GDT dropped 4.3% last week. While others panic, smart producers see opportunity.

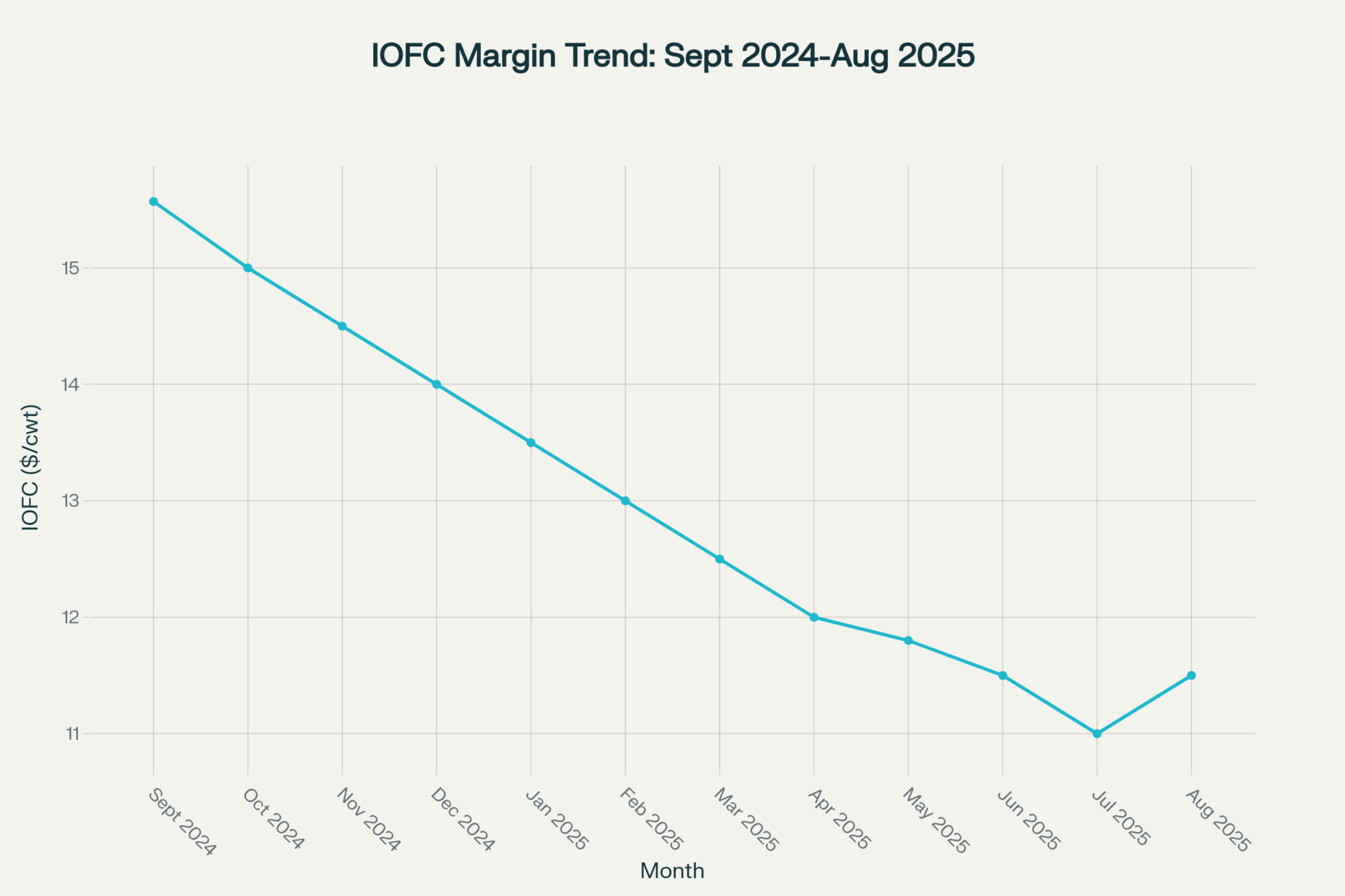

EXECUTIVE SUMMARY: Listen, here’s what happened while you were busy with the fall harvest. The Global Dairy Trade auction just delivered a 4.3% reality check that’s got producers from Wisconsin to New Zealand scrambling. Whole milk powder dropped 5.3%, skim fell 5.8%—and that’s just the beginning. Your feed costs? They’re brutal. Wisconsin corn’s hitting $5.20 per bushel, soybean meal’s near $380 per ton, pushing daily feed costs toward $8.50 per cow. Meanwhile, milk prices slipped to $21.30 per hundredweight in May—down 70 cents from last year. Those Income Over Feed Cost margins that peaked at $15.57 last September? Industry projections show them crashing below $12 this summer. But here’s the thing—this isn’t just about weather or bad luck. Global oversupply from Australia and Uruguay, plus China slashing dairy imports by 12%, is reshaping everything. The producers who understand this shift and adjust their component focus, hedging strategies, and cash flow planning? They’re the ones who’ll still be milking when the dust settles.

KEY TAKEAWAYS:

- Lock feed contracts now: With corn futures near $4.20/bu and soybean meal around $320/ton, smart contracting can save $1.50-2.25 per cwt when margins compress below $12/cwt

- Hedge Class III exposure: December 2025 futures trading near $18/cwt—use conservative $17.50 projections for 90-day cash flow planning to avoid nasty surprises

- Push component percentages: Butterfat and protein premiums hold value during base price weakness—every 0.1% butterfat increase buffers margin pressure when global markets tank

- Track global supply flows: Australia’s 8.4 billion liters (up 3.1%) and Uruguay’s 5.7% surge create oversupply pressure that affects your milk check regardless of local conditions

- Plan for FMMO impact: June reforms trimming 30 cents per cwt hit regions differently—know your Federal Order pricing structure before margins get tighter

You know that feeling when you open your milk check and your gut drops? That’s exactly what producers from Wisconsin’s dairy country to New Zealand’s Canterbury felt after September’s Global Dairy Trade auction dropped 4.3%. Whole milk powder fell 5.3%, skim milk powder 5.8%—a clear sign that production is running ahead of what the market can absorb.

Here’s the thing: USDA data shows global milk production outpacing demand by about 3.2% this year. That oversupply is hitting everyone’s bottom line, from family farms to corporate dairies.

Southern Hemisphere Floods the Market

Australia wrapped its 2024-25 dairy season this past June with 8.4 billion liters produced—up 3.1% from the year before, according to Dairy Australia. Sounds good on paper, but talk to producers and you get a different story.

Recent survey data from Australian dairy farmers reveals only 45% feel optimistic about the future, with many citing feed cost increases of nearly 50% over two years, while milk prices haven’t kept pace. “We’re having some tough conversations out here,” is how one Victorian farmer put it in recent industry reports.

Over in Uruguay—a smaller player that’s making waves—milk deliveries surged 5.7% in the first half of 2025, with June numbers jumping 10% during what is usually’s their quiet season. When you combine that with New Zealand’s production, industry analysis suggests a surplus exceeding 300 million liters hitting global markets this year. The pressure on prices is real.

China’s Structural Market Shift

Here’s what really gets your attention: China’s been battling a 27-month streak of falling milk prices due to domestic oversupply. Rabobank forecasts Chinese dairy imports dropping 12% this year, meaning hundreds of thousands fewer tons flowing through global markets.

When your biggest customer suddenly doesn’t need your product because they’re drowning in their own… well, that changes everything for exporters worldwide.

Feed Costs Squeezing Margins Everywhere

Let’s talk numbers that hit close to home. In Wisconsin, corn is selling for around $5.20 per bushel, and soybean meal is priced near $380 per ton. Industry estimates suggest feed costs ranging from $7 to $10 per cow daily, depending on your ration composition.

USDA reports show May milk prices fell to $21.30 per hundredweight—down 70 cents from last year. Remember when Income Over Feed Cost hit $15.57/cwt last September? Industry projections suggest those margins could drop below $12/cwt this summer.

That’s tighter than getting a fresh heifer to stand still for hoof trimming.

| IOFC Range (/cwt) | What You Need to Do | Timeline |

| Above $15 | Lock in feed contracts now | Next 6 months |

| $12-15 | Hedge feed, trim costs aggressively | Next 3 months |

| Below $12 | Emergency cash flow management | Right now |

| Below $9 | Consider herd reduction | Immediately |

Futures Market Reality Check

The interconnected nature of today’s dairy markets means that when one region gets hit, we all feel it. Recent Class III futures contracts suggest December 2025 pricing near $18 per hundredweight—levels that make debt service painful for leveraged operations.

Even butter took a hit, sliding 2.5% in recent GDT auctions. When butter weakens alongside milk prices, you know this isn’t just a powder market problem.

FMMO Changes Squeeze Already Tight Margins

As if margin pressure wasn’t enough, Federal Milk Marketing Order reforms that kicked in June 1st are expected to trim another 30 cents per hundredweight from all-milk prices. Different regions get hit differently, making financial planning even trickier.

It’s like trying to balance your books while someone keeps changing the rules mid-game.

Regional Strategies That Make Sense

Here’s where your zip code really matters. Wisconsin producers should be locking corn futures through the CME while prices remain manageable. California operations need to focus on securing quality alfalfa and bypass protein before costs spike further.

East Coast farmers face distinct challenges, including dependency on purchased feed and higher energy costs. Down in the Southeast, cottonseed and corn gluten feed contracts often provide stability when grain markets get volatile.

The operations doing well right now aren’t chasing volume—they’re optimizing genetics and nutrition programs that boost components. Butterfat and protein premiums hold value better when base prices are under pressure. It’s about working smarter, not just harder.

Currency Swings and Export Math

New Zealand and Australian exporters constantly juggle exchange rate swings that can make or break quarterly returns. A strong U.S. dollar makes American dairy products more expensive overseas, but it can also help offset lower global prices when revenue gets converted back to dollars. However, widespread domestic oversupply significantly limits these benefits.

Your Action Plan

Three things that can’t wait:

First, run conservative 90-day cash flow projections assuming Class III stays around $17.50/cwt. If those numbers don’t work, you need strategic alternatives now.

Second, lock in feed contracts for Q4 2025 and early 2026 while grain futures remain below recent peaks. Corn near $4.20/bu and soybean meal around $320/ton represent opportunities that might not last.

Third, double down on component-focused breeding and nutrition programs. Every tenth of a point in butterfat or protein helps when base prices are squeezed.

We’ve weathered these cycles before—those who plan ahead always come out stronger.

Current Market Snapshot

- GDT Price Index: 1,209 (down 4.3%)

- Class III Dec 2025: ~$18/cwt

- IOFC Margin Range: $11.30-12.80/cwt (varies by region)

- Feed Costs: Corn $5.20/bu, SBM $380/ton

This market cycle will test every operation differently. Know your numbers, protect your margins, and remember—the market will turn.

Bottom line? The producers surviving this cycle aren’t just watching weather and feed prices—they’re managing global market risk like the business professionals they are.

The question is whether you’ll be stronger or gone when it does.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- 7 Sins of Complacent Dairy Farmers – This tactical piece reveals the operational blind spots that can cripple profitability during a downturn. It provides a direct checklist for producers to self-audit their management practices and refocus on the core drivers of efficiency and cost control.

- The 2 Cents That Can Make or Break Your Dairy Farm – Shifting to a strategic, market-focused perspective, this article breaks down how minor shifts in milk price, component values, and input costs create significant long-term financial impacts. It demonstrates the importance of margin-focused management over chasing pure production volume.

- Robotic Milking Systems: Are They the Peter Principle of the Dairy Industry? – This innovative article challenges producers to think critically about major technology investments. It explores whether automation solves core management issues or simply elevates them, providing a crucial framework for evaluating ROI on future-focused capital expenditures during tight markets.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!