The T.C. Jacoby Weekly Market Report Week Ending June 11, 2021

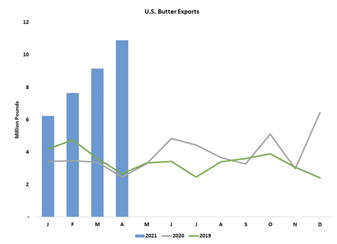

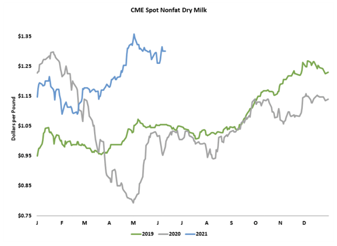

Summer is off to a sweltering start in much of the nation and there is still plenty of milk. Cheese plants are running full throttle, demand is strong and exports are booming.

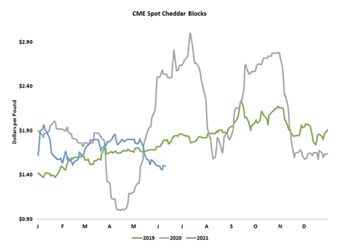

Still, there is plenty of fresh cheese to be had. Processors unloaded 52 cars at the CME spot market this week. Blocks held steady near 13-month lows at $1.50 per pound. Barrels ascended again. They added 5.75ȼ from Friday to Friday and reached $1.6725. The futures were unimpressed. There is quite a gap between the CME spot Cheddar average and July cheese futures. Spot Cheddar will have to strengthen to forestall a selloff in nearby cheese and Class III futures.

Nearby Class IV futures moved a little higher this week, and the September contract jumped 27ȼ. The futures project that Class IV values will inch higher through the rest of the year. Prices range from $16.56 per cwt. in June to $17.70 in December. Class III futures fell back, helping to close some of the gap between the low spot cheese market and loftier futures. Most contracts lost just a few cents, but the July contract fell 33ȼ to $17.53. August through December futures are trading well north of $18.

In a normal year, $17 and $18 milk is more than enough to pay the bills. But amid higher feed costs, rising wages, and a trucker shortage, expenses are adding up quickly. Losses are accumulating, especially for those producers who suffered from last year’s depooling and this year’s spike in feed costs. In recent weeks there have been noticeably more heifers for sale, and more chatter about dairy producers ready to exit the business, either due to their own fatigue or at the behest of their banker. But there are also expansions underway, and dairy producers in regions with onerous supply management programs stand ready to fill any vacuums left by their peers who sell out. In some cases, the cows will simply move a few miles down the road, and the milk will keep flowing. In others, dairy producers who have been held back by base programs will be given the opportunity to step up milk yields incrementally as their neighbor makes room. We’re likely to hear of more sellouts in the near future, but the U.S. dairy herd is massive, and it will take many months of red ink to push milk production noticeably downward.

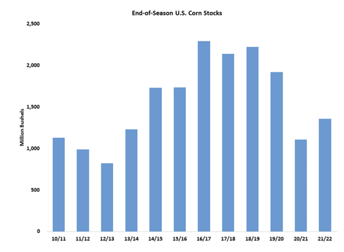

Like a fairgoer on a bungee trampoline, the old crop corn market shot breathlessly higher, dropped with stomach-churning speed, and then did it all over again. But, just like all carnival riders, corn futures ended up right back where they started, albeit a little sweaty and full of adrenaline. July corn closed today at $6.845 per bushel, up less than 2ȼ from last Friday. New crop futures strengthened. The December contract closed at $6.0975, up 18.25ȼ.

Hopefully, we’ll grow a bumper crop this year, which will ease the shortage and weigh on corn prices in the fall. Later this month, USDA will revise its acreage forecasts, and the industry is counting on a significant increase in corn area. Yields are harder to predict. The crop is off to a great start in much of the Corn Belt and in the Southeast, but it’s dishearteningly dry in the Dakotas and the crop in the northern states is looking parched. Next week’s rains will be crucial.

Soybean futures plummeted. The July contract fell more than 75ȼ to $15.085. Concerns about a potential slowdown in soybean oil usage for biofuels weighed heavily on the soy complex. Soybean meal futures also moved lower. The July contract lost nearly $13 and settled at $383.30 per ton.

Source: Jacoby