What if cutting your worst 40 cows could boost your milk check by $8600/month? One Bavarian farmer found out.

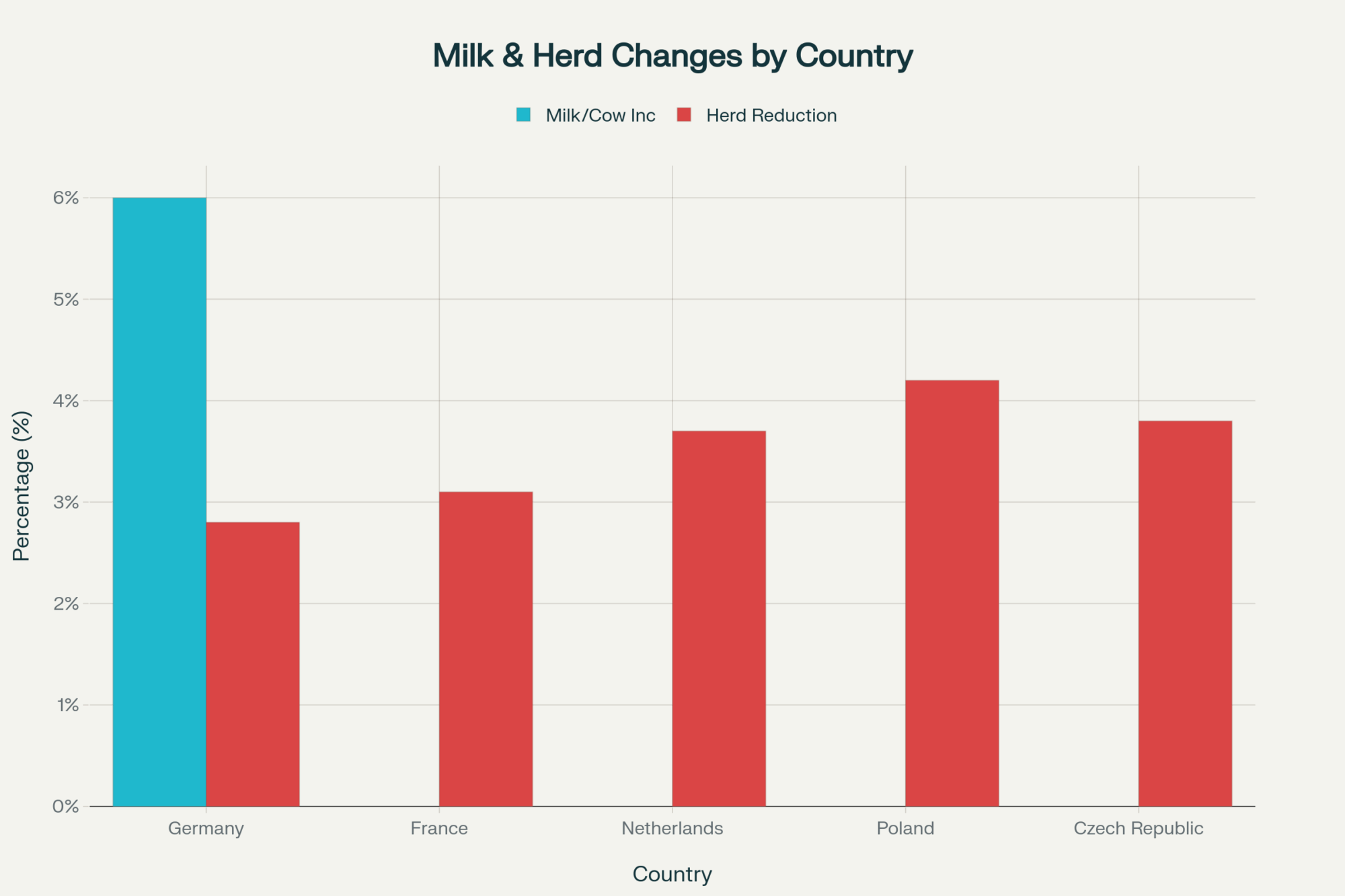

EXECUTIVE SUMMARY: While American producers keep adding cows, European dairy operations just cracked the code on strategic contraction—deliberately cutting herd sizes to boost per-cow profitability. German farms that reduced their herds by 2.8% saw a 6% increase in milk production per cow, with some operations saving €800 monthly on feed costs while also increasing quality bonuses by 40%. The numbers don’t lie: precision culling combined with component optimization is generating 25-30% price premiums across Europe, proving that smart management beats scale every time. From Bavaria to the Netherlands, dairy producers are discovering that fewer cows can mean fatter margins—especially when you pair strategic cuts with precision technology. This is no longer just a European trend. The playbook works anywhere you have the guts to cull smartly instead of expanding blindly.

KEY TAKEAWAYS

- Cut strategically, profit immediately: German operations reduced feed costs by €800/month ($860 USD) per farm while boosting quality bonuses 40% through selective culling—start by identifying your 10 lowest-producing cows this week

- Precision tech pays when done right: Danish precision feeding systems deliver 18-36 month payback periods with annual savings of €20,000 ($21,600 USD), but only if you invest in proper training first—budget 6 months for the learning curve

- Premium positioning captures outsized value: European premium dairy represents just 12% of volume but grabs 22% of export revenue through component optimization—negotiate quality bonuses with your processor using individual cow data

- Environmental compliance = competitive advantage: Dutch nitrogen regulations forced €120,000 investments that now generate €22,000 annual savings ($23,800 USD) through improved efficiency—turn regulatory pressure into a profit opportunity

- Strategic contraction beats volume expansion: While US operations added 58,000 cows chasing scale, European farms cut 687,000 head and watched profit margins soar 25-30% above historical averages—optimize what you have instead of expanding what you manage

You know that moment when everything you thought you knew about dairy gets flipped upside down? That’s what happened when I started hearing stories like this one from Bavaria. A dairy producer—let’s call him Klaus, representing dozens of similar cases across Germany—told his banker he was cutting 40 cows from his 320-head operation. Fast-forward to this fall, and that same banker was buying him drinks after the October milk check came in 22% higher—all while those extra mouths were gone and daily chores were lighter.

Klaus isn’t alone. Across Europe, dairy folks have caught onto something that challenges everything we learned at dairy short courses: sometimes less really is more, especially if you know which cows to keep and which ones get a ride on the truck.

This stands in stark contrast to North America, where operations continue to expand herd sizes, adding tens of thousands of cows in 2025, in an effort to chase volume targets. Meanwhile, European dairies collectively reduced their herd by around 687,000 head—and saw their profit margins soar.

Raw milk prices tell the story. German producers have been commanding premium pricing in 2025, tracking 25-30% above recent historical averages, with French operations following suit. But the secret isn’t just about cutting numbers; it’s about making each remaining cow work harder and smarter.

Europe’s Contraction: A Country-by-Country Playbook

The data shows one thing crystal clear: just slashing herd numbers won’t guarantee success. Real gains come when you pair fewer cows with significantly higher per-cow productivity.

Germany: Culling Smart, Not Just Hard

German operations reduced herd sizes while improving management, focusing on selective culling and quality optimization. The results speak for themselves—milk output per cow increased substantially while feed costs per liter dropped.

“We used to keep every cow that could stand up and give milk,” explains a Lower Saxony producer representative of this trend. “Now we only keep cows that can pay their way. Cut about 80 head last year, but got more milk per cow overall. The feed bill dropped by around €800 a month (roughly $860 USD / C$1,180), and our quality bonuses increased by 40%. But here’s the thing—it took us nearly two years to get the culling protocols right. Plenty of neighbors tried the same approach and didn’t see results.”

France: Turning Regulatory Pressure into Cheese Gold

French dairy operations reduced herd sizes largely in response to nitrate reduction requirements in sensitive watersheds. But instead of just shrinking, many invested heavily in precision nutrition systems and premium product development.

The payoff? French cheese exports increased in value, despite lower overall milk volumes, as artisan and specialty cheese production captured premium pricing that more than offset the volume reduction.

“We’re not just selling milk—we’re selling stories, tradition, and quality,” says a representative cheese producer from the French Alps. “The market rewards that approach when you execute it properly.”

Netherlands: How Environmental Pressure Created Profit

Dutch producers faced some of the toughest environmental regulations, with nitrogen emission limits requiring substantial investments in new technology and management practices. Many operations invested six-figure amounts in compliance systems—everything from precision feeding to advanced manure management.

“First two years were brutal,” admits a Utrecht-area producer representing this experience. “Spent over €85,000 (about $92,000 USD / C$126,000) on new tech, including digesters and feeding systems. Thought about quitting more than once. However, by year three, I was saving around €18,000 ($19,400 USD / C$26,600) annually on feed while meeting all environmental targets. My cows are healthier, margins are better, and I sleep through the night again.”

Another operation in Groningen invested over €110,000 (roughly $120,000 USD / C$163,000) in compliance technology and now generates an extra €22,000 per year ($23,800 USD / C$32,600) in savings and environmental bonuses.

The Reality Nobody Talks About

However, here’s what the equipment dealers won’t mention upfront: research indicates that a significant percentage of operations attempting precision systems fail to achieve positive returns on investment, primarily due to management challenges or poor implementation.

Success isn’t guaranteed. It depends entirely on your willingness to learn new management skills and adapt your operation to make the technology actually work.

Eastern Europe: Economic Survival Mode

Poland and the Czech Republic saw substantial herd reductions—around 4% each—but these weren’t strategic choices. They were an economic necessity. Rising feed costs, labor shortages, and processor consolidation forced smaller operations out.

The survivors, however, achieved remarkable efficiency gains through scale optimization and the adoption of smart technology.

The Million-Dollar Mistake: Why Tech Alone Won’t Save You

Denmark leads Europe in precision dairy adoption, but their experience teaches an important lesson: management matters just as much as machinery.

Studies of Danish precision feeding adoption show payback times ranging from 18 to 36 months, with considerable variation based on the quality of management. Some operations never achieve positive returns.

A Jutland producer invested €45,000 (about $48,600 USD / C$66,600) in individual feeding and monitoring technology for his 240-cow operation. “Took me 18 months to see my money back, and that’s because I spent the first six months just learning how to use the systems properly,” he explains. “The dealer training was worthless. Had to learn from other farmers who’d made it work.”

The Bottom Line on Tech Investments

Research shows precision nutrition systems typically cost €50,000-€80,000 ($54,000-$86,000 USD / C$74,000-$119,000), with successful adopters seeing annual savings in the €15,000-€25,000 range ($16,000-$27,000 USD / C$22,000-$37,000). However, significant farm-level variation exists, and the risk of no return is a real concern.

Start with component testing. Train yourself and your team properly. Add technology gradually. Track progress monthly. That’s how you avoid becoming another cautionary tale.

Premium Markets: Small Pond, Deep Water

European premium positioning works, but understanding the scale limitations is crucial for realistic expectations.

Premium dairy represents a small but valuable market segment—roughly 10-15% of production volume, yet capturing a disproportionate share of export value through higher pricing. That gap explains why strategic positioning works for some operations while remaining inaccessible to others.

French artisanal cheese operations fetch premiums of 45-65% over commodity pricing, but these markets have strict volume and quality requirements. You need consistent fat content above 3.8%, somatic cell counts under 150,000, and management protocols that meet processor specifications.

“Premium means hitting the grade every single time,” emphasizes a French cheese producer. “Fat, proteins, cells, handling—everything has to be perfect, or you’re out.”

Global Competition: Different Strategies, Different Results

Europeans optimize for value; North Americans chase volume. Both approaches work within their respective market structures, but the trends are diverging.

German operations reduced herd sizes while substantially improving per-cow productivity. US dairy production grew through herd expansion and genetic improvements. New Zealand producers reduced cow numbers but maintained milk solids through genetic selection and precision feeding.

| Region | Herd Strategy | Productivity Focus | Market Approach |

| Germany | Strategic reduction | Per-cow optimization | Quality premiums |

| New Zealand | Efficiency-driven cuts | Genetic improvement | Export efficiency |

| United States | Continued expansion | Scale and technology | Volume growth |

| Australia | Regional variation | Mixed approaches | Niche markets |

Sources: National agricultural statistics, industry reports

North American Implementation: What Actually Works Here

So what does Bavarian success mean for a farm in Michigan or Ontario? More than you might think—if you understand the management requirements.

An Ontario producer credits supply management stability for enabling his C$75,000 ($55,000 USD) investment in technology. “Stable milk prices let me focus on managing better rather than just milking more cows. But I spent six months learning the systems before seeing real results.”

A Michigan producer started with basic component testing, which eventually led her cooperative to offer quality bonuses. “The data made a huge difference, but you’ve got to know how to interpret the reports and make meaningful changes.”

Your Implementation Roadmap

Phase 1: Foundation Building (Months 1-6) Install component testing systems, begin individual cow monitoring, and establish baseline performance metrics. Don’t expect immediate results—focus on understanding your herd’s actual performance. Investment: $15,000-30,000 USD

Phase 2: Precision Systems (Months 6-18) Gradually implement precision feeding for high-producing groups, add automated health monitoring, and optimize rations based on individual cow data. Budget time for the learning curve. Investment: $40,000-80,000 USD

Phase 3: Premium Positioning (Months 18-36) Build processor relationships for quality bonuses, implement environmental monitoring for certifications, and explore direct marketing opportunities where feasible. Investment: $25,000-50,000 USD

Your Next Steps: The European Lesson for North America

The European transformation didn’t happen because producers got lucky with market timing. It happened because they used better data to make informed decisions about which cows to feed and which ones to sell—but it required developing new management skills to ensure the technology actually delivered results.

Start with component testing. Understand your herd’s real performance variations. Invest in training—both for yourself and your team. Build relationships with processors and buyers who value quality over quantity.

Your Action Checklist:

✓ Test milk components this week—establish your performance baseline

✓ Calculate individual cow profitability—identify your best and worst performers

✓ Contact your processor—explore quality bonus programs and requirements

✓ Budget for training time—technology without management skills consistently fails

✓ Start small and prove concepts—before making major capital investments

Will you optimize the cows you have, or just keep adding more mouths to feed?

You don’t need to be European to implement smart dairy management, but you do need to think like them—and invest the time to develop management skills that make precision systems deliver real results instead of just looking impressive in the barn.

The choice is yours, but don’t wait too long. European producers started this transformation five years ago, while others debated whether change was necessary. Now they’re capturing premium pricing while commodity markets squeeze margins.

Your turn.

Currency conversions based on approximate rates: 1 € = 1.08 USD, 1 € = 1.48 CAD

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Unlock Higher Milk Prices: The Ultimate Guide to Improving Milk Components – This guide provides actionable strategies for boosting butterfat and protein. It details proven methods for adjusting rations and management protocols to capture the quality premiums discussed in the main article, directly impacting your milk check.

- The Dairy Industry’s Great Consolidation: What It Means For Your Farm’s Future – This analysis explores the economic forces reshaping the dairy landscape. It demonstrates how market consolidation puts pressure on producers, reinforcing why the efficiency gains from strategic contraction are becoming essential for long-term survival and profitability.

- The Robots are Here: Is Dairy Farm Automation a Fad or the Future? – Going beyond the hype, this article offers a critical look at the real-world ROI of dairy automation. It helps you assess if new tech is a smart investment or a costly distraction, expanding on this article’s warnings about tech failing without proper management.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!