What happens when processors start paying farmers NOT to produce milk? We’re finding out right now

EXECUTIVE SUMMARY: Today’s CME action revealed what many producers have been suspecting—the September rally was built on hope rather than fundamentals, with cheese blocks plummeting 4 cents to $1.75/lb and butter crashing 5.5 cents to $1.6950/lb. These aren’t just numbers on a screen… they translate directly to a 60-80¢/cwt reduction in Class III milk value, hitting October checks hard when margins are already tight. Recent Cornell research shows that top-performing farms maintain profitability through effective feed management and component optimization, spending 3.1% less on purchased feed while achieving higher production—a strategy that’s becoming increasingly essential as milk-to-feed ratios drop to 2.35 from August’s 2.51. With 228 billion pounds of milk forecast for 2025 (up from 226.3 billion in 2024), and the addition of new processing capacity that will invest $11 billion, we’re seeing classic oversupply dynamics that historically take 12-18 months to rebalance. Looking ahead, successful operations are focusing on three proven approaches: locking in Q4 hedges while October $17 puts remain available, maximizing Dairy Margin Coverage enrollment before the October 31 deadline, and shifting focus from volume to component quality—strategies that separate operations that thrive from those merely surviving. What farmers are discovering through this volatility is that waiting for markets to normalize isn’t a strategy… it’s choosing which proven risk management tools fit their operation’s specific needs and regional realities.

Well, here we go again. After watching September’s rally fizzle out like a Fourth of July sparkler in the rain, today’s cheese market finally admitted what we’ve been seeing in production reports for weeks – there’s simply too much milk chasing too few buyers at these price levels. Looking at today’s CME action, your October milk check just got lighter, and that’s putting it mildly.

The Numbers Tell a Brutal Story

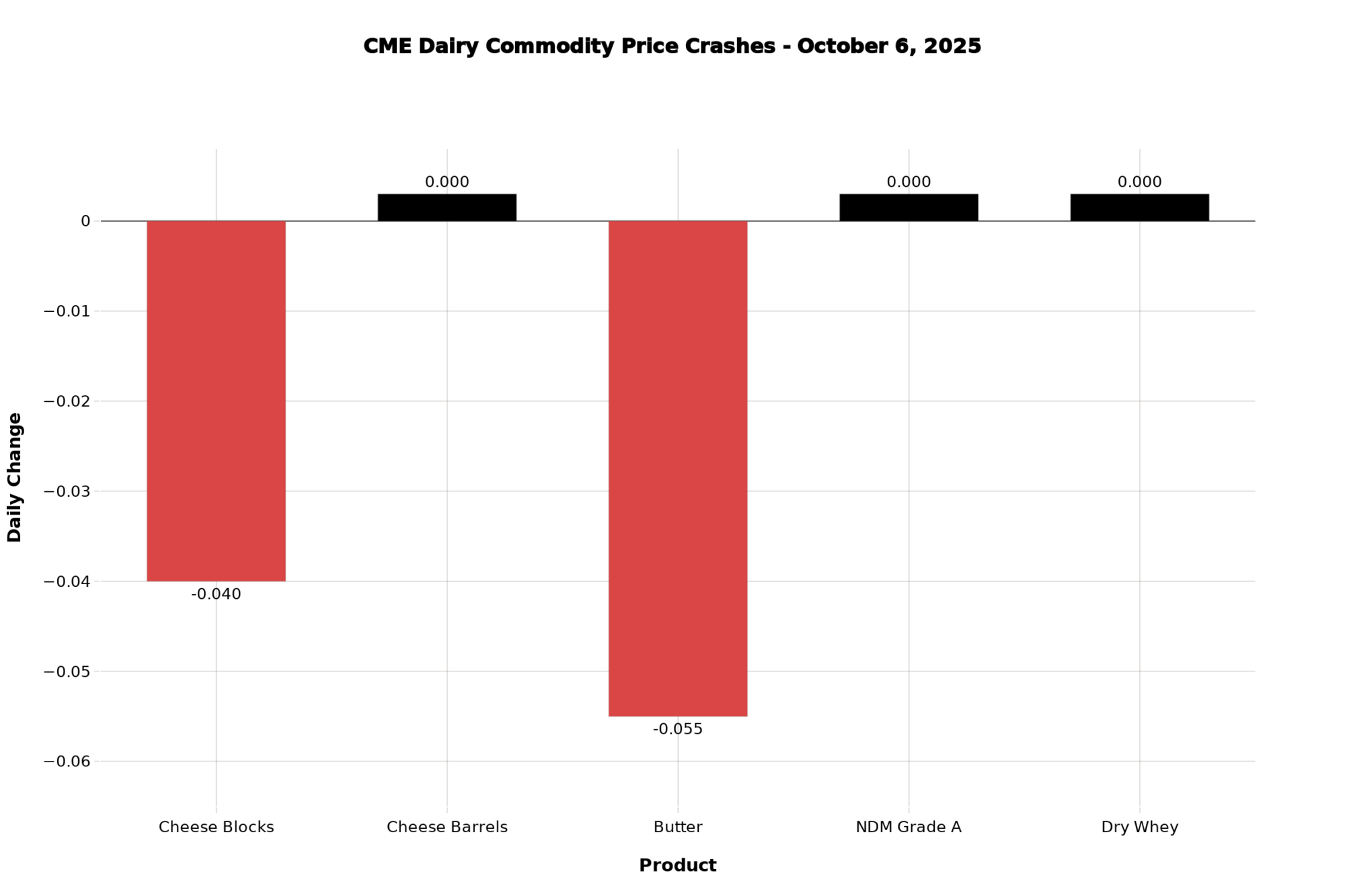

Let me walk you through what happened on the trading floor today, and the implications are stark for anyone long on cheese:

| Product | Price | Today’s Move | Weekly Average | What This Actually Means |

| Cheese Blocks | $1.7500/lb | -4.00¢ | Down to $1.75 from $1.79 | Class III drops 60-80¢/cwt |

| Cheese Barrels | $1.7700/lb | No change | Holding at $1.77 | Barrels are steady, but can’t prop up the market |

| Butter | $1.6950/lb | -5.50¢ | Crashed from $1.75 | Butterfat premiums evaporating |

| NDM Grade A | $1.1600/lb | No change | Steady at $1.16 | Powder markets holding |

| Dry Whey | $0.6300/lb | No change | Slight weekly decline | Protein values are stable but trending softer |

What’s particularly telling is how these moves played out. Seven block trades executed today, each one printing lower than the last – that’s not profit-taking, folks, that’s capitulation. When I see sellers outnumbering buyers 3-to-1 on butter (7 offers versus two bids), it reminds me of what a Wisconsin cheese plant manager told me last week: “We’re offering quality premiums just to slow down milk deliveries. That’s code for ‘please stop sending us so much milk.'”

The Trading Floor Speaks Volumes

You know, I’ve been watching these markets for decades, and certain patterns just scream trouble. Today’s bid-ask spreads told the whole story. Zero bids on cheese blocks against three offers? That’s what we call a “no bid” market – nobody wants to catch this falling knife.

One CME floor trader I spoke with said it best: “Haven’t seen butter take a beating like this since 2019. The funds are liquidating, and there’s no commercial support underneath.” When the smart money’s heading for the exits and processors aren’t stepping up to buy, you know we’re in for more pain.

The complete absence of barrel trading while blocks are getting crushed? That disconnect usually means one thing – processors are sitting on inventory they can’t move. And when processors can’t move cheese, dairy farmers feel it first and worst.

Where We Stand Globally

Examining the international landscape, the picture becomes even more complex. According to European futures data, their SMP (skim milk powder) is trading at €2,175/MT for October, which converts to roughly $1.05/lb, keeping them competitive with our NDM at $1.16. Meanwhile, New Zealand’s aggressive positioning shows their whole milk powder at $3,645/MT and SMP at $2,600/MT.

Ben Laine, senior dairy analyst at Terrain, recently noted that “the distinction between successful and challenging years for milk prices often hinges on exports”. Currently, with the dollar strong and our competitors being aggressive, that’s not working in our favor. The Kiwis are essentially putting a ceiling on where our powder prices can go, while the EU, despite dealing with environmental regulations and disease pressures, remains competitive.

Feed Costs: The Squeeze Gets Tighter

Here’s where the margin pressure really starts to bite. December corn futures closed at $4.6125/bushel today, up from $4.19 last week. Soybean meal is sitting at $277.10/ton. For those keeping score, that milk-to-feed ratio we all watch? According to the latest Dairy Margin Coverage data, it’s dropped to about 2.35 from 2.51 in August.

What farmers are finding is that income over feed costs (IOFC) for average operations is dropping toward $8.50/cwt. If you’re running efficiently, you may be holding at $9.50. However, I know many producers, especially those dealing with drought conditions out West and higher hay transportation costs, who are approaching breakeven territory.

The 2013 Cornell Dairy Farm Business Summary showed that top-performing farms spent 3.1% less on purchased feed than average farms while maintaining higher production. That efficiency gap is about to separate survivors from casualties.

Production Reality Check

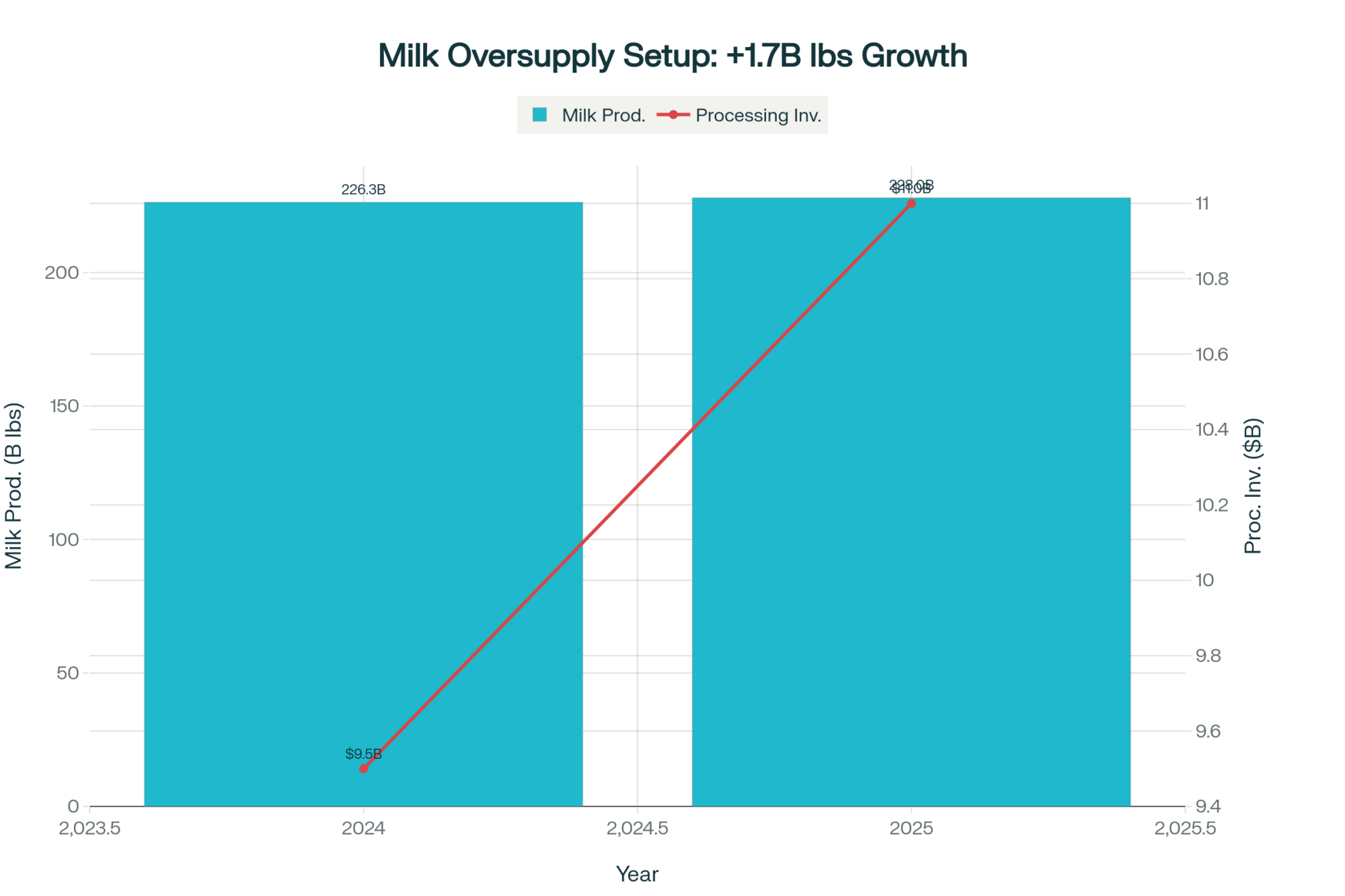

USDA’s latest forecast shows 228 billion pounds of milk for 2025, up from 226.3 billion in 2024. We have 9.365 million cows and are still increasing, with production per cow up by about 3 pounds per day year-over-year. That’s a lot of milk looking for a home.

What’s really caught my attention is the regional variation. Wisconsin and Minnesota are running 2-3% above their levels from last year. New York alone has seen $2.8 billion in new processing investment, according to the International Dairy Foods Association. Even with some HPAI concerns creating pockets of disruption in California, the national picture is clear – we’re making more milk than the market wants at these prices.

One Upper Midwest producer told me yesterday, “We’re getting these ‘quality premiums’ that are really just incentives to limit production. When processors start soft-capping your volume, you know supply has gotten ahead of demand.”

What’s Really Driving These Price Drops

Let’s be honest about domestic demand. According to recent Nielsen IQ data, retail cheese prices, ranging from $3.49 to $4.39 per pound/pound have finally reached the consumer’s price ceiling. Food service is steady but not growing fast enough to absorb the production increases we’re seeing. Supply isn’t the primary driver here – consumer behavior is. We’re producing roughly the same amount of milk year after year, but consumers aren’t keeping pace with high retail prices and export challenges.

On the export front, the situation’s equally concerning. Mexico – our biggest customer at $2.32 billion annually – is down 10% year-to-date according to USDA data. Political uncertainty and peso weakness aren’t helping. China? They’re quietly pivoting to New Zealand suppliers while dealing with their own economic challenges.

Looking Ahead: Managing Expectations

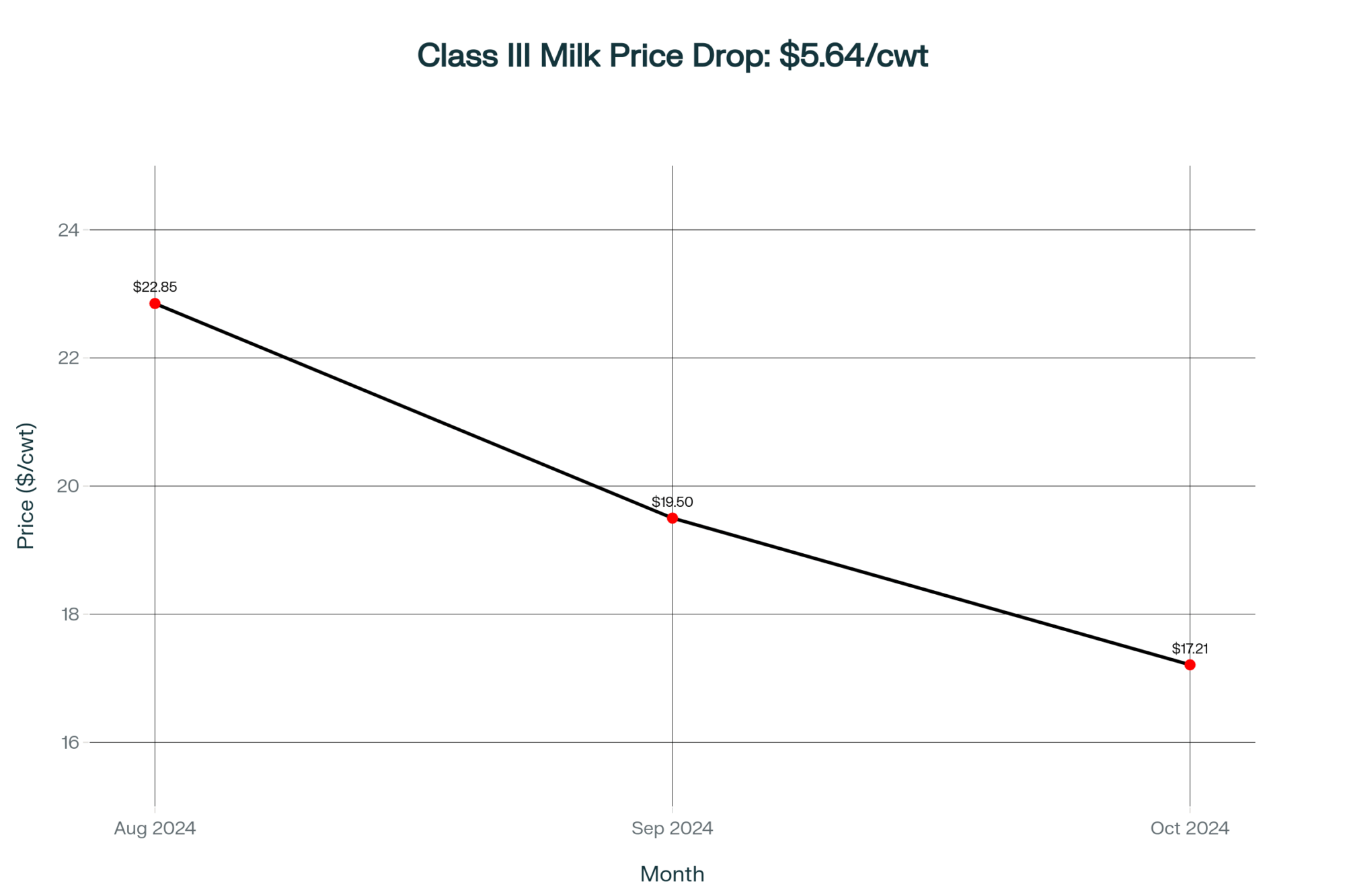

The USDA’s official forecasts for 2025 project an all-milk price of $22.00-$22.75/cwt, with Class III at $18.50. Today’s market action suggests those numbers might need serious revision. The futures market tells the real story – October Class III at $17.21/cwt and Class IV at $14.76/cwt. That’s the market voting with real money, and it’s voting bearish.

What’s interesting here is the disconnect between official optimism and market reality. December Class III is barely holding $17.00, and options implied volatility is spiking. That usually means traders expect more turbulence ahead.

What Smart Producers Are Doing Now

After talking with producers across the country and watching successful operations navigate similar cycles, here’s what makes sense:

Lock in Q4 hedges immediately. October $17.00 puts are still available at reasonable premiums. Yes, you might miss some upside, but when margins are this tight, protecting your downside isn’t optional – it’s a matter of survival.

Get serious about feed efficiency. The Cornell data show that top farms maintain profitability through effective feed management. Lock favorable grain prices if you haven’t already. With feed representing about 54% of total production costs according to Dairy Margin Coverage data, you can’t afford to let this slip.

Focus on components over volume. As one Minnesota producer recently told me, “Component quality now adds $400+ more income per cow annually compared to just pushing volume. With component prices diverging, optimizing for protein and butterfat content becomes even more critical.

Don’t forget Dairy Margin Coverage. Sign-up ends October 31. At $0.15 per hundredweight for $9.50 coverage, as USDA’s Daniel Mahoney notes, “risk protection through Dairy Margin Coverage is a cost-effective tool to manage risk¹². Don’t leave government money on the table.

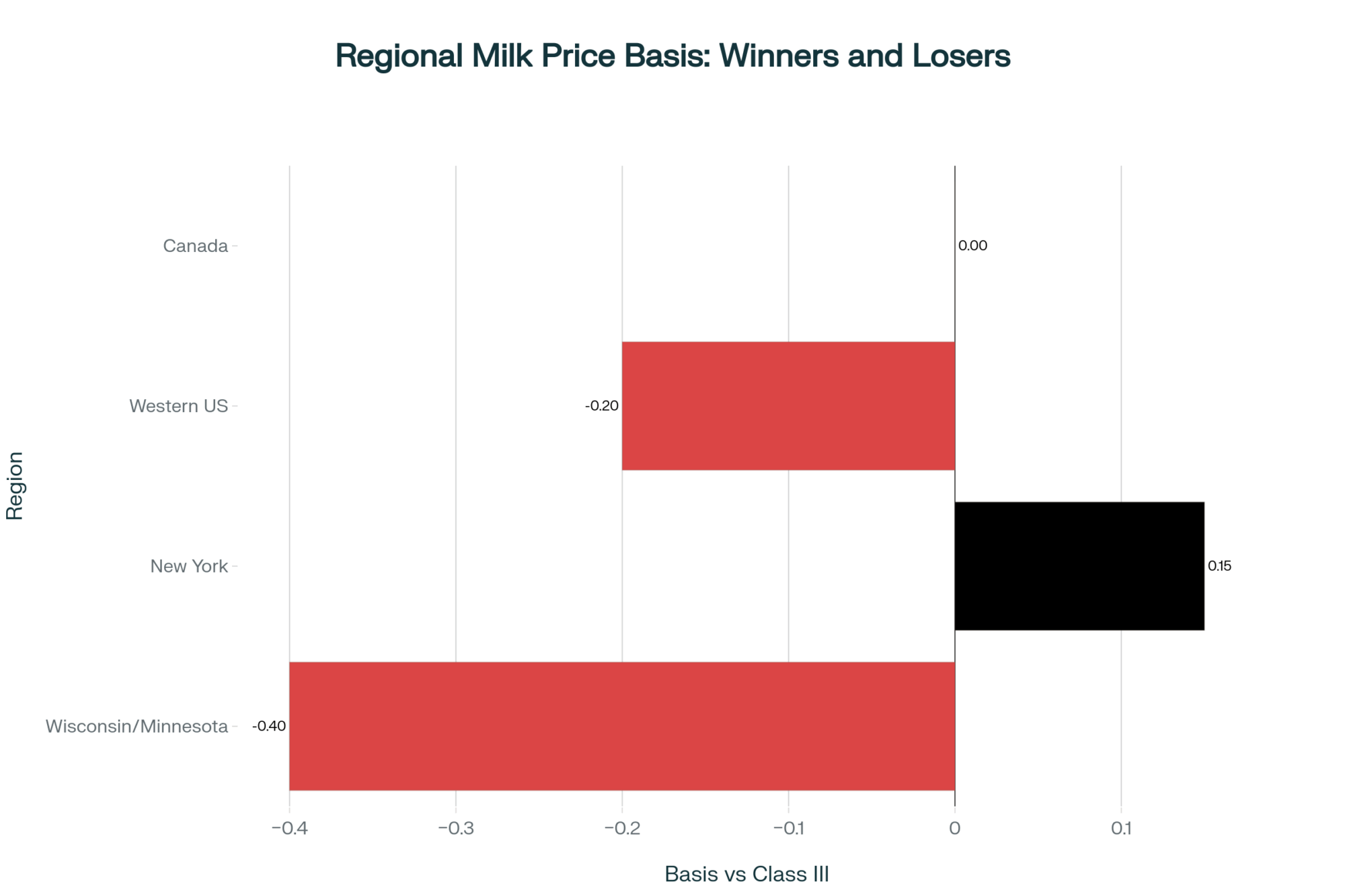

Regional Realities Matter

Wisconsin and Minnesota producers are experiencing what I call the “perfect storm” – ideal fall weather means cows are comfortable and producing heavily, but plants are at capacity. Local basis has widened to -$0.40 under class in some areas. Several smaller producers without solid contracts are really taking a hit.

Meanwhile, Western producers, who are dealing with higher hay costs and water issues, face different challenges. Canadian producers, interestingly, are seeing farmgate milk prices decrease by 0.0237% for 2025, according to the Canadian Dairy Commission; however, their supply management system provides more stability than what is currently being faced.

The Historical Context We Can’t Ignore

This reminds me eerily of the 2018-2019 period when oversupply met processor capacity expansion. That episode lasted 18 months before markets found equilibrium. Compare today’s Class III at $17.21 to October 2024, when it was $22.85/cwt. That’s a $5.64/cwt drop year-over-year – not a correction, but a fundamental reset.

Markets have a way of working themselves out. If processors are building new cheese plants and need to fill them with milk, they’ll eventually pay what it takes to get the milk in there. But that competitive market for milk? We’re not there yet.

The Bottom Line for Your Operation

Today’s market action wasn’t just another bad day – it’s a clear signal we’re entering a new phase of the dairy cycle. Your October milk check has just become lighter by at least $0.60/cwt, and November’s not looking any better. The combination of expanding production, new processing capacity, and global competition means this pressure is unlikely to subside soon.

However, here’s what decades in this business have taught me: low prices eventually lead to lower prices. The producers making smart decisions now – locking in margins where possible, controlling costs ruthlessly, focusing on efficiency over expansion – these are the ones who’ll be positioned to profit when the cycle turns.

Tomorrow, watch for follow-through selling in cheese. If blocks break $1.70, we could see accelerated selling pressure. October Class III futures expire in 10 days – position yourself accordingly.

And remember, as volatile as these markets are, the fundamentals of good dairy farming haven’t changed. Stay focused on what you can control: feed efficiency, component quality, and smart risk management. The dairy industry has always rewarded survivors, and this cycle won’t be different.

KEY TAKEAWAYS

- Lock in Q4 protection immediately: October Class III futures at $17.01/cwt signal continued pressure—farms using put options at $17 strike prices can protect against further drops while maintaining upside potential if markets recover

- Component quality now drives profitability: Minnesota producers report $400+ additional income per cow annually by optimizing protein and butterfat content versus pushing volume—a 4-5% margin improvement that matters when Class III hovers near breakeven

- Regional basis variations create opportunities: Wisconsin and Minnesota producers face -$0.40/cwt basis discounts as processors manage oversupply, while Eastern operations near new processing investments see premiums—understanding your regional dynamics determines negotiating power

- Dairy Margin Coverage becomes essential: At $0.15/cwt for $9.50 coverage (enrollment ends October 31), DMC provides positive net benefits in 13 of the last 15 years according to Ohio State analysis—it’s affordable insurance when margins compress to current levels

- Feed efficiency separates survivors from casualties: Top-quartile farms achieve $1.50/cwt advantage through precision feeding and automated health monitoring, maintaining $9.50 IOFC while average operations approach $8.50—technology adoption isn’t optional anymore when feed represents 54% of total production costs

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Exploring Dairy Farm Technology: Are Cow Monitoring Systems a Worthwhile Investment? – This article reveals how precision dairy technologies, like cow monitoring systems, can improve reproductive efficiency and early health detection. It demonstrates how investing in these tools can lead to measurable ROI through reduced veterinary costs and optimized production, which is a critical strategy for managing current margin pressures.

- Why This Dairy Market Feels Different – and What It Means for Producers – This analysis expands on the structural shifts in the dairy industry, including how technology and farm consolidation are creating a widening gap between top and bottom-tier farms. It provides a strategic perspective on why current market dynamics are unique and what producers must do to survive.

- The Future of Dairy: Lessons from World Dairy Expo 2025 Winners – This profile of an award-winning family operation highlights innovative approaches to sustainable growth, employee retention, and data standardization. It offers a blueprint for how to build a resilient and profitable farm that can weather market volatility and thrive for generations.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!