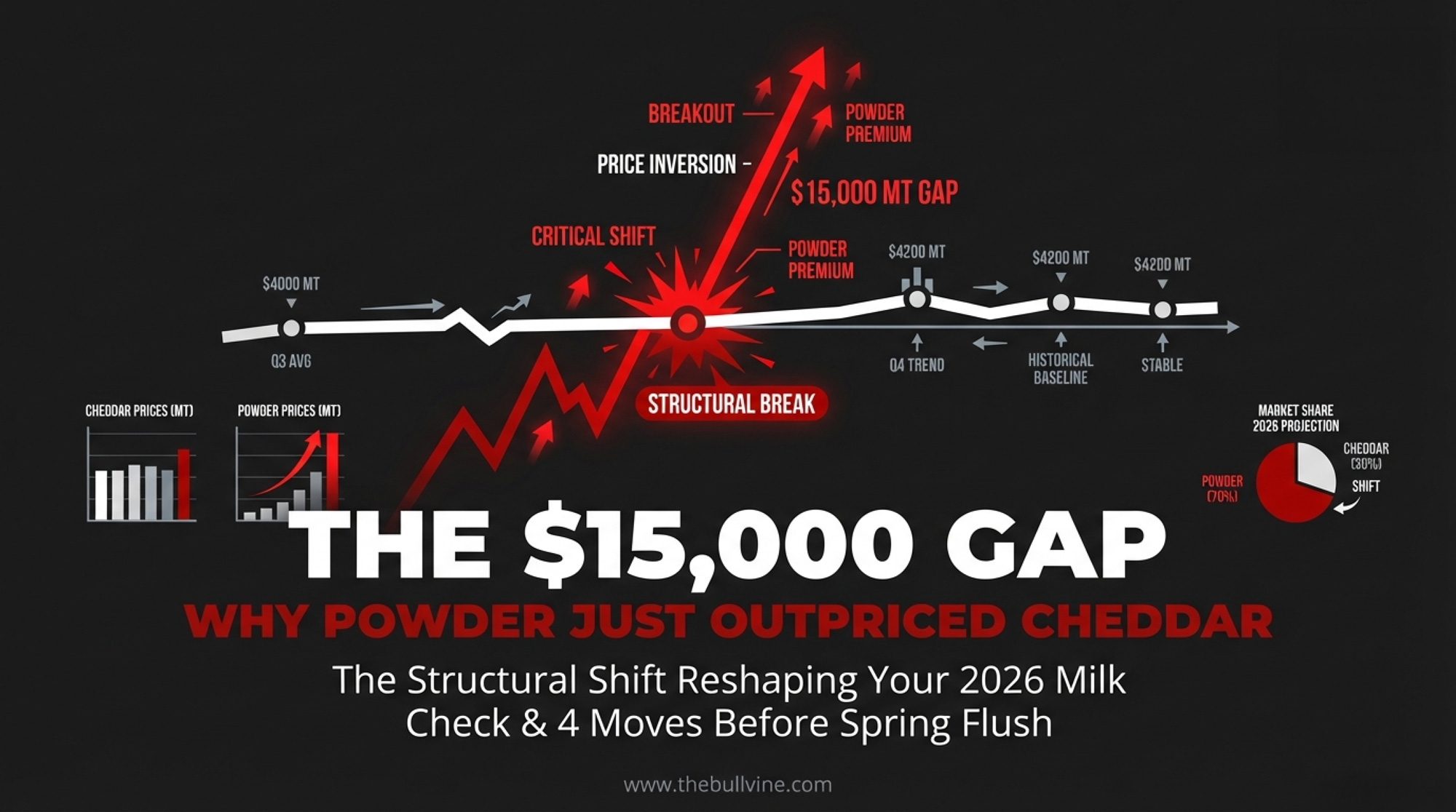

NDM’s best week since 2007 exposed a Class III/IV spread that’s costing cheese-pool herds $10,000–$15,000/month. Four moves before spring flush.

Executive Summary: If you’re shipping to a cheese-dominant handler, the Class III/IV spread is costing your operation $10,000 to $15,000 a month on 500 cows. NDM surged 18¢ this week to $1.64/lb — its strongest weekly gain since May 2007 — while Cheddar settled at $1.4725 and Class IV futures pushed into the high $18s versus Class III in the low $17s. The structural driver: U.S. powder output in 2025 fell to its weakest level since 2013 while over $11 billion in new processing capacity flowed to cheese and whey, not dryers. That imbalance has staying power. DMC enrollment closes in 52 days, and four moves — DRP restructuring, DMC stacking, component optimization worth $1.00–$1.50/cwt, and a hard look at your handler alignment — can narrow this gap before spring flush closes the window.

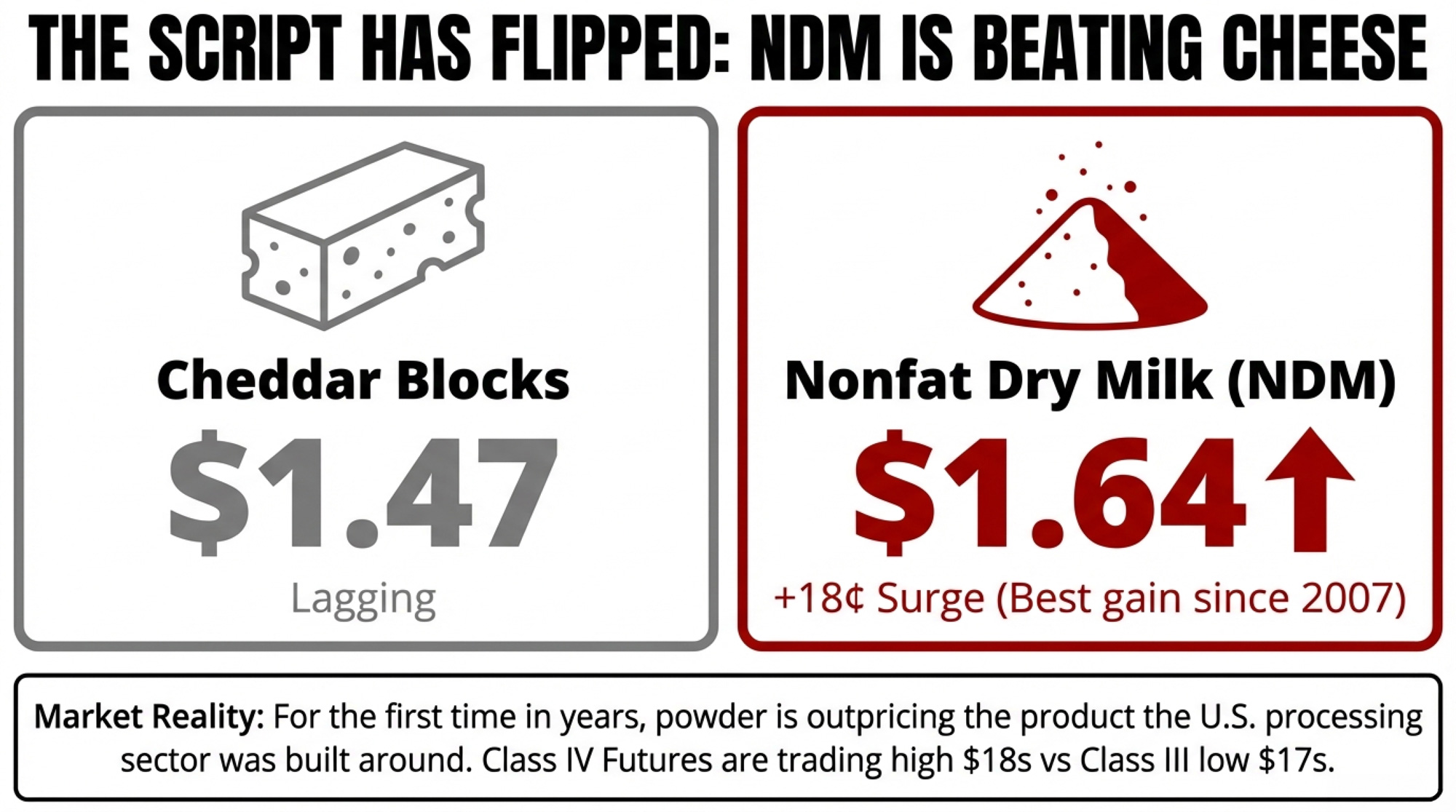

Nonfat dry milk surged 18¢ in a single week to settle at $1.64/lb on Friday, February 6, 2026 — the highest CME spot price since August 2022 and the strongest weekly gain since May 2007, per Jacoby & Associates. That puts powder a full 16.75¢ above Cheddar blocks and within pennies of butter. For the first time in years, milk powder is outpricing the product that the entire U.S. processing sector was built around.

For producers shipping to cheese-dominant handlers — where Class III drives the blend — the revenue gap is specific and measurable. The Bullvine’s October 2025 analysis of two identical 500-cow herds — same genetics, same production, same components, different pool structures — found a monthly revenue disparity of $10,000 to $15,000, with the cheese-heavy operation on the losing end. DMC enrollment closes March 31. Spring flush is six to eight weeks out. The decisions you make about DRP coverage, component targets, and handler alignment in the next 90 days determine which side of that gap you land on.

| Month | Class III Pool (Black Line) | Class IV Pool (Red Line) | Gap |

|---|---|---|---|

| Sep 2025 | $310,000 | $315,000 | $5,000 |

| Oct 2025 | $305,000 | $314,000 | $9,000 |

| Nov 2025 | $302,000 | $314,500 | $12,500 |

| Dec 2025 | $298,000 | $313,000 | $15,000 |

| Jan 2026 | $295,000 | $310,000 | $15,000 |

| Feb 2026 | $292,000 | $307,000 | $15,000 |

What $1.64 NDM and $1.47 Cheddar Look Like on Your Check

The week’s CME scoreboard tells a lopsided story. NDM at $1.64/lb. Cheddar blocks up 11¢ to $1.4725/lb on 51 loads — one of the busiest trading weeks in recent memory. Butter jumping 13¢ to $1.71/lb, with dozens of unfilled bids still on the board at Friday’s close. By Friday, MAR26 Class IV was trading in the high $18s to near $20/cwt — well above Class III in the low-to-mid $17s. That spread hits your check directly if you’re in a cheese-heavy pool.

| Product | Feb 6, 2026 Close | Weekly Change | YOY Change | Trading Volume (loads) |

|---|---|---|---|---|

| Nonfat Dry Milk | $1.64/lb | +18.0¢ | +42.6% | 38 |

| Cheddar Blocks | $1.4725/lb | +11.0¢ | +8.4% | 51 |

| Butter | $1.71/lb | +13.0¢ | +15.5% | 42 |

| Class IV Futures (MAR26) | ~$19.00/cwt | +$1.50/cwt | +12.2% | — |

| Class III Futures (MAR26) | ~$17.25/cwt | +$0.50/cwt | +4.1% | — |

Behind those numbers sits twelve months of compounding imbalance. USDA’s Dairy Products report, released February 5, confirmed that combined U.S. NDM and skim milk powder output in December totaled just 170.3 million pounds — down 6.2% year-over-year. Full-year 2025 powder production: 2.143 billion pounds. The weakest annual total since 2013.

Cheese, meanwhile, has never been higher. December output hit 1.279 billion pounds, up 6.7% year-over-year, with Cheddar surging 9%. Milk production grew 4.6% in December across the 24 major states. More milk than ever is flowing through the system. It’s going into cheese vats, not dryers.

Where Did All the Dryers Go?

Powder got scarce because the industry was built for cheese, not because the world suddenly needed more milk powder.

IDFA reported in October 2025 that U.S. dairy processors have committed over $11 billion in new and expanded processing capacity across more than 50 projects in 19 states between 2025 and early 2028 — overwhelmingly targeting cheese and whey protein, not drying. IDFA CEO Michael Dykes framed it as a response to “unprecedented demand for American-made dairy products, especially cheese and whey protein”. That investment wave is a supply-side explanation for the powder squeeze—and it suggests the scarcity has staying power.

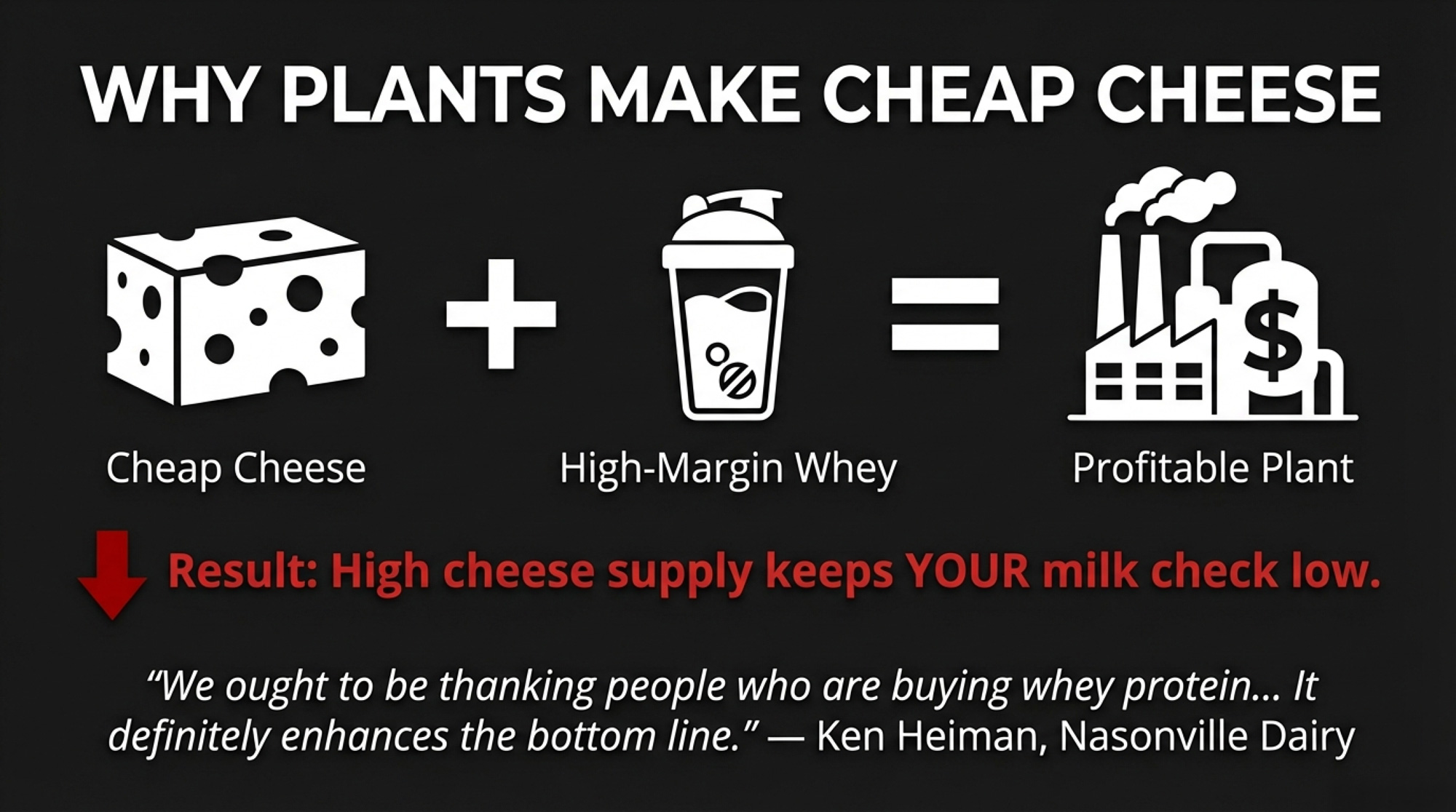

Inside the Plant Where Cheese Barely Breaks Even

Ken Heiman lives this math daily. The CEO and co-owner of Nasonville Dairy in Marshfield, Wisconsin — a certified Master Cheesemaker who got his license at 16 — processes 1.8 million pounds of milk daily from roughly 190 Wisconsin farm families, turning out more than 150,000 pounds of cheese every day. By his own account, the operation “just breaks even” on most of the cheese. What keeps Nasonville profitable is whey protein. “We ought to be thanking people who are buying whey protein at Aldi’s,” Heiman told the New York Times last July. “It definitely enhances the bottom line.”

That’s not an outlier — it’s the new economics of processing. December USDA data shows whey protein isolate production at 20.6 million pounds, up 11.7% year-over-year, while lower-protein WPC (25–49.9%) fell 12.8%. Plants keep making cheese — even at thin margins — because the whey stream subsidizes the operation. More cheese keeps Class III supply elevated, which holds down the blend price for every farm shipping to a cheese-dominant handler. Phil Plourd at Ever.Ag framed it bluntly: “It is a street fight, in terms of figuring out ways to stay relevant, to get more productive, to stay ahead of the curve, to manage risk better.”

What the FMMO Reforms Actually Did to Your Check

Kevin Krentz knows the cost of pool imbalances firsthand. The Wisconsin Farm Bureau President — who milks about 600 cows with his wife, Holly, near Berlin, in Waushara County — testified before USDA in August 2023 that negative PPDs reached $9/cwt, costing his operation nearly $200,000. Those losses accumulated during a PPD crisis that began when the “average-of” Class I mover took effect in May 2019 and persisted through at least 2023.

The June 2025 FMMO reforms addressed that specific formula — reverting to the “higher-of” Class I mover, with all 11 federal orders voting to accept it. But the reforms also raised make allowances by 5¢ to 7¢ per pound across all four pricing products. In three months, that wiped $337 million from pool values nationally, per AFBF economist Danny Munch, with the Upper Midwest absorbing $64 million of the hit. Class prices dropped 85 to 93 cents per hundredweight, even with make allowances alone.

UW–Madison extension specialist Leonard Polzin noted that make allowances are “embedded in the federal pricing formulas rather than itemized”—they don’t show up as a line on your check like a hauling charge. Roughly 90% of the component-priced milk check sits on butterfat and protein, per CoBank analyst Corey Geiger. With the spread running this wide, that concentration means your check swings harder on butterfat and protein than on volume — and the structural dynamics driving today’s Class III/IV divergence share some of the same characteristics as the crisis Krentz lived through.

Component Premiums — Run Your Own Numbers

The gap between high-component and volume-focused herds is calculable from the USDA’s monthly announcements. In January 2026, FMMO component prices were $1.4595/lb for butterfat and $2.1768/lb for protein. The Bullvine’s June and July 2025 market reports estimated that each 0.1% increase in butterfat translates to roughly $0.15–$0.35/cwt in additional revenue, depending on the month. For a farm testing 4.3% fat and 3.3% protein versus one at 3.8% and 3.0%, that cumulative advantage runs $1.00–$1.50/cwt.

On a 1,000-cow herd averaging 75 pounds per day, even the low end means roughly $22,000 per month. The high end: $34,000 — over $400,000 annually. This lever works regardless of your pool or handler — as long as component premiums hold. And that’s not guaranteed. Protected fat supplements run $0.35 to $0.55 per cow per day in the Upper Midwest. Genetic gains through sire selection take 6–24 months to show up in the tank. Ask your nutritionist for the breakeven component test level at current premiums.

| Component Test | Butterfat (%) | Protein (%) | Monthly Revenue Advantage (1,000 cows) | Annual Revenue Advantage |

|---|---|---|---|---|

| Low Components | 3.6% | 2.9% | — | — |

| Average Components | 3.8% | 3.0% | +$8,000 | +$96,000 |

| Mid-High Components | 4.1% | 3.2% | +$18,000 | +$216,000 |

| High Components | 4.3% | 3.3% | +$28,000 | +$336,000 |

Four Moves Before Spring Flush — and What Each Costs

- Restructure DRP to match actual pool exposure. If your co-op runs 60% cheese and 40% butter/powder but your DRP is weighted 80% Class III, you’re insuring a milk check that doesn’t exist. High-component herds generally benefit from the Component Pricing option; average-component herds from Class Pricing with accurate III/IV weighting. RMA premium subsidies range from 44% at 95% coverage to 55% at 70%. Compeer Financial’s 2020–2023 analysis found average DRP premiums of $0.31/cwt; HighGround Dairy’s five-year review showed an average net benefit of $0.23/cwt. Get a current quote — premiums fluctuate with volatility. The trade-off:premiums are sunk cost if the spread narrows. That premium stacks against a monthly gap exposure of $10,000–$15,000 on 500 cows.

- Stack DMC before March 31. Tier 1 now covers up to 6 million pounds — up from 5 million — giving medium-sized operations an extra million pounds of coverage. You must establish a new production history based on your highest marketings from 2021, 2022, or 2023. For operations with a longer risk horizon, DMC offers a six-year lock-in (2026–2031) with a 25% premium discount — but you give up annual flexibility, and if milk prices surge above $24/cwt, you’re locked into coverage you don’t need. With MAR26 soybean meal at $303.60/ton and corn at $4.30/bu, the feed-cost squeeze is real. DMC covers cost; DRP covers revenue.

- Audit your milk check. AFBF economist Danny Munch, at ADC’s Dairy Hot Topics session during World Dairy Expo last October, urged farmers to share milk check stubs with ADC, their state Farm Bureau, or their market administrator. Munch found instances — particularly in Wisconsin — where independent handlers weren’t following existing disclosure requirements. Look for months where your PPD went sharply negative while Class IV traded at a premium. Cost: one uncomfortable phone call. Potential payback: significant.

- Explore handler options in competitive milk sheds. In parts of Wisconsin, Idaho, and the Upper Midwest, producers with high-component milk may have leverage to find handlers whose plant mix better captures Class IV value. The trade-off is real: equity stakes in your current co-op, hauling logistics, and relationship costs. But when pool assignment can swing $10,000–$15,000 monthly on 500 cows, the conversation may be worth having.

| Coverage Scenario | Quarterly DRP Premium ($/cwt) | Monthly Premium Cost (9,000 cwt/month) | Monthly Uninsured Pool Gap Exposure |

|---|---|---|---|

| Low Coverage (70%) | ~$0.05/cwt | ~$450 | $10,000–$15,000 |

| Mid Coverage (85%) | ~$0.20/cwt | ~$1,800 | $10,000–$15,000 |

| High Coverage (95%) | ~$0.40/cwt | ~$3,600 | $10,000–$15,000 |

Running the Numbers: DRP Coverage (500-cow herd, ~9,000 cwt/month)

| Low Estimate | High Estimate | |

| Quarterly DRP premium (per cwt) | ~5¢ | ~40¢ |

| Monthly premium cost | ~$450 | ~$3,600 |

| Monthly Class III/IV pool gap exposure | ~$10,000 | ~$15,000 |

| Net monthly uninsured risk | ~$9,550 | ~$11,400 |

Compeer Financial 2020–2023 avg: $0.31/cwt. HighGround Dairy five-year avg net benefit: $0.23/cwt. RMA subsidies: 44% (95% coverage) to 55% (70% coverage). Gap: Bullvine analysis, Oct 2025. Get a current quote for your operation.

Four Signals That Separate Noise from Structure

- Q1 2026 powder production (USDA reports, March and April). If NDM/SMP output remains negative year-over-year despite record milk production, drying capacity is confirmed to be insufficient— not just seasonally tight. Monthly sales below 180 million pounds would be historically abnormal. Above 195 million pounds would suggest the system is self-correcting. This is the single most important data point for validating or killing the thesis.

- Monthly cheese exports to Mexico (USDEC data, ~6-week lag). Mexico accounted for 38% of all U.S. cheese exports through November 2024 — 392 million pounds — per Hoard’s Dairyman, with full-year 2024 volumes reaching 424 million pounds. If monthly volumes drop below 30,000 metric tons for two consecutive months, alternative markets can’t absorb the displacement.

- Class III/IV spread duration. A two-month spread is noise. One that persists through six months signals a structural change that even processing allocations will eventually follow. Last July, The Bullvine reported the Class IV premium hit $1.71/cwt over Class III. If the gap holds above $1.00/cwt through June 2026, that would mark the longest sustained Class IV premium driven by powder scarcity in modern FMMO history.

- Cheese inventories. USDA’s December 31, 2025, Cold Storage report showed 1.35 billion pounds of natural cheese in warehouses, up 1% year-over-year. Two consecutive months above 1.40 billion pounds would signal the export safety valve is failing — and that cheese is backing up faster than the market can clear it.

Your Next Moves

Start with three questions: What’s your handler’s cheese-to-powder plant utilization split? What’s your current DRP Class III/IV weighting? What’s your rolling 12-month average butterfat test? If you don’t know all three, that’s your first move.

- If your DRP is weighted more than 60% Class III but your handler runs significant butter or powder volume, you’re likely insuring the wrong revenue stream. Pull your current parameters this week.

- DMC enrollment closes on March 31 — 52 days from now. Tier 1 covers 6 million pounds for 2026. Six-year lock-in (2026–2031) saves 25% on premiums but sacrifices annual flexibility. With soybean meal above $303/ton, this is the cheapest margin backstop available.

- If your herd averages below 4.0% butterfat and 3.1% protein, you’re leaving an estimated $1.00+/cwt on the table relative to component-optimized herds in the same pool.

- If your PPD went negative in any month since October 2025, ask your co-op directly whether Class IV milk was depooled. Danny Munch at AFBF has flagged handlers — particularly in Wisconsin — not following existing disclosure rules.

- Run your cash flow at Class III, averaging $16.50/cwt for the next 18 months with current feed costs. If that doesn’t work on your spreadsheet, waiting costs more than acting.

- Counter-signal: If Q1 NDM/SMP production rebounds above 195 million pounds monthly, the scarcity thesis weakens. The March Dairy Products report is the first real test.

Key Takeaways

- The Gap: Today’s NDM–Cheddar spread is already costing a 500-cow cheese-pool herd $10,000–$15,000/month compared with the same cows in a more Class IV-exposed pool.

- Why It Lasts: 2025 powder output fell to its weakest level since 2013 while more than $11 billion in new capacity went to cheese and whey, not dryers — a setup that keeps Class IV firm and cheese-led pools behind.

- Your Biggest Lever: At current component prices, moving from “average” to high components is worth roughly $1.00–$1.50/cwt — about $22,000–$34,000/month on 1,000 cows — but only if your DRP mix and handler capture that value.

- The 52-Day Deadline: DMC enrollment closes in 52 days, giving you one tight window to line up DMC coverage, DRP weighting, and component targets with the actual market you’re in before spring flush hits.

- The Cost of Waiting: Rolling into spring with a cheese-heavy pool, a Class III-heavy DRP, and “good enough” components is a bet that the Class IV premium disappears before your cash does.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- Same Cows, $15,000 Apart: Class III Milk Price, DRP, and Your Spring 2026 Risk Plan – Stop five-figure revenue leaks by applying a three-lane risk playbook—Defensive, Balanced, or Aggressive. This guide arms you with the exact DRP and put-option parameters needed to protect your cash flow before the spring flush hits.

- Your Milk Check Just Got $337M Lighter – And Your Co-op Helped Plan It – Gain the strategic leverage needed to audit your cooperative’s pooling policies and reposition your farm against structural margin compression. This analysis exposes the “hidden tax” of 2025 FMMO reforms that drained $337 million from producer checks.

- Dairy’s Golden Calf Rush: $1,000+ Crossbreds Reshape Farm Economics – Secure a blueprint for banking record profits from crossbred calves by transforming your breeding program into a high-margin “beef-on-dairy” goldmine. It reveals how to capitalize on 60-year beef supply lows while maintaining your elite replacement pipeline.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!