Just 12 trades crashed butter 5.5¢ today. Why? The dairy industry’s free market fairy tale just died. And taxpayers funded the funeral.

Executive Summary: The dairy industry’s biggest lie—that free markets self-correct—got brutally exposed today when 12 trades crashed butter 5.5¢ and revealed an oversupplied market that processors can’t absorb. USDA’s 230.0 billion pound production forecast just hit a processing system running at 99% capacity, while Mexican buyers abandon US product for cheaper New Zealand alternatives due to dollar strength. Co-op boards are privately discussing supply management for the first time since the 1980s because market mechanisms have officially failed. Your September-October milk checks are heading into $16.50-16.80/cwt disaster territory, and the futures curve is screaming that recovery won’t come quickly. Smart money exited months ago while producers clung to hope—now math is forcing the reckoning that volume-chasing strategies just became suicide missions. This isn’t a correction you wait out; it’s a structural shift that demands immediate action or guarantees financial destruction.

Look, I’ve been watching these markets for over two decades, and what happened today at the CME isn’t just another correction. It’s the moment the industry’s biggest lie got called out by reality. The dirty secret? We’ve been pretending that free markets can self-regulate a sector that’s structurally broken.

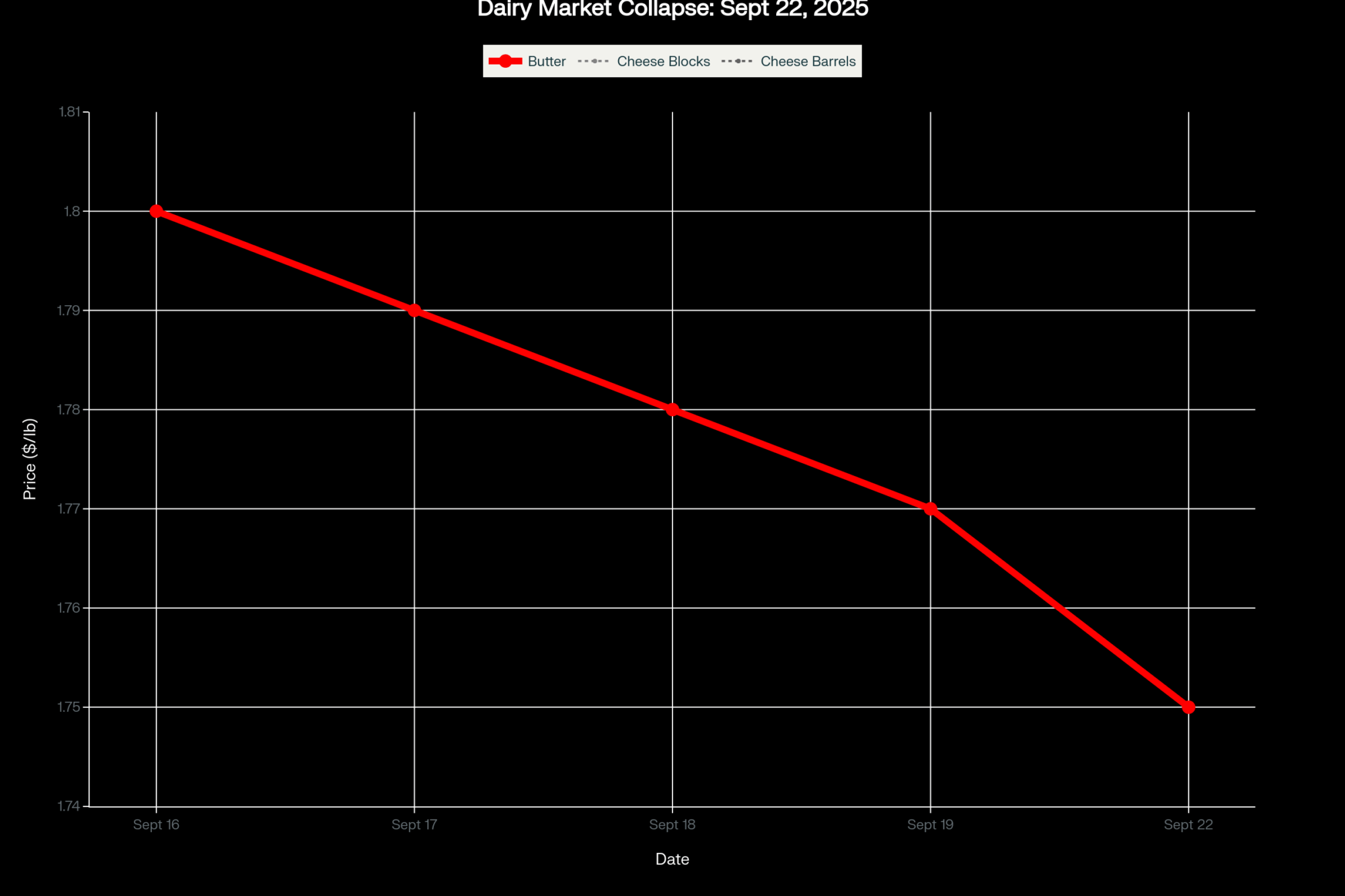

Butter tanked 5.5 cents to $1.75/lb. Blocks cratered 3.25 cents to $1.65/lb. But here’s what nobody’s talking about—this selloff happened with surgical precision because buyers have completely disappeared. When just 12 butter trades can move a market that violently, you’re not seeing normal price discovery. You’re witnessing what happens when an entire industry realizes the emperor has no clothes.

The Numbers That Expose the Real Problem

| Product | Final Price | Daily Change | Weekly Change | What This Really Means |

| Butter | $1.75/lb | -5.5¢ | -$0.04/lb | Class IV heading for $16.50 – your September checks are toast |

| Cheddar Blocks | $1.65/lb | -3.25¢ | -$0.02/lb | October Class III looking at $16.80 if we’re lucky |

| Cheddar Barrels | $1.64/lb | Unchanged | +$0.01/lb | Even barrels can’t rally – demand is dead |

| NDM Grade A | $1.15/lb | +0.25¢ | Flat | Only thing keeping us from total collapse |

| Dry Whey | $0.64/lb | +1.0¢ | +$0.02/lb | Protein demand – the lone bright spot in hell |

Why This Time Really Is Different

Three years ago, price crashes were weather-driven or pandemic-related. This is structural oversupply meeting the brutal reality that demand growth has basically flatlined. Restaurant sales dropped from $97 billion in December to $95.5 billion by February—that’s seven consecutive months of decline. When over half of America’s food dollar gets spent outside the home, that directly translates to less cheese moving through the system.

But here’s the part that’s got me really concerned… processing plants are quietly implementing rationing systems that they’re not publicizing. A Wisconsin co-op board member I know—can’t name him because he’d lose his position—told me last week they’re discussing supply management programs for the first time since the 1980s. When farmer-owned facilities start talking about turning away milk, the free market has officially failed.

The USDA Forecast That Changes Everything

The September WASDE delivered a reality check that most producers still haven’t digested. 2025 milk production: 230.0 billion pounds—up another 800 million from July estimates. That’s not a typo. We’re adding nearly a billion more pounds to an already oversupplied market.

Here’s the breakdown that should terrify you:

- 9.460 million cows (up 10,000 head)

- 24,310 pounds per cow (up 55 pounds)

- Class III Q4 forecast: $16.53/cwt

- Class IV Q4 forecast: $15.46/cwt

- All-milk price: $21.60/cwt (down $1.00 from earlier forecast)

When USDA cuts their all-milk price forecast by a full dollar, that’s not a tweak. That’s an admission that their earlier projections were fantasy.

What Industry Insiders Are Really Saying

“The fundamentals have been screaming correction for months. Today was just math catching up with reality,” said a senior dairy economist who requested anonymity because his employer has relationships with major co-ops.

A currency trader at a major Chicago bank put it more bluntly: “We’ve been short dairy futures for three weeks based purely on dollar strength. Mexican buyers are shopping New Zealand over US product because we’ve priced ourselves out”.

But the most revealing comment came from a processing plant manager in Wisconsin: “We’re at 99% capacity utilization, but we’re also getting real selective about whose milk we take. The days of guaranteed pickup are over.”

The Global Truth That’s Crushing US Producers

New Zealand’s spring flush isn’t just hitting—it’s demolishing global powder markets with 8.9% production growth. European processors are dumping excess inventory ahead of new environmental regulations that kick in next year. Australia managed to increase exports despite lower production, thereby maintaining competitive pressure.

The dollar impact is devastating. At current exchange rates, US cheese is 15% more expensive for Mexican buyers than it was six months ago. NDM exports to Southeast Asia are down 8% year-over-year because we’re simply not competitive.

Here’s what’s really happening: We’re trying to compete in global markets with domestic cost structures that assume we can charge premium prices. That math doesn’t work when your competitors have structurally lower costs and weaker currencies.

Feed Costs: The False Comfort Zone

Sure, December corn at $4.62/bu isn’t terrible, and soy meal at $284/ton is manageable. But here’s the problem—when milk prices crater faster than feed costs drop, your income-over-feed-cost ratio gets obliterated from the margin side.

A 1,000-cow operation in Wisconsin that was clearing $4.50/cwt over feed costs in July is looking at $2.80/cwt today. That’s a $170,000 monthly margin hit. Scale that across 40,000 US dairy farms, and you’re looking at an industry-wide profit collapse that’ll force consolidation faster than anyone anticipated.

The Processing Capacity Lie That’s About to Explode

Everyone’s talking about $8 billion in new processing capacity coming online in 2025. Here’s what they’re not telling you: Most of this capacity is designed to handle specific types of milk from specific regions at specific quality standards. It’s not just plug-and-play capacity that’ll solve oversupply.

Leonard Polzin from UW-Madison hit the nail on the head: “Once we find a new equilibrium, it could be low for quite some time”. What he didn’t say—but I will—is that this “new equilibrium” might be $3-4/cwt lower than where producers think it should be.

The Canadian System That Proves Our Industry Is Broken

Want to know why Canadian dairy farmers aren’t panicking right now? Supply management. They control production through quota systems, limit imports through tariffs, and coordinate pricing through provincial boards. Result? Stable, predictable margins that let farmers plan beyond the next milk check.

Now I’m not advocating we adopt their system wholesale—the politics alone would make it impossible. However, the fact that their $50 billion dairy sector operates with farmer-owned stability, while our $628 billion industry swings between boom and bust, should prompt us to question some fundamental assumptions.

The Cooperative Crisis Nobody’s Discussing

Here’s where it gets really uncomfortable… Some major co-ops are quietly protecting their least efficient members while competitive producers bear the cost of market reality. Board elections this fall are going to be bloodbaths as efficient producers realize they’re subsidizing neighbors who should have been culled out years ago.

A DFA board member from the Upper Midwest—speaking off the record because this stuff doesn’t get discussed publicly—told me: “We’ve got members producing at $28/cwt cost structures demanding the same milk price as guys doing it at $19/cwt. That math doesn’t work in a down market.”

The TBV Reality Check Index for today:

- Margin Squeeze Score: 8.5/10 (Critical Zone)

- Producer Desperation Level: 7/10 (Rising Fast)

- Co-op Loyalty Test: 6/10 (Serious Cracks Showing)

- Processing Plant Leverage: 9/10 (Total Control)

- Market Reality Acceptance: 4/10 (Still in Denial)

What Smart Producers Should Do Right Now

Stop waiting for a rally that isn’t coming. The futures curve is in steep backwardation—September Class III at $17.64 declining to October levels that look increasingly optimistic. If you’ve got unpriced milk, this isn’t the time for wishful thinking.

Focus ruthlessly on efficiency. The days of expanding your way to profitability are over. Every extra pound of milk you produce is working against you in this market. Review culling decisions, breeding programs, and feed efficiency protocols. Volume is your enemy right now.

Plan for margin compression that lasts months, not weeks. This isn’t a weather-driven correction that’ll bounce back in 90 days. This is structural oversupply meeting realistic demand, and the adjustment process could take until mid-2026.

Consider your expansion timeline very carefully. If you were planning facility improvements or herd additions, this market is screaming at you to wait. Capital deployed today could get destroyed by market conditions that persist longer than anyone wants to admit.

The Industry Reckoning That’s Already Started

Processing plant utilization rates have become the new king metric. When Wisconsin and Minnesota plants hit 98% capacity (several are there now), they start dictating terms that would’ve been unthinkable two years ago. Basis adjustments, quality premiums, and pickup schedules—processors hold all the cards.

Environmental compliance costs are about to hit like a freight train. Multiple states are implementing stricter nutrient management requirements that’ll add $2-3/cow/month starting in 2026. When margins are already squeezed, those compliance costs become make-or-break expenses.

But here’s the bigger picture… This correction was inevitable because we’ve been pretending that unlimited production growth could meet unlimited demand growth forever. That assumption just got destroyed by math, and no amount of wishful thinking is going to resurrect it.

The producers who survive this aren’t the ones hoping for a bounce. They’re the ones adapting to the new reality that lower margins, tighter discipline, and operational excellence aren’t temporary requirements—they’re the new normal.

Today’s market didn’t just crash. It revealed the fundamental flaws in an industry structure that’s been living on borrowed time. The smart money figured that out months ago. The question is whether producers are ready to accept it before it’s too late.

Key Takeaways:

- Market Mechanism Failure: Dairy’s free market illusion shattered when 12 trades obliterated butter prices—proving oversupply can’t self-correct without devastating producer casualties

- Supply-Demand Apocalypse: 230.0B pounds hitting 99% capacity plants while international buyers flee dollar-inflated US prices for New Zealand bargains

- Cooperative Betrayal: Efficient producers subsidizing failing operations as boards secretly consider supply caps—the free market’s ultimate admission of defeat

- Financial Destruction Timeline: $16.50-16.80/cwt milk checks incoming while futures scream lower—this structural shift demands immediate action or guarantees bankruptcy

Learn More:

- 2025 Dairy Market Reality Check: Why Everything You Think You Know About This Year’s Outlook is Wrong – This strategic analysis reveals how the shift to component-focused milk production, particularly butterfat, is changing market fundamentals. It provides a deeper understanding of the economic forces at play beyond simple volume, equipping producers to pivot toward a component-driven profit model that’s resilient in a volatile market.

- ICE Raids Resume: Why Dairy’s $48 Billion Labor Crisis Exposes Our Innovation Failure – This piece on innovation details how technology, like robotic milking and automated feeding, can solve the labor crisis and reduce operational costs. It provides specific ROI data and a phase-by-phase action plan for adopting automation, offering a tangible solution for surviving margin compression by increasing efficiency.

- Why the Global Dairy Market is Making Waves in 2025 (and What That Means for You) – This article provides a broader market perspective, analyzing global trends from Europe’s declining production due to environmental policies to emerging demand in Asia. It highlights external factors not covered in the main report, helping producers understand their place in the global supply chain and position their operations for international competition.