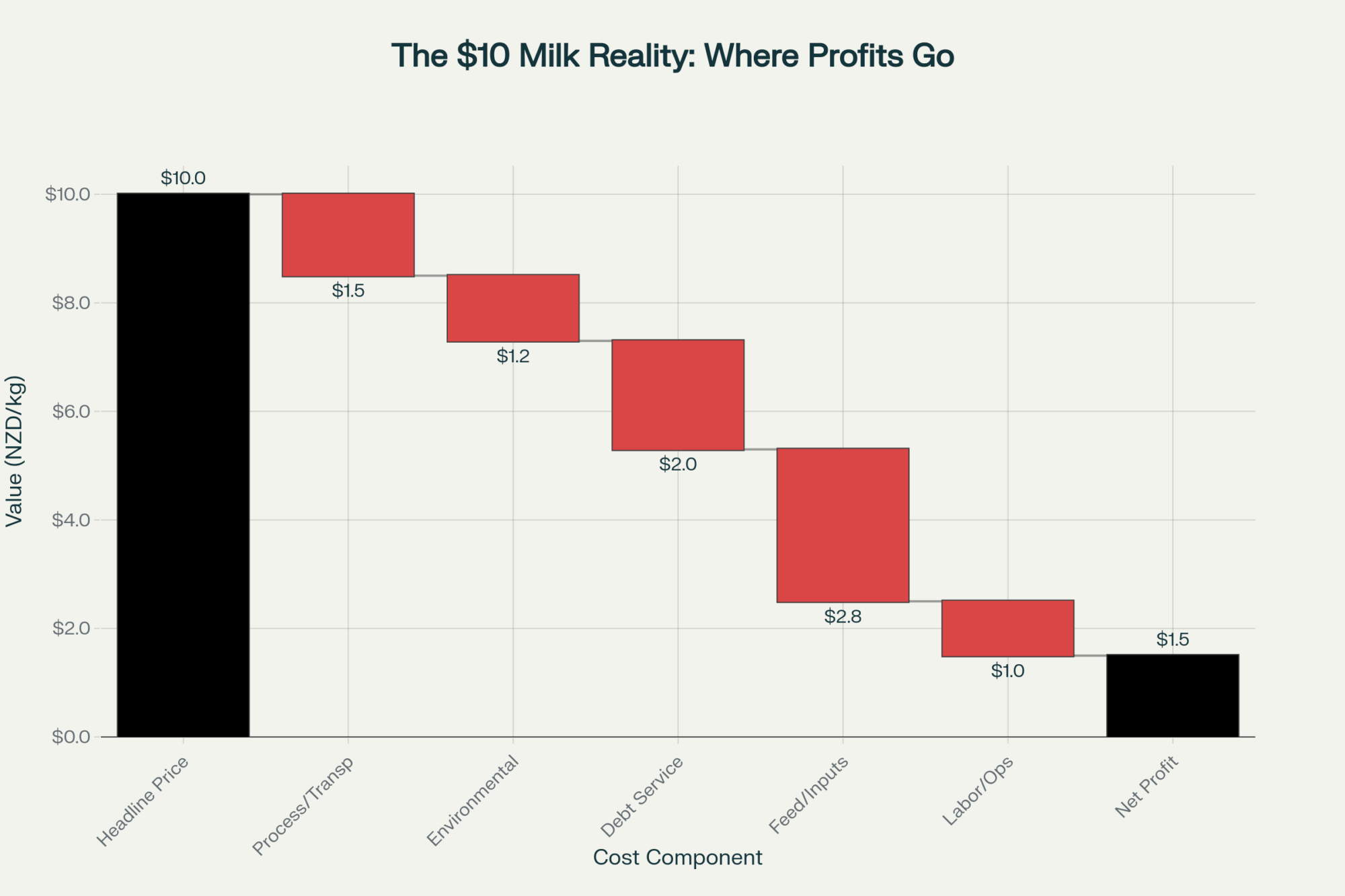

NZ farmers net just $1 on $10 milk—their breakeven hits $9/kg while debt servicing eats 20% of revenue

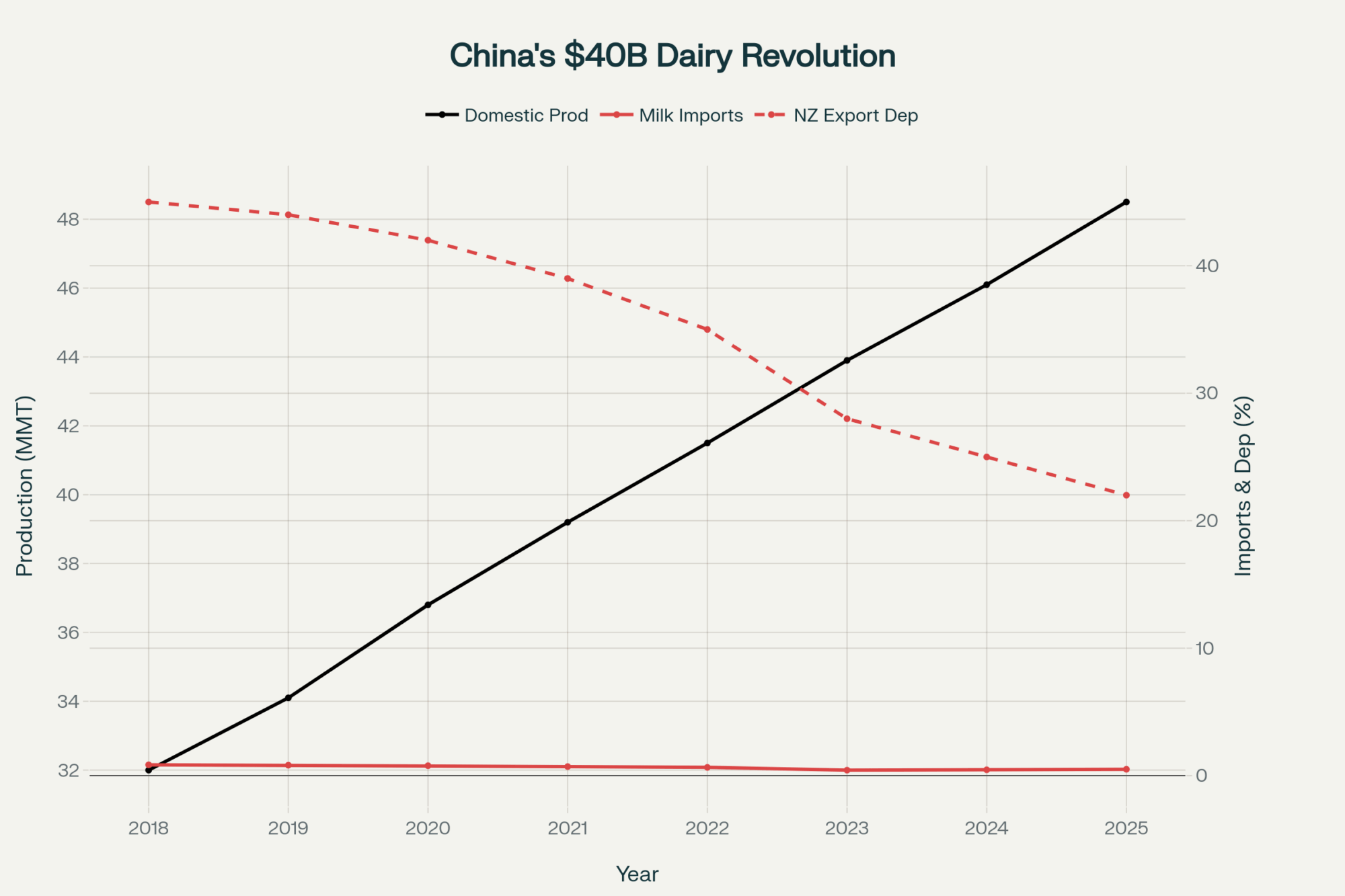

EXECUTIVE SUMMARY: What farmers are discovering about New Zealand’s celebrated $10/kgMS milk price reveals a sobering reality for global dairy operations—margins have compressed to just $1-1.50 per kilogram despite record headline prices, with DairyNZ’s 2025 economic tracking showing breakeven costs pushing $9/kg for many farms. This margin squeeze reflects three converging pressures: processing capacity constraints forcing 20-30% spot milk discounts in some regions, environmental compliance costs running $50,000-70,000 annually for methane reduction alone on mid-sized operations, and China’s 5% annual domestic production growth fundamentally restructuring global trade flows that New Zealand—and frankly, all of us—built our export strategies around. Recent Reserve Bank data showing billions in debt reduction, despite record prices, suggests that savvy operators recognize this isn’t a boom but a warning. Cornell’s Andrew Novakovic reinforces that operations needing current prices to survive aren’t truly profitable. Here’s what this means for your operation: the same capacity constraints hitting New Zealand are developing in California, Idaho, and Northeast markets, making location relative to processing more valuable than pure production efficiency. The producers who’ll thrive are already running their numbers at 70% of current prices, locking in supply agreements over chasing spot premiums, and using today’s decent margins to strengthen balance sheets rather than expand—because as these global patterns accelerate, it’s not about maximizing today’s opportunity but surviving tomorrow’s reality.

I was having coffee with a dairy farmer from just outside Madison last week, and he brought up something that’s been bothering many of us. “New Zealand’s getting ten bucks per kilogram,” he said, shaking his head. “That’s like four-fifty a pound. What are we doing wrong?”

You know, I get the frustration. Really, I do. Here we are, watching corn creep past four dollars, tweaking rations every week to save a few cents… and then you hear about these record prices on the other side of the world. Kind of makes you wonder if you’re in the wrong place, doesn’t it?

But here’s what’s interesting—and why I think we all need to pay attention to this. I’ve been digging into what’s really happening down there, talking with folks who work with Kiwi farmers, reading through their industry reports. And what I’ve found… well, it’s not the success story it appears to be. More importantly, the challenges they’re facing? We’re starting to see the same patterns developing here.

The Math Nobody Wants to Talk About

Let’s start with that headline number everyone’s throwing around. Ten dollars per kilogram. Sounds amazing, right? But here’s the thing—and this is what DairyNZ has been tracking in its 2025 economic reports—their breakeven costs have just skyrocketed. We’re talking somewhere in the high eighties, maybe even pushing nine dollars per kilogram for many operations.

Just think about that for a minute. If you’re getting ten but you need eight-fifty, nine just to break even… that’s what, maybe a dollar margin? Buck-fifty if you’re really efficient? That’s not exactly the windfall it sounds like.

What really caught my attention—and I spent some time reviewing their historical data here—is how different this is from their last real boom, about a decade ago. Back then, farmers were actually clearing better margins on lower headline prices. The entire cost structure has shifted completely.

It reminds me of something. That rough patch we had around 2014. Remember that? Decent milk prices on paper, but between feed costs and everything else, nobody was making money. Same story, different accent.

Labor’s killing them. And I mean really killing them. Finding good help—hell, finding any help—that’s tough everywhere, but they’re really struggling. Then you’ve got debt servicing. Many of these individuals expanded during the last couple of cycles, borrowing heavily when rates were low. Now they’re carrying that debt at higher rates. Sound familiar to anyone?

But the real kicker—and we’re starting to see this creeping in here too—is environmental compliance. Things that weren’t even a line item ten years ago are now consuming significant funds. I was reading through some of their farm publications, and one producer basically said that after all the deductions and real costs, that celebrated ten-dollar milk becomes more like seven-fifty, eight bucks in the pocket. And that’s before the next round of regulations kicks in.

When Your Success Becomes Your Problem

Here’s something that really hits home, especially for those of you in California or the Southwest. Do you know that feeling during the spring flush? When you’re making beautiful milk, components are great, cows are happy… but you’re starting to wonder if the plant can actually take everything you’re producing?

Well, that’s New Zealand right now. Except it’s not just spring flush—it’s becoming a year-round phenomenon.

Fonterra—they handle most of the milk down there, kind of like if Land O’Lakes and DFA had a baby—they’re basically running at capacity during peak season. According to industry insiders, we’re talking about 95% utilization during their spring months, which for them is October through December.

Now, in theory, that sounds efficient, right? Maximum utilization, minimal waste. But you and I both know what really happens when plants get that full. There’s zero wiggle room. One breakdown, one storm delays transport, whatever—suddenly you’ve got milk with nowhere to go.

If you’ve locked in a good contract and are close to a plant, you’re in a good position. Full price, no worries. But if you’re depending on spot markets? Or worse, if you’re an hour or two from the nearest facility? Man, that gets rough quick. I’m hearing from multiple sources—although I can’t verify it firsthand, enough people are saying it—that some regions are seeing significant discounts on spot milk. Like, painful discounts. Twenty, thirty percent off in some cases.

And here’s the real nightmare scenario: some farmers are being told to find alternative outlets for their milk. Can you imagine? You’ve already fed the cows, done the milking, paid for everything… and then you literally can’t sell the milk. That’s not a business problem anymore—that’s an existential crisis.

The timing makes everything worse. Fonterra continues to announce expansion plans, new facilities, and increased capacity. However, from what I understand, most of this is still at least eighteen months, possibly two years away. Therefore, farmers are left with the current infrastructure while production continues to grow.

A producer from Vermont, whom I met at World Dairy Expo, mentioned that their co-op’s starting to see similar issues during flush. “We’re not there yet,” she said, “but you can feel it coming.” And that’s the thing—these patterns don’t stay regional anymore.

China’s Quiet Revolution That Changes Everything

Alright, so this is the part that I think has massive implications for all of us, whether we’re selling milk in Wisconsin or Washington.

The numbers from USDA’s Foreign Agricultural Service paint a pretty stark picture. China’s imports of whole milk powder have dropped significantly over the past few years. We’re talking about a market that used to absorb just massive amounts of product—hundreds of thousands of tons annually. And now? It’s drying up.

What’s happening—and the folks at USDA’s Beijing office have been tracking this closely in their 2025 reports—is that China’s making this huge push for dairy self-sufficiency. And they’re not playing around. They’re building these massive operations, ten thousand cows, fifteen thousand cows. Bringing in genetics from everywhere. Utilizing technology that makes some of our setups appear outdated.

The data suggests that Chinese domestic milk production is growing at a rate of approximately 5% annually. Now that might not sound earth-shattering, but when you’re talking about a market that size… that’s displacing enormous amounts of imports every year.

Think about what this really means. For decades—I mean literally decades—the whole global dairy trade was built on this assumption that Chinese demand would just keep growing forever. New Zealand basically restructured their entire industry around it. We were all banking on it for our export growth. And now that fundamental assumption is just… gone.

This reminds me of something. What happened with whey exports. We used to send the majority of our whey protein to China. Now? That share has dropped significantly because they have built their own processing capacity. The market didn’t temporarily adjust—it fundamentally restructured. And it’s not coming back.

The Environmental Cost Nobody Calculated

Here’s something that’s particularly relevant for those of you dealing with new regulations in California, or if you’re in the Chesapeake watershed, or anywhere environmental standards are being tightened.

Fonterra launched this program where they pay farmers extra for reducing emissions. Sounds great on paper, right? Do the right thing environmentally, and get paid for it. Win-win.

But let me tell you what I’m hearing about the actual costs involved. And keep in mind, every operation’s different, but the numbers are sobering…

Feed additives to reduce methane? For a 400-500 cow herd, you could be looking at fifty, sixty, maybe seventy thousand a year. And that’s just for the additives themselves. Then you’ve got to upgrade your manure handling to meet new nitrogen standards. That’s serious capital we’re talking about—six figures for most operations, easy.

Then there’s all the monitoring, the paperwork, the verification. Testing, certification, third-party audits. That’s not a one-time expense—it’s forever. Every year. Ongoing costs that just keep piling up.

Best case scenario—and I mean absolute best case—you might see payback in five years. More likely seven. However, that assumes milk prices remain high, the programs don’t change (and when have government programs ever remained the same?), and you actually qualify for the maximum payments. From what I understand, only a small percentage of farms are going to hit those top payment tiers.

A producer I know, who has been following this closely, put it perfectly: “We’re betting tomorrow’s survival on today’s programs.” That’s… man, that’s a hell of a position to be in.

Interesting thing, though—those of you running organic or grass-based systems might actually have an edge here. Your baseline emissions are often already lower, making it more achievable to hit reduction targets. It’s one of those rare times when being smaller or different might actually pay off.

What the Smart Money Is Actually Doing

You know what’s really telling? While everyone’s celebrating these record prices, New Zealand’s Reserve Bank data from 2025 shows their dairy sector has been aggressively paying down debt. We’re talking billions in reductions over the past year.

That’s not what you do when you think the good times will roll forever, you know?

The operations that seem to be positioning best—at least from what I can tell—are doing three things that really stand out:

Getting dead serious about financing. I keep hearing stories about farmers discovering they’re paying way more interest than necessary. Not because they’re bad risks, but simply because they haven’t shopped around in years. We’re talking about differences that add up to serious money—tens of thousands of dollars annually on typical debt loads. With year-end coming up, now’s actually a great time to have these conversations with lenders. Banks are competing for good ag loans right now.

Choosing certainty over maximum price. They’re locking in supply agreements, even if it means taking a slight discount per unit. Because having guaranteed market access at $9 beats the theoretical $10 milk you can’t sell. We learned this lesson the hard way back in 2009, didn’t we?

Simplifying instead of expanding. Some are actually selling equipment and doing sale-leasebacks. Holding off on that new parlor upgrade. Building cash reserves instead of new facilities. It’s conservative, sure. But maybe that’s smart given everything else going on?

And here’s something for our smaller operations—those 100 to 200 cow farms that sometimes feel left behind in these discussions. You might actually have some real advantages here. Lower debt loads, more flexibility, less dependence on maxed-out processing capacity. Sometimes being smaller means being more nimble when things get tight.

What This Actually Means for Your Farm

So what does all this mean for those of us milking cows here in the States? I think the patterns are becoming increasingly clear if we’re willing to look.

The processing capacity seems fine until everyone tries to expand at the same time. We saw hints of this during California’s big growth phase a few years back. The Southwest is now showing similar signs. Idaho’s getting there. Even some Northeast co-ops are feeling the squeeze during the flush—I’m hearing similar stories from Pennsylvania producers and folks in upstate New York. It can happen anywhere.

Export markets we’ve counted on for years? They can shift faster than we think. And not temporarily—permanently. Whether it’s China with powder, Mexico with cheese, whatever the product. These shifts happen, and they’re accelerating.

Environmental costs that seem manageable at seventeen or eighteen dollar per gallon of milk? They become real problems at fourteen. And let’s be honest—we will see fourteen again. We always do, eventually.

Andrew Novakovic over at Cornell’s Dyson School said something in their recent 2025 dairy outlook that really stuck with me. He pointed out that if you need current prices to make your operation work—if you can’t survive at 70% of today’s milk price—then you’re not really profitable. You’re just temporarily lucky.

The 70% Test: Your Reality Check

So where does this leave us? What should we actually be doing with this information?

First thing—and I know this isn’t fun—but run your numbers at much lower milk prices. Nobody wants to think about this when things are decent. However, if your operation falls apart at 70% of current prices, that’s something you need to know now, not when it happens.

Have a real conversation with your milk buyer. Not the field rep who always says everything’s fine—someone who actually knows about capacity planning. Ask directly: If regional production increases by 10% next spring, what happens? Can they handle it? At what price? You might not like the answer, but you need to hear it.

Think carefully about any long-term investments, especially those related to environmental compliance. The experts I trust at Penn State Extension and Wisconsin’s Center for Dairy Profitability are all saying the same thing: three years or less for payback, assuming conservative milk prices. Anything longer, and you’re basically gambling on stability that rarely exists in dairy.

And here’s one that might seem obvious but apparently isn’t: location matters more than ever. Being an hour from the nearest plant just meant higher hauling costs. Now it might mean the difference between having a guaranteed market and scrambling for buyers. That super-efficient thousand-cow operation in the middle of nowhere? It might actually be riskier than a smaller farm adjacent to a cheese plant.

Oh, and please—if you haven’t reviewed your financing recently, do so now. The variation in rates and terms is wider than most people realize. Even a half-point difference compounds into serious money over time. With recent Fed moves and banks competing for good ag loans, you might be surprised at what’s available.

The Real Bottom Line

You know what really gets me about all this? It’s how apparent success can actually mask serious problems. That ten-dollar milk in New Zealand? It’s real. But so are all the things eating away at it—the costs, the constraints, the market shifts.

The farms that are going to thrive—whether they’re in New Zealand, Wisconsin, California, the Northeast, wherever—they’re not necessarily the biggest or the most technologically advanced. They’re the ones who understand the difference between a good price cycle and a sustainable business model. They’re using today’s decent prices to prepare for tomorrow’s challenges, not betting everything on the party continuing.

What’s happening in New Zealand… it’s coming here. Maybe not exactly the same way, but the patterns are unmistakable. Rising costs, capacity constraints, and shifting global demand. These forces aren’t going away.

The producers who see this clearly, who adjust now while they still have flexibility, are the ones I’d bet on. Because if there’s one thing we’ve all learned—usually the hard way—it’s that this industry cycles. Always has, always will.

The question isn’t whether things will change; it’s whether we can adapt to them. They will. The question is whether we’ll be ready when they do. And considering what’s happening in New Zealand, that’s a conversation worth having with your banker, family, and yourself. Sooner rather than later.

Because in the end, it’s not the headline math that matters. It’s the actual dollars-in-your-pocket math. And that’s what counts when the cycle turns.

Which it always does.

KEY TAKEAWAYS

- Run the 70% price test immediately: If your operation can’t break even at $11-12/cwt Class III (70% of current prices), you’re operating on borrowed time—Penn State Extension and Wisconsin’s Center for Dairy Profitability recommend restructuring debt and costs now while banks are competing for good ag loans

- Processing capacity matters more than efficiency: Farms within 30 miles of guaranteed processing are seeing $0.50-1.00/cwt premiums over efficient operations 60+ miles away—lock in supply agreements even at 5-10% below spot prices because having market access beats theoretical higher prices you can’t capture

- Environmental compliance payback can’t exceed 3 years: With feed additives for methane reduction costing $100-150/cow annually and system upgrades running six figures, only investments that pencil out at a conservative $14/cwt milk make sense—organic and grass-based operations may have advantages here with lower baseline emissions

- China’s self-sufficiency changes everything: Their 5% annual production growth means 200,000+ tons less powder demand yearly—diversify markets now, as USDA Foreign Agricultural Service data shows this isn’t a temporary adjustment but permanent restructuring like what happened with U.S. whey exports dropping from 54% to 31% of China’s imports

- Smart money’s building resilience, not capacity: New Zealand farmers paid down $1.7 billion in debt during record prices—consider sale-leasebacks on equipment, refinancing at today’s competitive rates (even 0.5% saves $15,000 annually on $3M debt), and maintaining 12-18 months operating expenses in cash reserves rather than expanding

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Stop Hemorrhaging Money on Feed: The Million-Dollar Risk Management Arsenal That’s Separating Profitable Dairies from the Walking Dead – This tactical guide reveals proven, layered feed procurement models to stabilize your biggest input cost. Learn how to combine forward contracts and opportunistic buying to reduce feed cost volatility by up to 35% and secure long-term budget certainty.

- China Killed Our Export Market – But These Dairy Operations Are Actually Growing Because of It – Discover how smart producers are turning China’s aggressive self-sufficiency push into a competitive advantage. This strategic analysis provides a roadmap for pivoting to high-margin domestic cheese and specialty markets, ensuring market access certainty.

- The Methane Efficiency Breakthrough: How Smart Breeding Cuts Emissions 30% While Boosting Your Bottom Line – Shift your environmental strategy from temporary fixes to permanent, cumulative gains. Explore how next-generation genetic selection for methane efficiency offers a long-term path to compliance that improves feed conversion and increases profitability.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!