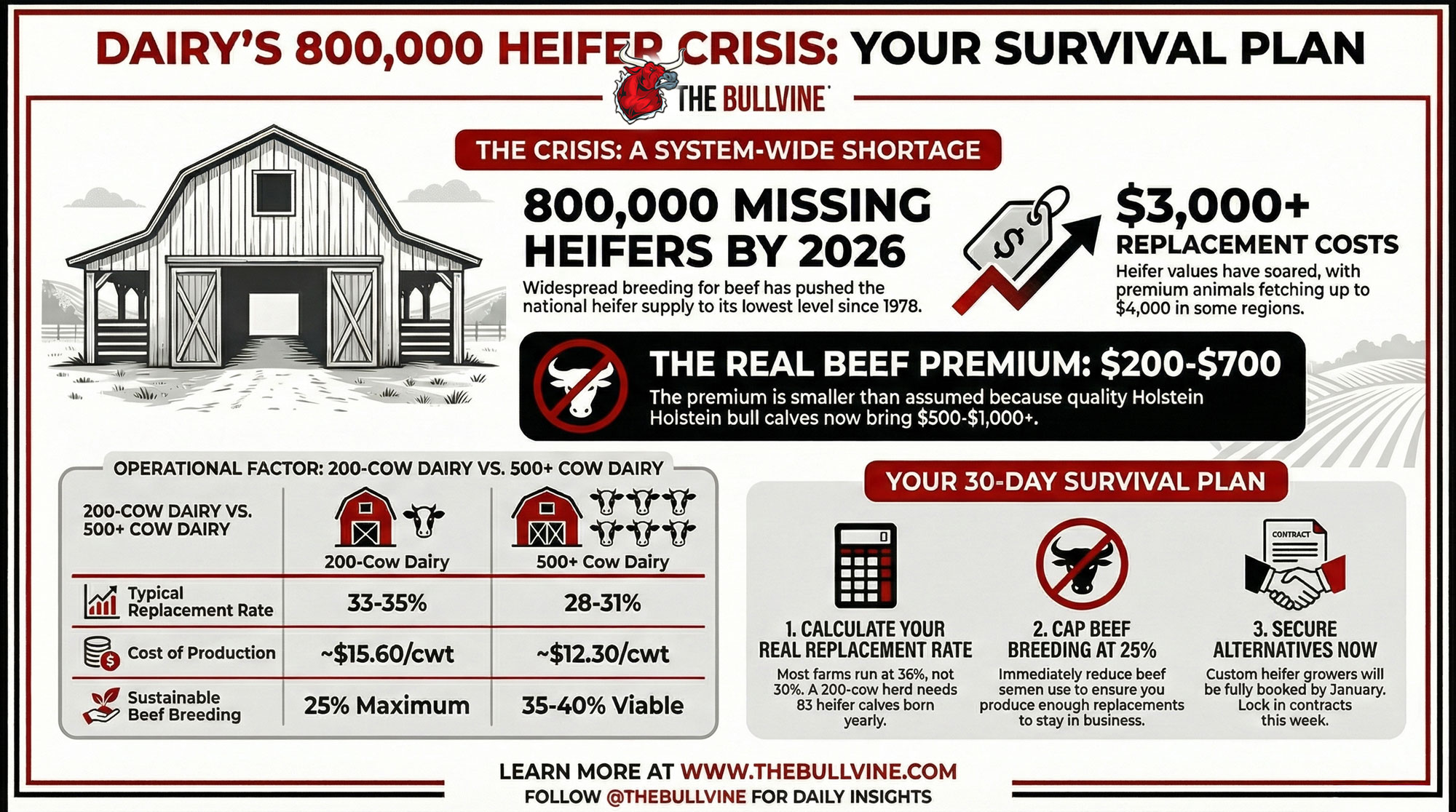

What happens when EVERY dairy breeds for beef? 800,000 missing heifers. $3,000 replacements. Three thousand seven hundred farms exiting. This is that story.

EXECUTIVE SUMMARY: We all bred for beef when premiums hit $1,200 versus $500-1,000 for Holstein bulls—seemed smart until everyone did it, creating an 800,000-heifer shortage. Now, replacements cost $3,000 if you can find them, custom rearing fills completely by January, and CoBank projects 2,400-3,700 farms won’t make it through 2027. You have 30-60 days to secure alternatives before every option vanishes: after January, it’s crisis management, not planning. The math doesn’t lie: 200-cow dairies running 36% replacement rates need 83 dairy calves born yearly, but can only afford 25% beef breeding—yet most are at 35-40%. Wisconsin’s adding heifers thanks to stable cheese plant relationships, Texas is bleeding them for quick cash, and California’s betting on scarcity value. Bottom line: the industry’s splitting into mega-dairies and specialty producers, and mid-sized farms have weeks to choose their path or have it chosen for them.

We are sleepwalking into a crisis. While we’ve been celebrating those beef-cross premiums, we’ve quietly dug an 800,000-heifer hole that’s going to reshape this industry whether we’re ready or not.

You know, I was at World Dairy Expo this October when Ben Laine from CoBank laid out the numbers, and honestly, it stopped conversations cold. According to their August analysis, we’re looking at dairy replacement heifer inventories shrinking by approximately 800,000 head through 2026. We haven’t seen heifer supplies this tight since 1978.

Let me repeat that—eight hundred thousand fewer heifers entering our national herd. And here’s what’s interesting: this isn’t some random disaster hitting us. It’s the result of every one of us making what seemed like smart individual decisions.

When beef-cross calves are bringing $1,200 to $1,400 while dairy bull calves—even with today’s historically high prices—are fetching $500 to $1,000, that beef premium still looks attractive. But when thousands of us make that same calculation… well, here we are.

I’ve been talking with folks from Wisconsin cheese country down to the Texas Panhandle lately, and what I’m hearing suggests this goes deeper than just a heifer shortage. The decisions we make in the next 30 to 60 days—and I mean that literally—these are going to determine not just whether we navigate this immediate crisis, but whether our operations can survive in what’s shaping up to be a fundamentally different industry by 2028.

The Mathematics Behind Today’s Decisions

So let’s talk numbers for a minute, because the data tells the story better than I can.

Now, I need to correct something that’s been floating around the industry. Yes, beef-cross calves are bringing $1,200 to $1,400, sometimes more. But dairy bull calves aren’t worthless anymore—far from it. According to USDA data this November, quality Holstein bull calves are actually bringing $500 to over $1,000 per head in many markets. I’ve seen Pennsylvania auctions where they’re breaking $1,000/cwt for top calves.

What We Thought vs. Market Reality

Here’s where many of us got the math wrong:

What We Assumed:

- Dairy bull calves: $100-200

- Beef-cross calves: $1,200-1,400

- Premium spread: $1,000-1,300 per calf

Actual November 2025 Prices:

- Dairy bull calves: $500-1,000+ (depending on quality/region)

- Beef-cross calves: $1,200-1,400

- Real premium spread: $200-700 per calf

But here’s the thing—even with dairy bull calves worth more than we’ve seen in years, a 200-cow dairy breeding 35 to 40 percent of their herd to beef genetics can still generate meaningful additional revenue. Let me walk you through the real math: 80 beef-cross calves annually × $500 average premium = $40,000 in additional revenue. That’s still real money, even if it’s not quite the $84,000 windfall we thought when dairy bulls were cheaper.

The folks at the National Association of Animal Breeders tell us that most dairy operations have jumped on this beef-on-dairy train. And honestly, even with higher dairy calf values, the math still pencils out for many. Beef semen sales to dairy farms have gone from basically nothing in 2014 to dominating the market today. As breeding consultants across the Midwest keep telling me, nobody’s seen adoption rates like this for any technology, ever.

Here’s what that means in real numbers: we’re producing something like 3 million beef-on-dairy calves annually now, based on current breeding patterns. Think about that—3 million calves that would’ve been potential replacement heifers just a few years ago.

According to USDA’s January data and what CoBank’s been tracking, here’s where we stand:

- We’ve got about 3.8 million head in the dairy heifer inventory over 500 pounds—that’s the lowest in two decades

- By 2026, projections show we’ll drop to around 3.4 million head

- Heifers actually available to enter milking strings: somewhere between 2.1 and 2.4 million, compared to the 3.3 million plus we used to count on

- Current replacement heifer values are averaging $3,010 nationally, according to the latest market reports

And it gets worse in certain regions. Producers I know in California’s Central Valley are seeing premium springer heifers hit $3,500 to $4,000. Minnesota’s seeing similar numbers. As Mike Overton from Zoetis pointed out at a recent meeting, we haven’t seen heifer prices like this since that expansion craze back in 2014—except back then, we were building herds, not struggling to maintain them.

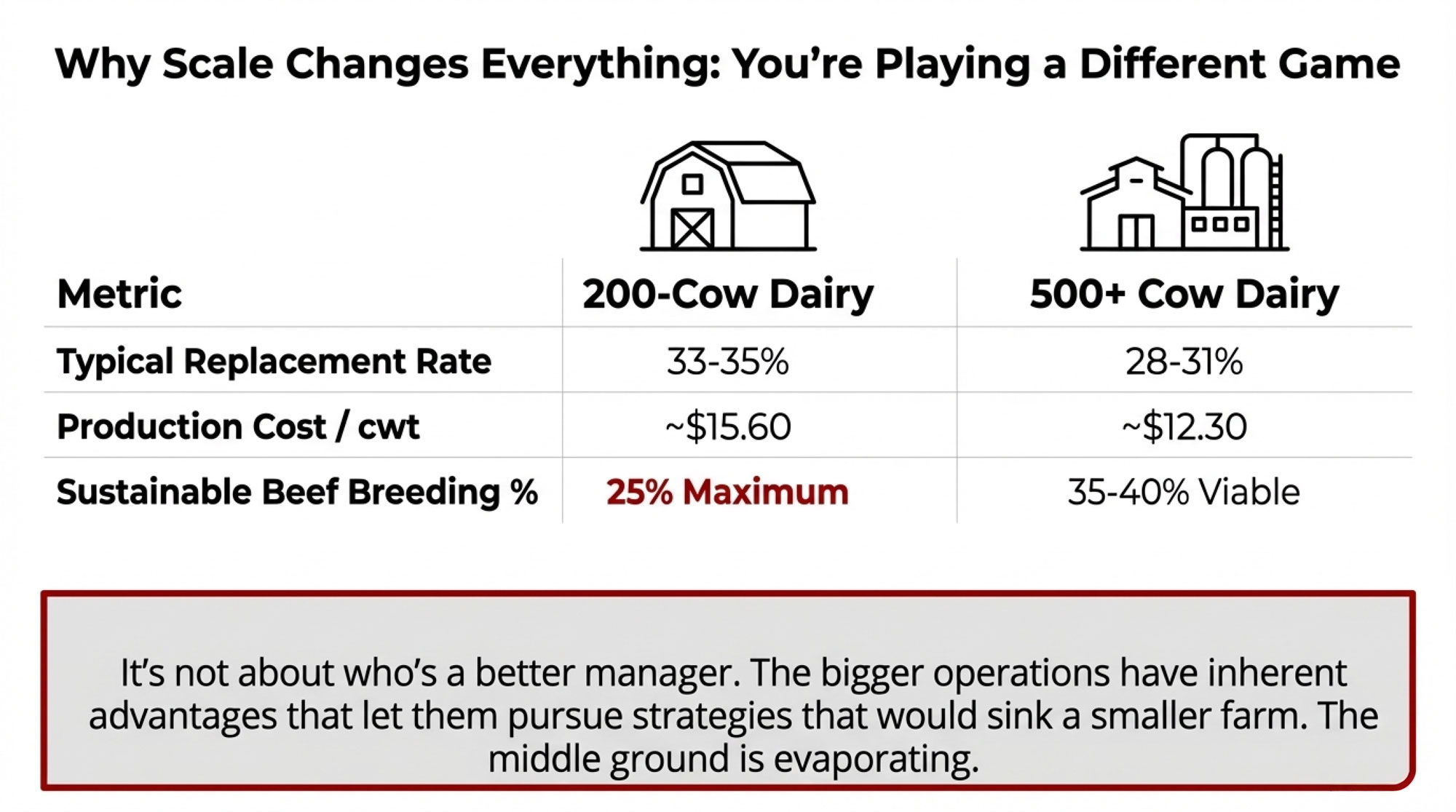

Why Scale Changes Everything

Here’s something I didn’t fully appreciate until recently—how much your herd size determines whether beef-on-dairy breeding makes sense or becomes a trap.

Look at those big operations out in Kansas or down in the Southwest. They’re milking several thousand cows, running 28 to 31 percent replacement rates because they can afford to be selective. They’re spending $35 to $45 per calf on genomic testing, culling the bottom performers before they even start raising them. Their management teams and economies of scale let them achieve completion rates that smaller operations just can’t match.

The cost structure differences are eye-opening. Those large operations? They’re producing milk at around $11 to $13 per hundredweight based on regional benchmarking. Meanwhile, a well-managed 200-cow dairy in Wisconsin—and I know plenty of them—they’re looking at costs closer to $15.60 per hundredweight according to the University of Wisconsin’s dairy profitability folks.

That’s not a small gap, and it changes everything about your strategic options.

| Operational Factor | 200-Cow Dairy | 500+ Cow Dairy |

| Typical replacement rate | 33-35% | 28-31% |

| Production cost per cwt | Around $15.60 | Around $12.30 |

| Heifer rearing investment | $3,010 | $2,000-2,500 |

| Sustainable beef breeding level | 25% maximum | 35-40% viable |

Albert De Vries, down at the University of Florida, has been studying this for years, and his research keeps coming back to the same point: it’s not about who’s a better manager. It’s structural. The bigger operations have inherent advantages that let them pursue strategies that would sink a smaller farm.

You’re not doing anything wrong if you’re running 200 cows—you’re just playing a completely different game.

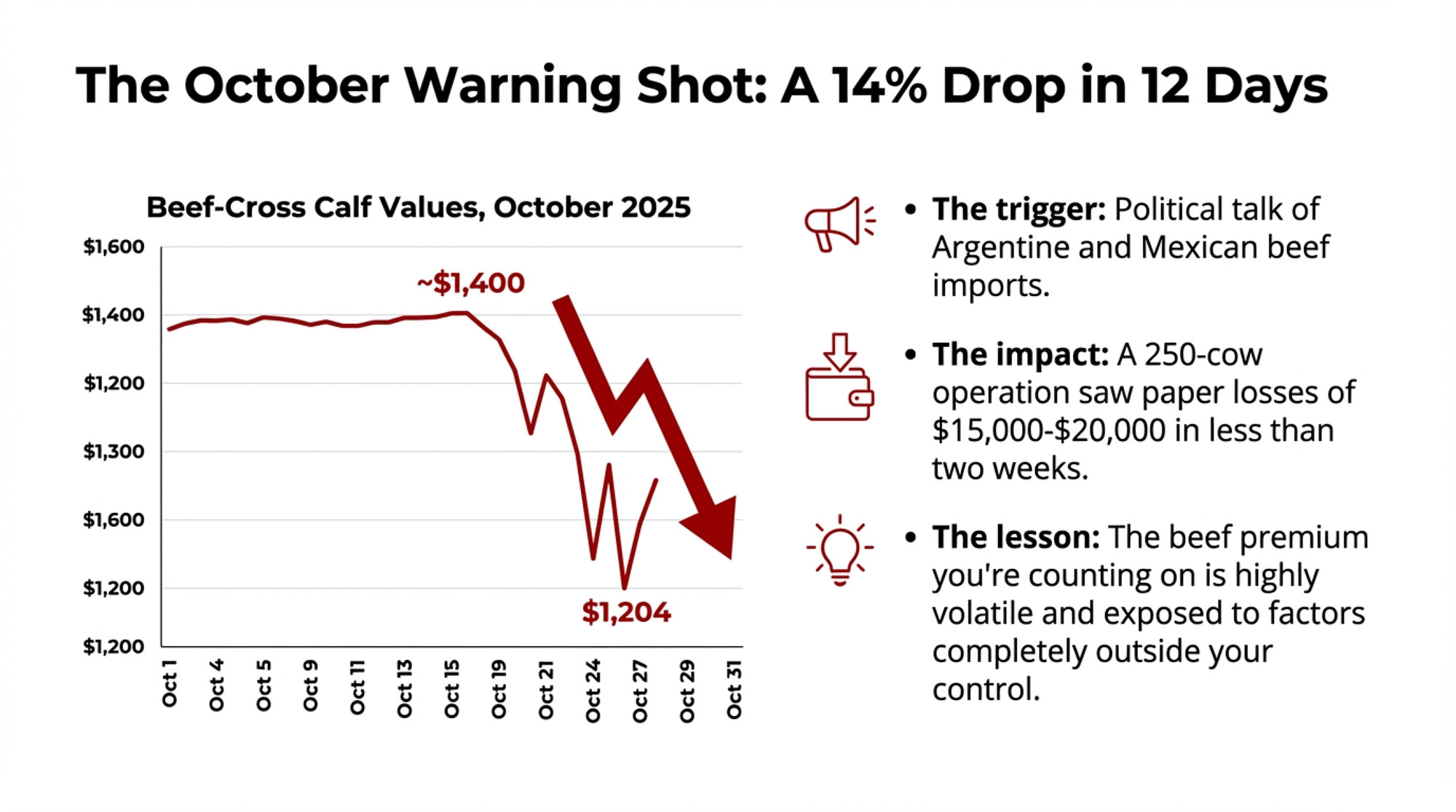

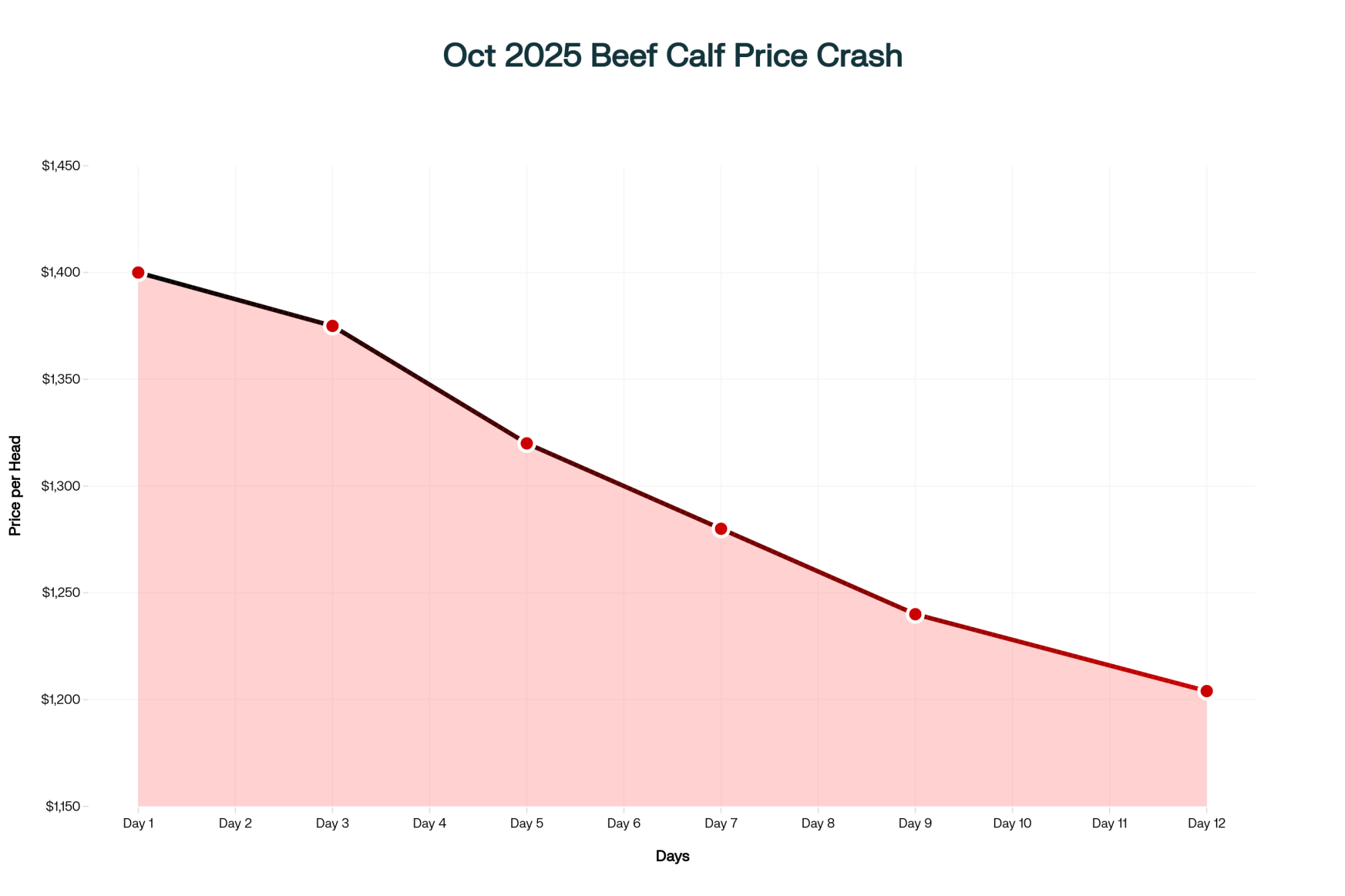

The October Market Signal

Remember what happened in October? Man, that was a wake-up call. In just 12 days, beef-cross calf values dropped from around $1,400 to $1,204 based on the CME data. That’s nearly $200 per head—gone, just like that.

I’ve been hearing from producers with 250-cow operations in Wisconsin who saw paper losses of $15,000 to $20,000on their beef-cross calf inventory during that correction. One guy told me, “I went from planning equipment purchases to wondering about cash flow in less than two weeks.”

But here’s what really got my attention: it wasn’t just the price drop, it was why it happened. Soon as live cattle futures got into politically sensitive territory, suddenly everyone’s talking about Argentine beef imports, Mexican trade deals… Those policy discussions alone knocked 14 percent off calf values.

And here’s the kicker—even with that drop, beef-cross calves at $1,200 are still commanding a $200-700 premiumover those high-priced dairy bull calves. The spread has narrowed, but it’s still there. We’re learning that these premiums we’ve been counting on are volatile, but they’re persistent.

Regional Variations Tell Different Stories

What’s fascinating is how different this shortage looks depending on where you farm. And the dairy bull calf values? They’re all over the map, too.

Regional Holstein Bull Calf Pricing (November 2025)

Wisconsin & Minnesota:

- Market range: $700-1,070 per head

- Some premium calves are reaching higher

- Strong local demand from calf ranches

Pennsylvania & Northeast:

- Market range: $850-1,190/cwt for quality

- Premium markets breaking $1,000/cwt

- Highest prices nationally for top calves

Texas & Southwest:

- Market range: $400-800 per head

- Lower averages than northern regions

- More variation based on quality

California:

- Market range: $600-900+ per head

- Premium for healthy, well-managed calves

- Water/regulatory pressures affecting demand

Wisconsin is actually doing okay—relatively speaking. The state’s ag statistics folks reported they added about 10,000 replacement heifers in 2024. Why? Those cheese plant relationships are rock solid. The pricing stability from those long-term processor agreements makes it worth raising replacements even with current challenges. Plus, with Holstein bull calves bringing $700-1,000 in Wisconsin markets, the economics of raising dairy replacements looks better here than elsewhere.

Texas? Completely different story. Down in the Panhandle, where all that new processing capacity’s coming online, producers are going all-in on beef breeding. Even with dairy bull calves worth more, they’re looking at it like this: Why invest $3,000 and two years raising a replacement when you can get $1,200 for a beef-cross calf today? State data shows their heifer inventory dropped by about 10,000 head year over year. The immediate cash flow wins every time.

California’s dealing with its own unique challenges. Water, regulations—some folks are reducing herd sizes regardless of heifer availability. But I know producers in the northern valleys are still investing heavily in replacements, betting that scarcity will drive values even higher. With some California markets seeing Holstein bulls over $900 per head, the decision gets more complex, but many are still choosing the beef route.

The Timeline Reality

Here’s where things get urgent, and I mean really urgent. If you’re reading this in late November, you’ve got maybe 30 to 60 days to secure alternative replacement strategies before those options disappear. This isn’t me trying to create panic—it’s just the reality we’re facing.

Mike Hutjens, the professor emeritus from Illinois, has been laying this out in presentations lately: By January, custom heifer growers will be full. By February, you’re looking at six-month waits for embryo transfer slots. Come March? You’re paying whatever the market demands, period.

Based on what I’m hearing from custom rearing operations and embryo transfer companies, here’s how it’s playing out:

November through December 2025: Custom heifer operations still have some space, but it’s going fast. Prices have jumped to $1,300 to $1,500 per head through freshening in most regions, up from $1,200 earlier this year. If you’re thinking about custom rearing, honestly, you need to make those calls this week.

January through February 2026: Trans Ova Genetics, probably the biggest embryo transfer outfit out there, is already booking into the second quarter of 2026. Their competitors? Same story. The window for being proactive is closing fast.

March through June 2026: This is when it gets ugly. External options are gone. You’re either paying market prices—whatever those turn out to be—or you’re reducing your herd size. By this point, you’re not planning anymore, you’re just reacting.

Learning from Early Adapters

Not everyone’s in crisis mode, though. Some folks saw this coming and adjusted early.

I’ve been hearing from Wisconsin producers who jumped on that August CoBank report immediately. Several of them dropped their beef breeding from 35 to 25 percent right away and locked in contracts with custom heifer growers at $1,250 per head before prices went up. As one of them said at a co-op meeting recently, “Sure, we’re giving up some beef-cross revenue—about $400-500 per calf with today’s dairy calf values—but we’ll have the replacements we need.”

Here’s what’s interesting—some are also extending lactations on their first-calf heifers. Instead of breeding them back at 60 days in milk, they’re waiting until 100 to 120 days in milk. It maintains production while reducing the total number of replacements needed. The nutritionists from the major feed companies have been working on rations to support these longer lactations, and it’s actually working pretty well. Amazing what you can figure out when you have to, right?

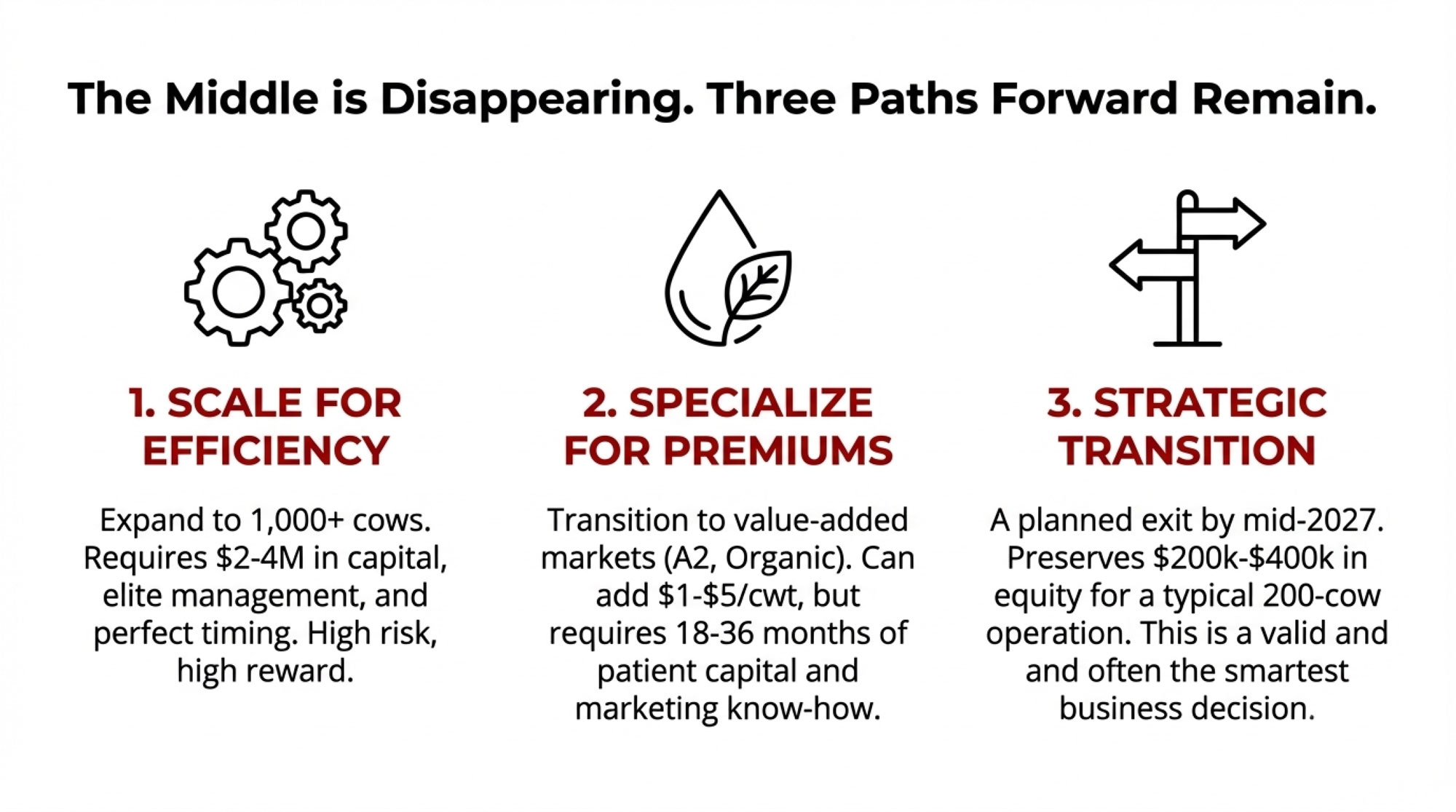

Three Strategic Paths Emerging

Looking past the immediate crisis, I’m seeing three distinct paths forward. Each has merit and risks.

Path 1: Scaling for Efficiency

Some operations are going for broke—expanding from 200-500 cows to 1,000 or more to get those economies of scale. We’re talking $2 to $4 million in capital for facilities and herd acquisition.

Historical data suggests it’s tough—really tough. Most operations that try to expand this size run into unexpected hurdles. Success depends on having capital, management expertise, and good timing. It’s not just about getting bigger—you’ve got to get better at the same time, and that’s harder than it sounds.

Path 2: Specialty Market Development

Value-added markets are getting a lot of attention. A2 milk’s bringing $1 to $2 per hundredweight over conventional. Organic can add $3 to $5 per hundredweight, though that transition period is brutal—18 to 36 months before you see those premiums.

According to dairy economists, these transitions are challenging. You need patient capital, marketing know-how, and usually some geographic advantage. Not everyone can go specialty—but for those who can, it might be the difference between thriving and just surviving.

Path 3: Strategic Transition

This is hard to talk about, but strategic exit is a valid business decision. Producers who transition before mid-2027, while their herds are healthy and equipment still has value, could preserve $200,000 to $400,000 in equity for a well-managed 200-cow operation, depending on assets and local markets.

There’s no shame in recognizing when it’s time to transition. Sometimes that’s the smartest business decision you can make.

Processing Capacity Considerations

Here’s something that doesn’t get enough attention: what happens to all that new processing capacity when there aren’t enough cows to fill it?

The dairy foods folks report that about $11 billion in processing capacity was built between 2023 and 2026, all designed for 2 to 3 percent annual growth in milk supply. But with 800,000 fewer dairy cows entering production? These plants are looking at running 80 to 85 percent capacity at best.

Marin Bozic, up at the University of Minnesota, has been analyzing this extensively. His research suggests processors will compete hard for milk supply, which should support prices. But—and this is important—they’re going to favor larger, more reliable suppliers. Mid-sized farms might find themselves on the wrong end of those negotiations.

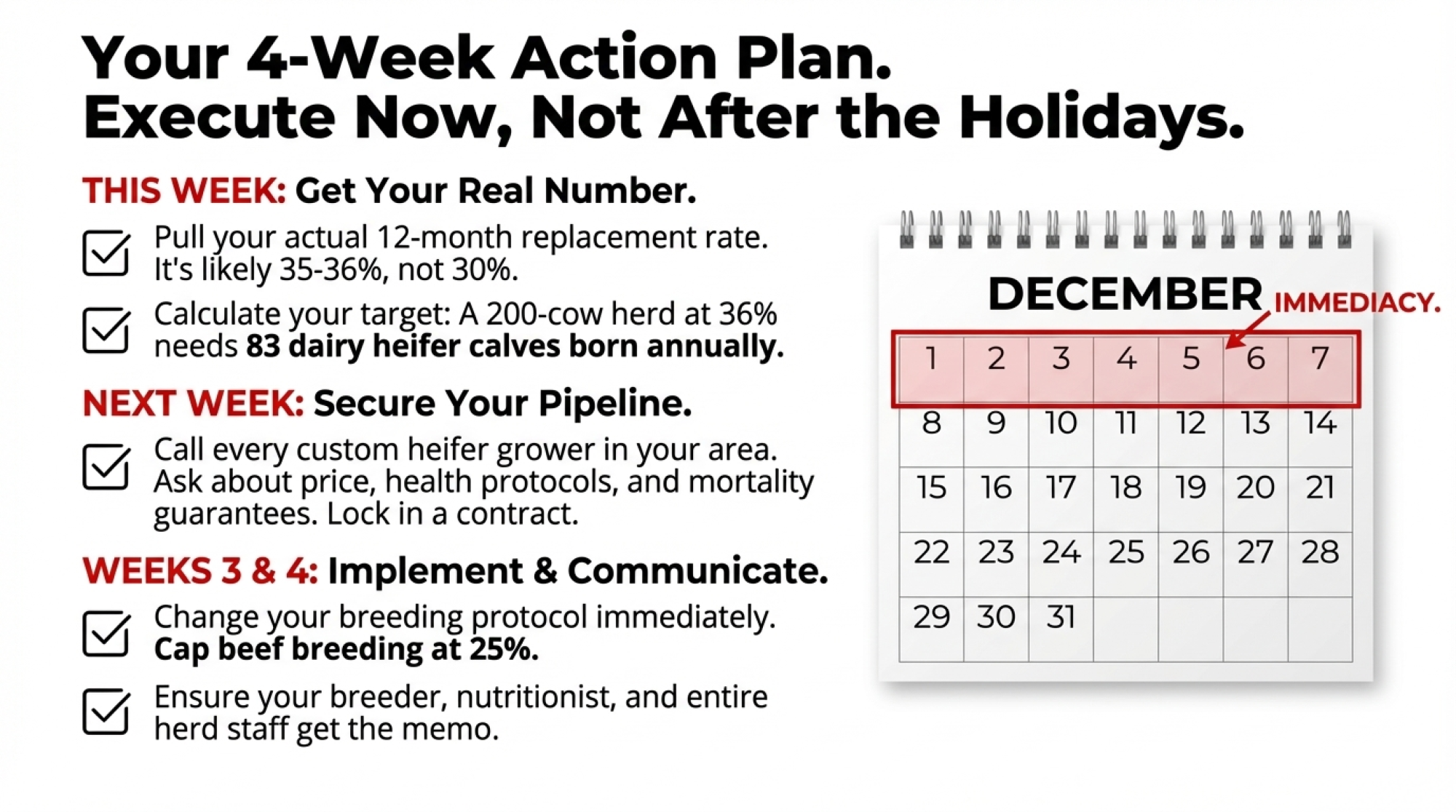

Practical Steps for the Coming Weeks

Alright, let’s get practical. Here’s what you should be doing right now—and I mean right now, not after the holidays.

This Week—Data Analysis:

Pull your actual replacement rate. Don’t guess. Look at the past 12 months: how many cows left your herd? Divide by your average herd size. That’s your real replacement rate, not what you hope it is.

Most 200-cow operations I work with discover they’re actually at 35-36 percent, not the 30 percent they planned for. At 36 percent, you need 72 replacement heifers entering the milking herd every year. Add 15 percent for losses before freshening, and you’re looking at needing 83 dairy heifer calves born annually. That’s your real target.

Next Week—Market Research:

Get on the phone with every custom heifer grower within a reasonable distance. Operations like Knight Dairy Development and others need to know your timeline, health requirements, and how many heifers you need.

And here’s a tip: don’t just ask about price. Ask about mortality guarantees, health protocols, and breeding management. The cheapest option isn’t always the best value—a dead heifer is expensive at any price.

Weeks Three and Four—Decision Implementation:

Document everything and communicate clearly. If you’re changing breeding protocols, make sure everyone knows—your breeder, your nutritionist, your herd manager. I’ve seen too many good plans fail because the person with the semen tank didn’t get the memo.

Understanding the Broader Transformation

This situation is bigger than just a heifer shortage. Industry analysts are projecting that 2,400 to 3,700 farms may exit by 2027, based on what CoBank and the National Milk Producers Federation are seeing. This isn’t market failure—it’s structural evolution. And whether we like it or not, it’s happening.

Andrew Novakovic from Cornell, who’s been studying dairy industry structure for decades, calls it a “bimodal industry”—really efficient large operations on one end, specialty producers serving premium niches on the other, and not much in between. That comfortable middle ground where many of us have operated for years? It’s disappearing.

For those of us in that 200 to 500 cow range who’ve been the backbone of this industry for generations, this is a massive change. But transformation creates opportunities too, if you’re positioned right. The question isn’t whether change is coming—it’s how we respond to it.

Perspectives Often Unspoken

Here’s something I’ve noticed after all these years: your advisors—nutritionists, lenders, co-op field staff—they all operate within business models that depend on you staying in business. They provide great expertise, don’t get me wrong, but their perspectives naturally favor continuation over transition.

This doesn’t mean they’re wrong, but it does mean those hard strategic questions—”Should I fundamentally reconsider my operation’s future?”—might not get asked. Successful navigation of this mess requires an honest assessment of whether your operation can be genuinely profitable in what’s coming. Sometimes the hardest questions are the ones nobody wants to ask.

The Bullvine Bottom Line

The next 30 to 60 days represent maybe our last chance for proactive positioning. After that, we’re just reacting to a crisis. The math is clear, the timeline’s set, and the structural transformation is already underway.

Here’s what every dairy producer needs to understand right now:

If you’re running 200-500 cows: Keep beef breeding below 25 percent immediately. Your actual 36% replacement rate means you need 83 dairy heifer calves born annually. Yes, you’re giving up $200-700 per calf in beef premiums (depending on your dairy calf market), but the math on replacements doesn’t lie.

If you need replacements: Custom rearing showing 70% full today will be 100% booked by January. Trans Ova and other embryo transfer services are already scheduling into Q2 2026. Act this week, not next month.

If you’re questioning your future: This isn’t just another cycle—it’s structural change. The industry’s splitting into mega-dairies and specialty producers. That comfortable middle is evaporating. By 2028, milk could be trading at $14-15/cwt while your production costs stay at $15.60/cwt. You can’t survive that math long-term.

The paradox we’re facing is more nuanced than we initially thought: each farm’s decision to breed for beef made sense even with dairy bull calves worth 0-1,000—that 0-700 premium per calf is still real money. But when we all chase that premium simultaneously, we created this 800,000-heifer shortage that’s threatening 2,400-3,700 farm exitsby 2027.

This isn’t our industry’s first restructuring, but for today’s decision-makers, it might be the most consequential. What you decide in the next few weeks doesn’t just determine who’s milking cows in 2027—it shapes what American dairy farming looks like for the next generation.

The real lesson here? It’s about recognizing structural change early enough to make proactive decisions. The difference between choosing your future and having it chosen for you comes down to what you do in the next 30 days.

That’s not a warning, folks. That’s just reality. And it’s what we need to face, thoughtfully and strategically, right now.

This analysis draws from CoBank dairy research published August 2025, USDA National Agricultural Statistics Service data from January and November 2025, USDA Agricultural Marketing Service auction reports showing current Holstein bull calf pricing, ongoing research from dairy programs at Wisconsin, Minnesota, Florida, Illinois and Cornell, CME Group commodity market data, industry association reports, and extensive conversations with dairy producers and industry professionals throughout 2025.

KEY TAKEAWAYS

- Your 30-Day Deadline: Calculate your real replacement rate (hint: it’s 36%, not 30%), confirm you need 83 heifer calves yearly per 200 cows, then lock in custom rearing contracts TODAY—January is too late

- The $200-700 Question: Beef premiums over $500-1,000 Holstein bulls seem worth it until you’re paying $3,000 for replacements you can’t find—cap beef breeding at 25% NOW

- Three Paths, No Middle Ground: Invest $2-4M scaling past 1,000 cows, transition to specialty markets for $1-5/cwt premiums, or exit by Q2 2027, preserving equity—staying mid-sized isn’t an option

- Regional Intelligence: Wisconsin’s stable (cheese plants), Texas bleeding heifers (quick cash), California gambling (scarcity bet)—know your market’s direction

- The Bottom Line: 2,400-3,700 farms won’t survive this restructuring. December’s decisions determine if you’re milking in 2028.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Hidden Cost of Every $1,200 Beef Calf: A $4,000 Heifer Bill – Tactical Strategy: Reveals the “Forward Replacement Inventory Formula” successful herds use to predict shortages 18 months out. Learn how a 30-minute weekly monitoring habit can save your operation $200,000 by catching the critical 45% dairy pregnancy threshold before it’s too late.

- The $11 Billion Reality Check: Why Dairy Processors Are Banking on Fewer, Bigger Farms – Market Analysis: Uncovers why processors are investing billions despite low margins, banking on 70-80% pre-contracted supply from mega-dairies. This analysis explains the structural disadvantage facing mid-sized farms and provides a framework for evaluating your 2026 processor access and viability.

- The $3,500 Calf Question: What Dairy Farmers Need to Know About April 2026’s New CDCB Calf Health Evaluations – Technology Insight: With replacements costing $4,000, keeping them alive is non-negotiable. This guide details the new 2026 genomic tools for predicting scours and respiratory resistance, demonstrating how to reduce calf mortality by 38% and protect your six-figure heifer investment.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!