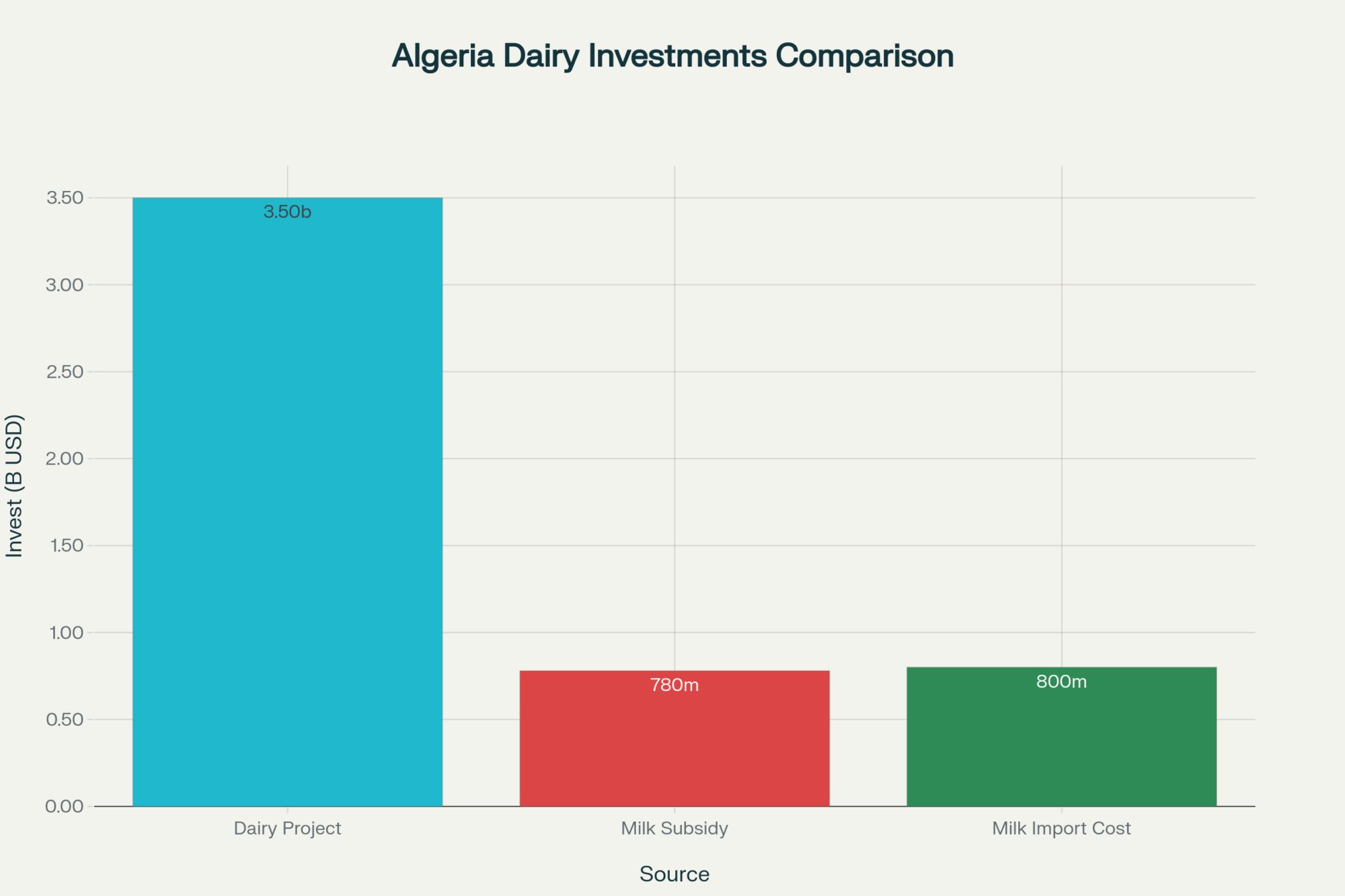

This $3.5 billion desert dairy will displace $400 million in global exports. The producers who survive will master the same feed efficiency and heat tolerance traits.

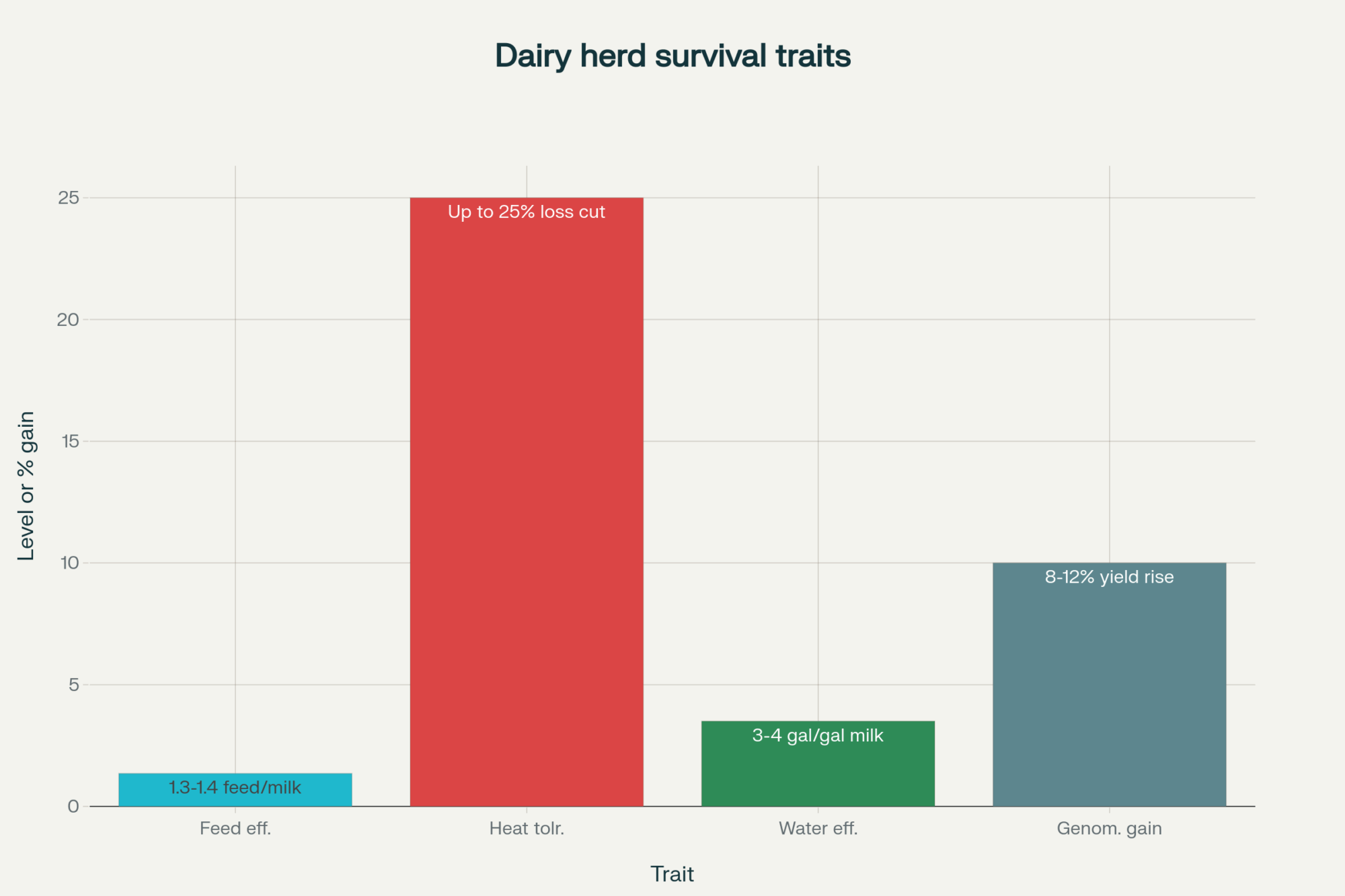

EXECUTIVE SUMMARY: Algeria’s national dairy initiative isn’t just about one big project—it’s about challenging everything we thought we knew about efficient milk production. They’re spending $800 million a year importing powder because they’re producing 2.5 billion liters but consuming 4.5 billion liters. Algeria’s targeting feed conversion ratios of 1.3-1.4 kg of milk per kg of dry matter in desert conditions—that’s competitive with temperate operations. Water use is high at 3-4 gallons per gallon of milk, but they’re managing it with smart tech. The real kicker? When this 270,000-cow operation hits full stride, it’ll cut global powder exports by $400 million annually. For us, this means that feed efficiency and genomic selection are no longer nice-to-haves—they’re survival tools. Start optimizing now or get left behind.

KEY TAKEAWAYS:

- Boost milk production 15-20% through precision feed management → Start tracking your feed conversion ratios weekly and adjust TMR formulations based on real data. With feed costs volatile in 2025, every 0.1% improvement in efficiency adds $0.08-$ 0.12 per cow per day.

- Cut heat stress losses by up to 25% with proactive cooling systems → Install shade structures and misting fans before summer peaks hit. Research shows dairy operations lose 15-20% of milk yield during heat stress events—preventable losses that directly impact your bottom line.

- Leverage genomic testing for 8-12% yield improvements within 18 months → Begin incorporating genomic evaluations into breeding decisions this season. Focus on feed efficiency and heat tolerance traits—the same characteristics making Algeria’s desert dairy viable.

- Optimize water efficiency to reduce operational costs 10-15% → Implement water recycling systems and monitor usage per liter of milk produced. Desert operations demonstrate that you can maintain production with effective water management—essential as water costs continue to rise globally.

- Prepare for shifting global markets by strengthening local efficiency. Algeria’s project is expected to displace major powder exporters by 2027. Farms with superior feed conversion and genomic programs will capture market share as traditional suppliers scramble to compete.

Algeria’s national dairy initiative is more than just a massive construction project—it’s a comprehensive strategic move that’s already making waves in dairy circles everywhere.

Algeria has partnered with Qatar’s Baladna, agreeing to invest $3.5 billion into what might just be the most ambitious dairy setup on the planet. And honestly, if you’re in this business, this is big news.

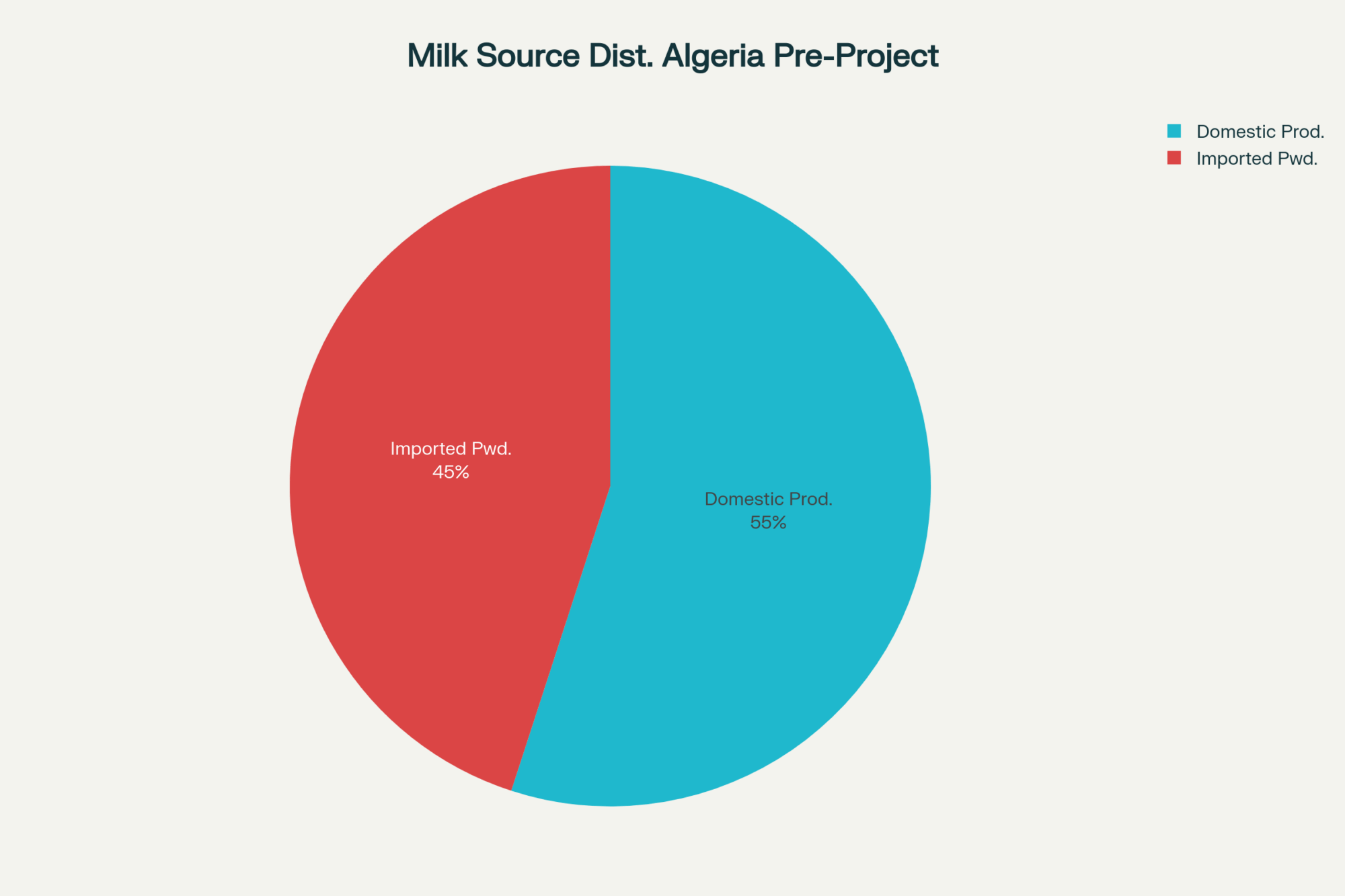

Algeria is shelling out a whopping $800 million a year on milk powder imports. Their domestic production clocks at around 2.5 billion liters, but people are guzzling about 4.5 billion liters annually. That’s a serious hole they’re trying to plug.

The consumption rate really stands out—folks are drinking about 130 liters per person yearly, nearly double what you’d see over the border in Tunisia or Morocco. The driver? Government subsidies have made reconstituted milk a staple in households for decades.

That subsidy angle is crucial, and frankly, it’s what makes this whole thing possible. The government’s annual dumping of approximately DZD 105 billion—roughly $780 million—across the dairy chain. But here’s the million-dollar question: can they sustain that level of support when global commodity prices get volatile?

Desert Dairy on a Scale That’ll Blow Your Mind

Picture this: a dairy setup sprawling over land twice the size of New York City in Algeria’s arid Adrar province, housing 270,000 cows to churn out 1.7 billion liters yearly.

That’s huge, even by global standards. German engineering giant GEA—which knows its stuff when it comes to mega dairy projects—landed the contract valued between €140 and €170 million. Construction is expected to kick off in early 2026, with production reaching full stride by late 2027.

Notably, the project is expected to create 5,000 local jobs—that’s serious economic development for a region that desperately needs it.

The Desert Reality Check: Can They Really Make Milk in the Sahara?

Let’s talk feed first, because that’s where the rubber meets the road. Based on recent regional data, they’re looking at approximately $280 per metric ton for their ration mix, which includes maize, alfalfa, and TMR components. Not cheap, but pretty standard for what you’d expect in North Africa.

Regarding feed efficiency, the feed conversion ratio they’re targeting is around 1.3-1.4 kg of milk per kg of dry matter intake. Those are actually respectable numbers, especially when you consider the environmental challenges faced in the desert heat.

Water’s a whole different story. Current estimates put water usage at around 3-4 gallons per gallon of milk produced—and that’s a big deal in an arid place. However, that number fluctuates significantly depending on your cooling technology and recycling systems. Experts like Dr. Michael Hutjens have been vocal about the critical importance of water efficiency in these harsh environments—mismanage it, and you’re burning cash faster than you can say “dry lot.”

Only about 20-25% of Algeria’s current milk moves through official channels. The rest flows through informal markets, which honestly makes modernizing the whole supply chain a real headache.

Heat stress? It’s no joke out there. I’ve seen operations in Arizona and Saudi Arabia where butterfat numbers drop 15-20% during peak summer without proper cooling infrastructure. That’s why the projected 7-9 year payback period hinges so heavily on getting the technology implementation right.

What This Means for Your Bottom Line

Zooming out, the big picture is massive: Algeria aims to slash milk powder imports by half once this plant’s fully operational. That spells serious disruption for traditional exporters in the EU, US, New Zealand, and Argentina—we’re talking about displacing roughly $400 million worth of powder imports annually.

And about the commodity powder market? That’s going to get a lot more competitive—no doubt about it. If you’re an exporter who’s been counting on that Algerian business, it’s time to start thinking about plan B.

The timeline matters too. Construction is scheduled to start next year, but full production is expected to begin in late 2027. That gives traditional suppliers approximately 18 months to pivot before the real impact is felt.

The Bigger Picture

The project’s most significant implication is that it shatters conventional thinking about where large-scale dairy operations can be effective. Traditionally, you’d never look at the Sahara and think “perfect spot for a dairy farm.” But with the right technology, water management, and government backing?

This isn’t just about Algeria. Other resource-rich nations are watching this closely. If it works, expect to see similar projects emerging in the Middle East, Central Asia, and possibly even parts of sub-Saharan Africa, where governments are committed to achieving food security.

For those of us managing operations or advising producers, the lesson is clear: the game is changing faster than most people realize. Desert dairy used to be an oxymoron. Now it might be the future.

The real question for your operation isn’t whether these new production models will impact you—it’s when, and how you’ll adapt to a world where traditional geographic constraints no longer limit milk production.

Algeria’s desert dairy gamble represents more than agricultural development—it’s a calculated bet on food sovereignty that will reshape global dairy trade. The producers who master extreme efficiency and heat tolerance now will be the ones still standing when the dust settles.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Dairy Cow Heat Stress: The Four Key Areas You Need To Address Now – This tactical guide provides actionable strategies for mitigating heat stress, focusing on the four critical areas of cow comfort and facility management. It reveals practical methods to prevent the 15-20% production losses mentioned in the main article.

- The Global Dairy Market: A Tale of Two Halves – This strategic analysis breaks down the complex forces shaping today’s volatile global markets. It provides essential context for the trade disruptions discussed in the main article, helping you anticipate shifts and position your operation for long-term profitability.

- Genomic Testing: Are You Leaving Money on the Table? – This article makes the definitive business case for genomic testing, a key takeaway from the Algeria analysis. It demonstrates how to leverage genetic data to accelerate progress on traits like feed efficiency and heat tolerance, directly boosting farm profitability.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!