As we now know, the policy rate has already increased by 2.25% since the beginning of the year and there will likely be further increases by the end of the year. Some economists are anticipating a total increase of 3% before the end of 2022.

The Impact on Dairy Farmers Will Be Significant

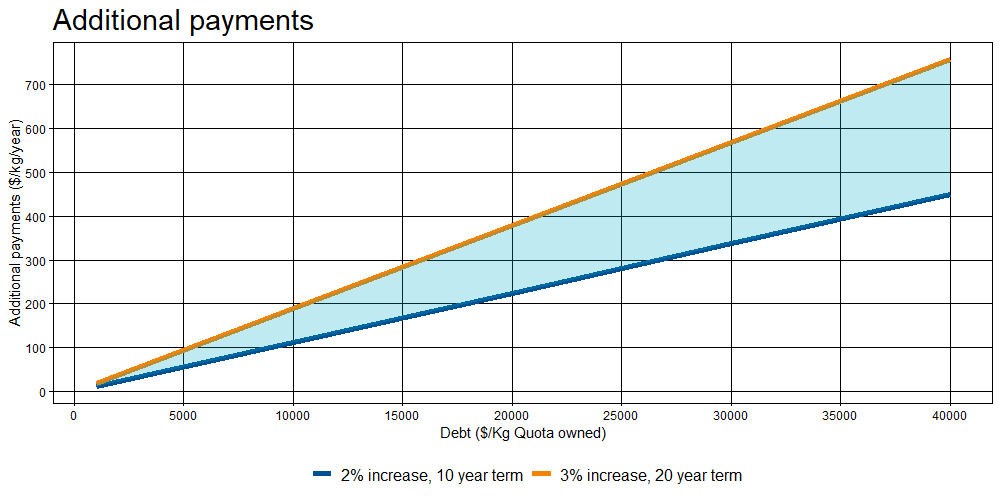

Most dairy farms have a debt load that ranges from $15,000 to $30,000 per kilogram of quota held, and much of this debt is short-term. Therefore, increasing interest rates will affect debt payments and the cash flow needs of producers over the next 12 months.

The impact on payments will depend on the debt ratio, but also on the terms of the debt. The longer the amortization period, the greater the impact. Therefore, payments on interest-only loans or on amortizations of 20 years or more will be most affected.

How do I know where I stand?

The graph below shows the effects of an increase in interest rates from 2% and 3%, for debt with terms ranging from 10 to 20 years. For example, for a farm with a $20,000/kg of quota debt with a 10-year term, a 2% increase in the interest rate translates into an additional cost of $225/kg/year, while a 3% increase in the interest rate with a 20-year term translates into an increase of $380/kg/year.

For a 100-cow farm with 113 kg of quota, this means between $25,425 and $42,940 in additional payments per year, or between $2,000 and $3,500 per month.

Any solutions?

In a context of input price inflation (feed, fuel, fertilizer, labour, etc.), a seasonal drop in production to come, and a possible drop in the price of milk on international markets, autumn could be very difficult financially for many farms. A Lactanet advisor is someone who can offer valuable insight in this regard.

In addition to minimizing farm expenses, some other financial solutions are available to you: the first thing to do is to budget and monitor your cash flow to better understand the extent of the situation and to manage it. Secondly, creditors may have solutions to offer, whether it is a debt restructuring or a capital payment forbearance. The availability of these solutions often depends on the farm’s financial situation and the creditors’ confidence in its management. Therefore, maintaining good, open communication with creditors can be beneficial and even necessary.

Despite input price inflation, rising interest rates and seasonal production variations, the few moments you spend talking with your creditor will help reduce your fall season stress. The changes you put in place to reduce your expenses will also help reduce the anticipated negative impact.

Source: Lactanet