Would your cash flow survive 70% of your cows dropping in production for two months straight?

EXECUTIVE SUMMARY: We’re going to be blunt: the H5N1 outbreak is costing progressive dairies far more than industry talking heads admit. Recent USDA data suggests the per-cow hit is $950 or more, with average losses of 945kg of milk over 67 days after infection (Cornell 2025). That isn’t just hurting margins; it’s gutting cash flow, especially in regions slow to roll out surveillance or invest in rapid detection. Our analysis shows states like Texas posting milk gains upward of 10% while parts of the Midwest and East watch output stall—even as federal disaster relief (ELAP) covers only a sliver of the true long-term pain. Here’s the twist: dairies leaning hard into sensor tech and proactive sanitation—think smart cluster checks and real-time rumen alerts—are shortening losses, cutting mortality risk, and heading off future disruptions. Industry-wide, the guys treating ELAP and tech grants as upgrade capital rather than handouts are building the next-generation playbook. Forward-thinking herds? They’ll see a competitive boost long after this flu is old news. Let’s turn H5N1’s chaos into a new operational edge—starting now.

KEY TAKEAWAYS:

- Rapid H5N1 detection using smart sensors (like CowManager) cuts “clinical lag” by 4-5 days, giving you a head start on isolating fresh cows and minimizing spread.

- Proactive cluster sanitation between every cow reduces milking-based transmission—Kansas State found viral loads may top 10⁸·⁸ per ml in parlors, highlighting sanitation as a non-negotiable.

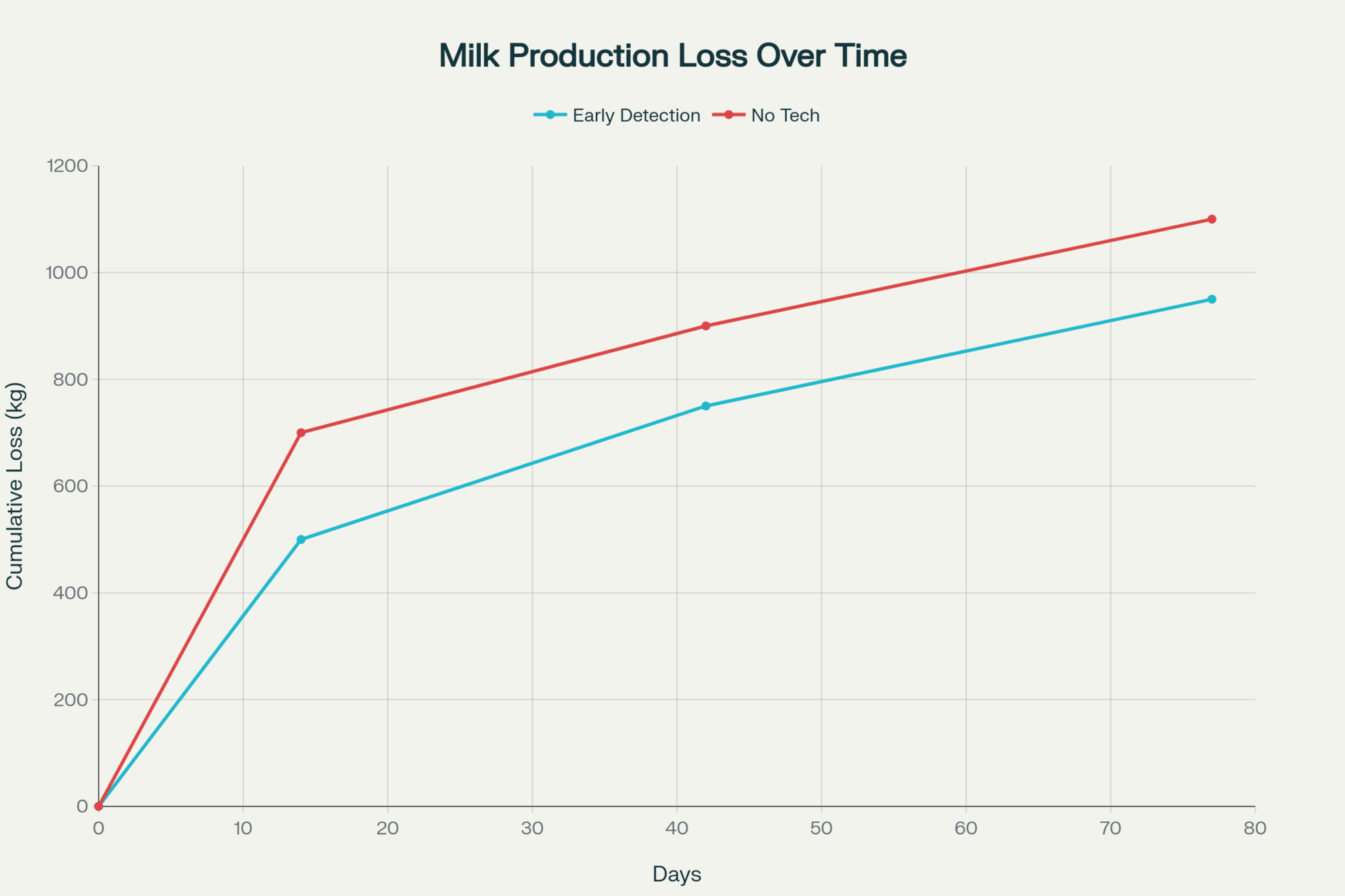

- While USDA’s ELAP covers up to 90% of milk loss for 28 days, true production recovery takes 2-3 times longer; budgeting for the “long tail” of losses matters more than ever.

- Herds in states with earlier adoption of national milk testing or monitoring tech are seeing less financial damage and faster market rebound—think Texas’ 10.6% output jump versus stagnant old-guard regions.

- Invest ELAP payouts, tech grants, or co-op incentives into resilience upgrades—real-world data says that’s what’s separating survivors from sellers in 2025’s market.

Let’s get right to it—if you’re milking cows anywhere from Tulare to Monroe County, Wisconsin, and you’re still treating H5N1 as just another line item on your biosecurity checklist, it’s time for a real talk. This isn’t a seasonal headache. It’s hitting producers right between the butterfat numbers and the bank account, and no, it’s not easing up after a couple of milking rotations.

According to recent university research—check out the Cornell numbers—the average infected cow in this outbreak is leaving a $950-sized hole in farm finances. And that’s just the direct costs. What’s wild is these losses aren’t short-lived. Cows are still lagging on production more than 77 days after clinical recovery. So, that old route where you pencil losses as a monthly blip? It doesn’t wash anymore.

What’s Actually Spreading This?

Here’s the thing, though… everyone loves talking about geese flying over feed lanes, but cutting-edge studies from Kansas State show that the main problem is how the virus is moving through milking equipment. The viral load in an infected Holstein’s bulk tank sample? Up to 10⁸·⁸ per milliliter. That’s billions—yes, billions—of particles getting a free ride through lines and clusters every single turn through the parlor.

So whether you’re milking in a double-30 rotary or scrubbing up your tie stall for winter, don’t let anybody tell you fence netting is the best defense. The state testing teams in California found actual virus in parlor air—and even the breath coming out of fresh cows. For folks stressing labor hours, that means proactively scheduling cluster sanitization and paying attention to those little moments between cows is damn near as important as the weekly herd test.

The Slow Burn: Milk That Never Comes Back

The story on production losses isn’t pretty. Cornell’s multi-region study tracked 945 kg lost per cow over 67 days. And what’s interesting is that the real pain kicks in two phases. First, there’s that 70% crash in milk yield in the first two weeks. But even after herd health “looks good,” cows are still coming up short by 30-40% for months after. This isn’t a quick strep or summer mastitis—it’s the kind of hit that chokes off farm liquidity way past the acute stage.

You might hope for federal backup… but ELAP only covers 90% of the first 28 days’ losses. If you’ve ever stared down an operating loan after an outbreak, you know how much that leaves exposed. Wisconsin’s central-sands dairies, in particular, feel the pinch.

Surveillance: The Holes in the Net

Now, let’s talk testing. Everyone’s writing press releases about “national” surveillance, but the nuts and bolts tell another story. USDA extended its National Milk Testing Strategy to over 36 states, but big players—Wisconsin, Arizona—weren’t onboard until well into 2025. And according to disease modeling, the virus is usually ahead of the reports… with outbreaks predicted long before sampling confirms anything.

Seen the Q2 numbers in Texas? Milk output’s up more than 10% year-on-year. Meanwhile, parts of the Midwest and Mid-Atlantic dairies are just holding steady at best. It’s a real game of herd movement vs. reporting lag.

Tech: Not Just for DIY Tinkerers Anymore

Here’s a bright spot. Sensor technology—CowManager’s ear module is making waves—gives managers a 4-5 day lead detecting sick cows before they go off feed. One health manager I talked to swears by catching changes in rumination and temp before the vet even gets there (and let’s be honest, sometimes that’s your margin when it comes to saving fresh cows).

But let’s stay grounded—while published performance data is promising, industry consensus is that claims of zero mortality need more multi-site validation before anyone calls it a silver bullet.

The Vaccine Tightrope

Vaccines—especially Medgene’s H5N1 shot—were released with promising trial numbers, indicating efficacy rates of around 100% efficacy. But the rub? The whole U.S. dairy sector needs close to 28 million doses for full initial coverage and annual boosters… and only about 10 million are available so far.

So, what’s happening right now is a scramble; allocations depend on politics, state relationships, and maybe a bit of dealer influence more than pure risk. It means that some herds get protected, while many are left waiting. That’s not just frustrating—it’s a structural disadvantage.

Trade Games: When Economics Masks as Safety

If you’re still hoping for global fairness, keep an eye on trade flows. Turkey put the kibosh on importing U.S. live cattle but quietly ramped up egg exports to fill our supply gaps, cashing in on $26 million worth of U.S. demand. Colombia pulled a similar move, banning beef imports without confirmed cases in beef herds—messing up U.S. sales for months.

Here’s the kicker… decades of FDA data back this up: pasteurization wipes out the H5N1 virus in milk completely. Real-world tests found zero viable virus after proper thermal processing. Yet, those trade barriers? Still standing.

Pivoting the Crisis: Who’s Really Winning?

Now, I’m seeing more producers treat ELAP payouts and USDA grants as more than just “get by” money—it’s investment capital for upgrades. There’s a wave of partnerships, like Foremost Farms working with Ginkgo Bioworks to turn whey and lactose (the stuff we all usually pay to haul away) into high-value industrial inputs, with big promises on carbon footprint reduction and revenue. If you get the right biosecurity in play, you don’t just fight the bug—you lower your risk and win with sustainability. Smart, right?

Canadian reports echo the same: data shows stricter biosecurity slashes losses across more than just this flu.

How Does This Reshape U.S. Dairy?

So here’s what it all boils down to… H5N1 is forcing us to finally act on tech, early intervention, and resilient supply chains. Producers with their arms around sensor data, scalable biosecurity, and vaccine access—especially in proactive regions like Texas and Arizona—are poised to scoop up market share. Processors are tightening up contracts and will pay premiums for uptime assurance.

The days of skating by on historical margins are over—and, in a way, that’s not all bad. The crisis is exposing weaknesses but also carving out space for those who innovate, invest, and treat biosecurity as a competitive edge.

If anything, what strikes me most is how fast the playbook is changing. So, the real winners? They’re not the ones just hoping for weather breaks or vintage milk prices—they’re the ones thinking three moves ahead, bringing science and new tech right into the heart of daily farm management.

We’re not here to scold or sugarcoat—just to cut to what moves the needle. The playbook is changing. Smart risk management, not wishful thinking, builds the new bottom line.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Battle Plan: How to Protect Your Dairy Herd from HPAI – This article provides a tactical, step-by-step guide on managing an H5N1 outbreak. It offers concrete strategies for early detection, supportive care, and protecting farm workers, enabling producers to implement an immediate, actionable response and minimize losses.

- U.S. Milk Production Report—January 2025: Navigating Avian Flu Impacts and Market Dynamics – Get a big-picture view of how H5N1 is reshaping the entire market. This piece reveals critical economic trends, from fluctuating milk prices and retail inflation to herd size changes, helping you position your farm strategically amidst broader industry volatility.

- The Biosecurity Myth: Journal of Dairy Science Reveals Why Enhanced Protocols Failed Against H5N1 – Dive into the science behind the outbreak with this innovative article. It demolishes conventional biosecurity wisdom by revealing that milking procedures—not respiratory spread—are the primary transmission route, urging producers to rethink their entire operational defense.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!