Pakistan’s hitting 470 gBPI scores while we’re stuck at 267. Time to rethink what’s possible with genomic testing.

EXECUTIVE SUMMARY: Okay, here’s what’s got me fired up about Pakistan’s dairy scene. They’re producing 63 million tonnes annually with herds hitting genomic scores that embarrass some of our best operations. We’re talking 470 gBPI when top 1% globally barely cracks 267. Their corporate farms are deploying the same elite genetics we use, but with $0.15/lb lower feed costs and 30% better heat stress management. One operation went from crossbred mediocrity to world-class daughters in just three years using Australian genomics and Zoetis testing. With export markets exploding and their 55% productivity gap closing fast, this isn’t just an overseas story anymore. If you’re not watching what Pakistan’s doing with TMR optimization and reproductive tech, you’re missing the next wave of dairy efficiency.

KEY TAKEAWAYS:

- Boost genetic progress 2.5x faster with genomic testing like Pakistan’s elite farms—talk to your breeding consultant about implementing daughter evaluations this fall before breeding season

- Save $0.15 per pound on feed costs through precision TMR formulations and heat-adapted rations—work with your nutritionist to optimize for 2025’s volatile ingredient markets

- Cut reproductive failures by 20% using advanced heat detection tech that’s solving Pakistan’s “silent heat” problems—especially critical as summer heat stress increases

- Slash milk spoilage losses 15-20% with cooperative chilling stations like Pakistan’s World Bank program—explore shared cooling infrastructure with neighboring farms

- Tap export premium markets worth billions through halal certification and international partnerships—diversify your income streams while global dairy demand surges

You know those moments at a conference when someone drops information that completely shifts your perspective? Had one of those recently while chatting over coffee with a geneticist who’d just returned from Pakistan. What he told me about what’s happening there… well, it’s got me thinking we all need to pay closer attention.

Here’s the thing most of us don’t fully grasp about Pakistan: they’re not just another developing market dabbling in dairy. We’re talking about the world’s fifth-largest population — over 255 million people — and a dairy sector that’s exploding. Their livestock sector now includes 57.5 million cattle plus 46.3 million buffalo, creating one of the world’s largest dairy herds.

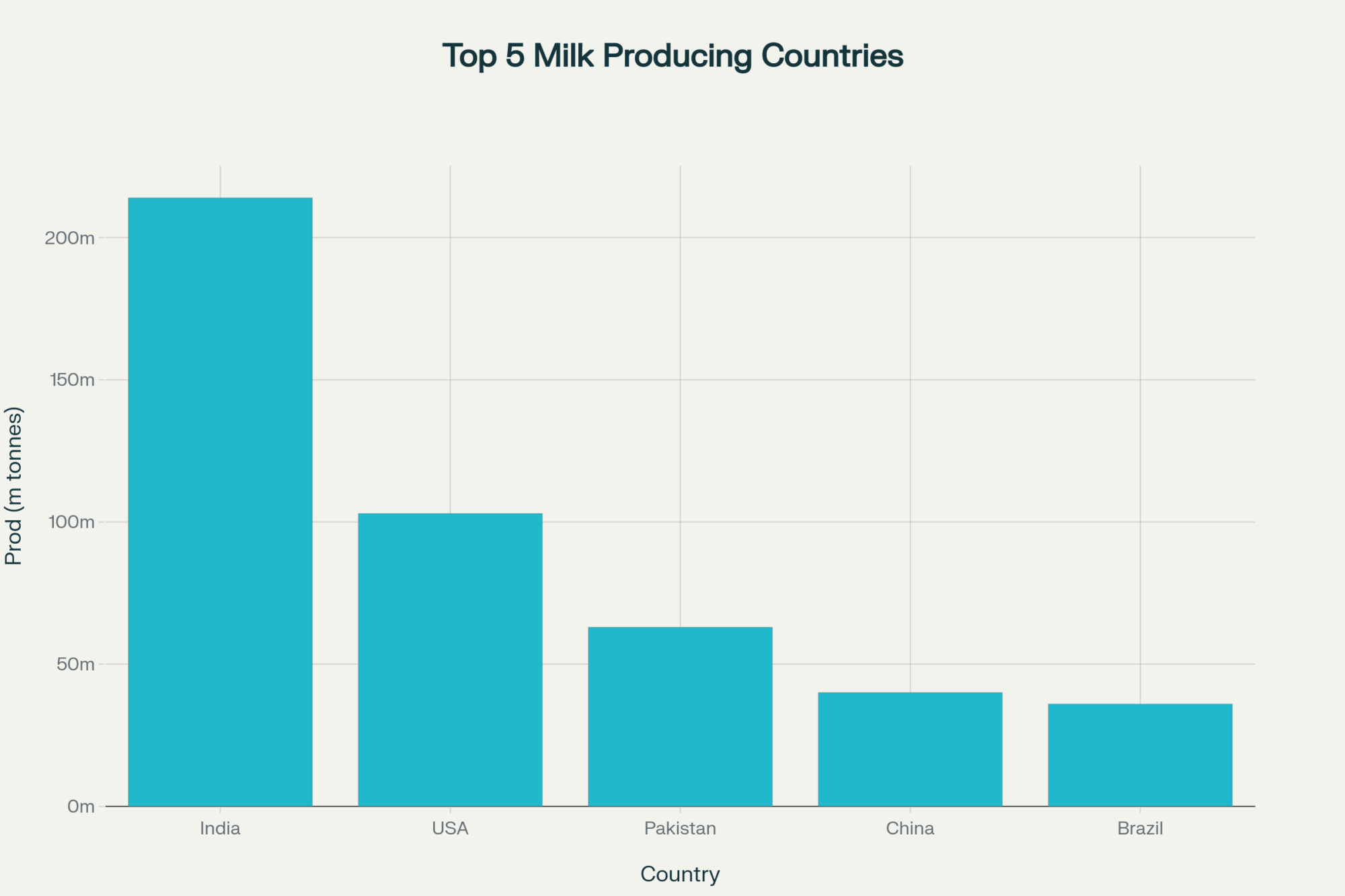

Think about that for a second. That’s more dairy animals than our entire North American inventory, and they’re producing around 64.3 million tons of milk annually, according to FAO’s latest data. That puts them third globally — behind India and the US, ahead of China and Brazil.

However, here’s where it gets interesting —and perhaps a little concerning for those of us considering long-term competition.

The Tale of Two Completely Different Dairy Worlds

What strikes me about Pakistan’s setup is how it’s basically two industries running side by side. You’ve got this massive traditional sector — we’re talking 80% of production coming from smallholder farms with just 2-5 animals each. Picture motorcycles weaving through traffic, loaded with twin milk cans, delivering fresh milk directly to consumers. That’s the reality for most of their supply chain.

Then there’s this other world emerging… and it’s impressive. Around 80 corporate mega-dairies ranging from 1,000 to 6,000 cows, with facilities that — I’m not exaggerating here — would make some of our operations take notice.

Take Interloop Dairies, recognized as Pakistan’s largest corporate dairy farm. They’re running over 10,000 Holstein Friesians with advanced milking parlors from GEA, producing export-quality mozzarella using Individual Quick Freezing technology. That’s not your typical developing market operation.

What’s fascinating is their cost structure. Abundant high-quality groundwater in Punjab province (think about that in our water-stressed environment), cheap labor, and the ability to grow corn and forages on incredibly fertile soils. Research shows that their commercial farms average 844 liters per cow daily for water usage during the summer — that’s a lot of water, but it’s available.

That combination should get anyone’s attention.

The Indigenous Foundation: Asset and Challenge

Here’s where breeding gets interesting. Pakistan’s traditional foundation is built on indigenous breeds that are perfectly adapted to local conditions, yet possess unique characteristics.

The Nili-Ravi buffalo dominates smallholder farms, and get this — recent research shows they’re producing milk with around 6.8% fat content. These animals are tough as nails — they have to be in that climate — but their genetic ceiling creates interesting dynamics. Then you have heat-tolerant Zebu cattle, such as the Sahiwal and Red Sindhi, which have evolved specifically for those conditions.

However, here’s the breeding challenge that most people don’t realize: those Nili-Ravi buffalo are prone to “silent heats,” making heat detection a significant challenge for AI adoption. From a competitive standpoint, this creates a moat around the traditional sector. You can’t just gradually upgrade these operations with better genetics — the biology doesn’t work that way.

That’s exactly why the corporate farms are going all-in on imported Holstein genetics. It’s not just about higher yields; it’s about building systems where modern breeding tech actually functions.

The Genetics Revolution Nobody Saw Coming

This development fascinates me more than anything else… Pakistan has quietly become a major destination for the same elite genetics driving productivity from Wisconsin to New Zealand.

The story that really captures what’s happening: a Pakistani veterinarian got stranded in Australia during COVID. Instead of sitting around, he worked on several high-tech Australian dairy farms and saw firsthand what elite genetics could do. When he returned home, he and two colleagues set up a dairy operation using imported, genomically tested Australian heifers.

This is where it gets impressive. HRM Dairies now genotypes all heifers with Zoetis and has produced daughters of Carenda Pilbara ranging between 348 and 470 gBPI. For context, the top 1% in Australia has an average wealth of over 267 gBPI. These aren’t just good numbers for Pakistan — these are elite numbers by any standard.

The Pakistani government has committed Rs40 billion toward genetic improvement programs. That’s transformational money.

Here’s what this means for competitive positioning: Research on 600 dairy farms in Punjab shows genomic selection could close a 55% productivity gap that currently exists. If they achieve even half those gains across their massive animal base…

Think about the implications… If a major milk-producing region can accelerate genetic progress by that magnitude, how does it change global market dynamics within a decade?

Corporate Farms That Would Impress Anyone

I’ll be honest — some of these operations are more sophisticated than farms I’ve visited in established dairy regions.

Dairyland was established with imported Australian Holstein heifers and now operates a complete “grass-to-glass” vertical integration, featuring hormone-free production and rigorous microbiological testing.

FrieslandCampina Engro’s Nara Dairy Farm spans 220 acres, housing over 6,000 animals that adhere to international health and safety standards. They’ve been pioneering corporate dairy farming since 2006, with flagship brands like Olper’s and Tarang as household names.

Everfresh Farms focuses on exceptionally high-quality fresh milk, consistently achieving low Total Plate Counts — a critical measure of milk hygiene. They’re using sophisticated milking parlors from GEA WESTFALIA Surge.

What caught my attention is the technology adoption. These aren’t scaled-up traditional operations — they’re deploying automated milking systems, climate-controlled barns with misting (essential at 50°C), TMR wagons for scientifically balanced feeding, and substantial solar installations.

What strikes me about these operations is how they’re integrating sustainability from day one. Water conservation, renewable energy, waste-to-biogas systems — they’re building climate-smart dairying into their DNA rather than retrofitting later.

The Infrastructure Reality That’s Finally Changing

Let’s talk about the elephant in the room — the cold chain that’s finally being built.

Anyone dealing with milk in extreme heat knows temperature control isn’t optional. In Pakistan’s climate, where summer temps hit 50°C (122°F), loose milk without refrigeration… well, you can imagine.

The numbers: Historically, 15-20% of milk wastage occurs due to spoilage before reaching consumers. For context, that’s equivalent to discarding the entire annual production of a mid-sized US state.

What’s interesting, though, is how targeted interventions prove this isn’t insurmountable. The World Bank’s Sindh Agriculture Growth Project provided milk chillers to producer groups, yielding immediate results: reduced waste, increased farmer incomes, and improved quality control.

Corporate farms are deploying full cold chain infrastructure alongside their advanced systems. They’re building modern dairy infrastructure from scratch, without the legacy constraints that many of us face.

For producers watching from afar: These infrastructure investments create templates that work in challenging climates. Some cooling and logistics solutions being developed could apply to southern US operations dealing with increasing heat stress.

The Productivity Gap That’s Actually an Opportunity

Here’s where numbers get really interesting. Recent research on 600 dairy farms in Punjab indicates that the average farm has a 55% yield improvement potential. By closing that gap, average operations could increase yearly fat-corrected milk production by 120,036 kg and the non-milking herd for meat by 25 head.

What strikes me is that we’re not talking about theoretical improvements. These are achievable gains based on existing technology and management practices that have already been demonstrated on corporate farms.

The study found that small farms (under 25 head) are actually more technically efficient than medium and large farms — suggesting room for improvement across all scales. Clear evidence shows that keeping higher shares of exotic cows versus local breeds, along with higher farm-gate milk prices, triggers significant efficiency gains.

That’s the productivity trajectory that could fundamentally alter global supply dynamics if it scales across their 30-million-head base.

The Export Opportunity That Changes Everything

Here’s where strategic implications become clear. Pakistan’s milk exports reached $5.47 million in 2023, primarily to Saudi Arabia ($2.78 million), the UAE ($1 million), and Somalia ($ 572,000). It might not sound like much, but industry analysts discuss export potential reaching billions.

The strategy involves utilizing buffalo milk for domestic consumption while targeting cow milk-based products for export, such as cheese, butter, and ghee. This leverages the growing base of high-yield Holstein and Jersey cows while maximizing value from different milk types.

China represents the primary target, with agreements already in place for companies like Fauji Foods Limited to begin exporting buffalo milk to China’s Royal Group. Given China’s dairy deficit and Pakistan’s geographic proximity, this could scale rapidly.

Middle East and North Africa markets offer additional opportunities, particularly for Halal-certified products, where Pakistan has natural competitive advantages.

What’s interesting from a competitive standpoint is the strategic focus on products. Rather than competing directly in commodity milk, they’re targeting value-added products where margins are higher and technical barriers create natural protection.

The Policy Wild Card Everyone’s Watching

Here’s where things get complicated… and why timing matters more than most realize.

Current policy includes an 18% sales tax on packaged milk, which has caused a 20% decline in formal sector volumes, effectively subsidizing the informal loose milk market while penalizing companies that invest in food safety and modern infrastructure.

But change is coming. The Pakistan Dairy Association proposed reducing that tax from 18% to 5%, projecting it could boost volumes by 20% and increase government revenue by 22% year-on-year. Government officials confirmed they’re reviewing this policy.

As Dr. Shehzad Amin from Pakistan Dairy Association put it: “No country taxes milk at 18% — the highest global rate is 9%. Safe milk is not a luxury, it’s a right.”

The competitive implications become clear when you consider that policy alignment could accelerate the timeline for Pakistani dairy reaching export competitiveness by several years.

Technology Adoption That’s Actually Impressive

What gets my attention is how quickly leading operations are adopting advanced technology.

Corporate farms aren’t just buying better cows — they’re deploying the full suite of modern dairy technology. Automated milking, climate-controlled housing, precision feeding, genomic testing, reproductive management software… the works.

HRM Dairies distinguished itself as the only farm in Pakistan currently conducting genomic testing. They’re not just importing genetics; they’re utilizing the same scientific selection tools that drive productivity on the most advanced farms globally.

Their genomic testing capability generates daughters that are performance-proven under Pakistani conditions. According to management, 97% of their herd achieved pregnancy last year, with low mortality and production averaging over 12,000 liters per cow. That’s world-class performance.

This trend suggests that we’re seeing “demonstration farms” — operations that prove elite genetics work under local conditions and serve as showcases for wider adoption.

Climate Innovation with Global Applications

Pakistan’s extreme climate forces innovations that could benefit dairy operations worldwide.

Research shows increasing cooling sessions to five times daily improved milk yield by 3.2 kg per day in Nili Ravi buffaloes. Studies indicate that a 1°C temperature increase reduces milk yields by 1.72 liters per month, while humidity increases further suppress yields.

These pressures drive the development of heat stress management systems with automated cooling cycles, feed adjustment protocols optimized for high-temperature periods, and water management systems designed for extreme conditions.

Technology adaptation opportunities are significant. Sprinkler cooling systems, climate-controlled housing designs, and feed formulation strategies developed for 50°C conditions could provide competitive advantages in other regions facing similar challenges — such as Texas, Arizona, or anywhere heat stress is becoming a bigger issue.

The Human Element That Makes It Real

Behind all these numbers and technology stories are people making it happen.

What resonates with me is how these operators think systemically about profitability, animal health, and long-term sustainability rather than just chasing production numbers.

The Pakistani veterinarian stranded in Australia perfectly captures how knowledge transfer happens in modern dairy. He didn’t just bring back genetics — he brought back an entire approach to dairy management that’s now influencing operations across Pakistan.

I was impressed by conversations with Muddassar Hassan from HRM Dairies, who played a key role in introducing Australian genetics to Pakistan. His background includes importing heifers from leading Australian breeders, seeing firsthand how these animals perform under local conditions.

“Profit isn’t just about milk production; it’s also about lower expenses. If your cow is producing 12,000 litres but gets mastitis twice and takes four services to get pregnant, you aren’t making much profit. But if she’s producing 8,000-9,000 litres while getting pregnant easily and staying healthy, she’s almost certainly more profitable,” he explained.

That’s practical wisdom that transcends geographic boundaries.

Regional Lessons for North American Producers

Several developments in Pakistan offer insights for producers dealing with similar challenges:

Heat stress management: Climate-controlled barn designs and cooling protocols developed for extreme conditions could benefit operations in southern US regions where summer temperatures are increasingly problematic.

Genomic acceleration: The Pakistani experience demonstrates how quickly genetic progress can be achieved when genomic testing combines with elite genetics and proper management — they’re compressing timelines that we thought would take decades.

Cooperative infrastructure: The Success of programs like the World Bank’s milk chiller project demonstrates how shared infrastructure enables smaller operations to access technology that would be uneconomical for them individually. Applications for producer cooperatives dealing with processing or cooling challenges.

Sustainability integration: Building renewable energy and resource conservation into operations from the ground up rather than retrofitting later. Their solar installations and water recycling systems are impressive.

What This Means for Global Markets (And Why You Should Care)

Implications here are bigger than most of us think. Pakistan isn’t just scaling up dairy production — it’s building an entirely different cost structure while deploying the same elite genetics that drive productivity in developed markets.

Consider the math: if these corporate operations achieve even moderate success in raising the productivity of that 30-million-head base while maintaining cost advantages, we’re potentially looking at fundamental shifts in global dairy competitiveness within the next decade.

Traditional bottlenecks — such as heat stress management, breeding efficiency, and feed quality — are being systematically addressed by operations with capital and technical sophistication, enabling the implementation of effective solutions.

And here’s the kicker: they’re doing it with labor cost structures and feed production capabilities most Western operations can’t match.

Looking Forward: What to Watch

The timeline for Pakistani dairy becoming a significant global competitor is compressing. Several factors suggest major impacts within 5-7 years:

Policy reforms that reduce tax barriers and improve regulatory consistency could accelerate the formalization of milk supply. That 18% to 5% tax reduction alone could be transformational.

Infrastructure investments in cold chain and processing capacity create the backbone for scaled operations. Once that cold chain is built, everything changes.

Genetic improvements are already yielding measurable results at leading farms and will continue to compound over time. Starting with a 55% productivity gap, there’s tremendous upside potential.

Export market development provides economic incentives for continued investment and modernization. Those Chinese contracts could be just the beginning.

The productivity improvement potential identified in recent research isn’t theoretical — it’s achievable with existing technology and management practices. If that scales across their massive animal base…

The question for North American producers isn’t whether Pakistan will become a significant dairy competitor, but when and how to position for that reality.

The Strategic Questions We Should Be Asking

This development raises fundamental questions about future global dairy competition:

Are we ready for this level of competition? When you combine scale, low costs, modern technology, and elite genetics, you get a formidable competitor.

What’s our competitive advantage moving forward? If they can deploy the same genetics and technology we use, what differentiates us?

How do we adapt our heat stress management? As climate change affects traditional dairy regions, innovations being developed for 50°C conditions could become essential.

What about our feed efficiency? Their necessity to optimize every production aspect might drive innovations we should watch.

The Bottom Line for Your Operation

So where does this leave us? Several practical takeaways:

Stay informed about global developments — what happens in Pakistan won’t stay in Pakistan. Global dairy markets are more interconnected than ever, and genetics companies, equipment manufacturers, and consultants are already active in this space.

Consider climate adaptation technologies — if heat stress is becoming a more significant issue for your operation, examine what’s being developed for extreme conditions. Some solutions might be applicable sooner than you think.

Don’t underestimate the power of genomics — the Pakistani experience shows how quickly genetic progress can accelerate with the right tools and commitment. Are you maximizing your genetic potential?

Think about your competitive advantages — what makes your operation unique in an increasingly competitive global market? Quality? Efficiency? Sustainability? Location advantages?

Watch policy developments — government decisions on taxes, trade, and regulations can dramatically shift competitive dynamics. Sometimes, policy changes matter more than technology.

The dairy industry has always been about adapting to change. The question is whether we’re adapting fast enough to stay competitive in a rapidly evolving global marketplace.

This sleeping giant is waking up fast. The combination of scale, modern technology, elite genetics, and cost advantages they’re building is unlike anything we’ve seen before in the dairy industry.

The Competitive Reality Check

Here’s what I keep coming back to: Pakistan represents a distinct model of dairy development that we haven’t seen before. Instead of gradually modernizing existing systems, they’re essentially building a parallel, modern industry alongside traditional operations.

If successful — and early indicators suggest they might be — this creates a producer with significant scale, low costs, and increasingly sophisticated genetics and management. That’s not a combination global dairy markets have had to contend with before.

For North American producers, this isn’t necessarily a crisis, but it’s definitely something to monitor. The same genetics companies we work with, the same technology providers, the same management consultants — they’re all active in Pakistan now. The knowledge and tools that give us a competitive advantage are no longer exclusive.

The question isn’t whether Pakistan’s dairy industry will continue to grow and modernize. Based on what I’m seeing, that trajectory is pretty well established. The question is how quickly they can scale their modern sector and what impact that has on global supply dynamics.

We might be looking at a new major player in global dairy markets within the next 5-10 years. Unlike some other emerging producers, they’re building on a foundation of modern technology and elite genetics from day one.

What are your thoughts? Are you seeing similar developments in other markets? How are you positioning your operation to compete in this global market?

Because one thing’s becoming clear: the global dairy industry is getting more competitive, not less. Producers who think strategically about these shifts — whether adapting climate technologies, maximizing genetic potential, or developing their own competitive advantages — will be the ones who thrive in the years ahead.

The real question isn’t whether Pakistan will become a major player in global dairy markets. Based on what I’m seeing, that trajectory is established. The question is: are we ready?

The bottom line? Pakistan’s combining our genetics with their innovation to create something we haven’t seen before. Time to steal their playbook.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Next Frontier: What’s Really Coming for Dairy Cattle Breeding (2025-2030) – Discover practical strategies for implementing genomic testing and AI-driven breeding programs that deliver measurable ROI, just like Pakistan’s elite operations are achieving with 470 gBPI scores.

- USDA’s Massive Shakeup: What Every Dairy Producer Needs to Know Right Now – Understand how policy changes and market dynamics are reshaping North American dairy economics while Pakistan emerges as a low-cost competitor with strategic advantages.

- 5 Technologies That Will Make or Break Your Dairy Farm in 2025 – Learn about the same cutting-edge technologies Pakistan’s mega-dairies are deploying—from robotic milking to precision feeding—and how to implement them for immediate productivity gains.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!