The T.C. Jacoby Weekly Market Report Week Ending November 5, 2021

U.S. cheese production topped 1.14 billion pounds in September, scoring an all-time high in daily average output. There is clearly plenty of fresh Cheddar available, and cheesemakers are unloading some at the market of last resort in Chicago.

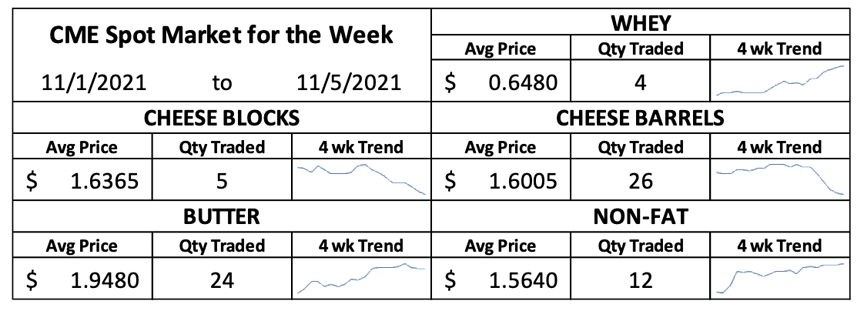

Record-shattering cheese output dragged the Class III market downward. U.S. cheese production topped 1.14 billion pounds in September, scoring an all-time high in daily average output. Production was up 3.3% from the already lofty volumes of September 2020. Compared to last year, U.S. processors stepped up Cheddar production by 3.2%. There is clearly plenty of fresh Cheddar available, and cheesemakers are unloading some at the market of last resort in Chicago. This week CME spot Cheddar blocks slipped 9ȼ to $1.585 per pound. Barrels plummeted a stomach-churning 31.75ȼ to $1.5025.

As more tankers traversed from the farm to cheese plants and bottlers, there was less milk available for Class IV manufacturers. Butter output fell 4.9% year over year to just 143.4 million pounds. By all accounts, cheese makers, milk bottlers, and Class II manufacturers continue to lap up milk and cream, leaving less for churns and driers. Grocers expect Americans to go big this holiday season, to make up for last year’s Scrooge-like celebrations. And retailers anticipate shipping delays and supply chain snarls, so they will likely order whips and dips and other cream-laden foods as early as possible. Cream multiples are on the rise, making churning less attractive. In the West, multiples stand at six-year highs. This week spot butter lost a half-cent and closed at $1.935, near the 17-month high.

The powders continued to climb. CME spot whey jumped 3ȼ to 66ȼ, just a few cents from the all-time high. In the face of heavy cheese production, strong demand for high protein whey products is helping to keep whey powder stocks in check.

Nonfat dry milk (NDM) prices got a boost from overseas markets, strong exports, and slower output. Skim milk powder (SMP) values leapt 6.6% at Tuesday’s Global Dairy Trade (GDT) auction, a seven-year high. It was a strong showing across the board at the GDT. Cheddar jumped 14.1% its highest price since January 2014.

Closer to home, CME spot NDM gained another 1.25ȼ this week and rallied to $1.57, yet another seven-year high. U.S. manufacturers dried 185 million pounds of NDM and SMP in September, 10.7% less than the prior year. U.S. NDM/SMP exports held firm, logging the strongest September total on record, up 14% year over year. Inventories waned.

Despite the lack of trucks, containers, and port infrastructure to keep product moving at an ideal pace, U.S. dairy exports continue to impress. As the Daily Dairy Report notes, the fact that exports have continued to ship at such a clip “is a testament to the competitiveness of U.S. products abroad.” So far this year, NDM exports are 12.8% higher than the record-breaking volumes of 2020. Cheese exports logged a new high for the month of September and were 20% greater than the previous record set last year. U.S. milkfat exports grew more than threefold.

After the recent run-up in Class IV values, U.S. dairy products have lost some of their competitive edge, but they are still less pricey than product from Europe or Oceania. However, if Chinese milk powder imports slow suddenly, U.S. trade volumes may suffer. The US Dairy Export Council notes that over the past 12 months, global dairy exports to China grew 29%, while exports to the rest of the world fell 3%. China has clearly crowded out other buyers, but the economics of the pandemic have likely also played a role. Will other buyers step in if China pulls back?

The dairy product mix has set the tone for the milk markets. Cheese production is heavy, and so are Class III values. The November contract dropped 69ȼ to $17.81 per cwt. December Class III fell 87ȼ to $17.59. Most 2022 contracts gained a few cents and are hovering near $18.50. The Class IV market has the wind at its back. All contracts scored life-of-contract highs again this week. Most advanced roughly 30ȼ from Friday to Friday, which is great news for dairy producers who suffered huge losses over the past 18 months as Class IV prices languished and Class III manufacturers pulled milk out of regional pools.

The sun is shining, combines are rolling, and the grain markets have pulled back from the highs. With lofty prices in Chicago and a weak real, Brazilian corn and beans are attracting foreign buyers. That’s unusual at this time of year, when South American stocks are minimal and the U.S. is flush with freshly harvested crops. A slowdown in U.S. exports at harvest is likely to result in lower sales overall; it will be harder to catch up once South America’s new crops hit the market in a few months.

The rainy season is in full force in northern Brazil and, despite the La Niña, rain is falling in southern Brazil and Argentina too. The season got off to a dry start, but the recent showers and the wet forecast are at least partially alleviating fears that the La Niña will wither South America’s row crops.

December corn settled today at $5.53 per bushel, down 15.25ȼ from last Friday. January beans lost 44ȼ and closed at $12.055. December soybean meal inched a dime lower, finishing at $332.70 per ton.

Source: Jacoby