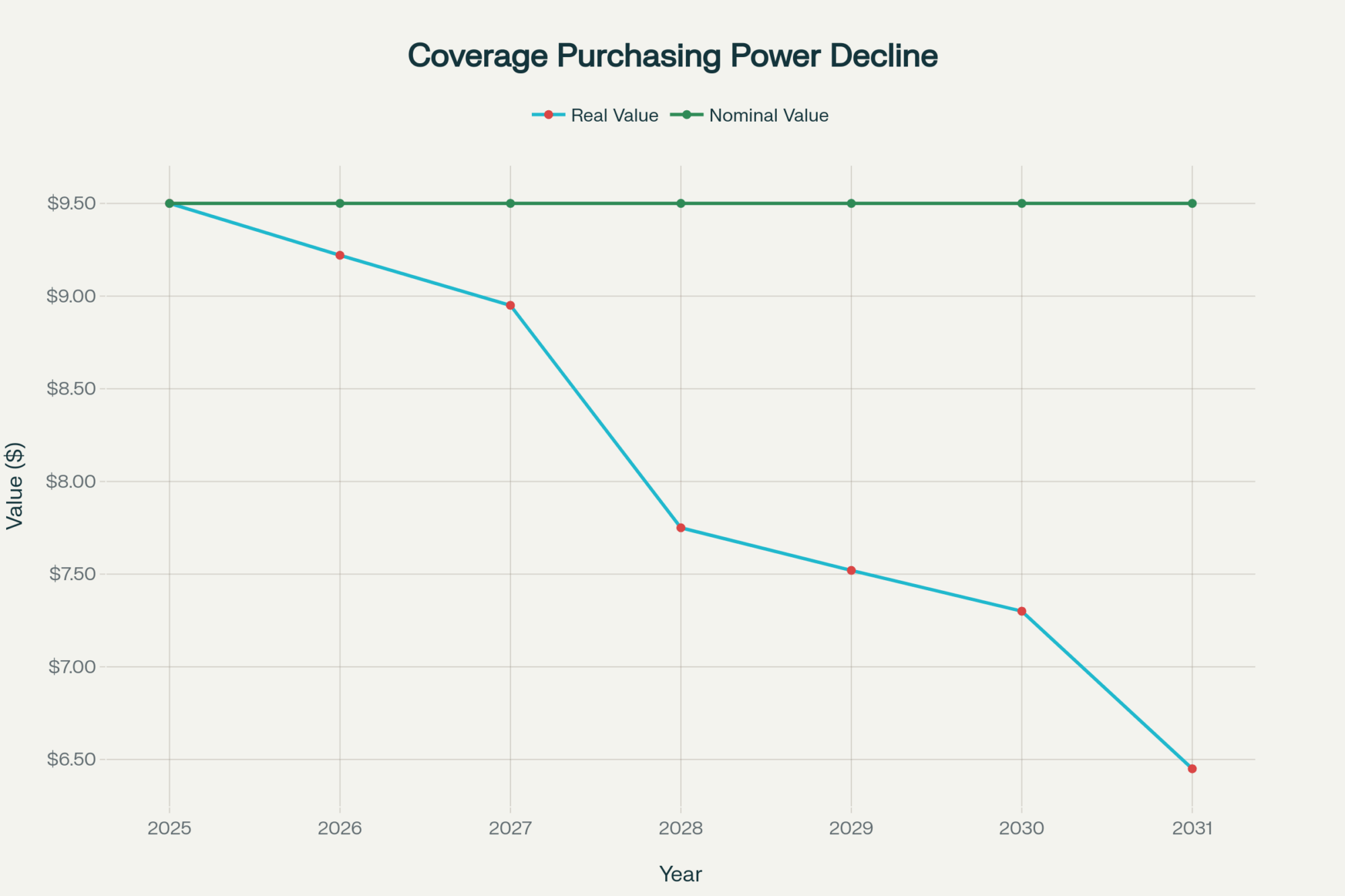

Fixed safety nets lose 30% purchasing power by 2031—your $9.50 coverage becomes worth $6.45

EXECUTIVE SUMMARY: What we’re discovering through conversations with dairy farmers across the country is that fixed safety net programs, while valuable, are creating an interesting planning challenge—coverage that doesn’t adjust for inflation loses roughly 30% of its purchasing power over typical extension periods. Take the Johnson farm example: their 500-cow Wisconsin operation faces $15,000-$ 20,000 in annual premiums for coverage that protects only half of their 12 million pounds of production, while the other half remains exposed to market volatility. Meanwhile, operations from Texas to Vermont are finding creative ways to build resilience beyond government programs—forming buying groups that cut feed costs by 10-15%, investing in shared equipment that reduces per-unit expenses, and developing direct market relationships that capture premium pricing. Recent discussions with producers suggest that the most successful operations treat safety nets as just one tool in their risk management toolkit, not the complete solution. The farms weathering volatility best are those focusing on fundamentals they can control: feed efficiency improvements that add $50-100 per cow annually, reproductive programs that reduce replacement costs, and facility investments that pay for themselves through improved cow comfort. Looking ahead, the real opportunity might be in building operations that are efficient enough for safety nets to become backup protection rather than a primary strategy.

You know, I was talking with a neighbor the other day about dairy safety net programs, and we got to discussing something that I think a lot of us are wondering about: what does longer-term program planning actually mean for our operations?

The headlines sound encouraging—expanded coverage options, program certainty, all that. However, when you delve into the planning aspect of things… that’s where the conversation becomes more interesting. And frankly, more important for those of us trying to make smart risk management decisions.

Understanding the Safety Net Framework

So here’s what we’re looking at with recent program developments. Congress has been working on extending program availability further into the future, which would give us more certainty about having these tools available when we need them. The basic program structure remains focused on providing safety net coverage for dairy operations, although, as many of us have seen, the details can become quite complex quite quickly.

Now, you probably already know this, but the way these safety net programs generally work is you can cover a portion of your production with premium costs that tend to increase as you go for higher coverage levels. Initial tiers typically offer better premium rates, and as you add more coverage… well, it gets expensive in a hurry.

What’s interesting here is how different this approach is from, say, your typical business insurance. Most commercial policies adjust rates and coverage annually based on changing conditions. But agricultural safety nets? They tend to become established and then remain in place for years at a time.

The Reality of Fixed Protection Levels

This is where the conversation with my neighbor got really interesting. Fixed coverage levels lose what economists call purchasing power as costs rise over time—and they generally do. It’s like having equipment insurance that covers replacement at today’s prices when you’ll need to buy that equipment several years from now at tomorrow’s prices.

For those of us running mid-size operations, this becomes particularly important. If you’re milking, say, 400-600 cows, you’re producing enough milk that only part of it typically gets the better tier coverage under most program structures. The rest is essentially exposed to market volatility.

I’ve noticed that producers who truly understand this dynamic tend to approach their overall risk management strategy differently. They’re not just considering whether to enroll in programs—they’re also asking what else they need to do to maintain protection as conditions evolve.

Case Study: The 500-Cow Decision

Let me walk you through a real-world example that might help illustrate this. Take a typical 500-cow Holstein operation in Wisconsin—let’s call them the Johnson farm. They’re averaging about 24,000 pounds per cow annually, which translates to approximately 12 million pounds of total production.

Under current program structures, they can obtain better premium rates on their first tier of coverage—approximately half their production. For the Johnsons, that means roughly 6 million pounds gets decent safety net protection, while the other 6 million pounds is basically exposed to market volatility.

If they’re paying premiums for coverage on that protected portion, they need to factor those costs into their budget—probably around $15,000 to $ 20,000 annually, depending on the coverage levels they choose. However, they also need to consider what happens to the value of that coverage over time.

The Johnsons have been dairy farming for 20 years. They’ve seen feed costs go from $120 per ton to over $300 per ton during tough years. Labor costs have more than doubled. Equipment prices… don’t even get me started. So, when they consider fixed coverage levels that remain unchanged for years, they’re thinking about whether that protection will still be meaningful when they actually need it.

What they’ve decided to do is treat safety net programs as just one piece of their risk management puzzle—not the whole solution.

The Other Side of Your Milk Check

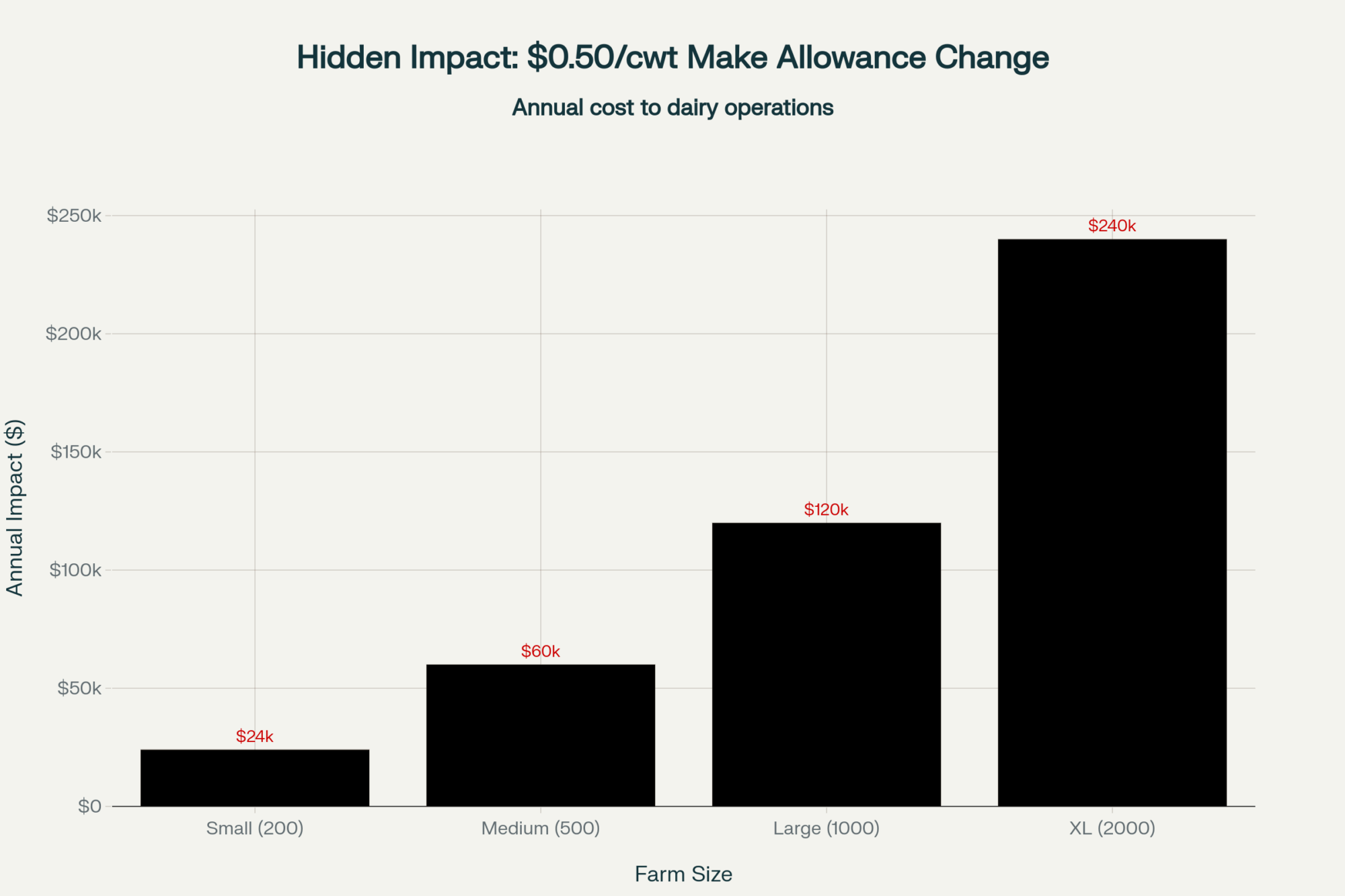

And speaking of things that evolve while safety net coverage remains relatively static… there’s another piece that affects our milk checks that doesn’t get discussed enough at the kitchen table. Make allowances—those deductions that supposedly cover processing costs—are something many producers report seeing changes in over time.

Here’s a simple exercise that might be worth doing: take your last six months of milk checks and calculate what a $0.50 per hundredweight change in deductions would mean to your annual cash flow. For a 500-cow operation producing about 12 million pounds annually, that’s $60,000. Not exactly pocket change, especially when you’re already paying premiums for safety net coverage.

How Your Operation Size Changes Everything

You know what I’ve been noticing more and more? These policy and market changes affect farms very differently depending on your scale.

If you’re running a smaller operation—perhaps 150-250 cows—most of your production likely receives reasonable safety net protection. The challenge is that you’re often more dependent on cooperative pricing without a lot of market alternatives. Additionally, your time is typically fully committed to daily operations.

But if you’re in that middle range—say 400-800 cows—you’re producing enough that changes represent serious money, but only a portion of your milk typically gets meaningful coverage. Additionally, you’ve likely invested heavily in facilities and equipment over the years, making it expensive to consider switching market relationships.

| Farm Size | Annual Prod | Coverage % | Exposed Prod | Risk Exposure |

| 150-250 Cows | 3.6-6M lbs | 90-100% | 0-0.6M lbs | $0-3K |

| 400-600 Cows | 9.6-14.4M lbs | 50-65% | 5-8.4M lbs | $25-42K |

| 1000+ Cows | 24M+ lbs | 25-35% | 16-18M lbs | $80-90K |

The largest operations? They’re often negotiating premiums above base prices anyway. Safety net coverage is nice to have, but it’s not make-or-break for their cash flow. Their volume helps them absorb cost increases that might really hurt smaller farms.

What’s encouraging is seeing some mid-size operations get creative about this challenge—forming marketing groups, exploring regional processing options, or investing in technologies that improve their bargaining position with processors.

Understanding Market Relationships

Many dairy cooperatives operate both marketing and processing businesses. That creates some interesting dynamics when policies and market conditions change.

Now, I’m not saying there’s anything wrong with this business model—cooperatives serve important functions and most are trying to optimize total value for their members. However, it’s worth understanding how your cooperative or processor generates revenue across all its operations, not just what is reflected in your milk price.

I’ve noticed that producers who take time to really understand their market relationships tend to make better decisions about their overall marketing strategy. They’re also better positioned to have productive conversations about pricing, services, and long-term contracts.

Take butterfat premiums, for example. Some operations focus heavily on maximizing butterfat performance through breeding and feeding programs because their market relationships reward that approach. Others find better returns through improvements in volume and efficiency. Understanding how your specific market relationship works helps you make smarter investment decisions.

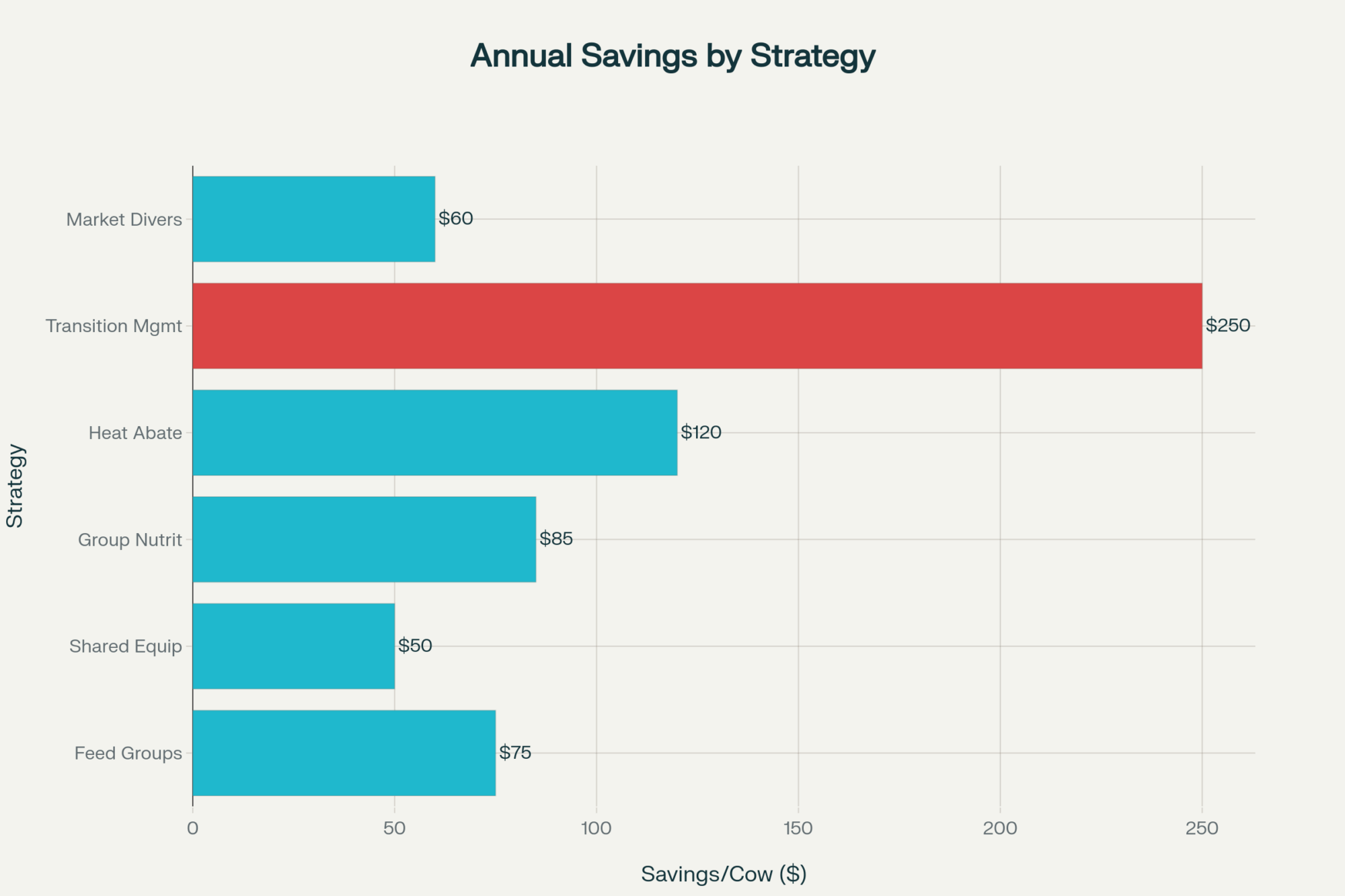

Alternative Approaches and Innovations

Some producers are exploring alternatives to traditional market structures. Mobile processing options are becoming a topic of conversation in some regions, although they still require substantial investment and regulatory navigation. Some operations are exploring direct-to-consumer approaches, particularly for specialty products like organic or grass-fed milk.

For example, some Wisconsin producers I know have formed buying groups for feed and supplies, using their combined purchasing power to negotiate better prices. In Texas, several operations have invested in shared equipment for feed processing, spreading the cost across multiple farms while improving feed quality and reducing per-unit costs.

In Michigan, a group of approximately 20 mid-sized dairies has pooled resources to hire a professional nutritionist who works exclusively with their operations. The cost per farm is manageable, but they’re getting top-tier expertise that would be unaffordable individually.

The Planning Framework That Actually Works

So where does this leave us? Well, I think it starts with understanding your own numbers—really understanding them, not just having a general sense of where things stand.

Calculate what a 10% increase in feed costs would do to your margins. Determine your break-even milk price based on current cost structures. Understand what percentage of your income comes from components like butterfat and protein premiums versus base price.

Here’s a practical framework that might be worth working through:

Monthly Financial Reality Check:

- Track your all-in cost of production per hundredweight

- Monitor your margin over feed costs as a key indicator

- Calculate how policy or market changes affect your actual cash flow

- Compare your costs to regional averages when available

Risk Assessment Questions:

- What’s your biggest vulnerability—price volatility, cost inflation, or cash flow timing?

- How much of your production gets meaningful safety net protection?

- What happens to your operation if margins stay tight for 18 months?

- Do you have access to alternative markets if your current relationship doesn’t work out?

Regional Realities and Opportunities

Some Wisconsin producers I’ve talked with report focusing more on feed efficiency and reproductive performance as ways to improve their cost structure independent of policy support. The emphasis on transition period management has intensified—getting those fresh cows off to a strong start makes a significant difference in overall herd performance and lifetime production.

What’s interesting is seeing more precision feeding approaches, where operations track individual cow performance and adjust rations accordingly. The technology has gotten more affordable, and the payback through improved feed conversion is pretty compelling when margins are tight.

In Texas and California, some producers mention investing in technologies that help manage heat stress and improve labor efficiency. The climate challenges they face make cow comfort investments particularly important for maintaining production levels during the summer months.

In Vermont and New York, some operations are exploring value-added enterprises and direct marketing opportunities. The proximity to urban markets creates opportunities that aren’t available in more remote areas, although navigating regulatory requirements can be challenging.

Meanwhile, in Iowa and Minnesota, several dairy operations with which I am familiar have begun collaborating with crop farmers on manure-for-feed arrangements that benefit both parties. The dairy receives competitively priced corn silage, the grain farmer receives valuable nutrients, and both parties save on transportation costs.

| Region | Primary Strategy | Key Investment | Cost Impact | Risk Factor |

|---|---|---|---|---|

| Wisconsin | Feed efficiency & reproduction | Transition cow management | -$0.75/cwt feed costs | Component price volatility |

| Texas/California | Heat stress management | Cooling systems & automation | -15% summer production loss | Energy cost increases |

| Vermont/New York | Value-added/direct marketing | Processing infrastructure | +$2-4/cwt premium potential | Regulatory compliance |

| Iowa/Minnesota | Manure-for-feed partnerships | Nutrient exchange programs | -$0.50/cwt feed + fertilizer | Weather dependency |

What This Means for Your Planning

Safety net programs provide a foundation—and that’s not nothing. Having some certainty about program availability helps with planning, even if the structure isn’t perfect. But building a sustainable operation on top of that foundation? That’s still up to us.

I’d encourage you to consider enrolling in available programs despite their limitations. Even imperfect protection is better than no protection when margins are tight. Consider enrollment strategies that offer premium savings, if your cash flow allows it. But don’t stop there.

Cost Management Priorities:

- Focus on feed efficiency improvements—every tenth of a point improvement in feed conversion helps your bottom line

- Evaluate your reproductive program’s impact—shorter calving intervals and improved conception rates reduce replacement costs

- Consider facility investments that improve cow comfort—better stall design, improved ventilation, and adequate water access often pay for themselves

- Invest in fresh cow management—transition period nutrition and management probably has the biggest impact on overall herd performance

Market Relationship Evaluation:

- Build relationships with multiple market channels where possible—even if you can’t switch completely, having options provides leverage

- Understand the total value proposition—consider component premiums, quality bonuses, and services provided

- Ask questions about how pricing decisions get made—understanding the process helps you plan better

- Keep good records so you can make informed comparisons—track your actual costs and returns to evaluate opportunities objectively

The Bottom Line

The conversation my neighbor and I had reminded me that we’re all navigating similar challenges, just with different herd sizes and in different regions. Safety net programs give us some tools for managing risk. But the real work of building resilient dairy operations? That’s something we do together, one cow at a time, one decision at a time.

Whether it’s improving your dry cow management to reduce metabolic disorders, investing in better ventilation systems to improve cow comfort during hot weather, or fine-tuning your breeding program to improve longevity—those day-to-day operational decisions probably matter more for your long-term success than any policy program.

The programs provide a safety net, but operational excellence provides the path forward. In my experience, producers who focus most on controlling what they can—such as feed quality, cow comfort, reproductive performance, and financial management—tend to be the ones who not only survive market volatility but also find ways to thrive despite it.

The safety net is there when you need it. But building a farm that doesn’t need to use it very often? That’s probably the best strategy of all.

So here’s my question for you: What’s one specific change you’re making this year to improve your operation’s resilience—regardless of what safety net programs do? Drop a comment below and share what’s working on your farm. Sometimes the best insights come from hearing what our neighbors are trying.

KEY TAKEAWAYS:

- Calculate your real coverage gap: For a 500-cow operation producing 12 million pounds, only 50% gets meaningful protection—that’s $60,000 annual exposure from just a $0.50/cwt market swing, which smart producers are offsetting through efficiency gains averaging 0.1-0.2 points in feed conversion

- Build three-layer protection beyond programs: Wisconsin buying groups report 10-15% feed cost savings, Michigan operations sharing professional nutritionists cut consultation costs 70%, and Texas dairies investing in heat abatement see 8-12% production gains during summer stress periods

- Focus on transition period ROI: Operations improving fresh cow management report $200-300 returns per cow through reduced metabolic issues, better peak milk (5-8 pounds higher), and improved reproductive performance—protection that works regardless of policy changes

- Create market flexibility now: Producers maintaining relationships with 2-3 potential buyers report better component premiums (averaging $0.15-0.25/cwt advantage) and negotiating leverage, while those exploring direct sales capture 20-30% price premiums on 5-10% of production

- Track what matters monthly: Progressive operations monitoring margin over feed costs, all-in production costs per hundredweight, and cash flow impacts from policy changes are making adjustment decisions 3-6 months faster than those using annual reviews alone

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- 11 Proven Strategies to Lower Feed Costs and Boost Efficiency on Your Dairy – This tactical guide reveals how to achieve measurable efficiency gains through operational changes, from forage management to rumen health. It provides actionable strategies for lowering your farm’s largest expense and building a strong financial foundation.

- 2025 Dairy Market Reality Check: Why Everything You Think You Know About This Year’s Outlook is Wrong – This article provides a strategic analysis of evolving market forces. It breaks down the impact of changing make allowances, volatile export markets, and rising labor costs, offering a new perspective on why progressive producers are building resilience beyond traditional safety nets.

- 5 Technologies That Will Make or Break Your Dairy Farm in 2025 – This piece identifies key innovations with proven ROI. It provides specific investment ranges, payback timeframes, and bottom-line benefits of adopting emerging technologies like calf monitoring and precision feeding. This shows how modernizing your operation can create a significant competitive advantage.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!