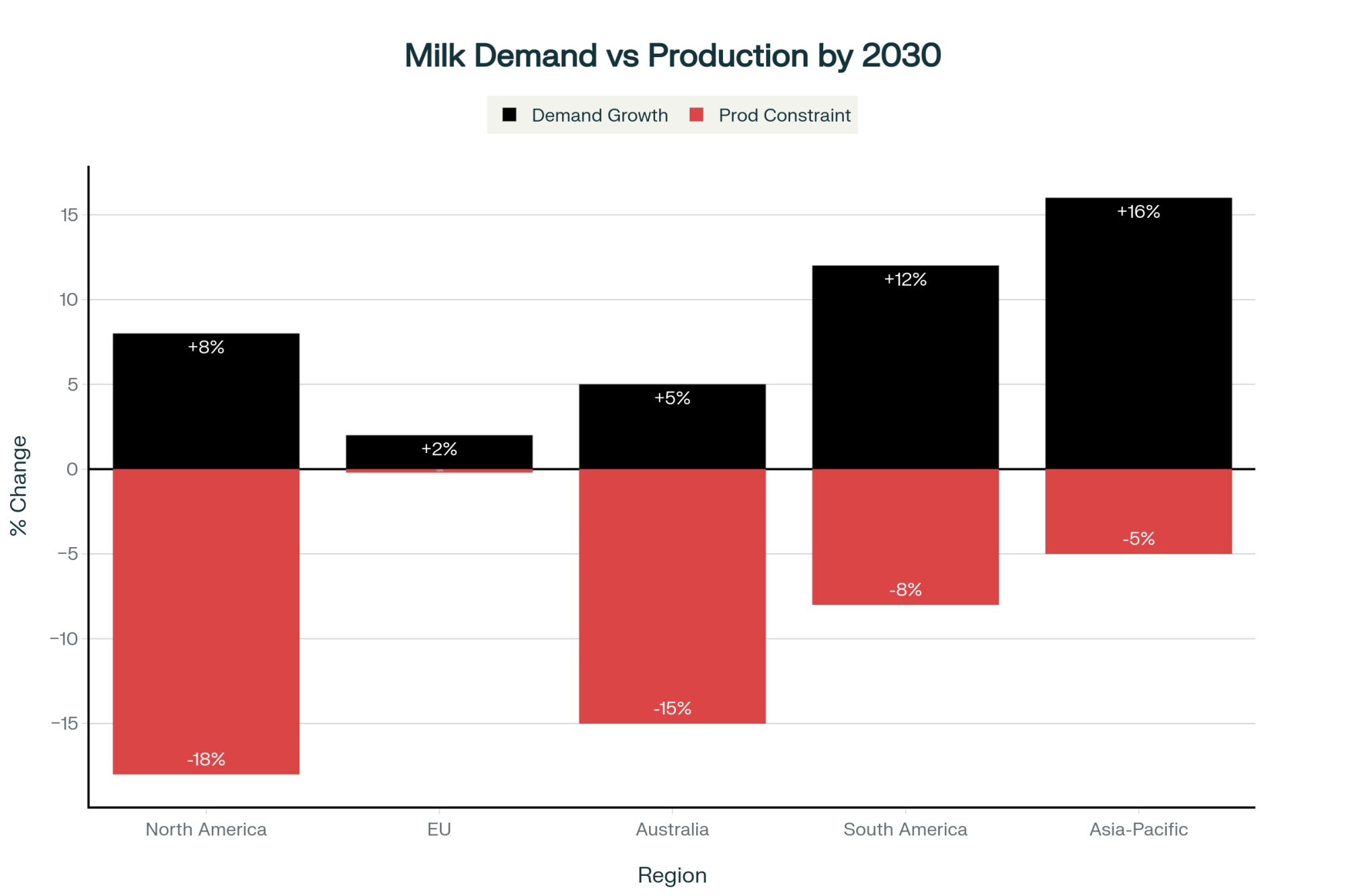

What I’ve found in the data lately is that we’re not seeing the typical supply hiccup or price swing. The International Farm Comparison Network released its projection last October, showing a 6 million tonne global milk shortage by 2030. Now, the International Dairy Federation? They’re suggesting it could hit 30 million tonnes. Even if we land somewhere in the middle… well, that’s not just a shortage. That’s a structural shift.

What’s Actually Driving This Supply Crunch

So here’s where it gets really interesting, and it’s the combination that matters.

The FAO and OECD put out their Agricultural Outlook last July—2024, not this year—showing global milk demand climbing by 140 to 208 million tonnes by 2030. We’re adding another 1.5 billion people to the planet, but what caught my attention is this: per capita consumption is jumping by 16% as developing regions gain purchasing power. Southeast Asia alone—according to IFCN’s April analysis—will command 37% of total global milk demand. I mean, think about that for a minute.

But production? That’s where things get complicated.

I was talking with a Wisconsin extension specialist last week, and she nailed it: “We’re watching three major dairy regions hit walls at the same time, and they’re different walls.” She’s absolutely right. DairyNZ’s latest statistics show New Zealand’s dairy cattle numbers dropped from 5.02 million back in 2014/15 to 4.70 million last year. The EU Commission’s December forecast? Milk production is declining by 0.2% this year, with growth capped at just 0.5% annually through 2031. That’s their greenhouse gas reduction targets at work, and those aren’t going away.

And then there’s our heifer situation here in North America—honestly, this one really concerns me.

The Heifer Shortage That’s Reshaping Everything

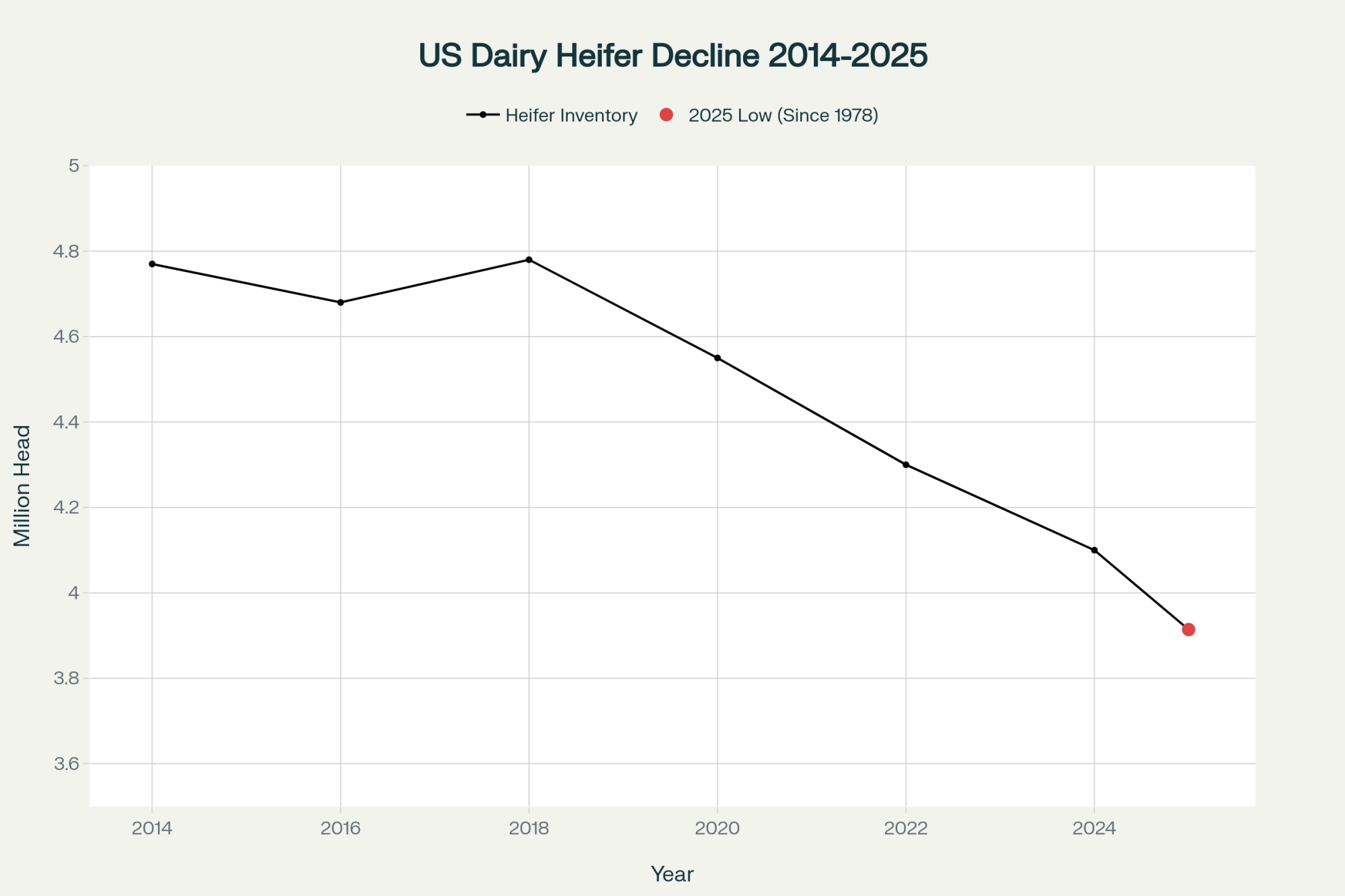

The USDA’s January Cattle report came out showing U.S. dairy heifer inventory at 3.914 million head. You know what that is? The lowest since 1978. We’re down 18% from 2018 levels.

CoBank’s research team published some sobering analysis in August—they’re projecting we’ll lose another 800,000 head over the next two years before we see any recovery. Think about that. We’re already at historic lows, and we’re going lower.

What’s driving this? Well, the National Association of Animal Breeders’ data shows beef-on-dairy breeding hit 7.9 million units in 2024. That trend alone—just that one factor—created nearly 400,000 fewer dairy heifers in 2025. Every beef-on-dairy calf born today is a heifer that won’t be entering your neighbor’s milking string in 30 months.

Dr. Jeffrey Bewley from Kentucky’s dairy extension program explained it perfectly when we talked last month: “The pipeline is essentially fixed for the next 30 months. It takes 24-30 months from birth to first lactation. The calves being born today won’t produce milk until 2027-2028, and we’re simply not producing enough of them.”

You’re probably already seeing this in heifer prices. The USDA’s Agricultural Marketing Service data from February showed prices running $2,660 to $3,640 per head—up 29% year-over-year. A Vermont producer told me last week he’s paying $4,000 for quality bred heifers… when he can find them. California operations? Some out there can’t source adequate replacements at any price. This dairy heifer shortage in 2025 is fundamentally different from past cycles.

Processing Expansion Creates Time-Limited Opportunities

Here’s a development that’s really worth watching, especially if you’re within reasonable hauling distance of new facilities.

The dairy processing sector is investing billions—we’re talking serious money—in dozens of new and expanded plants across the country. The International Dairy Foods Association has been tracking these milk processing expansion opportunities, and what fascinates me is how predictable processor behavior has become.

The University of Wisconsin’s Center for Dairy Profitability documented this pattern, and it’s remarkably consistent. In that first year after a facility announces expansion? They’re hungry for milk—offering premiums of $1.50 to $2.50 per hundredweight. But here’s what happens: by months 13 through 18, when they’ve locked in about 60-70% of what they need, those premiums drop to maybe $0.75 to $1.25. After 18 months? Standard market pricing.

Mark Stephenson from UW-Madison’s Dairy Policy Analysis program put it well: “We’re seeing farms within 75 miles of new facilities locking in bonuses worth $150,000 or more annually for a 500-cow dairy. But that opportunity has an expiration date. Once processors hit about 70-80% of their target volume, the welcome mat stays out, but the red carpet gets rolled up.”

I’ve seen this play out in Wisconsin, Pennsylvania, Idaho… same pattern everywhere. And what’s happening in Europe and Australia right now? Similar dynamics—processors scrambling for supply in tight markets, then becoming selective once they’ve secured their base needs.

Three Strategic Paths Forward

What’s fascinating to me—and I’ve been talking to producers all over—is how clearly folks are sorting themselves into three camps. Each one makes sense depending on where you’re at.

Strategic Expansion for Positioned Operations

Operations taking this route generally have strong balance sheets—we’re talking debt-to-equity ratios under 0.50. They’ve got established management systems, often with a clear succession plan in place.

Current construction costs? You’re looking at $3.5 to $4.0 million for a 500-to-1,000 cow expansion, based on what I’m hearing from contractors and extension budgets. Freestall construction alone runs $3,000 to $3,500 per stall. And financing… well, at 7-8% interest, that changes everything compared to three years ago.

A Pennsylvania producer expanding from 450 to 900 cows walked me through his thinking: “With milk projected at $21-23 per hundredweight through next year and geographic premiums adding another buck-fifty, we’re looking at $731,250 in additional annual income. Yeah, the interest rates hurt—we’re paying $840,000 more over the loan term than we would’ve three years ago. But we think the opportunity justifies it.”

Benchmarking suggests you need breakevens below $18 per hundredweight to weather potential downturns. That’s a narrow margin for error.

But here’s something worth noting—smaller operations aren’t necessarily excluded from expansion opportunities. I know a 150-cow operation in Ohio that’s adding just 50 cows, focusing on maximizing components and securing a local processor contract. Sometimes expansion doesn’t mean going big—it means going strategic.

Optimization Without Expansion of Debt

Now, this is where things get interesting for many operations. Dr. Mike Hutjens—he’s emeritus from Illinois but still consulting—has been documenting some impressive results.

Component optimization through precision nutrition, which typically costs $15-25 per cow per month, can generate $75 per cow annually just by improving butterfat and protein levels. Reproductive efficiency improvements? Those are yielding $150 in annual benefits per cow. And here’s one that surprised me: extending average lactations from 2.8 to 3.4 adds about $300 per cow in lifetime value.

“We’re documenting operations improving net income by $200,000 to $300,000 annually through systematic optimization,” Hutjens comments. “For producers who don’t want additional debt or can’t expand due to land constraints, this approach offers substantial returns.”

I’m seeing this work particularly well for operations in areas where expansion just isn’t feasible—whether due to land prices, environmental regulations, or personal preference. With this summer’s heat-stress issues reminding us of the importance of cow comfort and fresh cow management, there’s real money in getting the basics right.

For smaller herds—say, under 200 cows—optimization might be your best bet. Focus on what you control: breeding decisions, feed quality, cow comfort. One 120-cow operation in Vermont improved their net income by $85,000 annually just through better reproduction and component management. No debt, no expansion stress, just better management of what they already had.

Strategic Transition While Values Hold

This is the conversation nobody wants to have at the coffee shop, but it needs to be part of the discussion.

Cornell’s Dyson School research shows that well-planned transitions preserve $400,000 to $680,000 more wealth compared to distressed sales. That’s real money—generational wealth we’re talking about.

A farm transition specialist I know in Wisconsin—he’s been doing this for 30 years—shared something that stuck with me: “Strategic transition isn’t giving up. It’s maximizing value for the family’s future. I’m working with a 62-year-old producer right now, with no identified successor. If he transitions in 2026, he preserves about $2.1 million in equity. If he waits, hopes things improve, maybe faces forced liquidation in 2028? We’re looking at maybe $1.2 million.”

For our Canadian friends, it’s a different calculation. Ontario’s quota exchange is showing values around $24,000 per kilogram of butterfat. That’s substantial equity tied up in quota that needs careful planning to preserve.

The Human Side We Can’t Ignore

I need to bring up something we don’t talk about enough—the mental and emotional toll of these decisions.

A University of Guelph study from last year found that 76% of farmers experienced moderate to high stress levels. Dairy producers? We’re showing some of the highest rates. This isn’t just about personal wellbeing—though that matters enormously. Research in agricultural safety journals shows that chronic stress directly impacts decision-making quality. Poor decisions made under stress can affect operations for years.

A Minnesota producer was remarkably honest with me recently: “The weight of these decisions—expansion, optimization, or transition—it affects the whole family. Having someone to talk to, someone outside the immediate situation, has been invaluable.”

The Iowa Concern Line—that’s 1-800-447-1985—expanded nationally this year. Organizations like Farm State of Mind provide crucial support. Using these resources isn’t a weakness—it’s smart business. You wouldn’t run a tractor with a blown hydraulic line, right? Why run your operation when your decision-making capacity is compromised?

Risk Management in Uncertain Times

Now, I’d be doing you a disservice if I didn’t acknowledge what could go wrong with this thesis.

A severe recession? It’s possible, though the Federal Reserve currently puts the probability of a 2008-level event pretty low—less than 15%. Technology breakthroughs in genetics or reproduction could accelerate supply response, but biological systems don’t change overnight. We’ve been improving sexed semen for 15 years—sudden miraculous breakthroughs seem unlikely. Environmental policy reversals? Given current trajectories in the EU and New Zealand, I wouldn’t count on it.

And here’s something we haven’t talked about enough—feed price volatility. As many of you know, grain markets have been all over the map lately. USDA projections show significant price variability ahead for both corn and soybean meal over the next 18 months. These aren’t small moves. A dollar change in corn prices can shift your cost of production by $1.50 to $2.00 per hundredweight, depending on your feeding program. That’s why managing feed costs remains critical to any strategy you choose.

Smart producers are hedging their bets. The Dairy Margin Coverage program lets you lock in $9.50 or higher income-over-feed-cost margins for most of your production—and that “feed cost” component is key here. When feed prices spike, DMC payments help offset the pain. University of Minnesota Extension shows diversifying through beef-on-dairy programs adds $4-5 per hundredweight in supplemental revenue. These aren’t huge numbers individually, but together they provide meaningful buffers against both milk price drops and feed cost spikes.

And let’s not forget weather impacts—the drought conditions we’ve seen in parts of the Midwest and the heat-stress challenges—are adding another layer of complexity to these decisions. Climate variability isn’t going away, and it directly affects both production and feed costs.

Your 90-Day Action Framework

After talking with dozens of producers and advisors, here’s the framework that seems to resonate:

Weeks 1-2: Pull your real numbers. Not what you think they are—what they actually are. Calculate your true production costs, debt ratios, and stress-test at $16 milk for 18 months. If your breakeven’s above $20 or debt-to-equity exceeds 0.80, expansion probably isn’t your path.

Weeks 3-4: Map your market position. Meet with every processor within 150 miles. Understand which contracts are available and which premiums exist. Geography matters more than ever in this market.

Weeks 5-6: Have the succession conversation. I know—it’s uncomfortable. But if you’re over 50 without a clear successor, a strategic transition might preserve more wealth than holding on indefinitely.

Weeks 7-8: Determine actual borrowing capacity. Today’s 7-8% rates are a world apart from those of three years ago. Know your real numbers before making commitments.

Weeks 9-10: Make your choice—expansion, optimization, or transition—based on data, not emotion or tradition. This is where the rubber meets the road.

Weeks 11-12: Start executing. Delays mean missing opportunities and facing higher costs down the line.

The Global Context and What’s Ahead

What strikes me most is how this moment accelerates trends we’ve been watching for years. Industry consolidation? That’s mathematical reality. Hoard’s Dairyman’s October analysis suggests 25-40% of current operations will transition by 2030. That’s sobering… but it also creates opportunities for those positioned to capture them.

Looking globally, we’re seeing similar patterns in Australia with their drought recovery challenges, in Europe with environmental constraints, and in South America with infrastructure limitations. This isn’t just a North American phenomenon—it’s a global realignment of dairy production and consumption patterns.

A colleague at Penn State Extension said something that resonates: “Success won’t necessarily correlate with size or history. It’ll favor those who accurately assess their position and act decisively within this window.”

The 18-month timeframe isn’t arbitrary—it reflects the convergence of heifer biology, processor contracting patterns, and construction cost trajectories already in motion. While heifer availability remains fixed for 30 months ahead, the processor premium window closes in 18 months, making that the more urgent decision-making timeline. Multiple paths can succeed, but each requires honest assessment and willingness to act on that understanding.

For an industry built on multi-generational commitment and remarkable resilience, this period calls for something additional: recognizing when adaptation is necessary and positioning thoughtfully for what comes next.

Whether through expansion, optimization, or transition, the key is making intentional choices aligned with your operational realities and family goals. The decisions ahead aren’t easy—they never are. But as we’ve seen throughout dairy’s history, producers who engage thoughtfully with change, rather than hoping it passes, tend to find sustainable paths forward.

And that, ultimately, is what this is all about—finding your path forward in a changing landscape. The opportunity is real, the challenges are significant, and the window for decisive action is open… but not indefinitely.

KEY TAKEAWAYS:

- The 18-month window is biology meeting economics: Heifers at 3.9M (lowest since ’78) + 30-month production lag + processors desperately needing milk NOW = your decision window

- Three strategies, all winners: Expand if you’re positioned ($3.5M investment → $731K annual returns) | Optimize what you have ($200-300K profit, no debt) | Exit strategically ($680K more than waiting)

- Your report card determines your path: Breakeven under $18/cwt ✓ | Debt-to-equity under 0.50 ✓ | Clear succession ✓ = expand. Missing any? Optimize or exit.

- Location drives premiums: New processing within 75 miles = $150K+ annual bonus, but these premiums evaporate after 18 months—first come, first served

- The 90-day sprint: Weeks 1-2: Pull real numbers | Weeks 3-4: Map processor contracts | Weeks 5-6: Succession reality check | Weeks 7-12: Commit and execute

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Building a Beef-on-Dairy System: Capturing $360,000 in Annual Farm Profit – Reveals how dairy farms are transforming the heifer shortage challenge into opportunity by leveraging beef genetics, with breeding jumping from 50K to 3.2M head and boosting calf revenue from 2% to nearly 6% of total farm income.

- Pick Your Lane or Perish: The 18-Month Ultimatum Facing 800-1,500 Cow Dairies – Demonstrates why October’s $2.47 Class spread proves mid-size operations must choose between commodity and premium markets immediately, providing strategic frameworks for operations caught in the consolidation squeeze.

- 2,800 Dairy Farms Will Close This Year—Here’s the 3-Path Survival Guide for the Rest – Provides tactical roadmaps for navigating industry consolidation, offering specific survival strategies and financial benchmarks that complement your 90-day decision framework with tested approaches from operations that successfully transitioned.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!