Are you leaving money on the table by ignoring real-time milk data? Let’s fix that.

EXECUTIVE SUMMARY: This year’s markets are forcing us to take the basics seriously. Here’s something that’ll grab your attention: just 10% better feed efficiency can add over $100 per cow annually to your bottom line. That’s real money we’re talking about, Milk yield improvements through genomic testing? You’re not just throwing darts anymore — you’re making calculated moves. Farms around the globe that’ve embraced these tools are actually squeezing out better margins despite rising feed costs. The Journal of Dairy Science and USDA data back this up. With milk prices fluctuating as they are, adapting isn’t optional anymore. To stay profitable, you need to get ahead in genetics and feed efficiency now. Don’t wait — farm profits sure won’t.

KEY TAKEAWAYS

- Boost feed efficiency by 10% using precision feeding tech — that translates to $100+ extra per cow in 2025 margins. Get a feed analysis this week to spot where you’re losing money.

- Leverage genomic testing to improve milk yield by up to 15% over traditional herds. Contact your breeding consultant tomorrow to discuss a tailored genetic plan.

- Monitor your milk-to-feed ratio monthly — target 1.8 or above to protect margins when prices get volatile. Track this through your DHI reports starting now.

- Stay ahead of export demand by adjusting production to seasonal swings. Review USDA export data quarterly so you’re not caught off guard.

- Apply for those Dairy Business Innovation Alliance grants — up to $100K for efficiency projects that pay back in 1-2 years. Begin your application this month if you haven’t already started. The bottom line? Markets are rewarding the prepared and punishing those who wait. These aren’t just nice-to-have improvements anymore — they’re survival tools for 2025 and beyond.

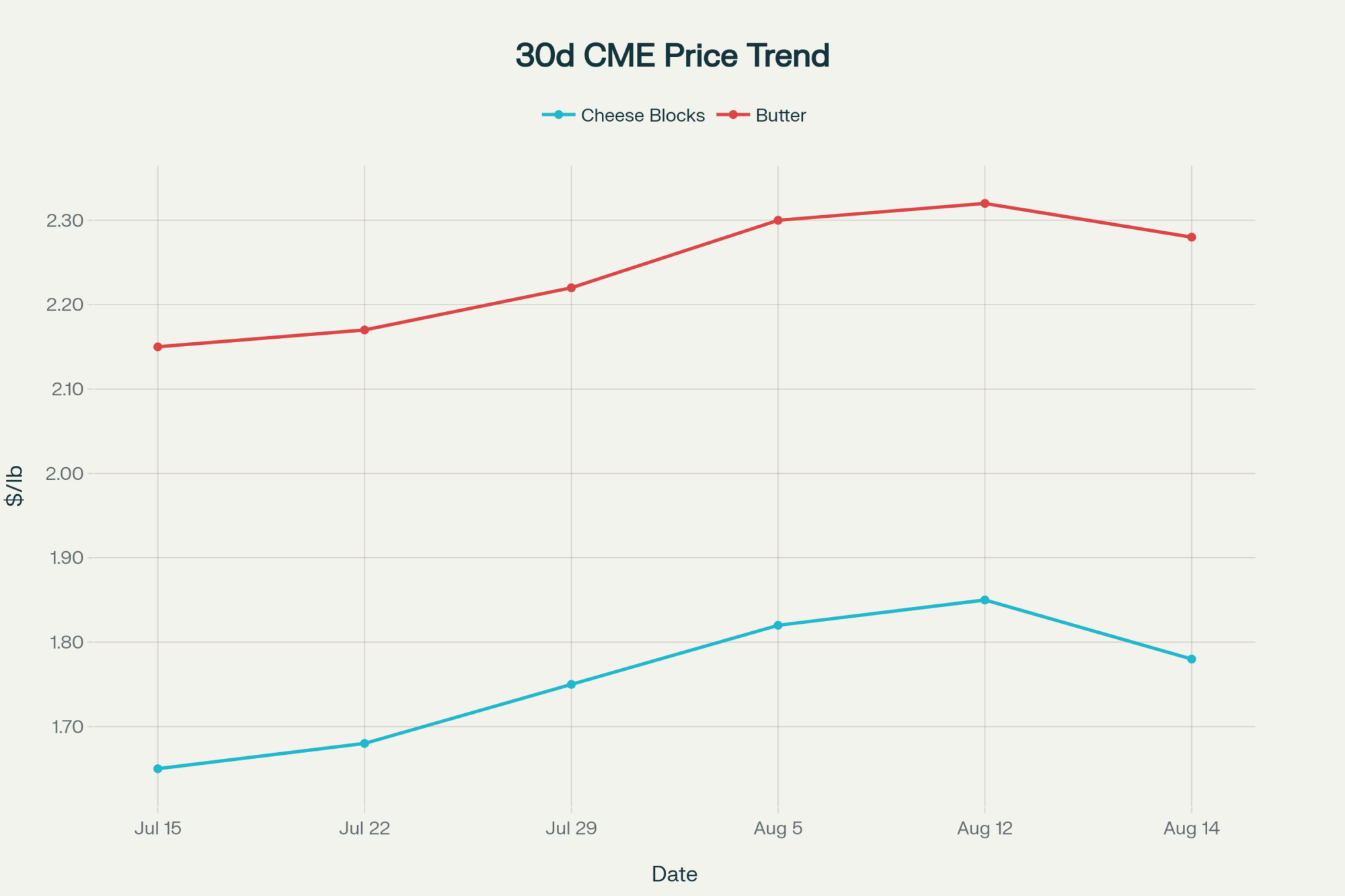

The thing about today’s cheese market moves? They’ve shaken up what was shaping up to be a pretty steady run for Class III prices this summer. Cheese blocks? They dropped 10¢, slicing through the optimism like a wire through butterfat. Moments like this get your attention fast — especially when you’re counting every cent on the farm.

But butter? Butter’s steady, hanging in there even though the weekly numbers show some softness creeping in. What strikes me is how exports keep bolstering these prices — like a sturdy fence you can lean on when the wind howls. Lock in those profits when you can, especially on cheese, because these swings aren’t waiting around.

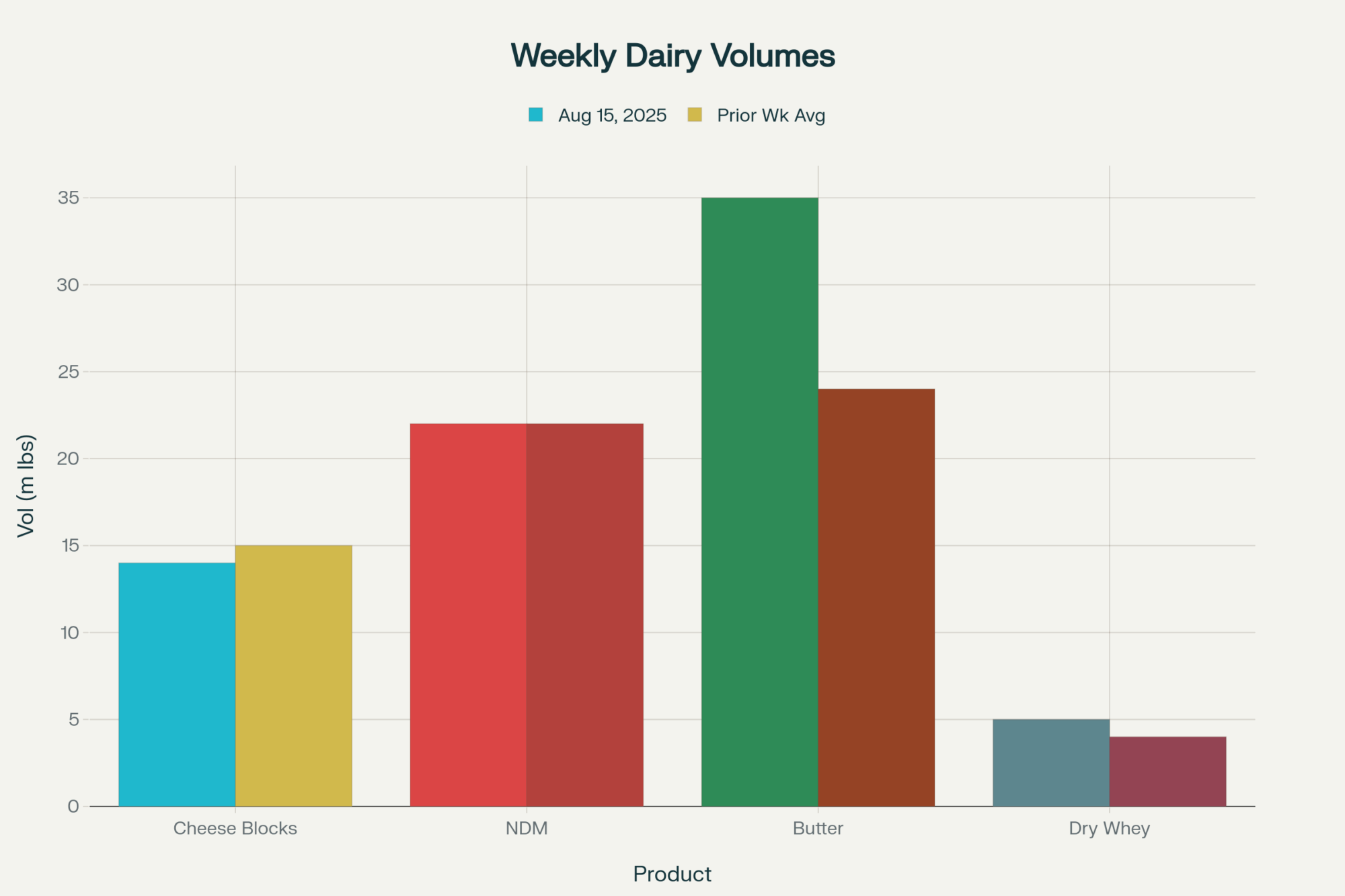

Let’s get real with the numbers farmers actually care about — none of that finance jargon that’ll put you to sleep.

Market Snapshot & What It Means to Your Farm

| Product | Price | Change | Weekly Trend | Farm Impact |

| Cheese Blocks | $1.78/lb | -10¢ | +2.1% | Today’s drop could reduce your milk checks by about 60¢/cwt, based on the latest Class III formula weightings. |

| Cheese Barrels | $1.83/lb | -4¢ | +2.9% | A softer drop here, but just as much a signal of jitters. |

| Butter | $2.28/lb | Unchanged | -4.8% | Standing firm for now, though weekly softness rings alarms for Class IV pricing. |

| NDM Grade A | $1.26/lb | -0.5¢ | -1.4% | Steady as the export bookings hold strong. |

| Dry Whey | $0.60/lb | -1¢ | +5.6% | Minor pullback, but the weekly trend says it’s riding high. |

Here’s what’s interesting: while cheese blocks saw a gain earlier this week, padding that weekly climb to 2.1%, today’s sharp 10-cent pullback feels like the market taking a breath — a sprint, then a pause, if you will. Real markets don’t operate in a straight line.

That late-day selling? Probably some profit-taking and hedging ahead of reports. Only a handful of loads changed hands, but that’s enough to send a signal.

Butter has been more active this week, a sign that exports are still fueling interest. Cheese? Traders are a little more hesitant.

30-Day Price Trends: Cheese and Butter

This shows the gradual rise with today’s bump downward — a sign the market’s keeping everyone on their toes.

How Are We Doing Globally?

No matter how tight things look here, it’s a global market. Our butter prices are about a dollar cheaper than those in Europe and New Zealand, and NDM prices are comparable. That helps us stay competitive on exports — the lifeblood of our market.

| Product | U.S. Price | Europe Price | New Zealand Price |

| Butter | $2.28/lb | ~$3.20/lb | ~$3.29/lb |

| NDM | $1.26/lb | ~$1.08/lb | ~$1.26/lb |

California farms face higher feed and energy costs — an extra 15 to 25 cents per cwt — because water’s expensive and drought has tightened availability. That’s pushing folks to double down on water-saving tech and efficiency tweaks.

This August’s heatwave is another story — the Southwest’s dealing with stressed cows and chipped feed quality, which is cutting milk production there somewhat. Meanwhile, the Upper Midwest has been fortunate with timely rain, which has improved forage and sustained production.

Exports: Where The Pressure and Opportunity Meet

Exports stay strong. USDA’s Foreign Agricultural Service shows cheese shipments up roughly 25% year-over-year through June. Mexico remains a solid top customer, while Southeast Asia and the Middle East emerge as new markets. But the EU and Australasia aren’t giving up any ground.

China’s ramping up selective butter imports even as their milk production slips — something to watch.

And USDA keeps the 2025 all-milk price pegged near $22 per cwt, with Class III and IV futures about $17.40 and $18.54. Locking prices ahead feels smart.

If you’re considering investments or diversification, consider grants like those offered by the Dairy Business Innovation Alliance. They’re offering up to $100,000 for efficiency and modernization projects.

Dairy-beef crosses and automation technologies — such as feeders and meters — are becoming increasingly vital for managing the fluctuations.

What It Means for You

Markets are swinging — today’s cheese price pullback is proof. If you can, lock in your prices to protect your margins.

Know your local reality: feed costs and weather conditions differ widely by region, so tailor your plan to your specific farm.

Keep an ear on global trade moves and currency shifts. That’s the tune your milk check dances to.

The bottom line? This industry rewards the prepared and punishes the complacent. Today’s moves are just another reminder that having a plan — and sticking to it — beats hoping prices will always go your way.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Navigating the Storm: Why a Solid Risk Management Plan is Your Dairy Farm’s Best Friend – This article provides a strategic framework for building a robust risk management plan, turning market volatility like today’s cheese price drop from a threat into a manageable part of your business strategy and protecting your long-term profitability.

- Cracking the Code: The Unseen Financial Power of A2 Milk in Your Herd – For a tactical edge, this piece reveals how to leverage genetic selection for A2 milk to unlock new revenue streams and increase herd value. It offers a practical guide to capitalizing on a high-demand consumer trend.

- The Digital Cow: How Big Data is Revolutionizing Dairy Farming – Looking to the future, this article explores how innovative data analytics and AI are transforming herd management. It demonstrates how to turn farm data into predictive insights for boosting efficiency, health, and your overall bottom line.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!