Butter slides $2.50/lb – your August Class IV check takes a punch while whey rally keeps Class III hopes alive.

EXECUTIVE SUMMARY: Look, I’ve been watching today’s market action, and here’s what really jumped out at me. Most producers are still thinking backwards – chasing milk price rallies instead of locking in the feed cost savings that just landed in their lap. That 61¢ corn drop translates to real money when your milk-to-feed ratio hits 4.67, but here’s the kicker – operations running precision genomic testing are seeing 2-3% higher yields while cutting feed costs by $470 per cow annually. With replacement heifers hitting $3,000+ in premium markets and beef-on-dairy breeding crushing the replacement pipeline, you can’t afford to guess on genetics anymore. The European competition is eating our lunch on powder exports, but smart U.S. producers are using this market disruption to invest in feed efficiency and genetic improvements that compound annually. Trust me, while everyone else is watching butter prices swing, the profitable operations are building permanent competitive advantages through genomic selection and feed optimization that’ll matter long after today’s volatility fades.

KEY TAKEAWAYS

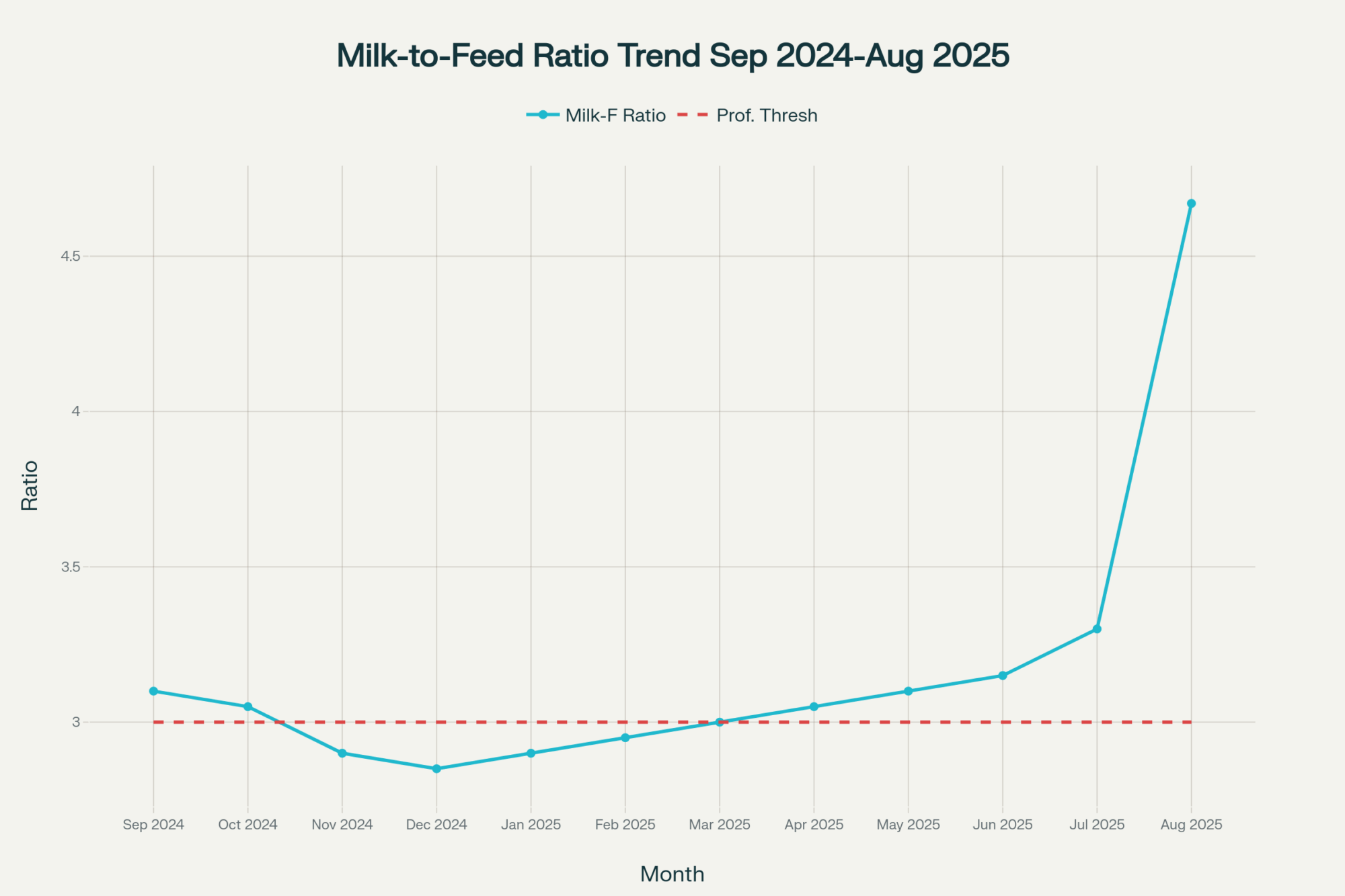

- Lock in feed savings immediately – The 61¢ corn crash saves roughly $85-$ 120 per cow for fall feeding, but only if you forward contract now at these levels. Start tracking your milk-to-feed ratio weekly and target that 1.4 pounds of milk per pound of feed that top herds achieve.

- Implement genomic testing for replacement decisions – At $35 per head, genomic testing identifies low-merit heifers before you waste $1,400-2,000 in feed costs raising them. Focus on feed efficiency and component traits, not just production volume, in this volatile 2025 market environment.

- Capitalize on precision feeding technology – Systems delivering 40-50¢ daily savings per cow while boosting yields 3-5% pay for themselves quickly when feed represents 50-60% of your variable costs. Begin with TMR analysis if you’re running operations with 200+ heads.

- Protect against Class IV weakness with strategic hedging – Today’s 2.5¢ butter drop signals potential $0.80-1.20 per cwt reduction in August milk checks. Consider put options or DRP for Q4 production while butter prices remain under pressure from seasonal demand fade.

- Focus on permanent genetic improvements over temporary price gains. While markets fluctuate daily, genetic progress compounds annually. Herds testing 75-100% of heifers show $50,000+ higher annual profits than those testing under 25%, creating sustainable competitive advantages regardless of commodity volatility.

know how some days the market just can’t make up its mind? Well, today was one of those days that’ll have you scratching your head while simultaneously reaching for your calculator. Butter took an absolute beating – we’re talking a 2.5¢ nosedive that basically erased a week’s worth of gains in one session. But here’s where it gets interesting… dry whey went completely the other direction, rallying 2.75¢, as if someone had just discovered a new use for the stuff.

The thing is, this isn’t just noise. That butter drop is going straight to your Class IV check – we’re probably looking at $0.80 to $1.20 less per hundredweight for that portion of your August milk payment. Meanwhile, the whey rally is single-handedly keeping your Class III calculation from falling apart. And then corn… man, corn just had one of those days you don’t see very often, crashing 61¢ like someone suddenly found a billion bushels hiding in a barn somewhere.

Today’s Price Action – The Numbers That Matter to Your Operation

| Product | Price | Today’s Move | Weekly Trend | What This Really Means |

| Cheese Blocks | $1.8800/lb | Flat | +3.4% | Processors comfortable with inventory levels – steady as she goes |

| Cheese Barrels | $1.8600/lb | Flat | +4.2% | That 2¢ spread to blocks? Classic balanced market signal |

| Butter | $2.2800/lb | -2.50¢ | -5.7% | Your Class IV headache right here – summer demand fade is hitting hard |

| NDM Grade A | $1.2650/lb | +1.50¢ | -0.9% | Trying to help, but still priced out of too many export markets |

| Dry Whey | $0.6125/lb | +2.75¢ | +8.6% | The hero of the day – Southeast Asia can’t get enough of this stuff |

Feed Costs Just Threw You a Curveball (A Good One, Finally)

This corn move today… I mean, when’s the last time you saw a 61¢ drop in one session? That takes corn down to $3.73/bu for September delivery, which is the kind of relief your feed budget’s been praying for.

Here’s your new reality:

- Corn (Sep): $3.7275/bu (down 61¢) – biggest single-day drop in months

- Soybean Meal (Sep): $286.90/ton (up $5.60) – protein costs still climbing the wall

- Current Milk-to-Feed Ratio: 4.67 (well into profitable territory above the 3.0 line). What’s fascinating is how this creates a weird split in your feed costs. Energy has become cheap quickly, but protein remains expensive as ever. If you’re in the Midwest with decent access to local corn, you’re probably feeling pretty good right now. But those of you dealing with freight costs out West? You’re seeing some of the benefit, just not all of it.

Another thing worth noting – and this is something I’ve been watching for months – is the increasing volatility of these feed ingredient relationships. It used to be that corn and beans moved together more often than not. Now? They’re doing their own thing, which makes feed planning… well, let’s just say it keeps you on your toes.

Trading Floor Drama (Or Lack Thereof)

So here’s what was really happening in the pits today… The butter action was legit – 14 loads traded hands with that 2.5¢ slide, which tells you real money was making real decisions about where they think prices should be headed. That’s not some thin market phantom move; that’s fundamental repricing happening in real time.

But the cheese market? Dead as a doornail. One block trade. Zero barrels. That’s not traders being lazy – that’s everyone sitting on their hands waiting for someone else to show their cards first.

What the volume told us: Butter’s 14-load volume confirms this wasn’t just some computer algorithm having a bad day. Serious money changed hands, and they were selling into strength. The cheese market’s virtual silence means today’s flat prices don’t mean much either way.

Technical levels that matter: Butter support’s sitting right around $2.25 now. Break that, and we could see another leg down pretty quickly. For cheese, that $1.85 floor has been holding for weeks and still looks solid.

The bid-ask spread story: In butter, seeing 14 bids against 10 offers at the close suggests some smart money was stepping in at lower levels. It’s possible that we won’t fall much further, at least not immediately. In cheese, that single bid-offer situation screams thin liquidity – classic setup for a big move once someone decides which direction they want to go.

The Bigger Picture – Global Competition Reality Check

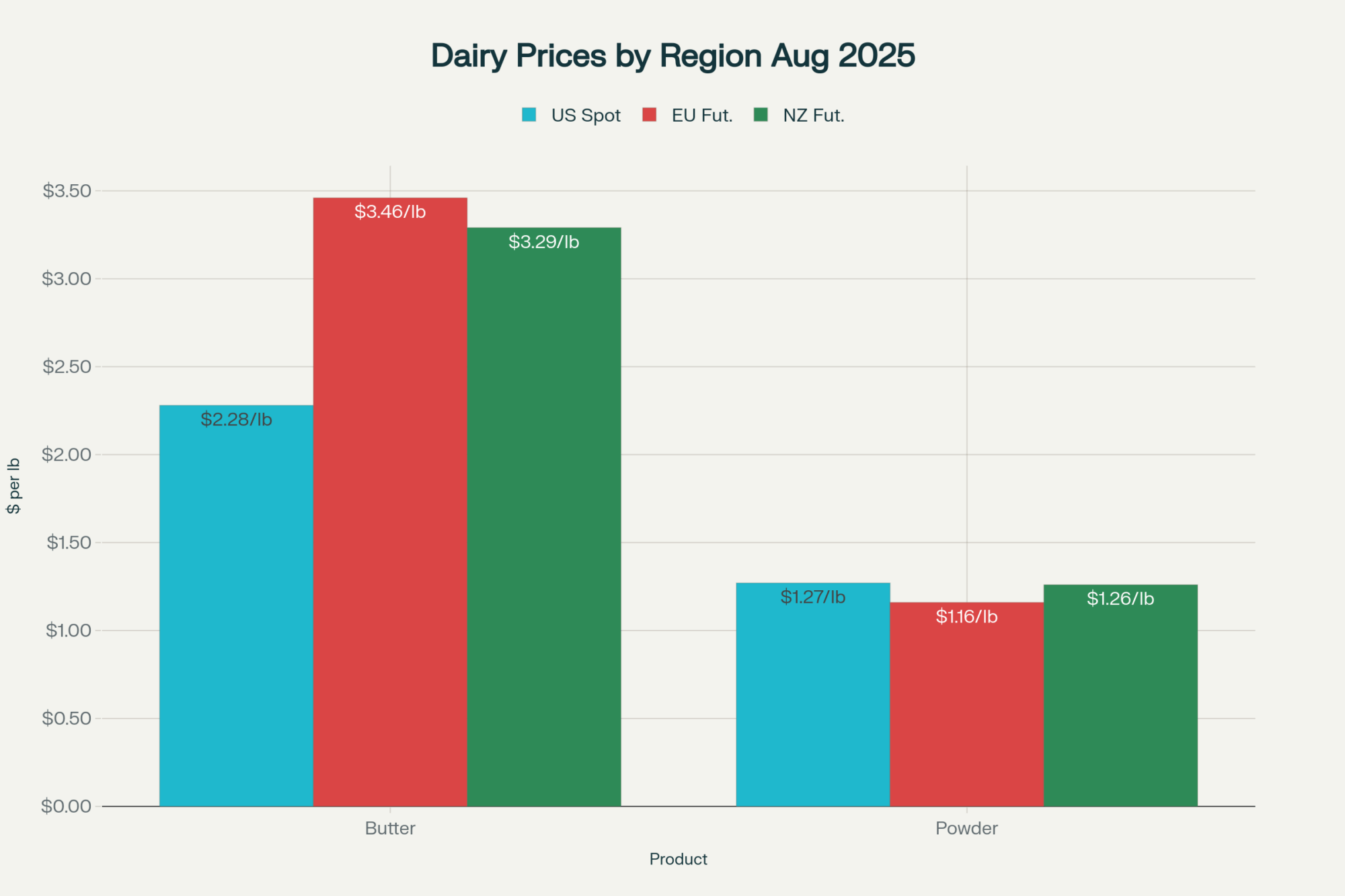

Do you want to know where we stand compared to the competition? Here’s the real deal, converting everything to apples-to-apples dollar pricing (using €1.08/$ exchange rate):

| Product | U.S. Spot | EU Futures (Aug) | NZ Futures (Aug) | What This Means |

| Butter | $2.28/lb | ~$3.46/lb | ~$3.29/lb | We’re practically giving it away – export opportunity |

| Powder | $1.265/lb | ~$1.16/lb | ~$1.26/lb | Getting schooled by Europe, matched by New Zealand |

The story these numbers tell is pretty clear if you’ve been watching export trends. The world wants our butter – we’re more than a dollar per pound cheaper than everyone else. But powder? We’re losing our lunch to European competition, and that’s been evident in disappointing export volumes for months.

This competitive dynamic also explains a significant portion of today’s price action. That butter weakness might actually help our export competitiveness, despite sounding strange. And the powder strength? Well, it’s nice, but it’s pricing us further out of global markets.

Production & Supply – What’s Really Happening Out There

We’re deep in summer heat stress season, and it’s showing up exactly where you’d expect. California’s Central Valley, Texas, and Wisconsin’s southern counties – all dealing with the usual August production challenges. However, what’s interesting about the current supply picture is…

According to the latest USDA data, the national dairy herd’s holding steady at about 9.47 million head, which is actually up slightly from earlier in the year. Culling rates are running about 2% of the herd – pretty normal for this time of year. What’s really wild, though, is what’s happening with replacement heifers.

Get this – heifer inventories are at the lowest levels since 1978. I mean, 1978! That’s pushing replacement costs through the roof. USDA’s reporting average prices around $2,660 per head nationally, but if you’re shopping for quality animals in California or Minnesota, you’re looking at $3,000-plus easily.

The beef-on-dairy breeding trend is absolutely crushing the replacement market. Producers are getting $200/cwt for live cattle and breeding half their herd to beef bulls. Smart from a cash flow standpoint, but it’s creating this massive bottleneck in the replacement pipeline.

What’s Really Moving These Markets

The domestic demand story is pretty straightforward – butter’s following its seasonal script. The summer grilling season’s winding down, and retail promotions are pulling back, which is showing up directly in spot prices. Food service cheese demand remains the bedrock of the market – steady and reliable, but not growing fast enough to drive prices higher on its own.

Export markets are where the real drama is. Mexico consistently ranks as our most reliable customer. They’re savvy buyers who time their purchases well, often stepping in when others are selling.

But Southeast Asia? That’s become the story for whey. The demand from that region has been absolutely relentless – feed applications and food uses; they can’t get enough. Today’s 2.75¢ rally reflects just how hungry they are for our product, and it’s becoming a genuinely important price driver for the whole whey complex.

The concerning part is our powder pricing in global markets. Europeans are consistently undercutting us, and until we become more competitive, we will continue to lose market share. That’s a strategic issue that extends beyond daily price fluctuations.

Historical Context – Where Today Fits

This August 13th action sits right in the normal seasonal range, but the volatility’s definitely running above average. What strikes me most is the divergence between fat and protein markets – we’re seeing increasingly complex global trade dynamics affect different dairy components in completely different ways.

The correlation breakdowns between products are creating opportunities for savvy marketers, but they’re also making traditional hedging strategies more complicated. Once, you could pretty much predict how cheese and butter would move relative to each other. Not so much anymore.

Looking Ahead & Taking Action

Futures market guidance:

- Class III (Aug): $17.40/cwt

- Class III (Sep): $17.21/cwt

- Class IV (Aug): $18.54/cwt

- Class IV (Sep): $18.66/cwt

The curve’s telling us to expect a bumpy sideways ride for Class III, with perhaps some improvement into the fall, while Class IV faces near-term pressure from today’s butter slide.

Here’s what’s interesting about the volatility picture – the options market’s pricing in about 15% more uncertainty than we typically see this time of year. The 90-day historical volatility for Class III is running significantly above seasonal norms. Put options are more expensive, but given these mixed signals, they might be worth considering for Q4 production.

Seasonal probability analysis based on the last five years suggests that we have about a 65% chance of seeing Class III prices improve by $0.50-$1.00 from current levels by October. But (and this is important) that’s assuming normal seasonal tightening patterns, and this year’s been anything but normal.

Correlation analysis shows that the usual relationships between products are breaking down. Historically, cheese and butter moved together about 70% of the time. This year? It’s more like 45%. That creates both opportunities and challenges for risk management.

Regional Market Deep Dive – Upper Midwest Focus

Let’s talk about what’s happening in Wisconsin and Minnesota specifically, because this region’s dealing with some unique dynamics right now.

Regional production patterns: Despite the heat stress episodes, milk production has been holding up reasonably well, thanks to improved cooling systems and better heat stress management. The local basis to national prices has been running tighter than usual as processing plants operate at full capacity.

Feed cost advantages: Today’s corn crash is particularly beneficial here, given the proximity to growing regions. Local basis for corn is typically $0.10-$0.15 under futures, so producers are seeing the full benefit of that 61¢ drop.

Processing dynamics: The numerous specialty cheese plants throughout Wisconsin and Minnesota are especially benefiting from whey strength. These facilities often generate significant whey volumes relative to cheese output, so that a 2.75¢ rally adds meaningful revenue beyond just the cheese pricing.

Transportation factors: Regional trucking rates have been relatively stable, though driver availability remains a challenge. Most plants are within reasonable hauling distance, so milk marketing flexibility remains good.

Risk Management Tools & Hedging Strategies

Given today’s market action and volatility levels, here are some specific strategies worth considering:

For Class IV exposure: Consider put options around the $18.00 strike for October and November contracts. Premium’s running about $0.25-$0.30, which isn’t cheap, but given butter’s weakness, it might be worth the cost.

Class III hedging: The September contract at $17.21 offers some interesting opportunities. Consider selling calls at around $18.00 and buying puts at around $16.50 for a collar strategy that costs approximately $0.15-$0.20 net.

Feed cost management: That corn drop creates a great opportunity to lock in fall and winter pricing. Consider buying December corn futures or entering into a forward contract with your supplier. Don’t get too cute trying to time the absolute bottom.

Volatility plays: With implied volatility elevated, selling option spreads might generate some premium income. For example, selling the $17.50-$18.50 call spread on September Class III for about $0.10-$0.15.

Immediate Action Items for Your Operation – Feed procurement:

Lock in that corn price drop immediately. When corn falls 61¢ in one session, you don’t wait around for it to fall another 20¢. Contact your supplier today to discuss securing fall and winter corn at these levels.

Milk pricing: With butter showing this weakness and Class IV under pressure, consider establishing some downside protection for fall production. Dairy Revenue Protection or put options make sense for Q4 output.

Cash flow planning: Your August milk check will reflect today’s butter weakness, so adjust your cash flow projections accordingly. But the feed cost relief should help overall margins even if milk prices stay soft.

Production planning: Heat stress management remains critical through the rest of August. Any investments in cow comfort that maintain production during these stress periods will pay dividends.

Industry Intelligence & Strategic Developments – Processing capacity updates:

That major Southwest cheese plant expansion we’ve been hearing about is reportedly coming online ahead of schedule. Word is they’re offering premiums that are starting to influence producer decisions across a pretty wide geographic area. Could significantly shift regional milk flow patterns.

Technology trends: The adoption of precision feeding systems continues to accelerate, particularly with protein costs remaining elevated. The ROI calculations for these systems are looking increasingly favorable for larger operations that deal with volatile ingredient pricing.

Regulatory environment: There’s ongoing discussion about potential changes to federal milk marketing orders in the upcoming Farm Bill negotiations. Nothing imminent, but worth staying informed about how these conversations develop. Any changes could reshape regional pricing dynamics.

Global trade developments: Keep an eye on EU production trends and any changes in their regulatory environment. Their ability to undercut our powder pricing continues to be a strategic challenge for U.S. exports.

The bottom line?

Today’s mixed signals remind us why diversified marketing strategies and solid risk management remain essential, regardless of what any single day’s trading brings. This market’s going to keep throwing curveballs, but that corn price relief gives us some breathing room to make smart decisions rather than panicked ones.

Your operation needs to stay flexible, seize opportunities like today’s feed cost break when they arise, and manage downside risk on the milk side. The dairy business has always been about rolling with the punches – today just gave us a few more to roll with.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Genomic Testing: A Game-Changer for Profitable Breeding Decisions – This article provides a tactical framework for using genomic data to make immediate culling and breeding decisions. It demonstrates how to translate test results into actionable steps that increase genetic gain, cut replacement-rearing costs, and boost overall herd profitability.

- Beef on Dairy: The Ultimate Guide to Getting It Right! – Complementing the report’s market analysis, this guide delves into the strategic implementation of a beef-on-dairy program. It reveals methods for selecting the right beef genetics and managing crossbred calves to capitalize on high beef prices and optimize herd value.

- The Digital Dairy Farm: How Technology is Transforming Herd Management – Taking a future-focused perspective, this piece explores how integrated technologies, including the precision feeding systems mentioned in the report, are creating smarter, more efficient farms. It highlights innovative tools that unlock new levels of herd health and productivity.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!