India’s hitting 12.8 liters per cow daily with genomic testing—while its paneer market races toward $ 24 billion. What are we missing?

EXECUTIVE SUMMARY: Here’s something that’ll make you think twice about your current setup. India’s paneer cooperatives are teaching us a lesson in efficiency—they’re producing 12.8 liters of milk per cow daily, while we struggle with feed costs. Amul has just posted $8 billion in revenue, representing 11% growth, and Mother Dairy has hit $2.1 billion. These aren’t tech startups—they’re farmer-owned co-ops that figured out how to make genomic testing and digital tracking actually pay off. Their paneer plants are outperforming our cheese operations in terms of margins (18-22% vs. 12-15%) and payback times (3.5-4 years vs. 4-6 years). With feed costs climbing everywhere, they’re using data to squeeze out savings we’re missing. Bottom line? It’s time to stop thinking small and start tracking everything, as if your profitability depends on it—because it does.

KEY TAKEAWAYS

- Cut feed waste by 15-20% with systematic tracking — Indian co-ops save $0.05 per liter through digital monitoring. Start by auditing your feed conversion ratios on a weekly basis and targeting genomic markers to improve efficiency.

- Push milk yield past 12 liters per cow — Gujarat herds hit 12.8 liters daily using selective breeding and optimized nutrition protocols. Benchmark your current yields against this target and adjust your breeding program.

- Test value-added products for 18-22% margins — Paneer operations outperform commodity cheese by 6-10 percentage points. Partner with a local processor to trial specialty protein blocks or fresh cheese varieties.

- Leverage cooperative models to access tech financing — India’s infrastructure fund provides 3% interest rates with 2-year payment holidays. Research grants, co-op partnerships, or equipment-sharing arrangements in your region.

- Audit processing costs against global benchmarks — Indian plants achieve faster payback (3.5-4 years vs 4-6 years) through operational discipline. Conduct monthly efficiency reviews to compare your ROI with that of industry leaders worldwide.

You know how it is in this business—sometimes the biggest breakthroughs come from places you’d never expect to look. India’s paneer market is projected to reach ₹2 trillion ($24 billion USD) by 2033, and the lessons these cooperatives are teaching about efficiency, innovation, and farmer alignment could transform how dairy operations are approached globally.

The thing about dairy is, sometimes the biggest breakthroughs come from unexpected places. Take paneer—the Indian cheese quietly disrupting global protein markets. According to IMARC’s latest analysis (2025), India’s paneer market is projected to hit ₹2 trillion (approximately $24 billion USD) by 2033, up from roughly ₹650 billion ($8 billion USD) today.

What’s Really Driving This Thing?

Here’s what gets me excited about this story: it’s not some Silicon Valley startup or venture capital play. We’re talking about massive farmer-owned federations—Amul and Mother Dairy—that have figured out how to scale dairy in ways most of us are still trying to wrap our heads around.

Amul has just posted ₹65,911 crore ($8.0 billion USD) in FY25 revenue—that’s 11% growth —and they’re openly targeting ₹1 trillion ($12.1 billion USD) next year. Remember: a crore denotes ten million, so we’re talking about a cooperative with over 4 million farmers that generates more revenue than most Fortune 500 companies. And the mindset? A co-op leader I spoke with off the record put it bluntly: “If you’re not innovating, you’re irrelevant.”

Mother Dairy’s pushing toward ₹17,000 crore ($2.1 billion USD) with 15% growth, driven by what folks in Delhi are calling an innovation-or-die mentality. These aren’t just big numbers—they’re proof that cooperative models can compete with anyone when they’re run right.

Does This Actually Matter in Wisconsin? Or Alberta?

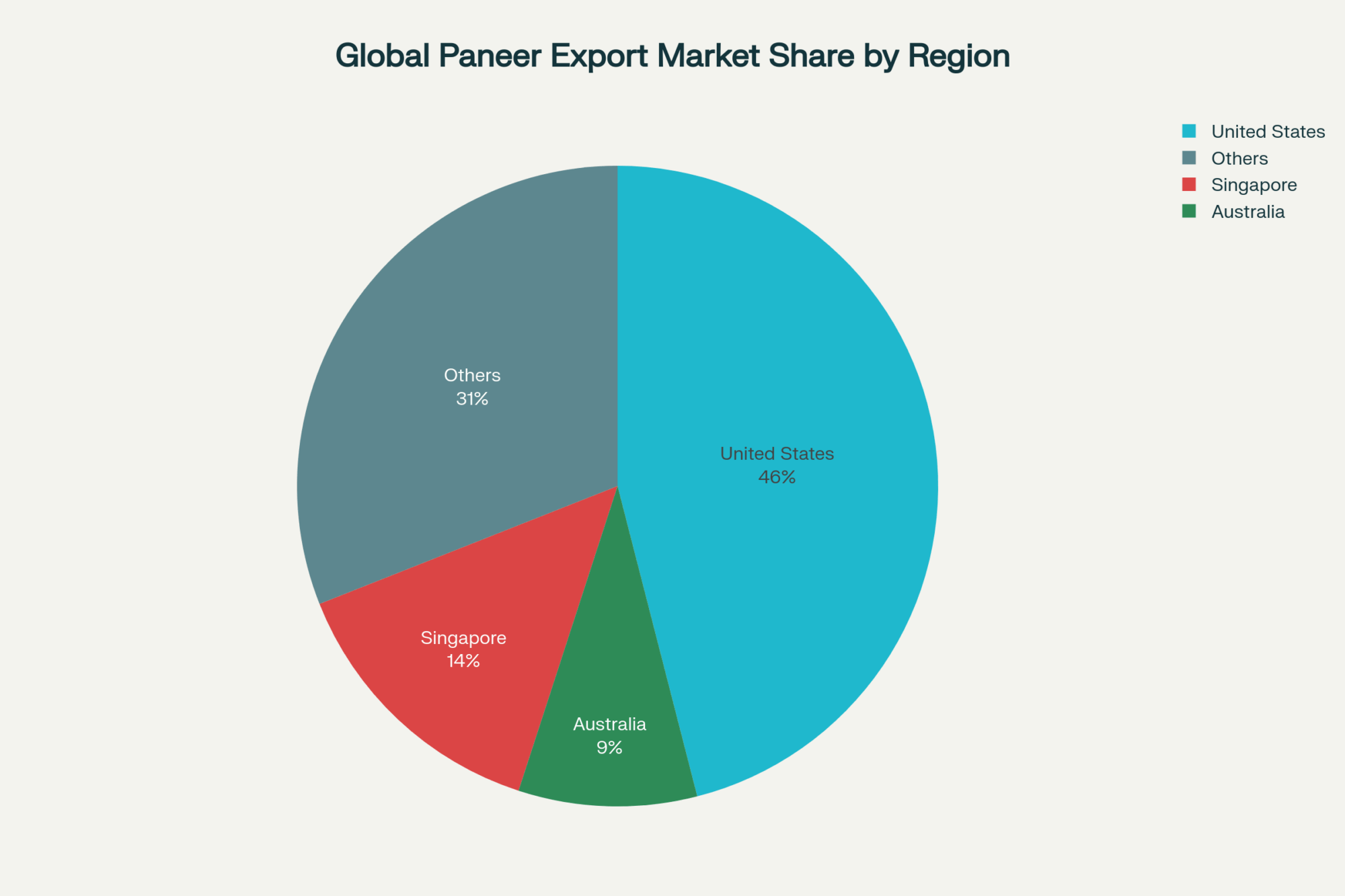

You bet it does. According to trade data from Volza (2025), India is shipping tens of thousands of paneer shipments globally and controlling virtually the entire export market. The U.S. takes nearly half of those imports, followed by Singapore and Australia. I’ve already spotted Indian paneer at specialty stores from Wisconsin to Vancouver—which tells me the supply chains are real, and this isn’t just a regional story anymore.

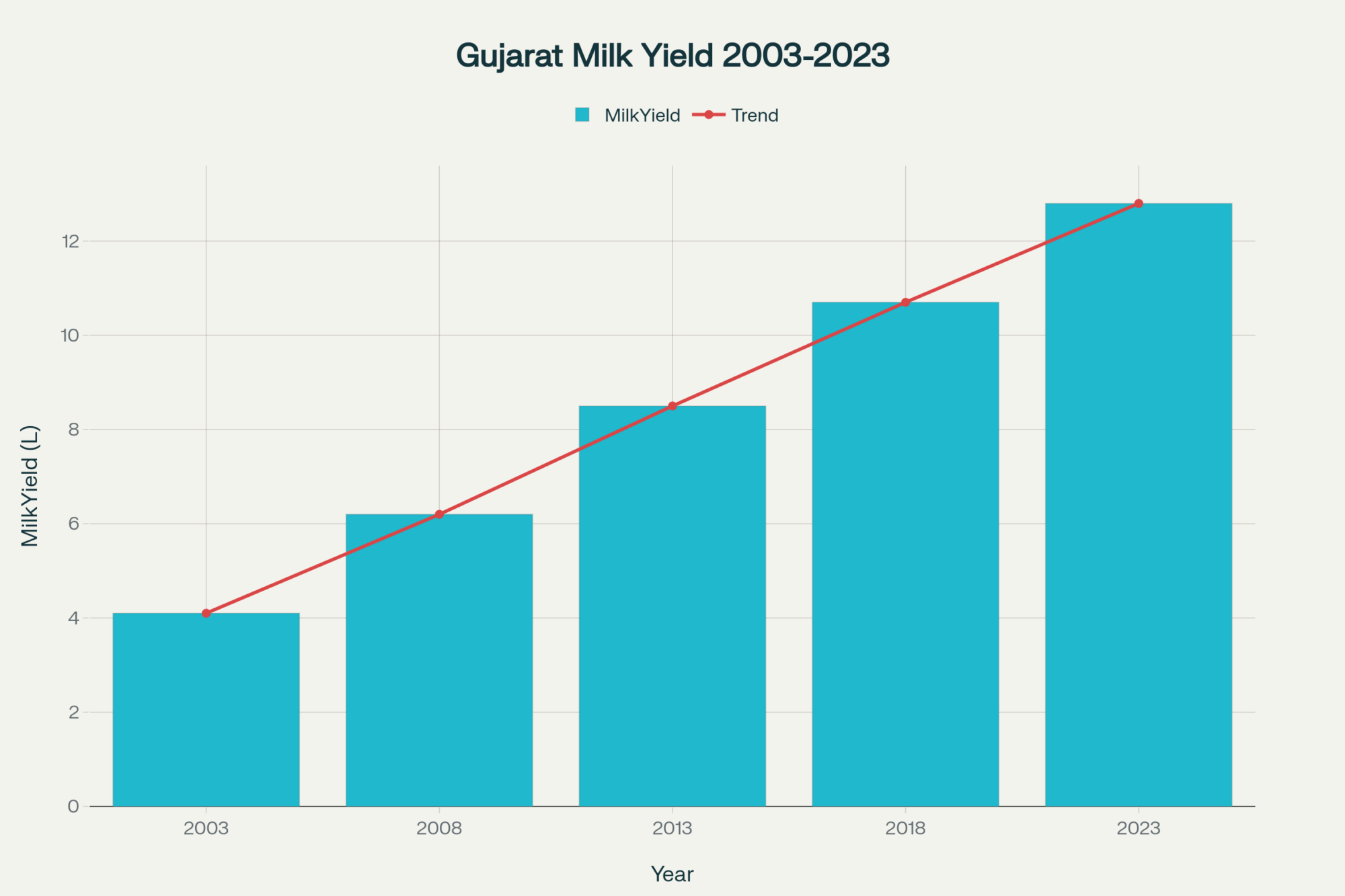

But what really matters is what’s happening at the production level. Gujarat’s milk production increased by 212% over the past two decades, with per capita availability rising from 418g to 700g daily. Today they’re averaging about 12.8 liters (roughly 3.4 gallons) per cow per day, even with feed costs climbing. According to recent work from the University of Wisconsin’s dairy extension program, similar cooperative efficiency gains are possible in North American operations when farmers commit to systematic data sharing and coordinated marketing—something that is already working in places like Organic Valley and Cabot Creamery.

The Tech Side: More Real Than Conference Hype

Look, we’ve all heard the IoT and digital tracking buzzwords at World Dairy Expo. But what’s happening in India’s top co-ops goes beyond the trade show demonstrations. Industry observers report that digital milk tracking and supply chain monitoring can deliver meaningful cost savings—though specific amounts vary widely based on scale and implementation.

Plant investments? Industry estimates suggest automated paneer operations typically require ₹25-30 crore ($3.0-$3.6 million USD), with additional infrastructure for chilling and storage. Payback periods depend heavily on throughput and market positioning, but some operators claim returns within 3-4 years when all factors align properly.

The Animal Husbandry Infrastructure Development Fund provides ₹15,000 crore ($1.8 billion USD) to help bridge financing gaps, offering a 3% interest subvention for eight years, including a two-year moratorium. That’s the kind of government backing that changes investment calculations and makes you wonder what similar programs could do for cooperative development here.

Financial Reality Check: How Do the Numbers Actually Compare?

Here’s something you won’t see at most industry events—a straight comparison between Indian paneer plants and U.S. cheese operations:

| Metric | Indian Paneer Plant | U.S. Cheese Plant |

| Capital Investment | ₹25-30 Crore (~$3-3.6 Million) | $5-7 Million |

| Payback Period (Years) | 3.5-4 | 4-6 |

| Production Yield (%) | 16-18% | 10-12% |

| Market Margin (%) | 18-22% | 12-15% |

Indian co-ops, with their current demand dynamics and supply chain integration, often achieve faster payback and higher margins than comparable U.S. operations. Not through secret technology, but through scale, cooperative cost advantages, and a market that’s still growing at double digits.

What’s Pushing Growth (And What’s Holding It Back)

The demand story is pretty straightforward: younger, urban, protein-conscious consumers are driving growth through foodservice. QSRs and fast-casual restaurants have figured out how to make paneer the star of wraps, bowls, and fusion dishes. It’s similar to what happened with mozzarella when pizza chains proliferated—except this market’s moving faster.

But let’s be honest about the challenges. Recent industry reporting shows feed costs have increased substantially across various inputs, putting pressure on even large cooperatives like Amul. And outside the major milk sheds? Infrastructure gaps, technician shortages, and connectivity issues slow down the kind of digital integration that makes headlines.

A contact in rural Karnataka put it bluntly: “When your nearest service tech is two hours away, equipment downtime becomes a quarterly crisis.” Sound familiar?

Bottom Line: Three Things You Can Start Doing Monday Morning

Don’t copy India’s model wholesale—learn from what works and adapt it to your situation. Here’s what I’d focus on if I were running a dairy operation today:

Track everything obsessively. Start by implementing the kind of systematic cost monitoring that the Indian Dairy Board considers essential. I’m talking about tracking every liter, every route, every touchpoint from farm gate to delivery. Most operations I know have a general sense of their numbers, but the level of precision these Indian co-ops use would surprise a lot of folks. Set up weekly cost-per-liter reports and monthly efficiency audits—you might discover inefficiencies you didn’t know existed.

Rethink your processing priorities. Regular audits of post-farm operations can reveal optimization opportunities that add up fast. Compare your actual ROI against what innovative plants globally are achieving. If you’re not seeing paybacks of 3-4 years on major equipment investments, ask why. Consider consolidating milk routes, upgrading cold storage facilities, or exploring shared processing facilities with neighboring operations to optimize efficiency and reduce costs.

Test value-added seriously. Don’t just think about specialty products as nice-to-haves. Indian co-ops have proven there’s significant margin potential in niche protein blocks, fresh cheeses, and products that cater to evolving consumer preferences. Start small—maybe partner with a local restaurant or food truck to test demand for fresh paneer or specialty cheese curds. But test intentionally, with clear metrics and expansion plans.

What strikes me most about India’s transformation is how it confirms something we all know but often overlook: the fundamentals still matter most. Cost control, coordinated marketing, and genuine cooperative alignment drive sustainable growth.

The next breakthrough insight for your operation might not come from the latest agtech conference or Silicon Valley startup. It could come from studying how a cooperative in Gujarat manages four million farmers, or how a paneer plant in Maharashtra turned traditional dairy processing into a growth engine.

That’s the kind of lesson worth paying attention to, whether you’re managing 500 cows in Vermont or 5,000 in the Central Valley.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Why “Get Big or Get Out” is Killing Dairy Communities – This article provides a tactical look at the cooperative advantage. It offers actionable steps for farmers to leverage group purchasing power, diversify into value-added products, and use genomic testing to capture component premiums—proving that collective action can deliver a higher ROI than simply increasing herd size.

- 2025 Dairy Market Reality Check: Why Everything You Think You Know About This Year’s Outlook is Wrong – This strategic piece complements the main article by analyzing current global market shifts. It reveals why focusing on milk components over raw volume is key to capturing rising export demand and navigating price volatility, providing a crucial long-term market perspective.

- The Digital Dairy Revolution: How IoT and Analytics Are Transforming Farms in 2025 – This article is a deep dive into the technology discussed in the main piece. It details how on-farm digital systems, like IoT sensors and AI, can boost productivity by 15-20% and reduce health costs, providing concrete examples of how to implement these technologies for real-world savings.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!