On Friday, June 1 Mexico announced that it would impose retaliatory tariffs on a number of US exports in response to duties the US placed on imports of Mexican steel and aluminium. Of the commodities singled out, cheese was one which will impact the US and Mexican dairy industry most directly. Market reactions to date have been muted, August cheese futures are only 3% lower at the time of writing.

Details of Mexico’s new tariffs emerged on June 5 and further details continue to trickle in. As of June 5 nearly all US cheese exports, which were previously exempt from tariffs under NAFTA, now face tariffs of 10% to 15% with a further round of increases planned for July 5th, at which point they will increase to 20-25%.

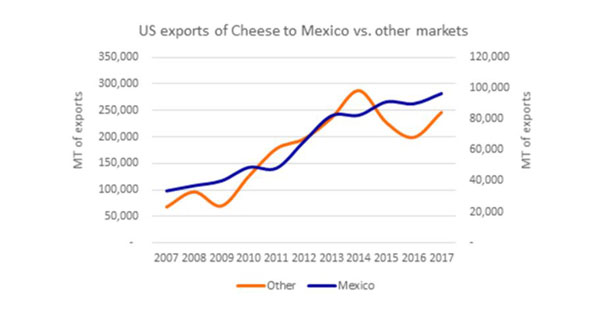

In 2017, the US exported 97k MT cheese to Mexico, accounting for 28% of total US cheese exports, and representing 80% of Mexico’s cheese imports. US cheese exports accounted for 12% of all cheese consumed in Mexico in 2017. This is not the first time Mexico has placed tariffs on US cheese. In 2010 Mexico placed nearly identical tariffs on US cheese during tensions over Mexican trucks’ access to US roadways. However, US cheese exports to Mexico only slowed marginally during the period (-1% year on year, 2010 vs. 2011), for a number of reasons:

1. Mexico had no alternative suppliers

2. MXN was stronger relative to the USD helping affordability

3. NAFTA was not in limbo

4. Option to shift to other cheese variety

This time around things may be different:

1. Mexican Peso has depreciated against the dollar

2. EU trade agreement has been signed, giving Mexico leverage

3. US-Mexico relationship are not as amiable today

4. More comprehensive cheese variety coverage

Source: GTIS

So what is Mexico to do? For now it appears Mexico may be well stocked, with up to an estimated 6 months of cheese in stores. However, if the tariffs remain in place Mexico will need to seriously consider its options.

The newly signed Mexico-EU FTA is not yet in effect, but there is the possibility that Mexico may expedite implementation of tariff reductions on EU cheese. New Zealand, is in the process of negotiating a trade agreement with Mexico, which may also be expedited. One would think Canada could also look fill the void, given their presence in NAFTA. However, Canada is unlikely to have milkfat to spare for exports.

Under the new tariffs the US will continue to have preferential rates (25% vs. 45%) for some of the cheese types (cheddar, Gouda, Monterey, and fresh cheese). However, Mozzarella and hard Italian style cheese appear to have equal rates (20%) compared to other cheese exporters. This may result in a shift in the balance in the style of cheese being exported to Mexico.

Going forward, cheese prices in the US may feel some pressure due to lower exports. While prices are unlikely to fall too far in the short term, if these tariffs remain in place for over 6 months, cheese producers will need to work hard to find new markets and dairy producers may see their milk prices coming in a little lower.

Given that milk powders were exempt from the tariff hikes, Mexican cheese manufacturers will be able to import milk powders to be used to help domestic cheese production – to the extent they have capacity. As a result, the US might see a slight uptick in non-fat dry milk powder exports to Mexico.

Longer term potential implications for US dairy exporters may be detrimental. While individual exporters are doing their best to be good partners and to solve these new challenges, the reality remains that the US may be viewed as a less reliable trade partner going forward. This is not ideal given the ever-increasing presence of the US as a significant player in the global dairy export market, and the invaluable quality of being a reliable partner.

Possible impacts to cheese manufacturers:

o Higher cheese inventorieso Prolonged tariffs may could put downward pressure on cheese priceso Higher than expected NFDM prices – assuming uptick in imports

o Higher uncertainty in market may increase demand for price risk management tools

o Shift in product mix (non-tariff cheese or into non cheese products where capability exists)

o More pressure on Mexican cheese manufactures to increase output

o Realization of urgent need to broaden US dairy export market capabilities (trade agreements, sales teams, international market knowledge)

· Rural

o The longer the tariffs are in place, the greater downward price pressure on farm-gate milk prices in major cheese producing regions

o Increased uncertainty/lack of faith in markets

Destinations for US cheese exports in 2017. Source: GTIS