Dean Foods: Gone. Borden: Gone. Your local processor: Probably next. What every dairy farmer needs to know about 2026

EXECUTIVE SUMMARY: While Santiago’s dairy leaders celebrate a coming 20-million-ton shortage, 83.5% of farm kids are walking away from free operations—and the math explains why. Operating costs rising 3% annually, sustainability compliance accelerating ensus of Agriculture came out in5% yearly, but milk prices growing just 1% means that a $900,000 net income becomes a $540,000 net income within a decade. Add $54,750 for methane additives, processor consolidation, and operations requiring 1,260 cows just to reach the median scale, and the structural disadvantages are clear. Dean Foods and Borden’s bankruptcies preview the consolidation ahead in the processor industry, leaving producers with fewer buyers and less negotiating power. The next 24 months will determine whether you scale big, pivot to premium, or preserve wealth through a strategic exit—because waiting costs thousands in annual retirement income.

You know that feeling when milk prices hit $22.60 per hundredweight and everyone starts talking expansion?

Let’s talk about what really came out of Santiago this week.

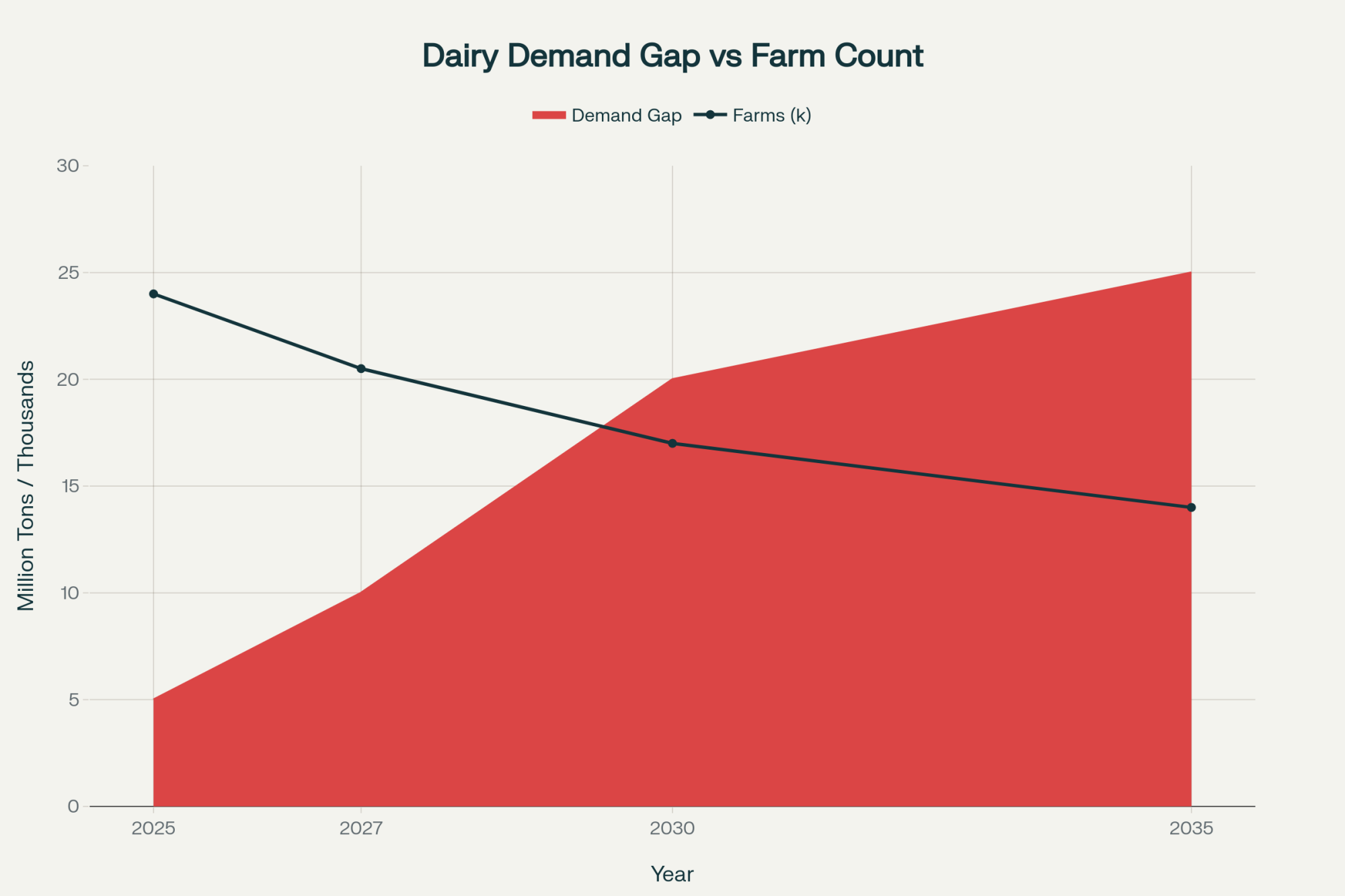

The International Dairy Federation is holding its World Dairy Summit this week—the first time in South America in 123 years—which is noteworthy, and the projections deserve a closer look. They’re talking about a 20-30 million ton global demand gap by 2035. IDF President Gilles Froment kept emphasizing “authentic collaboration” during his keynote, and that’s all well and good, but here’s what’s interesting…

When you examine these numbers alongside what’s actually happening on farms—I’ve been talking with producers from Vermont to California—some patterns emerge that suggest certain operations are going to capture value while others might struggle. These deserve a closer look.

And it’s not necessarily about who’s the better farmer.

The Demand Gap: Real Opportunity or Something Else?

So this 20-30 million ton shortage everyone’s excited about—IDF’s analysis backs it up, USDA shows 11% consumption growth through 2030, and yeah, the demand’s real.

But here’s the thing: where’s the production going to come from?

Current production reality:

- U.S. milk production: growing at just 0.9% annually (you’ve probably seen the NASS reports)

- Europe: basically flat (Brussels keeps confirming this)

- New Zealand: hitting environmental limits (their Ministry’s been pretty clear about that)

Even with the USDA predicting a milk price of $22.60, with room to grow, who actually benefits here isn’t as straightforward as you’d think.

Consider what DFA’s been doing. They marketed 65.5 billion pounds in 2021—that’s about 29% of all U.S. milk according to their annual reports. When you control processing, ingredients, export channels… you’re capturing value at every step.

Meanwhile, if you’re an independent producer shipping to whoever takes your milk that week, it’s a different game entirely.

And here’s something that really caught my attention: the Class III versus Class IV spread is $2.86 right now—widest we’ve seen since 2011 according to AMS data.

You know what that means? If you’re shipping to cheese plants in Wisconsin, you’re banking thousands more monthlythan your cousin in California selling to butter-powder operations. Same cows, same feed quality, same parlor management… but processor relationships determine who’s making money.

That’s not exactly what they teach in dairy science programs, is it?

Sustainability Costs: The Bill’s Coming Due

The Paris Declaration on Dairy Sustainability—signed by 53 countries, representing 46% of global production—changed the conversation from “wouldn’t it be nice” to “here’s your compliance timeline.”

And the costs… well, let me walk you through what producers are actually facing.

Bovaer methane additives: DSM’s been transparent about pricing at about $0.30 per cow per day. For 500 cows, that’s $54,750 annually. Just for the additive, nothing else.

Thinking about digesters? European Joint Research Centre research puts installation between €250,000-€275,000, and here’s what nobody mentions—you need about 35-40 kilowatt hours per kilogram of nitrogen for processing, which means solar panels or you’re burning through your savings on electricity.

Ben & Jerry’s ran this pilot with seven Vermont farms—the smallest had 60 cows, the biggest just under 1,000. They got 16% emissions reduction, which sounds great until you realize the company paid for everything. Staff time, equipment upgrades, robotic feed pushers… their published report basically says farmers can’t afford this without support.

At least they’re honest about it.

Now, California’s doing something interesting. Their dairy methane program—the Air Resources Board tracks this closely—has achieved impressive results:

- 5 million tons of CO₂ equivalent are reduced annually

- $522 million in private investment since 2022

- $9 per ton cost-effectiveness (beats other climate tech by 10-60 times)

But here’s why it works: programs like the Low Carbon Fuel Standard create actual revenue from methane reduction. You’re not just spending money; you’re making it.

Most states? They don’t have anything close. I’ve been talking with producers in Ohio, Texas, Iowa, and even Wisconsin, outside the renewable natural gas corridor. They’re staring at these costs with no revenue offset.

And California’s got its own challenges—SGMA water compliance is brutal. Some producers I know are converting to solar at a rate of $800-$ 1,200 per acre annually. Beats volatile feed margins when water’s scarce, though.

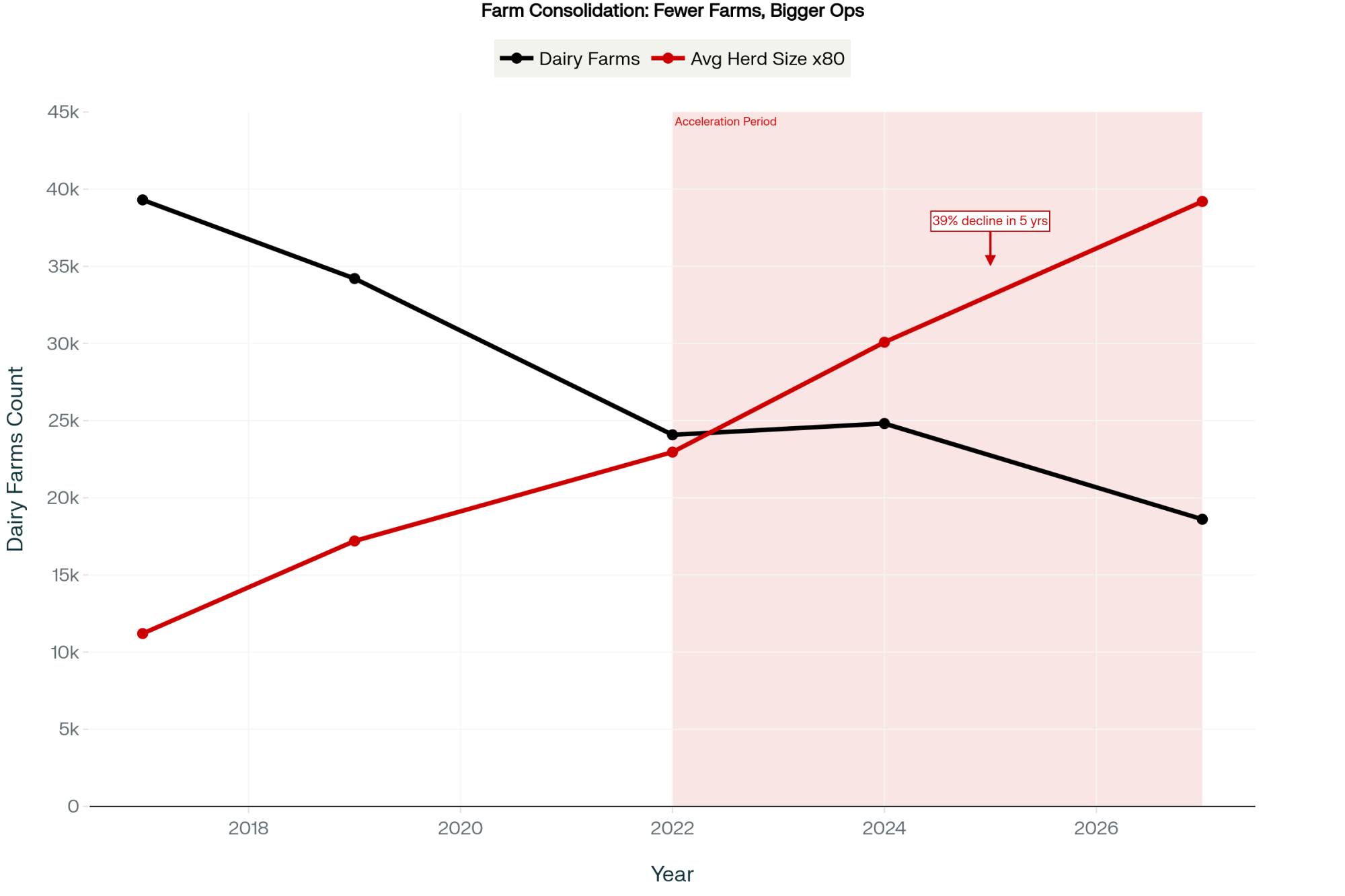

Consolidation: The Numbers Tell the Story

USDA’s Census of Agriculture came out in February, and the numbers are sobering.

The stark reality:

- 2022: 24,013 dairy operations (down 39% from 2017)

- Since 2012: 50% of farms have gone in a decade

- Rabobank projection: Another 20-25% decline by 2027

But here’s what really tells the story—look at where the milk’s coming from according to USDA’s Economic Research Service:

Operations over 1,000 cows:

- Now: Control 65% of the herd

- 1997: Just 17%

Farms under 100 cows:

- Now: 7% of production

- 1997: 39%

Midpoint herd size:

- 2021: 1,260 cows

- 2000: 180 cows

| Herd Size | Cost/cwt | Profit at $22.60 |

|---|---|---|

| 100-199 | $23.06 | -$0.46 |

| 500 | $20.25 | $2.35 |

| 1,000 | $18.50 | $4.10 |

| 2,500+ | $13.06 | $9.54 |

And it’s not just about bulk feed purchases or spreading fixed costs, as many of us have seen. What I’m finding—especially visiting Wisconsin operations lately—is revenue diversification that smaller farms struggle to match.

These bigger operations are breeding 60% or more of their herds to Angus bulls. With beef crosses bringing $800-1,200 versus maybe $150 for dairy bulls, a 2,900-cow operation can generate millions extra annually just from calves.

Add in what they’re doing with:

- Genetics sales internationally

- Digester partnerships (companies like Vanguard Renewables)

- Commercial grain operations on thousands of acres

It’s a completely different business model, honestly.

A 600-cow operation—and I know plenty of excellent managers at that scale—generally can’t tap those revenue streams. You don’t have the volume for direct feedlot contracts, digesters don’t pencil out, and international genetics buyers aren’t calling.

It’s not about management quality; it’s structural advantages that kick in above certain thresholds.

Why the Next Generation’s Walking Away

Here’s a statistic that keeps me up at night: University of Minnesota Extension found that while 69% of farmers expectto pass the farm to their children, actual succession success is only 16.5%.

That 83.5% failure rate? It’s not because kids are soft or don’t appreciate farming. It’s math.

I’ve been helping young couples run the numbers using Wisconsin’s Farm Financial Standards—proper analysis, not back-of-the-envelope stuff.

Take a typical scenario:

- 25-year-old with an ag degree

- Parents running 500 cows

- Normal debt loads

- Year one: Maybe $900,000 net with current prices

Sounds good, right?

But factor in reality based on historical trends:

- Operating costs: Rising 3% annually (that’s the 10-year average)

- Sustainability compliance: Accelerating 5% yearly (as regulations tighten)

- Milk prices: Maybe 1% growth if you’re lucky (20-year data shows this)

By year 10, That net income could drop 40% or more.

And that’s while working 60-70 hour weeks—you know how it is during calving season—carrying complete liability for over a million in debt.

Their college friends?

- Ag lenders: Starting $58,000, reaching $90,000 within a decade (Bureau of Labor Statistics data)

- Herd managers: $80,000-120,000 (based on industry surveys)

- Benefits: Home for dinner, actual vacation time, no debt liability

Student loans make it worse—National Young Farmers Coalition says 38% of young farmers carry an average debt of $35,660. As folks at USDA’s Beginning Farmer Program keep pointing out, you’re already in debt before you even think about taking over the farm.

The math often doesn’t work. And honestly? Can you blame them for choosing differently?

Your Four Critical Decisions—Quick Reference

Decision 1: Can premium markets work for you? (6 months to figure out)

- Within 100 miles of metropolitan markets with strong demographics

- Need 50%+ equity to weather transition losses

- Someone who actually wants to do marketing, not just milk cows

- Reality: Losses years 1-3, break even 4-6, profit after year 7 (every transition study shows this)

Decision 2: Can you scale to 1,500+ cows? (12 months to secure financing)

- Need $3-4.5 million capital (that’s current construction costs)

- Current profits should exceed $400/cow for lender confidence

- Debt under 30% of assets for favorable terms

- Reality: $175,000-292,000 annual debt service at current rates

Decision 3: Are You Preserving or Bleeding Equity? (3 months to assess honestly)

- Delaying exit while losing money costs thousands in retirement income

- Declining working capital = converting equity to expenses

- Continue only if genuinely cash flow positive

Decision 4: If exiting, how do you maximize value? (12-18 months to execute)

- Best: Sell to expanding neighbor (92-98% value recovery)

- Good: Liquidate herd, keep land for rent (85-90%)

- OK: Convert to heifer raising (40-50% income reduction)

- Fast: Complete auction (60-80% recovery)

Processors: The Other Consolidation Story

The processor landscape changed dramatically with recent bankruptcies, as you probably know:

Dean Foods (November 2019)

- Over $1 billion in long-term debt, according to bankruptcy filings

- Combined revenues over $12 billion—just gone

Borden Dairy (January 2020)

- Followed Dean into bankruptcy

- Couldn’t compete with integrated processors

When Walmart built their Fort Wayne plant in 2018 and Kroger expanded private label… that was game over for traditional processor margins, honestly.

After Dean collapsed, DFA bought 44 facilities for $433 million—the DOJ tracked all this. Now, many upper Midwest producers basically have two buyers: DFA and Prairie Farms.

That’s not exactly competitive price discovery, is it?

What Europe’s showing us about what’s next:

- Arla-DMK merger: Creates €19 billion giant

- FrieslandCampina-Milcobel: Combines €14 billion

- DMK’s reality: €24.6 million profit but negative €54.8 million cash flow in their FY2024 report

They’re burning reserves despite making operational profit. Their CEO’s been blunt with members: milk production’s declining, and they need scale to survive.

What’s this mean for us? Fewer buyers, less negotiating leverage, more dependence on whoever’s left standing.

And if you think that leads to better milk prices… well, I’ve got a bridge to sell you.

The Talk Every Farm Family Needs to Have

Here’s the conversation I’ve been coaching families through—and it needs real numbers, not hopes:

“Listen, we’ve got three realistic paths given where the industry’s heading.

Path one—go premium. Organic, processing, direct sales. That’s serious money upfront, losses for years according to every university study, and you’d basically be running a food company. Farmers markets every Saturday, Instagram all the time, dealing with customer complaints. That sound like the life you want?

Path two—scale up big. We’re talking millions in debt, managing 20+ employees, becoming a CEO instead of a farmer. HR headaches, safety meetings, and managing managers instead of cows. You ready for that?

Path three—we sell while we’ve got equity. You pursue your career without our debt. We preserve retirement funds. You can still work in dairy—plenty of good jobs—just not owning the risk.

What actually fits your vision for the next 40 years?”

When kids see real numbers, Iowa State’s research suggests that about 75% choose path three. They become nutritionists, agronomists, equipment specialists. Good careers using farm knowledge without the burden of ownership.

And given the economics? It’s often the smart choice.

What’s Actually Working Out There

Now, it’s not all challenges—I’m seeing some operations successfully thread the needle.

New York producers integrating processing are doing something interesting. Making specialty cheese and butter for NYC markets—one operation I visited is selling butter for $12 per pound in Manhattan. That vertical integration changes everything.

California cooperatives where smaller farms banded together before consolidation forced them, are now receiving premiums. Clover Sonoma’s a good example—27 farms averaging 350 cows each, all within 100 miles of their plant. They control their story and receive premium prices.

Vermont innovation through programs like AgSpark, is worth noting. Individually, a 400-cow farm can’t justify a digester. But three farms together? Now you’re talking viable scale. That’s real collaboration, not the “take whatever price we offer” kind.

Plains states are finding niches too. Custom heifer operations serving multiple dairies, spreading costs. Grazing dairies in Missouri are finding grass-fed markets that actually pay premiums.

Mid-Atlantic producers are leveraging proximity. Pennsylvania’s farmstead cheese operations are growing—being close to Philadelphia and Pittsburgh matters. Maryland producers supplying Baltimore and D.C. with local milk get decent premiums despite high land costs.

Even in the Southeast, despite cooling costs running $180-$ 200 per cow annually, I know operations that maximize component premiums. When your butterfat’s at 4.2% and protein is at 3.4%, you’re getting paid. It’s about finding what works for your situation.

Looking Ahead: The Industry Will Survive, But Will You?

The industry will absolutely meet that 20-30 million ton demand gap. Sustainability goals will be achieved. Global production will modernize.

But the structure doing it? Nothing like today’s.

Operations under 1,000 cows without premium markets, face increasingly challenging economics. Sustainability costs are rising, processor options are shrinking, and the next generation is making rational career choices.

It’s not about farming quality—it’s about structural realities nobody wants to discuss at industry meetings.

Those positioned to scale or differentiate have real opportunities, but execution has to be nearly perfect. I’ve seen too many half-hearted organic transitions fail. Expansions without multiple revenue streams just create bigger debt.

You need a complete strategy, not just hope.

The next 24 months look critical based on what I’m seeing. Processor consolidation’s accelerating—Rabobank says 2026 could see major shifts. Asset values may decline as more operations exit. Waiting usually means fewer options at lower values.

The Bottom Line: Your Choice to Make

Santiago’s summit revealed an industry transforming whether we’re ready or not.

The question isn’t if you’ll be affected—it’s whether you’ll choose your position or let circumstances choose for you.

Understanding these dynamics isn’t pessimistic—it’s getting clear-eyed about making wealth-preserving decisions while you still have options. I’ve watched too many good operators wait too long, hoping for better prices or magical policy changes that never came.

What gets me is all the knowledge we’re losing. Generations of understanding specific fields, managing fresh cow transitions, getting the most from local forages… when a farm exits, that expertise often goes too.

But here’s what’s encouraging—that knowledge can transform into new roles. Some of the best herd managers I know are former owners who sold at the right time. They’re managing thousands of cows, earning well, and home for dinner.

The knowledge continues, just in different structures.

Your action steps:

- Talk with your lender—really talk, not just renew notes

- Run honest numbers using proper methodology (Wisconsin’s Farm Financial Standards work well)

- Visit operations succeeding in different models

- Make decisions based on facts, not tradition or guilt

This transformation isn’t about good farms versus bad farms. It’s about structural changes favoring certain models over others.

Understanding that—and positioning accordingly—separates those who’ll thrive from those just trying to survive.

The next 24 months will likely determine the structure of American dairy for the next generation. Make sure you’re actively choosing your place, not just watching it happen.

We’ve been through big changes before, right? Hand milking to pipelines. Family labor to hired help. Local cream stations to global markets. This is another turn of that wheel—probably the biggest many of us have seen.

The question is: are you steering, or just hanging on?

Because at the end of the day, this industry needs people who understand cows, who know how to produce quality milk, who can manage the biology and complexity of dairy farming. That need won’t go away.

But how that knowledge gets applied, in what structures, at what scale—that’s what’s changing.

Your operation has value. Your knowledge has value. Your family’s future has value.

The key is making sure you’re the one determining how to best preserve and deploy that value, not having it determined for you by circumstances beyond your control.

That’s what Santiago really taught us—not that change is coming, but that we need to be intentional about our place in it.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Future-Proof Dairy: 7 Financial KPIs Your Banker Wishes You Were Tracking – While the main article warns of financial pressures, this guide provides the tactical dashboard you need. It details the key metrics for assessing your operation’s true health, helping you make the data-driven decisions on scaling or exiting that are now essential.

- Beyond the Bulk Tank: Why Component Pricing is the Key to Unlocking Hidden Herd Profitability – This piece offers a direct strategy to combat shrinking margins discussed in the main article. It reveals specific genetic and management methods for maximizing component payments, giving you more control over your milk check in a consolidated processor landscape.

- The Data-Driven Heifer: How AI is Predicting Future Rock Stars at Weaning – To survive the consolidation trend, you need elite efficiency. This article demonstrates how to leverage predictive AI and early-life data to improve heifer selection, reduce rearing costs, and build a more profitable, high-performing future herd from the ground up.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!