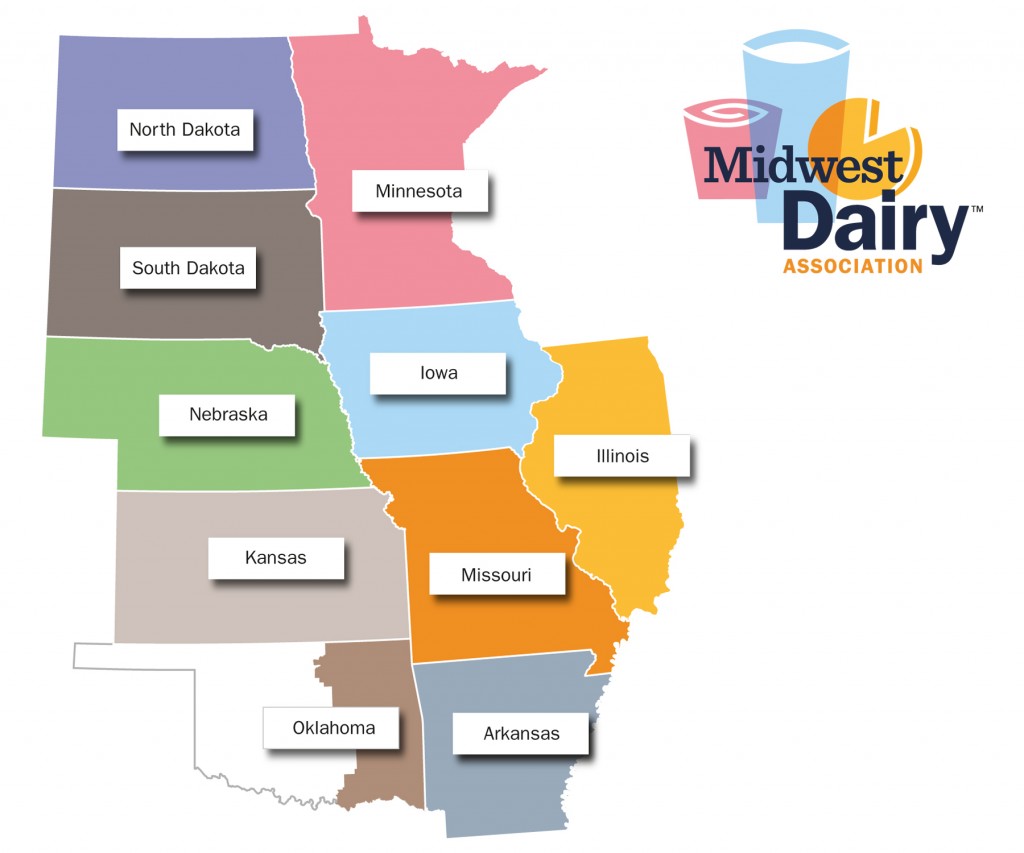

The map representing Midwest Dairy Association’s territory.

One of the dairy industry’s most important assets is its diverse collection of individuals, organizations and businesses with differing roles that, together, can take advantage of every opportunity to put dairy products into the stomachs of people all over the world.

That opportunity is projected to grow significantly in the coming decade. In fact, USDA estimated demand for U.S. dairy products will grow by 30 billion lbs. (milk equivalent) by 2022. While it’s a huge number to digest – literally – and will be met by the collective assets of the dairy industry, it also has meaning for each individual farmer, processor, state and region. It represents their future.

Here in the Midwest, we want to make certain we’ve identified the products to fill that demand, have the processing capabilities to provide them, and the farms from which the milk will come. With all this in mind, we’ve applied Midwest Dairy checkoff funds to begin addressing that challenge and identifying our role in the effort. Midwest Dairy Association, in conjunction with processor and producer leaders from the region, recently commissioned a new study, Growth and Prosperity for the Midwest Dairy Industry…A Path Forward. It’s meant to serve as a tool in examining our region’s dairy sector in light of the potential that lies ahead.

The study was conducted by Blimling and Associates, Inc., and carried out under the direction of the Midwest Dairy Foods Research Center’s Dairy Economic Advisory Council, consisting of dairy farmer and processor leaders.

Why us? As a checkoff entity, we’re charged with helping to grow sales and demand for Midwest-produced milk. Furthermore, as a regional organization, we can work across boundaries and add to the work already going on within our states.

Advantages, challenges and unique conditions

Not surprisingly, the Path Forward study brought forth our obvious Midwest advantages: plentiful land, water and feed; innovative processors and cooperatives; professional and supportive infrastructure; and our strong dairy tradition.

It also spelled out the challenges for our region: high land values; competition for capital with other ag sectors; and our geographic location in the middle of the country, far from ports and population centers.

Furthermore, the study identified a number of unique conditions in the Midwest: a variety of milk buyers both private and cooperative; the trend toward farm facility configurations requiring greater start-up costs; and the diverse agricultural economy.

Three focus categories

From that data, our discussions with producer and processor leaders identified three major categories of work to be done:

• reinforce consumer confidence

• identify global and domestic opportunities

• allocate dairy development resources

The checkoff can make major contributions within the first two of those categories: reinforcing consumer confidence so that dairy farms and processors can grow and thrive, and identifying the unique global and domestic market opportunities for dairy during the next decade. Industry partners must be the ones to address the third area of work: dairy development initiatives. To that end, we’ve already visited with many of the players engaged with those efforts across the Midwest, sharing both the study’s findings and the insight provided by those with whom it’s been reviewed. It’s up to our state dairy development officials, processors, dairy farmers and others to determine whether they can apply resources to the production and processing sector, calling on their extremely savvy business skills and dairy farmer commitment.

As demand grows, Midwest dairy farm families have a stake in how they will share in filling the growing need for dairy’s excellent nutrition for people here in the U.S. and around the world. We hope the Path Forward study will help to shed light on how the industry can collectively meet their expectations.

• To read a summary of A Path Forward, visit midwestdairycheckoff.com.

• Mike Kruger is CEO of Midwest Dairy Association, a nonprofit organization funded by dairy producers to help build sales and demand for dairy products through integrated marketing, nutrition education and research.

Initiatives supported

Meeting in June, the region’s dairy industry leaders expressed support for the following initiatives:

• Pursue a “growth and prosperity” strategy across the region, aiming to maintain share of U.S. milk supply while paying producers a nationally competitive milk price;

• Enhance state dairy economic development plans including South Dakota’s Dairy Drive, Grow Nebraska Dairy, Dairy Iowa and the North Dakota Dairy Coalition; and a repurposed Minnesota Dairy Leaders Roundtable;

• Identify pre-competitive domestic and global value-added product marketing challenges and opportunities through the Midwest Dairy Foods Research Center; and

• Build on Midwest Dairy’s consumer confidence initiatives to address dairy farmers’ “public license” to operate, thrive and grow.

Midwest Dairy and other stakeholders will determine how to apply the study’s recommendations and what further information is required, along with identifying what entities should be engaged in initiatives surrounding them.

By the numbers

Midwest Dairy is funded by checkoff dollars from dairy producers in a 10-state region, including Minnesota, North Dakota, South Dakota, Nebraska, Iowa, Illinois, Missouri, Kansas, Arkansas and eastern Oklahoma. The northern five states contribute about 9% of the total U.S. milk supply. Milk production in the region dipped to a 40-year low in 2004, but has rebounded by 15% as of 2013.

The study found milk prices in the region were comparable or better than many other major U.S. milksheds.

2013 average all-milk price ($/cwt.)

I-29 Corridor – $20.38

Colorado – $20.24

Idaho – $19.20

Michigan – $20.46

New Mexico – $18.79

Wisconsin – $20.31

While milk prices and margins are favorable, dairy start-up costs were a detriment to further investment in the region. Cost for a 3,000-cow cross-ventilated barn, coupled with soaring land prices, made expansion expensive, doubling from $13 million in 2004 to $26 million in 2013. Loans of that size carried collateral requirements nearing $9 million.

From an overall “business friendliness” index, all five states in the region rank among the top 20 in the U.S.: North Dakota – #4; South Dakota – #8; Nebraska – #10; Iowa – #12; and Minnesota – #16.

Source: Midwest Dairy Association