Milk prices climbing fast! Here’s what today’s market rally means for your bottom line.

Executive Summary: Cheese prices surged today with cheddar blocks up 5.75¢ and barrels rising 2.75¢, signaling a strong lift for Class III milk pricing. Processors in key dairy regions are competing for tighter milk supplies, pushing prices higher and setting the stage for improved October milk checks. Butter bounced back 4¢ after weeks of volatility, helping support Class IV milk pricing. Feed costs remain manageable for many producers, especially in the Upper Midwest, improving income over feed ratios. Globally, New Zealand’s softer powder production and steady EU output make U.S. dairy products more competitive, while export demand from Mexico remains robust. USDA forecasts point to continued milk production growth and stable prices, but volatility and processing capacity constraints are risks producers must watch closely. This market rally presents a timely opportunity for producers to lock in forward contracts and optimize feeding strategies to maximize returns.

Key Takeaways:

- Cheese prices surged, with cheddar blocks leading gains, boosting Class III milk value and October checks

- Butter prices bounced back after volatility, aiding Class IV milk stability

- Tighter milk supplies in key regions are driving increased processor competition and higher component values

- Export demand, especially from Mexico, remains strong despite a challenging currency environment

- USDA forecasts predict continued milk production growth amidst processing capacity concerns and market volatility

The thing about today? Cheese decided it wants to lead the show. Blocks jumped 5.75¢, barrels up 2.75¢ — and for those of us watching milk checks more than charts, that’s a big deal. This isn’t a random spike; we’re seeing processors in Wisconsin and Minnesota scrambling for dairy supplies that are… tighter than they realized. The consequence? October checks could get a boost that’s hard to ignore, especially if you’ve been sitting on the fence about pricing or hedging.

| Product | Final Price | Today’s Move | Month Trend | Why It Matters For Your Farm |

| Cheddar Blocks | $1.6850/lb | +5.75¢ | Strong Up | Big lift in Class III, consider locking prices |

| Cheddar Barrels | $1.6400/lb | +2.75¢ | Steady Up | Reinforces cheese strength across markets |

| Butter | $1.8100/lb | +4.00¢ | Recovering | Class IV bouncing, but still watch the swings |

| NDM Grade A | $1.1450/lb | +0.50¢ | Holding Steady | Powder keeping its ground, exports critical |

| Dry Whey | $0.6100/lb | +0.75¢ | Gaining | Another bright spot for Class III |

What strikes me about this? Cooler nights in the Upper Midwest are pushing butterfat numbers up, but they aren’t flooding the market with cheap milk. Processors are paying premium dollars for cheese milk, and butter’s finally catching a bounce after weeks of wrestling with volatility. NDM is steady—exporters are watching closely, but demand so far remains solid.## Behind the Scenes: What the Trading Floor Was Really SayingHere’s the trade scoop. Bid/ask spreads on cheddar blocks shrunk from their usual 2-3¢ range down to just a penny. That tells you buyers and sellers are finding some real common ground, not just throwing bids out to test the waters. Butter’s spread also narrowed nicely, sitting around 1.5¢, compared to the 3¢ gap we’ve seen recently.

Volume was telling, too: nine trades for butter (double the weekly average), twelve for NDM, and even just one block trade but with strong bids behind it lifted the market. Intraday? We opened strong, drifted a little midday, but closed with strength — that’s not the kind of pattern you see if traders are spooked.

Support’s building around $1.65 for blocks — with that close at $1.685, a $1.70 test is definitely in the cards. Barrels are sitting at $1.60 firm ground, even with limited actual trades. This is solid price discovery in action.## Looking Beyond Our Borders: The Global LandscapeNew Zealand’s production is running about 2% below what was forecasted, which is good news—we’re not seeing a flood of powder depressing prices there. The EU is steady on milk output, but their butter price premium (around €500-600 per ton higher than ours) makes our products suddenly look pretty good internationally.

Mexico keeps gobbling up our cheese and NDM like there’s no tomorrow. Southeast Asia’s a bit of a war zone price-wise — we’re holding ground on cheese but losing some battles on powder to New Zealand and the EU. China’s market? Volatile, thanks to policy swings, but whey exports there have perked up.

Then there’s South America, which is starting to make waves. Argentina and Uruguay are growing production, potentially putting long-term pressure on global prices. Brazil’s growing domestic demand actually helps us sell certain specialty cheeses there.

Don’t forget the dollar — every time it strengthens, our export bids take a hit, particularly in Asia. So that’s a factor we’re all watching closely.

Feed Costs: The Other Half of Your Margin Story

Corn futures closed at $4.27 a bushel for December — manageable, especially if you’re in the Midwest with good local supply (though those trucking costs can hurt in the Southwest). Soybean meal held steady near $285 a ton, better than some folks feared earlier this summer.

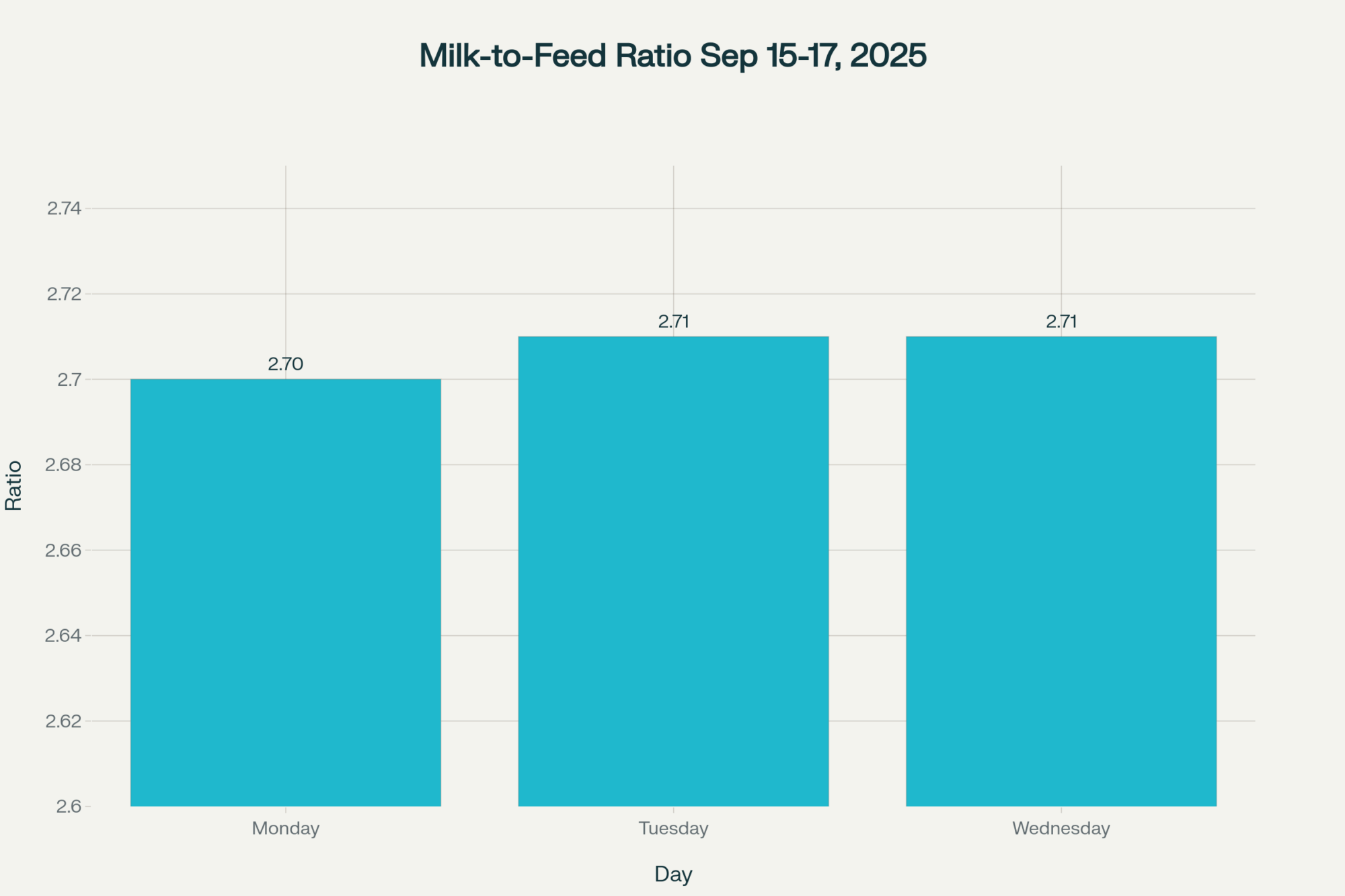

The milk-to-feed ratio is the headline here. With Class III futures around $17.62/cwt, we’re seeing better margins coming through than last month. If you’re feeding a typical 1,800-pound Holstein in Wisconsin with $6.50/day costs, your margin is decent. Out west, feed transport makes it tougher.Hay prices? All over the map, really. Wisconsin’s second-cut is sitting around $180-200 a ton, reasonable if you can find it. Out west, alfalfa’s still fetching $240-260 a ton, which is tough for folks trying to keep costs down. Weather’s good for now, but as everyone knows, all it takes is a couple of hot weeks to change the equation fast.

Production Reality Check: What the USDA and Your Plants Are Saying

Aug data from USDA shows production up 3.25% YOY — biggest leap since 2021. Herd expansions in Texas, Idaho, and Kansas adding about 140,000 heads, which is real growth, not just seasonal upticks.

But here’s the rub. Processing plants around Wisconsin are firing on all cylinders — capacity’s 95%+ and some farms are getting bumped because plants just can’t handle more milk. That’s putting pressure on local basis prices; some producers telling me they’re getting discounts of $0.50-0.75/cwt below Class.

California’s bounce back after HPAI restrictions is real. Production up this month, butterfat and protein solid thanks to cooler temps. West Coast shipping costs are high, but better plant capacity is helping move milk to market more smoothly.

What’s Really Moving the Market? Digging a Little Deeper

Retail cheese demand is solid. Food service? A bit off, around 3-4% below last year, adding some uncertainty. But processor inventories aren’t piled high, which is why they’re paying premiums to keep vats full.

Exports remain the wild card. Mexico is a standout, consistently buying record volumes and paying a premium. Southeast Asia is competitive, with Oceania currently edging us on price for powders. China imports bounce with policy but whey’s looking better.

Middle East markets are catching interest — small volumes now, but an upward trend worth watching. Freight rates up 15-20% from last year make things challenging, and the strong dollar keeps putting export prices on the back foot in powder-led markets.

The Crystal Ball: What the Forecasts Say

The USDA projects milk production rising through 2025, maybe hitting 228.5 billion pounds. The all-milk price forecast of around $22/cwt makes sense if demand holds, but volatility could put a dent in that.

Class III futures at $17.62 for September give you a chance to lock in prices for Q4. Class IV at $16.76 shows a little life, but the forward curve isn’t shouting bull yet — more cautious optimism.

If you haven’t started hedging, this is the time. Fence strategies offer protection while letting you capture upside. Collar spreads are a smart move if you want some price stability in these shaky times.

California Spotlight: The Comeback State

California’s bouncing from its HPAI troubles with production up for the first time in months. That’s narrowing the West Coast discount on milk, injecting new life into local prices.

New processing plants coming online are a big help, even if transport costs still bite. Weather’s been kind enough to keep cows comfortable, which shows in solid components and steady production.

What Should You Be Doing?

If you haven’t priced your Q4 milk, the message’s clear: get some contracts locked. This rally isn’t just a fluke. Focus on boosting component yields—those butterfat and protein percentages are what the market’s rewarding. Dial in your nutrition plans accordingly.

Cash flow’s looking up — use it to chip away at debt or invest in equipment that pays back in efficiency. Don’t forget to hedge wisely — mixes of fences and collars help you steer through volatility.

Feed buying? Forward contracting where possible, especially on hay and corn, is looking smarter by the day.

The Bottom Line

This rally feels real. Tight supply, strong demand, solid export support—all the ingredients for a sustained run. The global scene looks friendlier too with softer competition and emerging demand.

That said, watch your back. Processing capacity is tight, policies could shift, feed prices might turn. The dollar’s strength still complicates exports.

So keep that pencil sharp and options open. We’re in for an interesting finish to 2025.

Learn More:

- 2025 Dairy Market Reality Check: Why Everything You Think You Know About This Year’s Outlook is Wrong – This strategic deep dive challenges traditional market forecasts, revealing how the “Component Revolution” and shifts in milk composition are creating unexpected winners and losers. Learn how to leverage this trend to secure new processor premiums and protect your operation from policy shocks.

- Boosting Dairy Farm Profits: 7 Effective Strategies to Enhance Cash Flow – This tactical article provides a clear roadmap for improving your farm’s bottom line from the ground up. It offers practical strategies for optimizing milking parlor efficiency, diversifying revenue streams, and managing feed costs to achieve measurable gains in profitability.

- 5 Technologies That Will Make or Break Your Dairy Farm in 2025 – Discover the innovative technologies, from advanced sensors to precision feeding systems, that are transforming dairy farming. This piece reveals how these tools can reduce labor costs, improve animal health, and boost your component yields—turning capital investments into a competitive advantage.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!