Fairlife sells for $6. You get paid like it’s a store brand. Meanwhile, direct-market dairies are getting $48/cwt. See the gap?

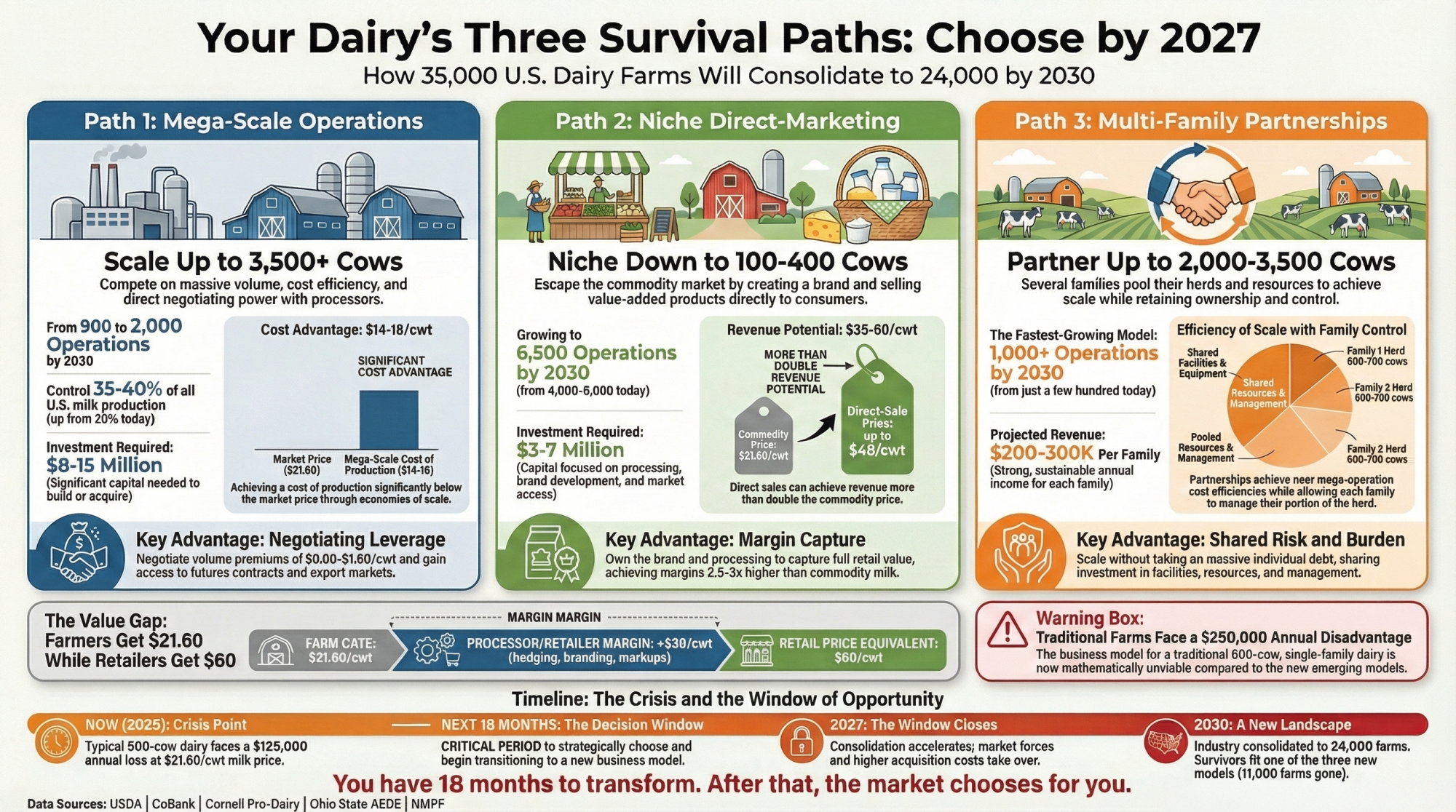

EXECUTIVE SUMMARY: At $21.60/cwt, milk prices are crushing farm profits—your typical 500-cow dairy loses $125,000 this year while processors capture $38/cwt through hedging and consumers pay record retail prices. This isn’t a downturn; it’s the industry’s fundamental restructuring. By 2030, America’s 35,000 dairy farms will shrink to 24,000, with survivors clustering into three models: mega-operations leveraging scale, niche producers earning $48/cwt through direct sales, or multi-family partnerships pooling resources. The traditional 600-cow family farm is mathematically obsolete, running $250,000 in the red each year. Smart operators are already moving—diversifying revenue through beef-on-dairy, optimizing components for Class III premiums, or restructuring operations entirely. You have 18 months to choose your model before market consolidation chooses for you. The farms that thrive in 2030 won’t be those that survived 2025—they’ll be those that transformed during it.

You know, when I saw USDA’s latest forecast showing milk prices heading down to $21.60 per hundredweight, my first thought was about what this actually means for folks like us. For most 500-cow operations—and that’s a lot of farms I work with—we’re talking about roughly $125,000 in lost annual revenue. That’s not exactly small change when you’re already running things pretty tight.

Here’s what’s interesting, though. I’ve been looking at the Bureau of Labor Statistics data, and retail dairy prices? They’re still near record highs. And get this—fluid milk consumption actually grew in 2024 for the first time in 15 years. USDA’s own sales reports are showing this. The International Dairy Federation keeps saying global demand is climbing steadily.

So what’s going on here? Why are we getting squeezed when everything else suggests we should be doing better?

I’ve been talking with producers from Wisconsin to California lately, and what I’m hearing goes way deeper than typical market-cycle complaints. It’s this disconnect between what we’re getting at the farm gate and what consumers are paying at the store. And here’s the thing—even with the tightest heifer supplies in two decades, prices aren’t responding like they used to. What’s really fascinating is we’re seeing three distinct operational models emerging that’ll probably determine who’s still milking cows come 2030.

If you’re paying attention—and I know you are—the next year and a half represents what I’d call a critical decision window. The choices you make now? They’re going to determine whether you’re thriving or just hanging on when this industry looks completely different five years from now.

Let’s Talk About What’s Really Happening with Prices

So back in March, when CME Group reported Class III milk futures dropping to .75 per hundredweight, most of us expected the usual pattern, right? Supply tightens up, prices recover, and we all catch our breath. But that’s not what’s playing out, and honestly, it’s revealing something pretty concerning about how these markets work now.

Peter Vitaliano over at the National Milk Producers Federation articulated something that really resonates—the gap between farmgate and retail has never been this wide. We’re looking at USDA data showing farmers getting .60 per hundredweight while consumers are paying over a gallon for whole milk and around a pound for cheddar. These are historically high retail prices, folks.

What I find particularly noteworthy is how processors have positioned themselves. Take these massive new facilities—Leprino Foods with its 8-million-pound-per-day capacity plant, and Coca-Cola’s new fairlife facility up in New York. The International Dairy Foods Association has been tracking, it says, over $2 billion in infrastructure investments since 2020. These plants need milk volume a consistent milk supply to justify those investments. And that’s creating some… well, let’s call them interesting market dynamics.

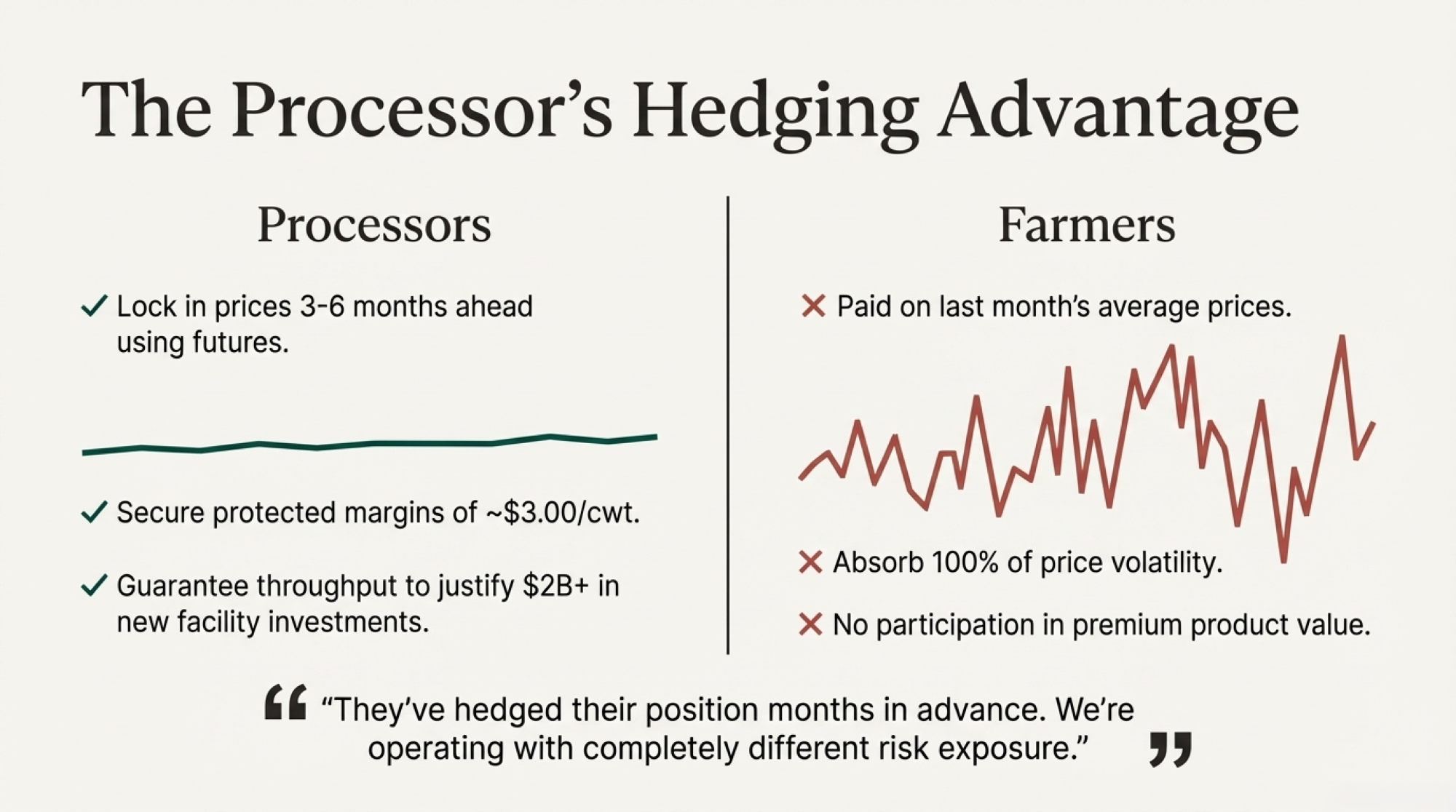

Mark Stephenson from Wisconsin’s Center for Dairy Profitability shared something with me that really clicked. Processors are using futures contracts to lock in their margins months ahead, while we’re getting prices based on last month’s averages. That timing difference? It’s worth about three dollars per hundredweight in a protected margin for them. Three dollars!

A producer I know well out in California’s Central Valley—runs about 650 Holsteins—put it to me this way: “They’ve hedged their position months in advance. We’re operating with completely different risk exposure.” And you know what? He’s absolutely right.

[INSERT IMAGE: Graph showing the widening gap between farmgate prices and retail dairy prices from 2020-2025, with processor margins highlighted]

That Heifer Shortage Everyone’s Banking On

Now, conventional wisdom says—and I’ll admit, I believed this too—that this replacement heifer shortage should fix everything. CoBank’s August report shows we’re at a 20-year low, down to about 3.9 million head. You’d think that means better prices by late next year, maybe 2026?

Well… not so fast.

What we’re learning about beef-on-dairy breeding is fundamentally changing the game. The breeding association data shows that about a third of our Holstein and Jersey calves are now beef crosses. Think about what that means for a minute.

Replacement heifer prices have exploded—USDA’s tracking them at over three thousand per head, up 75% since early 2023. And if you’re looking for premium genetics? I’ve seen them go for thirty-five hundred, even four thousand at regional auctions. Down in Georgia and Florida, some producers are paying even more for heat-tolerant genetics. CoBank’s projecting we’ll be short another 800,000 replacements by 2026.

Yet—and here’s the kicker—this dramatic supply constraint isn’t translating to better milk prices. Why? It’s the processing overcapacity. Andrew Novakovic from Cornell’s Dyson School explained it to me this way: when processors have billions invested in facilities that require high volume, they have incentives to keep farmgate prices stable to ensure consistent throughput. It sounds backwards, but that’s the reality we’re dealing with.

The Darigold situation out in the Pacific Northwest really drives this home. Despite obvious milk supply tightness, they announced a $4-per-hundredweight deduction on all member farms back in May. A producer out there—runs about 3,000 cows—spoke at a meeting about it and didn’t mince words: “When milk price is down and you add these deducts, it really starts to sting.”

Why Growing Demand Isn’t Helping Us (This One Really Gets Me)

Here’s what caught me completely off guard when I first saw the International Dairy Foods Association data. Fluid milk sales grew about half a percent in 2024—first increase in 15 years! USDA’s marketing service confirms whole milk consumption hit its highest level since 2007. The Organic Trade Association reports that organic milk sales jumped by over 7%. And premium products? IRI’s retail data from 2024 shows brands like fairlife grew nearly 30% in dollar sales compared to the year before.

You’d think this demand recovery would support our prices, right? Instead—and this is what’s so frustrating—it’s doing the opposite. The growth is all concentrated in premium products where processors and retailers, not farmers, capture that value.

Let me break this down in real numbers—here’s The Value Disconnect:

| Level | Price | Who Gets It |

| Farm Gate | $21.60/cwt | Farmers (commodity price) |

| Conventional Retail | ~$40.00/cwt equivalent | Retailers (standard markup) |

| Premium Retail (fairlife) | ~$60.00/cwt equivalent | Processors & retailers |

| The Gap | $38.40/cwt | Captured via hedging & branding |

Marin Bozic, who does dairy economics at the University of Minnesota, explained the mechanism to me: the Federal Milk Marketing Order structure simply has no way for farmers to participate in the creation of premium product value. Your milk could become commodity cheese or the fanciest filtered milk on the shelf—you get the same basic commodity price either way.

The Three Futures: Why the Traditional 500-Cow Family Farm is Mathematically Obsolete (And What to Become Instead)

Research from Cameron Thraen’s team at Ohio State, which analyzed USDA’s agricultural census data and published its findings in the 2024 dairy outlook report, reveals something both fascinating and, honestly, a bit scary. They’re projecting that consolidation will reduce the number of dairy farms from about 35,000 today to 24,000 to 28,000 by 2030. And the production? It’s going to concentrate into three pretty distinct models.

If you’re running a traditional 500-to-700-cow family operation like many of us, the mathematics suggest you need to evolve into one of these structures, or… well, face some really tough decisions.

[INSERT IMAGE: Infographic showing the three operational models with icons – Mega-Operation (factory icon), Niche Producer (farmers market icon), Multi-Family Partnership (handshake icon) – with their respective herd sizes, investment requirements, and profit projections]

The Large-Scale Operations (3,500+ Cows)

We’ve got about 900 of these operations now, controlling roughly 20% of production. Wisconsin’s Program on Agricultural Technology Studies published their structural change analysis in 2024, suggesting this’ll grow to maybe 1,500 or 2,000 operations controlling 35-40% of all milk by 2030.

What makes them work? Well, Cornell’s annual Dairy Farm Business Summary shows they’re hitting costs of around 14 to 16 dollars per hundredweight through massive scale. They negotiate directly with processors—not as suppliers but as genuine business partners. They’re getting 50 cents to $1.50 per hundredweight just on volume guarantees. Investment required? We’re talking eight to fifteen million, according to the ag lenders I’ve talked with.

As one industry analyst put it, “A 5,000-cow operation with consistent component quality has real negotiating leverage.” And that’s the key word there: leverage.

The Niche Direct-Marketing Operations (100-400 Cows)

There are maybe 4,000 to 5,000 of these operations now, and interestingly, the National Young Farmers Coalition’s 2024 land access survey suggests this could grow to around 6,500 by 2030, particularly as beginning farmers explore alternative market channels.

I spoke with a producer in Vermont recently who made this transition—went from conventional to organic with direct marketing. She’s getting around $48 per hundredweight equivalent through farmers’ markets and on-farm sales. “It’s definitely more work,” she told me, “but we’re actually profitable now.”

A Texas producer I know took a different approach—focusing on A2 genetics and local Hispanic market preferences. He’s capturing premiums I wouldn’t have thought possible five years ago.

What works for these folks:

- Premium pricing in that $35-to-50 range through direct sales

- Organic, grass-fed, A2 genetics, local food positioning

- On-farm processing so they capture those processor margins themselves

- Investment needs are different—three to seven million, but it’s focused on brand building and market access, not just production

The Multi-Family Partnerships (2,000-3,500 Cows Total)

This is the emerging model that’s really interesting. We’re seeing maybe a few hundred of these now, but projections suggest over a thousand by decade’s end.

Mike Hutjens, who recently retired from the University of Illinois after decades of dairy research, described it well in his recent Extension publication on consolidation strategies: “Three families combining resources, each contributing 600-700 cows, sharing facilities and management. They’re achieving near-mega-operation efficiency while maintaining family control.” Based on operations he’s worked with, each family can see $200,000 to $300,000 annually.

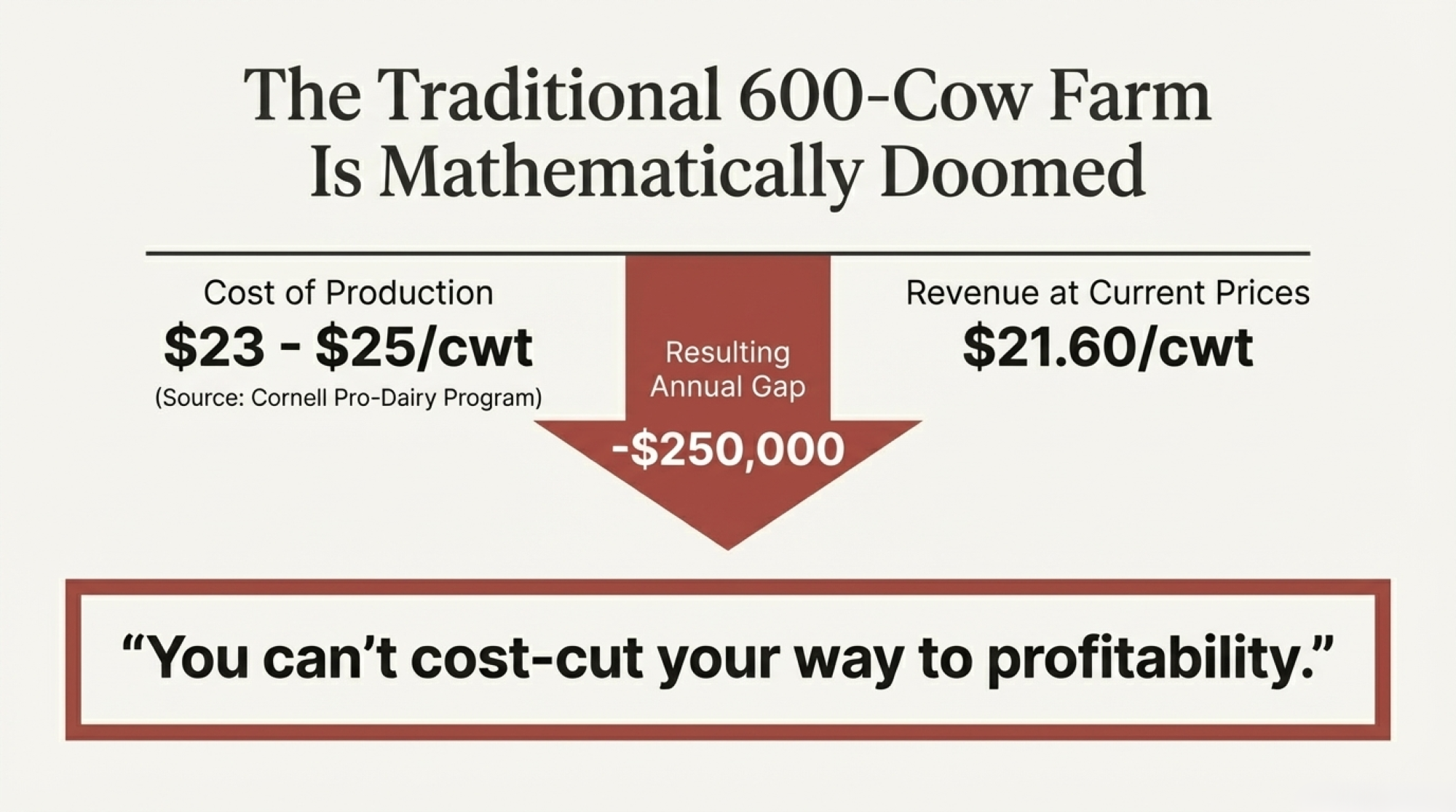

Here’s the hard truth nobody really wants to hear: Cornell’s Pro-Dairy program’s 2024 cost of production analysis suggests that traditional 600-cow single-family operations face an approximately quarter-million-dollar annual profit gap compared to these three models. Without evolving into one of these structures… well, the math becomes pretty challenging.

What Successful Producers Are Actually Doing Right Now

What distinguishes farms positioned to thrive from those heading toward crisis? It’s not hope for market recovery—it’s specific actions during the downturn. I’ve been watching successful operations across the Midwest, and there are definitely patterns.

Moving Beyond the Milk Check

The smartest producers I know have completely abandoned the old assumption that milk sales should be 85-90% of revenue. A Wisconsin producer I work with is breeding 30% of his herd with beef semen. At current beef prices—around $250 per calf—that’s significant money. Plus, he’s not overwhelming his heifer facilities.

Strategic culling at these cull cow prices—USDA’s reporting over $145 per hundredweight—is generating serious cash. An Idaho producer told me she culled 15% strategically, generated substantial one-time revenue while cutting feed costs permanently by about 16%.

And value-added production? Penn State Extension’s 2023 bulletin on dairy value-added enterprises shows that even converting 5% of your milk to yogurt, cheese, or specialty products can generate margins two and a half to three times higher than commodity milk. Their case studies are pretty compelling, actually.

It’s About Efficiency, Not Just Volume

What I’m seeing is successful operations focusing on feed efficiency over just pushing for more milk. Kent Weigel at Wisconsin-Madison has data showing feed efficiency genetics have a heritability of around 0.43—meaning those improvements compound fast.

The approach is getting pretty sophisticated:

- Genomic testing to identify and cull the bottom 20% for feed efficiency before they even enter the milking string

- Switching to bulls with high Feed Saved indexes—costs nothing, impacts everything

- Getting that metabolizable protein dialed in at 100-115% of requirements saves fifty to seventy-five dollars per cow annually, according to University of Minnesota research

For a 500-cow operation? These strategies might cost ten to fifteen thousand dollars to implement, but can return ten times that annually. And it compounds year after year. Scale it down to 250 cows, and you’re looking at maybe a $50,000 return on a $5,000-7,500 investment. Scale up to 1,000 cows? We’re talking $200,000-280,000 annually.

Components and Geography Matter More Than Ever

Here’s something worth noting: USDA’s November projections show Class III prices around $18.82, while Class IV falls to maybe 15 or 16 per hundredweight in 2026. That three-to-four-dollar spread? It rewards specific decisions.

A Minnesota producer told me about switching to Jersey-Holstein crosses three years back. “Our butterfat runs 4.3% now versus 3.7% before. That’s worth about seventy cents per hundredweight. Doesn’t sound like much until you’re shipping 50,000 pounds daily.”

What Canada’s System Reveals (It’s Not What You Think)

Looking north offers an interesting contrast. While we’re facing this dollar-per-hundredweight drop, the Canadian Dairy Commission’s February announcement showed essentially minimal change—less than a tenth of a percent adjustment.

Their stability comes from a formula: prices adjust by half to production costs and half to the consumer price index. As Sylvain Charlebois from Dalhousie University’s Agri-Food Analytics Lab explained, “Canadian farmers know their milk price nine months ahead.” Imagine being able to plan that far out!

But—and this is important—there are trade-offs. Dairy Farmers of Canada reports quota costs around $24,000 per kilogram of butterfat. That’s a massive entry barrier. A 2024 study in the Agricultural Systems journal documented approximately 6.8 billion liters of milk waste from 2012-2021 in the Canadian system. And the Fraser Institute calculates Canadian families pay nearly $300 more annually for dairy.

What’s really revealing? Statistics Canada’s agricultural projections suggest they’ll still lose about half their dairy farms by 2030, bringing the total to around 5,000. So even with all that protection, consolidation is happening. It’s fundamental economics that transcends whatever system you use.

The 2025-2027 Window: Why Timing Is Everything

What I’m seeing suggests 2025 is where three forces converge for the first time:

First, we’ve got this processing capacity overhang from billions of new facilities coming online. Industry tracking shows it’s massive. Second, the International Dairy Federation projects global consumption growing faster than production—about 1.1% versus 0.8%. And third, producer exits are accelerating. The American Farm Bureau reports Chapter 12 bankruptcies up over 50% year-over-year.

This creates what I’d call an 18-to-24-month window for strategic positioning. Christopher Wolf, who heads Cornell’s dairy markets and policy program, suggests once global supply scarcity becomes obvious and prices start recovering—probably 2027—consolidators will move aggressively. Acquisition costs will spike. Windows close.

So What Should You Actually Do? (The Practical Stuff)

Understanding all this, here’s what I’m seeing work:

If You’re Planning to Continue:

Focus on efficiency over growth. A Pennsylvania producer told me, “We’ve stopped all expansion. Every dollar goes to efficiency improvements and component optimization. That dollar-fifty from better components beats any volume premium.”

Lock in what you can. USDA’s Dairy Forward Pricing Program, reauthorized through April 2025, lets you contract ahead when futures look reasonable. Creating revenue floors has saved several operations I know.

Build those alternative revenue streams now. Beef-on-dairy, strategic culling, value-added—these can offset entire milk price declines.

If You’re Considering Structural Change:

The partnership conversation needs to happen now. An Ohio producer who merged three family operations told me they spent eight months finding the right partners. “Wait until the crisis? Your best options are already gone.”

Thinking about the niche route? Start small, but start now. That Vermont producer I mentioned began with just 5% of its output going to farmers’ markets. It took three years to transition fully, but she learned as she grew.

Geographic disadvantages are real. USDA data shows consistent one-to two-dollar regional differences. If you’re in a disadvantaged area, seriously consider your options.

For Everyone:

Accept that mid-size independence might require significant adaptation. As one Cornell economist put it, “That’s not defeat—it’s realistic evolution in a consolidating industry.”

Focus on what you control: genetics, efficiency, component quality, and marketing channels. An Idaho producer said it best: “The market does what it does. I can’t control that. But I absolutely control my cost per hundredweight.”

For those who want to dig deeper, information on the USDA’s Dairy Forward Pricing Program is available at your local FSA office. Cornell’s Pro-Dairy program has excellent resources on cost analysis. And if you’re considering the partnership route, the University of Wisconsin’s Center for Dairy Profitability has some solid guidance materials.

The Bottom Line (Where This All Leads)

The 2025 milk price situation isn’t really about traditional supply and demand—it’s a structural transformation that’s been building for decades. That $21.60 forecast from the USDA? It’s looking more like a new reality where processor margin management matters more than the old market dynamics we learned.

Yet within this challenging environment, I’m seeing clear paths forward for producers willing to abandon old assumptions. The farms thriving in 2030 won’t be those that simply survived 2025 through sheer determination. They’ll be operations that recognized this inflection point and repositioned, while others that waited for the recovery that follows will follow completely different rules.

You’ve got maybe 18 to 24 months for deliberate transformation. After that, market forces make the choices for you. The question isn’t whether to change—it’s which of these emerging models fits your operation’s future. That decision, made with clear eyes rather than false hope, determines success or failure.

What’s interesting is every producer I know who’s made these strategic pivots says the same thing: “Should’ve done it sooner.” Maybe that’s the real lesson. The best time to transform isn’t when crisis forces your hand—it’s right now, while you still have options.

And honestly? That’s both scary and oddly encouraging. At least we know what we’re dealing with. Now it’s time to act on it.

KEY TAKEAWAYS:

- The $38/cwt gap is permanent: Processors locked in margins through futures—your $21.60 milk price won’t recover, costing typical 500-cow dairies $125,000 annually

- Pick your path in 18 months: Mega-operation (3,500+ cows), direct-marketing ($48/cwt premiums), or multi-family partnership—traditional single-family 600-cow farms face mathematical elimination

- Diversify revenue TODAY: Leaders generate $45,000+ from beef-on-dairy (30% of herd), 3x margins on value-added products, and $0.70/cwt from component optimization

- 10:1 returns exist: Genomic feed efficiency selection costs $15,000, returns $150,000 annually—compound these gains before the 2027 consolidation wave

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Dairy Wins, Beef Loses: Inside the 18-Month Window Where $1,400 Calves Meet Record Component Premiums – Reveals how progressive operations are generating over $700,000 in new annual revenue by stacking beef-on-dairy windfalls with component optimization, effectively decoupling their financial survival from base milk prices.

- The $11 Billion Reality Check: Why Dairy Processors Are Banking on Fewer, Bigger Farms – deep dives into the massive infrastructure spending that is forcing consolidation, explaining why processors are locking in supply with mega-dairies and what that means for your 2026 contract negotiations.

- Unlock Hidden Dairy Profits Through Lifetime Efficiency: How Modern Genetics and Strategic Nutrition Can Cut Feed Costs by $251 Per Cow – Provides a technical blueprint for implementing Residual Feed Intake (RFI) genomic selection to slash feed costs, offering a proven method to protect margins even when milk prices bottom out.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!