July milk per-cow jumped to 2,081 lb in the 24 big states—while corn’s pegged at a record 188.8 bpa. Margins? Tight… unless planned.

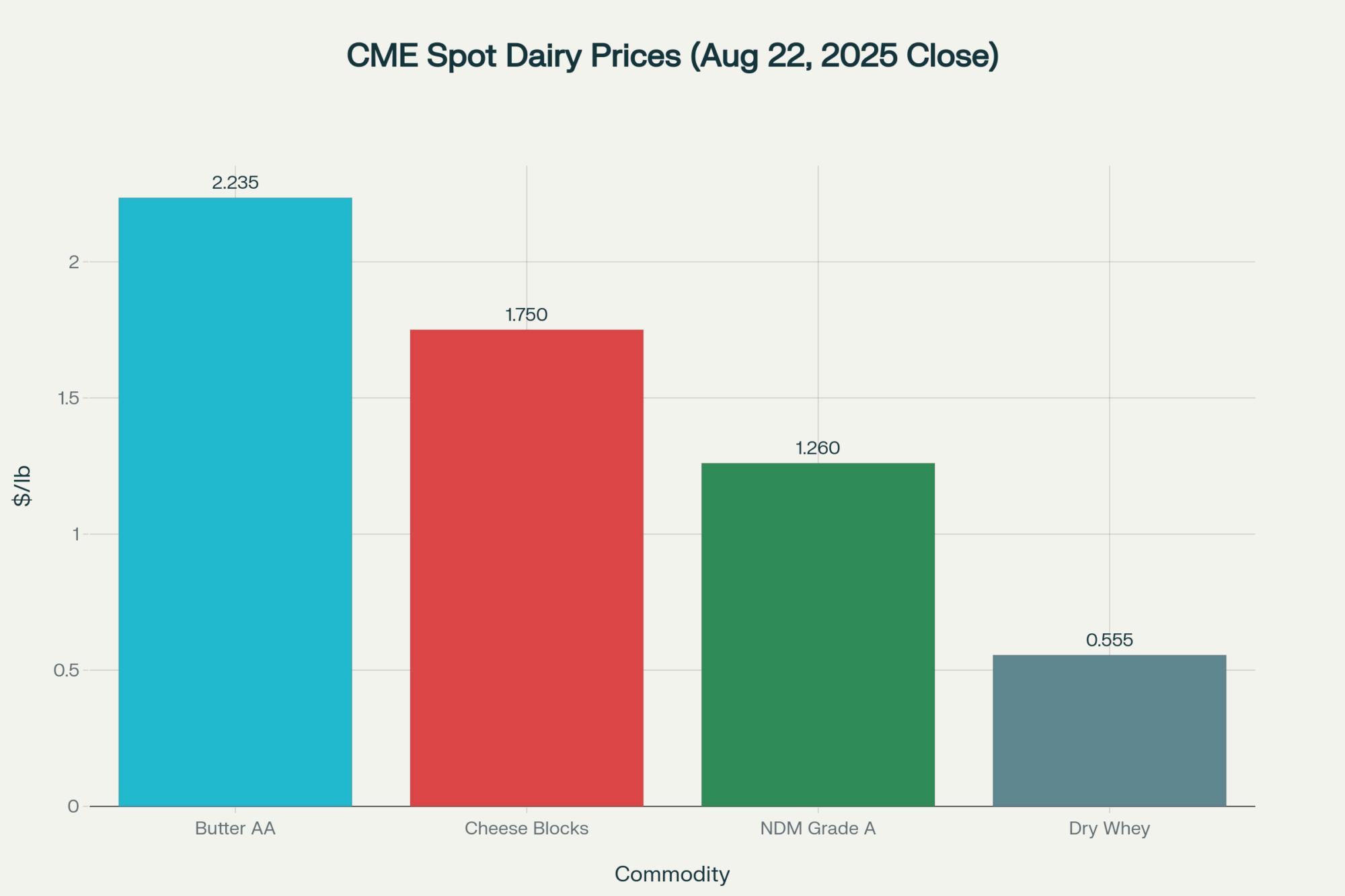

Executive Summary: Here’s the quick read over coffee. Milk output is running hot—per-cow hit 2,081 lb in July across the 24 major states—while butter’s been slipping on the board even though cold storage isn’t bloated. USDA’s August WASDE prints a record 188.8 bpa corn yield and a 16.7-billion-bu crop, which screams “cheap feed”… if it holds. But field scouts aren’t buying it—Pro Farmer’s final at 182.7 bpa points to disease shaving kernel weight, and that’s exactly the kind of shift that can add 20–40 cents/bu fast on a short-covering pop. Meanwhile, the butter spot around $2.235/lb and a firmer whey tone keep Class III steadier than Class IV—so checks tied to butter/powder feel more pressure. The big move right now isn’t fancy: lock about two‑thirds of feed through early 2026 while the curve is friendly, and set a reasonable floor on milk revenue—then lean into butterfat and protein to keep IOFC intact. Plants coming online in Dodge City and Lubbock will help basis, but not in time to save September spot loads—so plan hedges around the plant’s utilization, not a national average. The bottom line is to get coverage on the books while there’s room, and don’t wait for the market to force the hand.

Key Takeaways

- Lock feed while it’s offered: with USDA at 188.8 bpa vs. Pro Farmer 182.7, pre‑commit ~66% of Q4’25–H1’26 rations; that cushions a 20–40c/bu corn jump that could hit IOFC $0.20–$0.40/cwt.

- Use DRP as a true hedge tool: quote it in real time with an agent—the premium and coverage change daily with futures; set a floor that matches the plant’s utilization mix.

- Aim components for ROI: pushing ~4.2% butterfat and ~3.3–3.4% true protein typically offsets Class IV weakness and stabilizes income-over-feed when whey props Class III.

- Watch butter vs. stocks: butter around $2.235/lb despite July stocks down ~6% YOY says the market’s pricing future cream; don’t overbuild inventory if processing.

- Expect basis relief later, not now: Dodge City is online and Lubbock ramps in 2026—help is coming, but September milk still travels; hedge the haul and basis accordingly.

The U.S. dairy industry is heading for a collision. That isn’t hyperbole. July data shows milk production is running significantly higher year over year, while feed market risk is anything but settled, setting up a classic margin squeeze if timing goes the wrong way for producers selling milk daily and buying feed in chunks. USDA NASS Milk Production | USDA ERS LDP Outlook

More Than a Milk Price: Why Supply and Basis Are Driving Your Check

What’s striking this summer is a tricky mix for producers planning Q4 coverage and cash flow: stronger per‑cow output in key dairy states combined with unusually wide spreads in feed market signals that amplify basis and logistics risk on the ground. USDA Dairy Market News

| Scope | Per‑cow (lb) | Notes |

|---|---|---|

| 24 major states (July) | 2,081 | +36 lb YoY; higher output corridor |

| National (July) | 2,063 | Lower than 24‑state average |

According to the USDA’s July Milk Production report, production per cow in the 24 major states averaged 2,081 pounds, up 36 pounds year over year; the national July average was 2,063 pounds, and that difference matters when estimating loads and component tons per month under tight plant schedules.

The growth corridors across the South‑Central and Plains keep adding milk and steel, but line time and trucking don’t appear out of thin air—when plants prioritize nearby milk, basis penalties can hit loads that have to move farther even if headline prices look fine. USDA Dairy Market News

Butter, Classes, and Why Inventory Isn’t the Whole Story

Butter told the market story in August as spot Grade AA settled around $2.2350 per pound on August 22, looking cheap versus global values but largely discounting what’s coming more than what’s currently in storage. CME butter prices

Cold Storage shows July butter stocks down about 6% year over year—tight enough today—yet prices softened anyway, signaling traders are pricing future cream flows and churn time rather than present availability. USDA Cold Storage – July 2025

This development has a fascinating effect on Class dynamics. When butter and powder soften while whey holds firm, Class III can look relatively better than Class IV. In certain months, this translates into weaker Producer Price Differentials (PPDs) in markets with a butter/powder‑heavy utilization mix. Class spreads and pricing context

Feed Risk: Why the USDA and Field Scouts Disagree on Your Corn Bill

According to the August WASDE, the first survey‑based national corn yield printed a record 188.8 bushels per acre with production at 16.7 billion bushels if realized—an undeniably feed‑friendly deck if it stands. DTN/Progressive Farmer summary

But the view from the field tells a different story: Pro Farmer’s final tour estimate pegs yield at 182.7 and flags widespread late‑season disease pressure across parts of the Belt, which is big enough to tighten carryout and nudge basis and futures higher into winter.

Positioning raises the stakes—CFTC data show managed money carrying sizable net shorts in corn ahead of harvest, the exact fuel that can power a fast short‑covering rally if the crop underperforms.

What to Do Now (Before the Market Makes the Choice for You)

| Action | What to do now | Why it pays |

|---|---|---|

| Lock feed (~66% Q4–H1’26) | Pre‑commit while USDA’s high yield is priced | Cushions a 20–40c/bu corn pop; protects IOFC $0.20–$0.40/cwt |

| Price DRP in real time | Quote with an agent; align to plant utilization mix | Sets floor against Class IV softness, matches actual pooling |

| Push components (BF/TP) | Aim ~4.2% butterfat; ~3.3–3.4% true protein | Lifts pay price when cheese/whey support Class III |

Based on market signals and risk calendars, producers should consider these three strategic actions now:

- Lock In Feed Costs: Pre‑commit to roughly two‑thirds of feed needs for Q4 2025 and early 2026 while the forward curve still reflects the USDA’s high yield scenario, leaving room to average if field‑driven numbers prevail and basis firms. USDA WASDE

- Evaluate Dairy Revenue Protection (DRP): Work with an agent to price DRP in real time—premiums and terms change daily with futures and endorsements, so it’s a tool to manage actively, not guess at. USDA RMA DRP policy

- Maximize Component Pay: For component‑based pay, push butterfat toward 4.2% and true protein into the 3.3–3.4% range to lift IOFC even when class prices wobble—especially if feed conversion efficiency holds under current diets. Milk check and pooling dynamics

Capacity and Basis: Help Is on the Way, Just Not for September

Capacity growth is real but won’t solve September’s milk; it matters for anyone with spot loads and a long haul to a dryer or churn while plants juggle maintenance, staffing, and qualifications. USDA ERS LDP Outlook

Hilmar’s new Dodge City facility—an investment north of $600 million—anchors the emerging milk map from western Kansas into the Panhandle and should help rebalance line time and haul distance over the next 12–18 months.

Leprino’s Lubbock facility is staged toward early 2026 for a full ramp, so relief is coming, but not fast enough to erase basis pressure for milk still looking for a closer home this fall and winter.

Global Pull and Why U.S. Butterfat Still Matters

U.S. butterfat remained globally competitive in early 2025, and USDEC highlighted strong mid‑year export momentum that helped keep domestic butter stocks tighter even as milk rose—one reason current weakness is more about forward cream supplies than a freezer problem.

For operators reading the tea leaves, watch the spread between U.S. and EU/NZ butter values alongside Cold Storage—if the U.S. discount narrows as milk stays high, export pull can fade and leave more butterfat at home right into seasonal cream recovery. USDA ERS LDP Outlook

If exports hold, inventories won’t spike quickly; if they wobble, Class IV bears the brunt first, and it shows up in the milk check. Class IV and utilization context

Your Milk Check Explained: How Class Spreads and PPDs Impact Your Bottom Line

When whey resilience props up Class III while butter/powder softness drags Class IV, checks in cheese‑heavy utilization areas can look materially different than those tied more heavily to churns and dryers, and that matters for how DRP or options are layered over already‑contracted milk. Class spreads and pricing context

Weak Class IV tends to pull PPDs lower and reduce the final pay price in orders where Class IV utilization spikes, so re‑read the plant’s pay formula and align hedges with the utilization reality—not a national average that won’t match the load on the truck. Milk check and pooling dynamics

The cheapest penny is the one not lost to a mismatch between pooling math and hedges, especially in a fall when spreads can move faster than loads can be re‑routed. USDA Dairy Market News

Bottom Line: Before the Collision, Not After

If USDA’s big yield verifies, feed stays friendly and margin math gets breathing room, but if Pro Farmer is closer to right and disease pulled kernel weight, the short‑covering bid can meet softening milk and turn the screws on IOFC unless protections are already in place. USDA WASDE | Pro Farmer final

The smartest move is the one made before the market forces your hand—lock in feed and revenue floors while the opportunity exists, don’t wait for the market to dictate terms, and let new capacity in Dodge City and Lubbock ease basis and haul pressure as it ramps over the next few quarters. Hilmar Dodge City | Leprino Lubbock

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Maximizing Milk Components: The Key to Higher Milk Checks – This article provides tactical, in-the-barn strategies for ration balancing and herd management to achieve higher butterfat and protein, demonstrating how to translate market signals into feeding decisions that directly boost your income-over-feed-cost (IOFC).

- Beyond the Bulk Tank: How Global Dairy Demand is Reshaping the US Market – Shifting focus to the broader economic landscape, this piece analyzes long-term consumer trends and export dynamics. It provides a strategic framework for understanding how international demand will impact future U.S. milk prices and processor investments.

- From Theory to Reality: How Genomic Testing is Delivering ROI in Commercial Herds – This forward-looking piece reveals how top producers are using genomic data to build more resilient and efficient herds. It offers a practical look at leveraging this technology to increase profitability and navigate the market volatility discussed in the main article.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!