She trusted the formula. Her baby spent days in the hospital. Nestlé’s $1 billion recall just exposed the supply-chain failure that leads straight back to your milk cheque.

Executive Summary: Nestlé, Danone, and Lactalis have recalled infant formula across more than 60 countries after a heat-stable toxin called cereulide was traced to contaminated ARA oil from a Chinese supplier. Barclays estimates Nestlé’s worst-case hit at CHF 1 billion; Danone faces up to €100 million. Two infant deaths in France are under investigation, though no causal link has been established. The unsettling part: the contaminated ingredient had been classified as “low-risk”—not subject to the same scrutiny as raw milk or base powders. If your processor makes infant formula or high-spec powders, this matters directly to your operation: when premium outlets choke, the value of your milk gets more fragile. This piece maps the full timeline, explains why standard pasteurization couldn’t prevent this toxin, and lays out the specific questions you should be asking your co-op board right now.

The call came on a cold January morning that no parent ever wants to get. A UK mother was standing next to her three-month-old’s hospital crib, watching doctors perform two lumbar punctures on her baby boy. According to her account shared with Sky News, he’d spent days violently vomiting and struggling with diarrhoea, his skin mottled and his feet turning blue in the days after feeds of Nestlé’s SMA formula. “I trusted the brand,” she said—and you could hear that trust shatter in her voice.

Doctors diagnosed meningitis and treated him with antibiotics. Only later did his mother learn that the SMA product she’d been feeding was among those Nestlé recalled, though no official link has been established between the formula and his illness. Nestlé has said cereulide “does not lead to meningitis” and that there’s no evidence its product caused the baby’s condition. The mother has called for a full investigation, saying, “we don’t have the full picture of what has happened.”

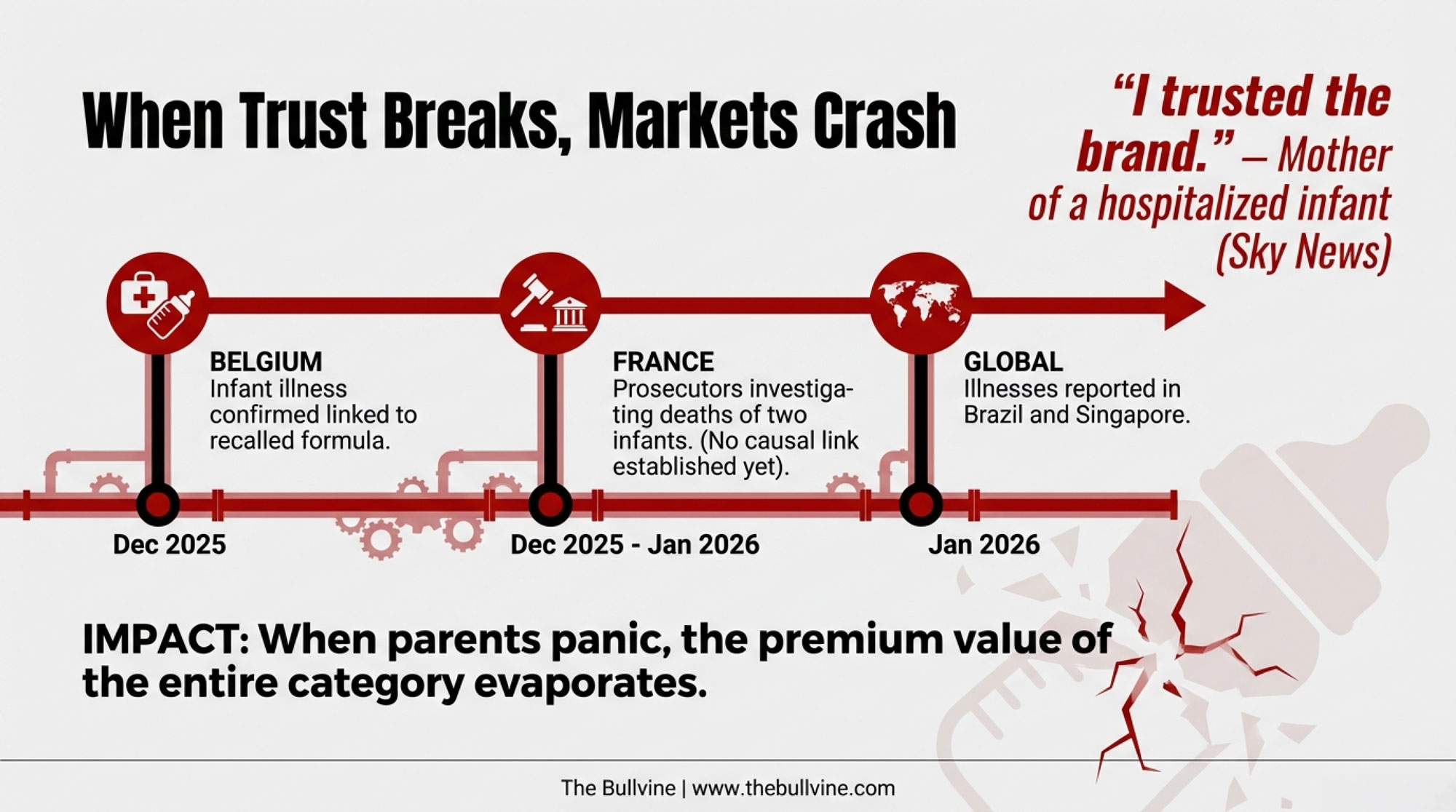

While she was living that nightmare, another family in Belgium was riding out 10 days of vomiting and watery diarrhoea after their baby drank Nestlé formula. In Brazil, two more infant illnesses linked to the recalled formula. In Singapore, a consumer with “mild symptoms likely associated with cereulide exposure.” And in France, prosecutors opened investigations into the deaths of two babies whose parents reported they had been fed Nestlé’s Guigoz formula in the days before they died.

At the same time, Nestlé, Danone, and Lactalis were scrambling to pull product from shelves in more than 60 countries, watching billions in market value evaporate, and tracing the crisis back to a single contaminated input: ARA oil from a supplier in China.

Here’s what you need to understand: this isn’t just a baby food story. It’s a live-fire stress test of the global dairy supply chain. If your milk ends up in powder or infant formula—directly or through your co-op—this hits your processor’s risk profile and, on many plants, eventually works its way back into the milk price you see.

Sick Babies, Scared Parents, and Two Death Investigations

We’re going to start where this actually matters: in the nursery, not the boardroom.

In Belgium, authorities were more definitive about the toxin itself. Joris Moonens, spokesperson for the Flemish Department of Care, confirmed that stool samples from an affected child contained cereulide and were linked to consumption of recalled formula. The child recovered after about ten days.

Brazil’s national health surveillance agency reported two infants sickened after consuming Nestlé formula that has since been recalled. Singapore’s Food Agency noted one consumer who developed mild symptoms and later recovered.

France is where the story turns tragic—and where nuance matters most. One baby born on December 25, 2025, died on January 8, 2026, at Haut-Lévêque Hospital in Pessac; the child’s parents told investigators she had been fed Guigoz formula between January 5 and 7. A second case involves a 27-day-old girl who died on December 23, 2025, in Angers; her mother likewise reported Guigoz consumption.

Angers prosecutor Eric Bouillard has called the formula a “serious lead” but stressed it’s “far too early” to say there’s a causal link. France’s health and justice ministries have reiterated that, as of late January 2026, no scientific evidence links the formula to these deaths, and toxicology and epidemiological investigations are ongoing. French prosecutors and health authorities are still gathering medical records, toxicology results, and feeding histories from the families involved. Any formal conclusions on whether the formula contributed to these deaths are expected to take weeks or months.

This is the emotional core that can get lost in corporate timelines: parents feeding their babies what’s supposed to be the safest, most regulated dairy product on the shelf—and then watching those babies get sick.

How One “Low-Risk” Ingredient Brought Down Three Giants

So how did three of the biggest dairy-adjacent players on the planet end up here?

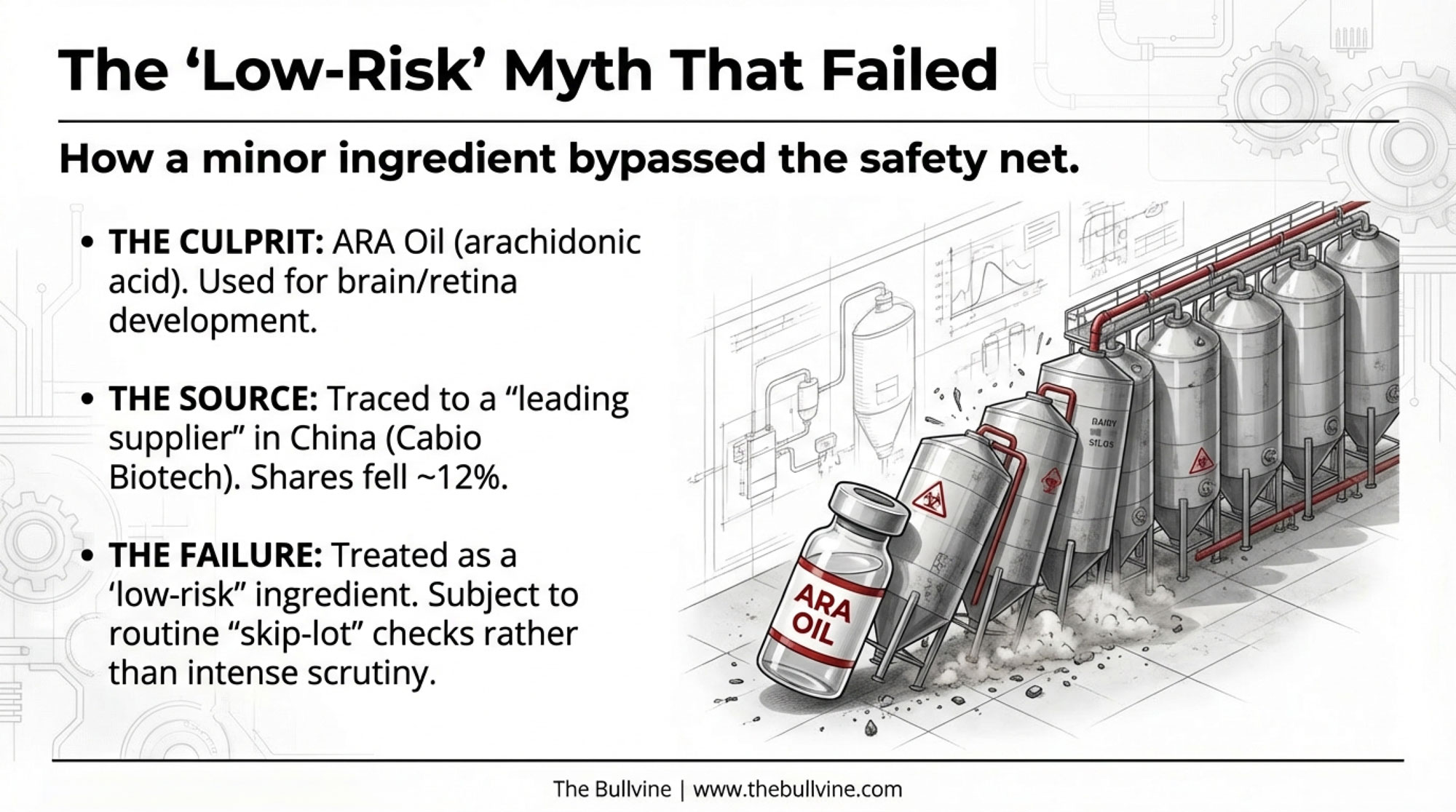

The common thread is a specialty ingredient called arachidonic acid (ARA) oil—a long-chain fatty acid added to infant formulas to mimic components of breast milk and support brain and retina development. It’s typically produced by fermenting a particular fungus, then extracting and purifying the oil.

In this scandal, Nestlé traced the contamination to ARA oil from an unnamed “leading supplier” based in China. Market indicators and reporting from Chinese outlet Yicai Global have linked the ARA supply used by Nestlé to Cabio Biotech, a Wuhan-based producer whose 2024 financial report notes significant growth in its ARA business and lists major clients such as Nestlé and Danone—though Nestlé has not publicly named the supplier. Once this story broke, Cabio’s shares dropped nearly 12%, according to Yicai Global.

Here’s the part that should make every QA manager sit up: industry quality experts reported that, in many specialized nutrition HACCP plans, ARA oil had been treated as a “low-risk” ingredient. That label meant it received routine quality checks, but not nearly the scrutiny given to raw milk, base powders, or the final product.

| Ingredient Type | HACCP Classification (Pre-Recall) | Testing Protocol (Pre-Recall) | HACCP Classification (Post-Recall Expected) | Testing Protocol (Post-Recall Expected) |

| Raw Milk | High-Risk | Every lot tested; full pathogen panel | High-Risk | Every lot tested; full pathogen panel |

| Base Powder (SMP/WPC) | High-Risk | Every lot; identity + moisture + micro | High-Risk | Every lot; identity + moisture + micro |

| ARA Oil (specialty lipid) | Low-Risk | Skip-lot; routine identity checks | High-Risk | Every lot; cereulide + B. cereus panel |

| DHA Oil (specialty lipid) | Low-Risk | Skip-lot; routine identity checks | High-Risk | Every lot; toxin screening |

| Vitamin Premixes | Low-Risk | Certificate of Analysis (CoA) accepted | Medium-High-Risk | Quarterly audit; CoA + third-party verification |

An industry insider put it bluntly: “Normally, low-risk ingredients aren’t monitored as closely—you just have your routine checks.” The same coverage predicts that ARA oil will now be upgraded to high-risk status by most serious players.

From the Chinese supplier, the ARA oil was shipped to Europe via a Dutch intermediary. French authorities have confirmed the ingredient was manufactured in China and “sold by a Dutch company” to European manufacturers. That oil was then used at:

- Nestlé plants, including its Nunspeet factory in the Netherlands, making BEBA, NAN, SMA, Guigoz, Nidal, and Alfamino

- Danone facilities in Wexford and Macroom, Ireland, producing Aptamil, Cow & Gate, and Nutrilon

- Lactalis plants making Picot infant formula for 18 countries

The problem isn’t just the bacteria. It’s the toxin.

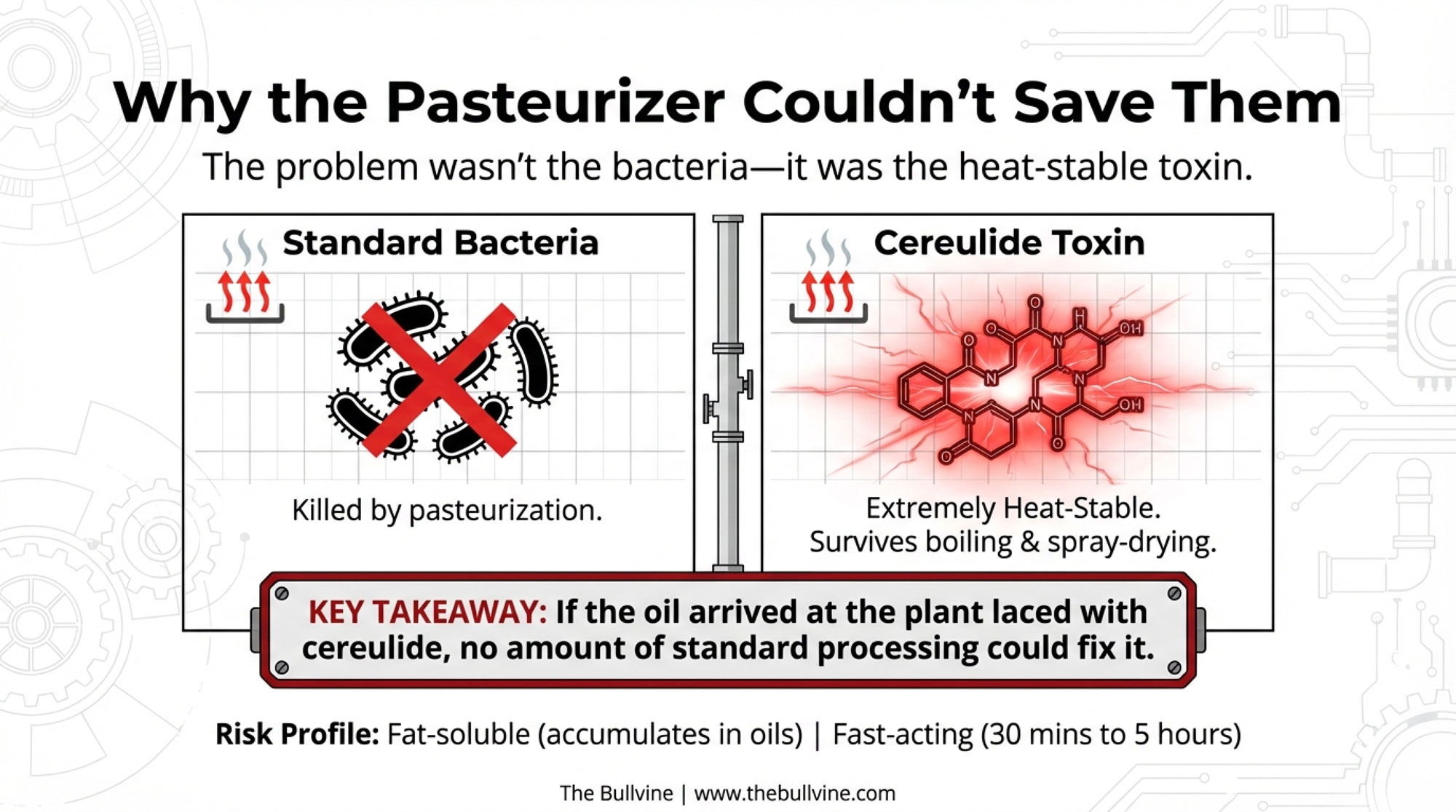

Cereulide is extremely heat-stable. Once it’s formed in a food or ingredient, it survives boiling water, pasteurization, spray-drying—the whole toolbox of typical dairy processing. C&EN’s January 2026 explainer made it clear that cereulide can withstand the high temperatures used in infant formula manufacturing and remain active. If the ARA oil arrived at the plant already laced with cereulide, no amount of standard processing heat would “cook it out.”

The “high-risk” raw milk that everyone obsesses over wasn’t the issue. The “low-risk” micro-ingredient that was supposed to be safe enough for skip-lot testing is what brought the house down.

The Timeline: Who Knew What, and When?

The timing is where consumer groups and regulators are focusing their anger—and where your own risk radar should start buzzing.

- Late November 2025 — Routine checks at Nestlé’s Nunspeet plant detect low levels of cereulide; further testing confirms trace amounts.

- December 9, 2025 — Nestlé informs Dutch food safety authorities.

- December 10, 2025 — Nestlé France announces a limited recall of 25 batches in 16 countries.

- December 12, 2025 — Italy logs the first entry in the EU Rapid Alert System for Food and Feed (RASFF).

- January 5, 2026 — Nestlé publicly announces a major recall across 49 countries.

- January 14, 2026 — Nestlé executive Philipp Navratil releases a video statement, saying parents “trust us to provide products that are safe and of high quality,” and insisting the company followed each national authority’s guidance.

- January 17, 2026 — Singapore Food Agency orders Danone to recall Dumex Dulac 1 after detecting cereulide.

- January 21–22, 2026 — Lactalis recalls Picot infant formula in 18 countries.

- January 22–25, 2026 — French prosecutors open investigations into two infant deaths.

- January 23–26, 2026 — Danone recalls specific Aptamil batches in Ireland and the UK.

- January 30, 2026 — Le Monde reports Nestlé acknowledges a 10-day delay between initial detection and the first precautionary recall.

Consumer group Foodwatch has hammered both the companies and regulators. Their legal filings argue that Dutch authorities were informed on December 9, yet the full cross-border risk wasn’t shared with other EU countries or consumers immediately. Foodwatch says, “by the time scandals are uncovered, it is often too late: the products have been consumed, and people have fallen ill.”

Nestlé’s public line is that, as soon as it confirmed the issue, it “engaged proactively with the respective health and food safety authorities…and followed their guidance.” That might pass the legal test. It doesn’t fix the trust gap for parents—and it doesn’t reduce the operational shock for plants or the farmers behind them.

Worth noting: some markets have not been affected. Canada’s Food Inspection Agency stated that recalled products were not distributed in Canada.

The Billion-Dollar Hit

Let’s pull the numbers together—because they’re real.

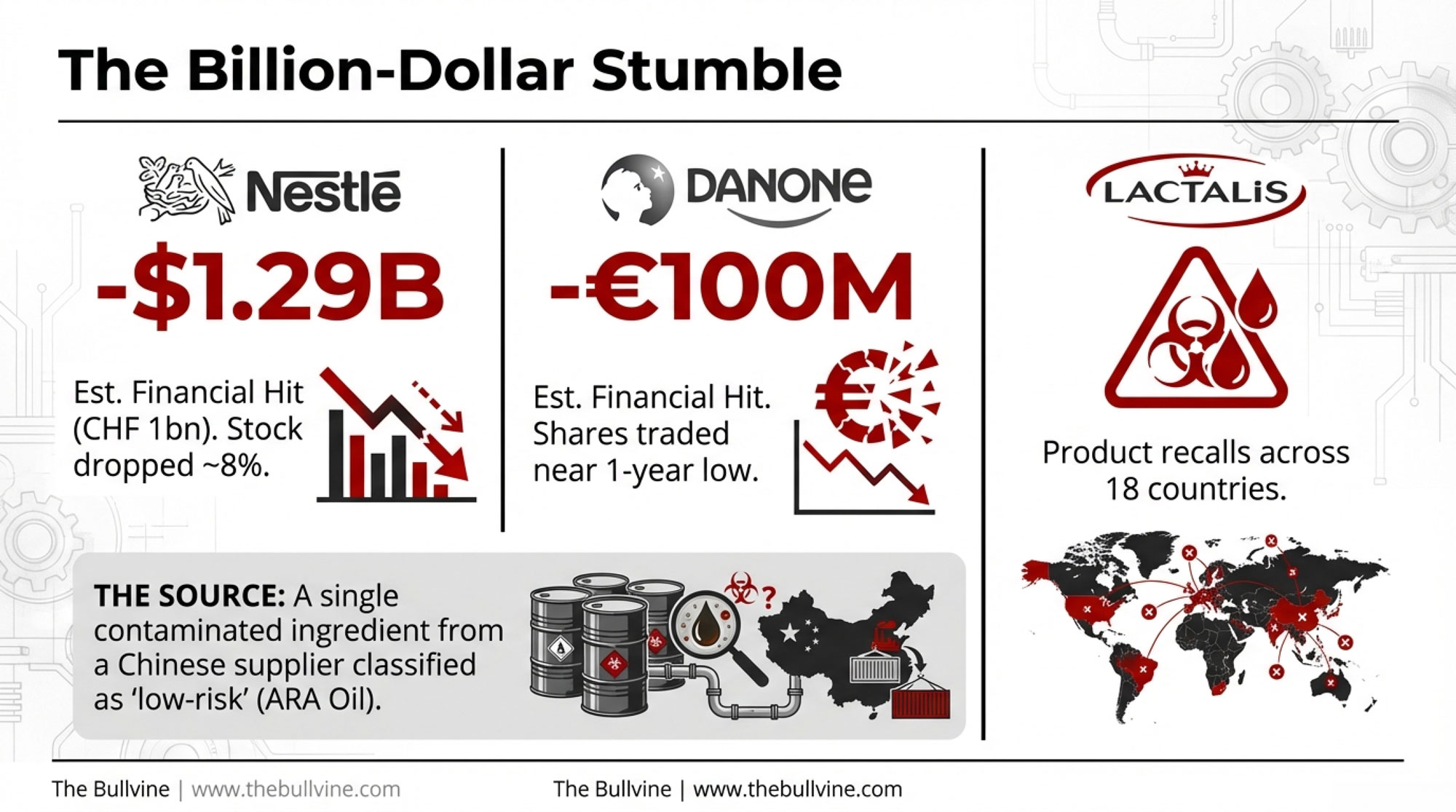

- Nestlé — Barclays estimates a worst-case impact of around CHF 1 billion (~$1.29B USD) when you combine product write-offs, logistics, and brand damage, according to Reuters and FoodIngredientsFirst. Nestlé has said the recalled batches represent less than 0.5% of annual group sales, but infant nutrition still accounts for roughly 5% of total revenue. Shares fell around 8% in the weeks following the January 5 announcement.

- Danone — Infant formula is about 21% of Danone’s business, according to Reuters. Barclays pegs a worst-case hit near €100 million (~$118.5M). Stock dropped 8–10% around the recall announcements and traded near a one-year low.

- Cabio Biotech — Shares fell nearly 12% once the contamination was linked to the Chinese ARA oil supply, per Yicai Global.

- Combined — Total direct and indirect losses comfortably exceed $1 billion, according to analyst estimates.

| Company | Product Write-Offs & Destruction | Logistics & Recall Execution | Brand Damage & Legal Reserves | Stock Market Loss (Red) | Total Impact (USD) |

|---|---|---|---|---|---|

| Nestlé | $320M | $180M | $290M | $500M | $1,290M |

| Danone | $30M | $18.5M | $20M | $50M | $118.5M |

| Cabio Biotech | $10M | — | $10M | $30M | $50M |

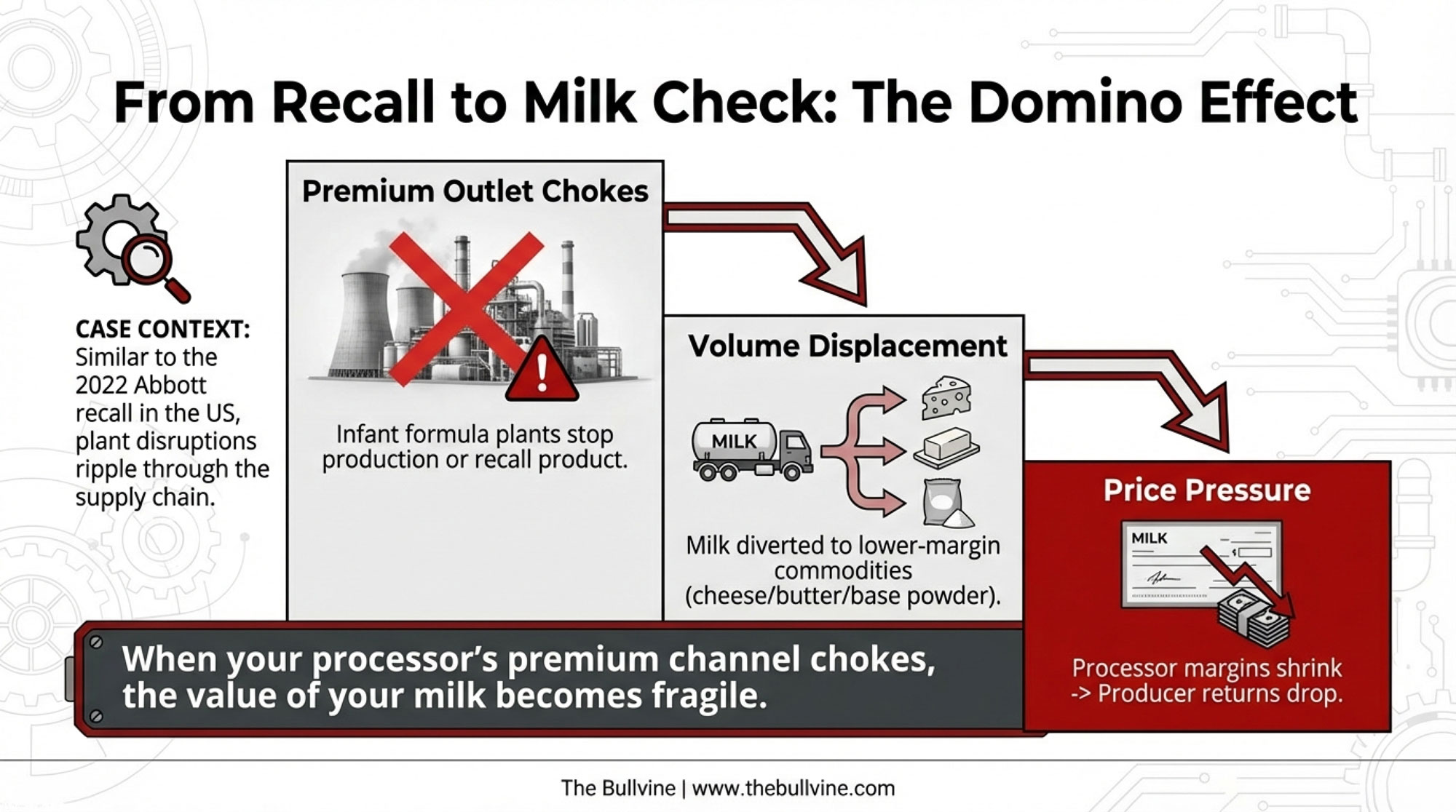

For dairy, the lesson in those numbers isn’t sympathy for multinationals. It’s how fast value can evaporate when one high-value outlet—infant formula—goes sideways. Plants don’t magically keep every litre at the same value when they’re forced to downgrade product, shift volumes into lower-margin streams, or run under capacity.

That shows up in processor margins—and on many plants, shocks like this eventually work their way back into the milk price farmers see.

Why Cereulide Is Different

Sixty seconds on the chemistry, because you need to understand why this hazard is so nasty.

Cereulide is a small, cyclic dodecadepsipeptide toxin produced by certain emetic strains of Bacillus cereus. Unlike the bacteria itself—which you can often kill with heat—cereulide is:

- Extremely heat-stable — survives boiling and spray-drying

- Fat-soluble — accumulates in fatty ingredients like oils

- Fast-acting — symptoms typically start within 30 minutes to 5 hours

Typical symptoms: sudden nausea, repeated vomiting, diarrhoea, abdominal cramps, lethargy, dehydration. In babies, that often shows up as intense crying and refusal to feed. Most cases resolve within 6–24 hours, according to EFSA and Food Standards Australia New Zealand guidance. But severe intoxication has been associated with acute liver failure and life-threatening outcomes, especially in vulnerable populations.

The key takeaway: once cereulide is present in an ingredient, no standard pasteurization step in your plant will remove it. Prevention and supplier control are your only real levers.

| Pathogen / Toxin | Typical Source | Survival at Pasteurization Temps (72°C / 161°F, 15 sec) | Survival at Spray-Drying Temps (180–200°C) |

| Salmonella spp. | Raw milk, environment | Killed | Killed |

| Listeria monocytogenes | Raw milk, equipment biofilm | Killed | Killed |

| E. coli O157:H7 | Raw milk, fecal contamination | Killed | Killed |

| Bacillus cereus (bacteria) | Soil, environment, ingredients | Killed | Killed |

| Cereulide toxin | Produced by B. cereus in fatty ingredients | SURVIVES | SURVIVES |

| Botulinum toxin | Anaerobic environment, poor sanitation | Heat-labile (destroyed) | Destroyed |

| Staphylococcal enterotoxin | Human handling, poor hygiene | SURVIVES | SURVIVES |

The Processor Playbook: Five Questions for Your Board

If you’re in a plant, on a co-op board, or responsible for quality systems, this should feel like a fire drill with the alarm still ringing.

1. Which of our ingredients are still tagged “low-risk” that could carry high-impact hazards?

Go beyond raw milk and water. Look at ARA, DHA, vitamin premixes, specialty proteins going into infant and medical nutrition lines. If your HACCP documents still treat these inputs like table salt, that’s a problem.

2. Do we test every lot of critical micro-ingredients, or are we still on skip-lot protocols?

Health Canada’s guidance for infant formula manufacturing makes it clear: every lot of incoming material must be sampled and tested unless you have robust historical data demonstrating consistent compliance—and even then, every lot requires identity testing. “We trust Supplier X” isn’t a methodology.

Decision rule: Test every lot of specialty lipids until you have 12+ consecutive compliant lots documented, with full traceability to upstream manufacturing sites.

3. Could we trace any recalled ingredient to the finished product within hours, not days?

That means real-time digital traceability down to specific batches and pack codes—not spreadsheets and binders that take all weekend to reconstruct. If you can’t answer “Which exact facility made the ARA in this batch?” without phoning three people, your traceability is paperwork, not practice.

4. Are we over-dependent on any single plant or supplier for infant or medical nutrition ingredients?

You don’t need to double your ingredient costs, but you should qualify at least one alternate supplier for each critical input. Use contracts that require upstream transparency—suppliers should tell you when they change their own sources or face investigations.

5. Is our crisis communication plan designed to make regulators comfortable—or to keep parents informed?

Be honest: are you building statements for legal teams, or for the mothers and fathers in the NICU?

Decision rule: Target customer notification within 24 hours of a confirmed serious hazard—not “when the regulator tells us to.”

| Question for Your Co-op Board | Weak Answer (Red Flag) | Strong Answer (What to Demand) |

| Which ingredients are still tagged “low-risk”? | “We follow industry standards for all ingredients.” | “We’ve reclassified ARA, DHA, and all specialty lipids to high-risk. Every lot now tested for B. cereus and cereulide.” |

| Do you test every lot of critical micro-ingredients? | “We use skip-lot protocols for ingredients with strong supplier histories.” | “We test every lot of ARA, DHA, and vitamin premixes until we have 12+ consecutive clean batches—then quarterly audits.” |

| Can you trace recalled ingredients within hours? | “We maintain full traceability records in compliance with regulations.” | “Digital traceability down to batch codes and upstream manufacturing sites. We can answer ‘Which facility made this?’ in under 2 hours.” |

| Are you over-dependent on any single supplier? | “We’ve built strong relationships with our key ingredient partners.” | “We’ve qualified at least two suppliers for every critical input. Contracts require 48-hour notification of upstream source changes.” |

| Is your crisis plan designed for parents—or lawyers? | “We have robust protocols and follow all regulatory guidance.” | “Target 24-hour customer notification for confirmed hazards—before regulators mandate it. Parent trust > legal comfort.” |

What This Means for Your Operation

If you’re milking cows and shipping to a processor with any infant formula business, you’re in this story whether you’ve ever seen a can of SMA or Aptamil or not.

Infant formula is a premium outlet—when it’s running.

Ireland is a good example. Around 90% of Irish dairy production is exported in some form, and infant nutrition products are a well-publicized part of that export mix. Danone’s plants in Wexford and Macroom were expanded specifically to serve global infant formula markets, supplying Aptamil, Cow & Gate, and Nutrilon across Europe and beyond.

When those plants run flat out, they’re a value-add engine for Irish milk. When they have to slow, rework, or divert volumes because of an ingredient issue, that milk has to go somewhere else—more volume pushed into lower-value commodities, less ability to pay premiums on nutrition-grade product, potential pressure on base price.

We saw a different version of this dynamic in the US after the Abbott infant formula recall in 2022. The shutdown of Abbott’s Sturgis plant triggered major shifts in import flows, emergency approvals for foreign formula, and ripple effects in powder markets. If you weren’t paying attention to how formula plant disruptions can cascade through the broader dairy supply chain, that was your wake-up call. This is your second one.

Nobody has a clean $/cwt figure yet for this cereulide recall, and it will vary hugely by plant and contract. The point is simple: when your processor’s premium channel chokes, the value of your milk becomes more fragile.

Three Conversations to Have with Your Co-op

You can’t control where a Chinese supplier sources its raw materials. You can control how informed and engaged you are with the people who sell your milk.

1. “How much of our milk is tied to infant formula and high-spec powders?”

It’s not prying to ask roughly what share of plant output goes to infant formula versus cheese, butter, or commodity ingredients. A plant with 5% of volume in infant nutrition is in a very different risk position than one sitting at 25–30%. The upside in good times is bigger. So is the downside when something goes wrong.

2. “What changed here after the Nestlé–Danone–Lactalis recalls?”

You’re looking for specific moves: revisiting HACCP risk rankings for micro-ingredients, reviewing supplier qualification for overseas sources, and running crisis simulations. If you get answers like “we’re monitoring the situation” or “we’re fully compliant,” that’s nice—but it’s not the same as “this is what we’ve changed.”

3. “If something goes wrong upstream, how will you protect the farmer reputation?”

We’ve all seen how fast social media can paint with a broad brush: “dairy” gets blamed long before anyone distinguishes between a Chinese ingredient plant and your bulk tank. Ask whether your co-op has a clear stance on how they’ll communicate when an issue isn’t farm-level.

Trust on Trial—Again

Part of why this story has so much heat is that it sits on top of a long, ugly history.

- Lactalis salmonella (2017–2018) — 35 babies in France were infected with Salmonella Agona after consuming Lactalis infant formula, prompting a recall of 12 million boxes across 83 countries, according to Eurosurveillance reporting. The same Craon facility had been linked to an outbreak in 2005. In 2023, Lactalis was criminally charged with aggravated deception and involuntary injuries.

- China’s melamine scandal (2008) — Adulterated milk powder killed at least six babies and caused kidney damage in an estimated 300,000, according to WHO figures. Trust in Chinese infant formula never fully recovered.

- Nestlé’s 1970s marketing practices — Aggressive promotion of infant formula in developing countries contributed to serious illness and death. The resulting boycott, starting in 1977, has shadowed Nestlé’s infant nutrition brand ever since.

When infant formula brands stumble, they don’t just damage their labels. They erode trust in the idea that highly processed, highly regulated dairy products are bulletproof.

You and your co-op don’t control that history. But you’re living in the shadow of it.

Key Takeaways

If you’re a processor or on a board:

- Re-score ingredient risks so nothing that can quietly carry a toxin sits in the “low-risk” bucket without hard justification

- Map critical supply chains at least two tiers back, and audit upstream plants where needed

- Build a 24-hour recall and communication playbook that leads with consumer safety, not legalese

- Stress-test your business mix so a shock in infant formula doesn’t take down your whole value structure

If you’re a farmer:

- Get clear on how much of your milk rides on infant formula and high-spec powders

- Push for straight answers on how your buyer is adjusting sourcing and safety systems post-recall

- Keep your own house in order on quality and documentation—so if a crisis hits upstream, you’re part of the solution, not the question mark

The Fork in the Road

Let’s be honest: none of this is comfortable. It’s hard enough to manage feed bills, labour, fresh cow management, breeding decisions, and maybe a robot payment without worrying what some ingredient plant halfway around the world is doing.

But that’s the reality of the market we’re in now. Your milk doesn’t just become cheese for the local deli anymore. It becomes powder for Jakarta, formula for Dublin, ingredients for Dubai.

We can treat this as a PR mess for three multinationals in far-off factories. Shake our heads, hope regulators patch a few things, and carry on.

Or we can treat it as what it really is: a warning shot that says every link between your bulk tank and a baby’s bottle has to withstand this level of scrutiny.

Because at the end of the day, this isn’t just about one Chinese supplier or Nestlé or a Dutch broker. It’s about whether parents can keep trusting dairy-based formula to nourish their babies—and whether you can keep trusting the brands and plants that turn your milk into that promise.

If we want to keep that trust, it’s on all of us—from the parlour to the boardroom—to tighten the weak links we’ve been willing to live with.

Your future milk cheque, and a lot of babies’ futures, are riding on the same thing: whether this industry can look in the mirror after a billion-dollar recall and say, honestly, “We’ve learned from this—and we’ve changed.”

Editor’s Note: This analysis draws on official statements and reporting from national food safety agencies, Reuters, FoodNavigator, Le Monde, Euronews, C&EN, Yicai Global, and Foodwatch between December 2025 and January 2026. Investigations into potential links between specific infant illnesses and recalled products are ongoing; where causality is not established, we’ve said so. Economic impacts will vary by processor, region, and contract structure.

Learn More

- 51 Sick Babies, 55 Organic Farms, One Powder Plant: What the ByHeart Botulism Outbreak Means for Your Dairy Contracts and Supply-Chain Risk – Exposes the lethal fine print in modern supply agreements and deliversa step-by-step negotiation framework. Use these tactics to shield your equity from lopsided recall liabilities before the next market disruption hits your milk check.

- More Milk, Fewer Farms, $250K at Risk: The 2026 Numbers Every Dairy Needs to Run – Reveals the brutal math of the 2026 dairy reset and arms you with the strategic clarity needed to navigate the “more milk, fewer farms” era. Decide your path before the next market cycle decides it for you.

- The $50,000 Biofilm Crisis Your ATP Test Will Expose – Breaks down the invisible $50,000 profit leak hiding in your equipment while revealing how advanced monitoring catches pathogens. Mastering this tech prevents catastrophic grade-outs and secures your reputation as a top-tier supplier in high-scrutiny markets.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!