Strategic exit: Walk away with $1.2M. Wait 18 months: Lose everything. Hormel’s layoffs just started your countdown.

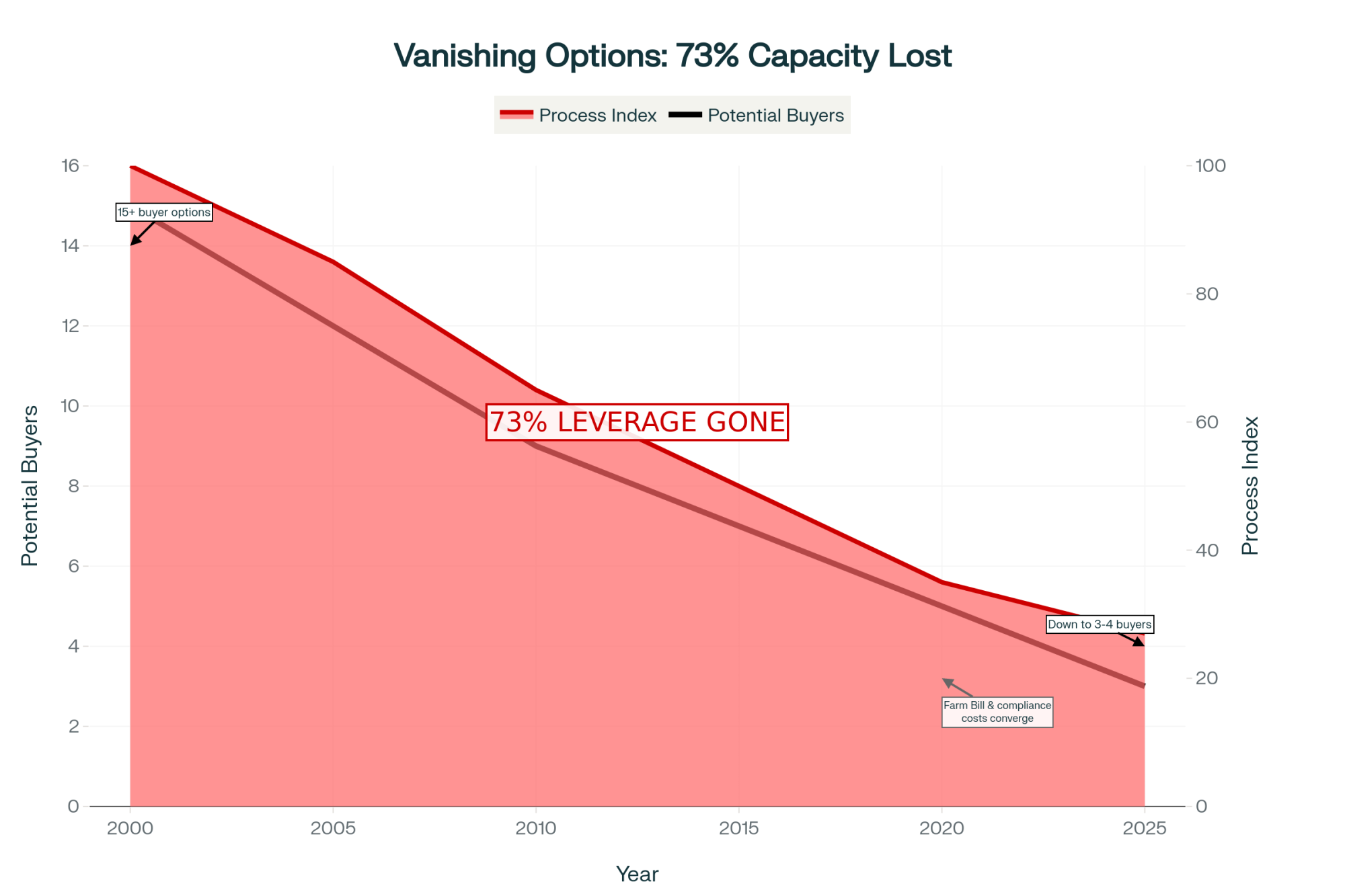

EXECUTIVE SUMMARY: Hormel’s elimination of 250 procurement positions triggers a predictable 12-18 month pattern: processor consolidation, standardized pricing, and $1.50-2.00/cwt in new deductions that destroy farm profitability. With 73% of processing options lost since 2000, most farms now have only 3-4 potential buyers—eliminating negotiating leverage exactly when Farm Bill changes, environmental compliance costs ($75,000-175,000), and heifer shortages (prices hitting $4,800) converge in 2026. Our analysis of Wisconsin and Pennsylvania exits reveals a stark reality: a strategic exit in months 8-10 preserves $1.2 million in family wealth, while waiting until month 18 results in forced liquidation and devastating losses. Of four survival paths—scaling (8% viable), differentiation (15-20% viable), strategic exit, or resilience through low-cost production—only resilience offers hope for mid-sized operations. Your 90-day window to build reserves, create information networks, and secure alternatives started Monday.

Monday’s announcement from Hormel Foods wasn’t just another corporate headline—it was a warning shot for the entire dairy supply chain. The company is cutting 250 positions, and these aren’t factory floor workers. We’re talking about headquarters and sales staff—the people who typically manage relationships with suppliers like ours.

Now, you might be thinking “that’s Hormel’s problem, not mine.” But here’s what’s interesting—Hormel owns Century Foods International up in Sparta, Wisconsin. That’s a significant dairy ingredient processor that pulls milk and proteins from farms across the Upper Midwest. When a company with $12 billion in annual revenue starts reducing procurement and relationship staff… well, that pressure has to go somewhere, doesn’t it?

What I’ve found is that this pattern keeps showing up across the industry. And understanding it might just help us prepare for what’s coming.

The Bigger Picture We’re All Dealing With

Looking at today’s consolidation, you can see it builds on changes that started decades ago. The data from USDA’s Economic Research Service and the National Milk Producers Federation is pretty sobering—we’ve lost between 65 and 73 percent of regional processing options since 2000.

Just think about that. Many of us used to have 15 or 20 potential buyers within reasonable hauling distance. Now? Three or four if we’re lucky. In some regions, it’s even tighter.

Take a look at what’s happening across different regions right now. Darigold members—about 250 farms in the Northwest—are paying a $ 4-per-hundredweight assessment. Capital Press reported back in May that $2.50 of that is going toward new plant construction in Pasco, Washington. That’s real money coming right off the milk check.

In the Upper Midwest, Foremost Farms implemented a 90-cent assessment for its patrons in September 2022. Hoard’s Dairyman covered it extensively—they cited the gap between Class III prices and what they’re actually getting for cheese. And Saputo? Food Processing magazine reported in June 2024 that they’re closing six facilities by early 2025, including operations in Wisconsin and California, to “consolidate production and reduce redundancy.”

Here’s what really caught my attention about Hormel’s restructuring. According to their November 4th investor announcement, they’re specifically eliminating corporate strategic and sales positions—these are the folks who maintain relationships with suppliers. They’re spending $20 to $25 million on severance and transition costs. That’s roughly $80,000 to $100,000 per position they’re cutting.

You don’t spend that kind of money unless you’re planning for years of pressure ahead, not just a tough quarter.

Now, it’s worth noting that processors face real challenges too. Retail consolidation means they’re dealing with Walmart, Costco, and Amazon—all of which are squeezing margins. Energy costs are up. Labor’s tight everywhere. These companies aren’t making these cuts lightly. But understanding their pressures doesn’t change what flows down to us.

The Pattern I Keep Seeing

Industry financial advisors tracking processor transitions have identified a consistent pattern that typically unfolds over 12 to 18 months. Let me walk you through what actually happens…

First Few Months: Everything Gets Quieter

Your field rep who used to manage 40 or 50 farms? Now they’re covering 150. Response times stretch from hours to days. Those quarterly visits become phone calls. As many of us have seen, when representatives manage three times as many accounts as before, personalized service just isn’t possible anymore.

Months 2-6: The Standardization Push

This is when you get that letter about “standardized pricing formulas” to ensure “fairness.” Sounds reasonable, right? But what it really means is they’re eliminating those adjustments that recognized your specific situation—your spring flush components, your consistent quality premiums, that understanding that your butterfat always runs high in October.

Months 6-9: The Deductions Start

New fees start appearing. Processing assessments. Quality charges. Transportation adjustments. Wisconsin dairy business associations documented accumulated deductions ranging from $1.50 to $2.00 per hundredweight during 2023. For a typical 180-cow operation, that’s $2,500 to $3,300 coming off your monthly milk check.

By Month 12: You Realize Your Options Are Limited

You start looking around for alternatives, but those other processors? They’re managing their own challenges. They’re not actively recruiting. And you need daily pickup—can’t exactly store milk while you shop for a better deal.

Learning From History (Because We’ve Been Here Before)

This isn’t our first rodeo with consolidation. The USDA Economic Research Service’s 2019 report “Consolidation in U.S. Dairy Farming” documented similar patterns during the 1980s farm crisis, and its 2010 analysis covered the impacts of the 2009 financial crisis. Each time, the farms that saw it coming early and adapted survived better.

What’s different this time? The alternatives are scarcer. Back in ’09, you could still find regional processors looking to grow. Today, with interest rates where they are and construction costs through the roof—as Compeer Financial told Brownfield Ag News in October—expansion activity has basically stopped.

Southeast operations face additional challenges, with heat-stress management costs averaging $150 to $200 per cow annually, according to University of Georgia Extension research. Meanwhile, Southwest farms are dealing with ongoing water allocation issues, with Arizona and New Mexico operations seeing water costs rise by 30-40% since 2020, according to state agricultural department data. Each region has its unique pressures, but the consolidation pattern remains consistent.

What Successful Farms Are Doing Right Now

Despite all this, I’m seeing farms navigate these challenges successfully. Their approaches are worth considering.

Building That Financial Cushion

What is the difference between farms with negotiating leverage and those without? Operating reserves. Penn State Extension’s dairy business analysis and the Center for Farm Financial Management both point to the same figure—about 90 days of operating capital makes all the difference.

For a 200-cow operation, that’s roughly $280,000. For 150 cows, about $180,000. I know those numbers sound huge, but here’s what’s working…

Farm financial management research shows that extending equipment replacement cycles by one to two years can generate significant reserve-building capacity. Several Mid-Atlantic operations have successfully banked the difference between equipment payments and increased maintenance costs. After a few years, they’ve built up enough to cover six months of expenses.

Cornell Cooperative Extension has documented that farms directing 5-10% of production to premium direct-market channels accelerate reserve accumulation without disrupting bulk sales. You’re not replacing your regular market—just capturing better margins on a small percentage of it.

Information Networks That Actually Work

You probably know this already, but the coffee shop isn’t where real information sharing happens anymore. Networks of 5 to 8 farms comparing actual numbers—payment timing, deduction patterns, alternative buyer pricing—are documenting surprising disparities.

Farm business management specialists report producer networks discovering pricing gaps of $0.60 to $1.20 per hundredweight between processors for identical milk quality. When these groups approach processors collectively with documentation, they often achieve improvements worth $0.40 to $0.65 per hundredweight.

California producers managing water costs—University of California Cooperative Extension’s 2024 cost studies show averages of $450 to $650 per cow annually in the Central Valley—face additional challenges. But similar information networks help them identify opportunities. The principle’s the same everywhere: shared knowledge beats isolation.

Getting Real Information from Your Processor

Here’s what progressive operations are asking for—and often getting:

Monthly competitive benchmarks showing what processors within 100 miles pay for comparable components. Detailed breakdowns of processing costs at their delivery facility. Inventory levels and 90-day demand projections that might signal adjustments coming.

State Extension services offer tremendous support here. Programs at Michigan State, Cornell, Penn State, UC Davis—they’ve all got dairy business specialists who can help analyze this information. That’s what our tax dollars support, after all.

The Four Strategic Paths: An Honest Assessment

Most advisors focus on three options: scale to 3,500+ cows, differentiate into premium markets, or exit strategically. But I’m seeing a fourth path among farms that consistently stay profitable even when milk drops to $17 or $18…

Path 1: Scaling Up (Works for Maybe 8% of Farms)

Let’s be honest here. Scaling to 3,500+ cows require $21 to $27 million in capital investment, according to current construction costs. You need interest rates that make sense (they don’t right now), heifer availability (scarce and expensive), and processing capacity willing to take your increased volume. If you’re already at 1,500-2,000 cows with strong financials, maybe. Otherwise? This probably isn’t your path.

Path 2: Premium Differentiation (Viable for 15-20%)

Organic, grass-fed, A2—these markets exist, but they’re not magic bullets. Organic premiums have compressed from $7-9 to $3-5 per hundredweight. You need 3-7 years to transition, specific processor relationships, and often geographic advantages. If you’re near urban markets or progressive processors, it’s worth exploring. But it’s not a quick fix.

Path 3: Strategic Exit (Sometimes the Smartest Move)

Wisconsin and Pennsylvania farm financial counselors document $800,000 to $1.2 million differences in family wealth between planned exits at months 8 to 10 versus forced liquidation at month 18 and beyond. There’s no shame in preserving what three generations built rather than losing it all trying to outlast market forces.

Path 4: The Resilience Strategy (The Surprise Option)

These operations have basically flipped the traditional production philosophy. Instead of maximizing output, they’re optimizing for consistent profitability across wide price ranges.

Rethinking Production Economics

University of Minnesota Extension case studies show lower-production systems—18,000 to 19,000 pounds per cow—achieving $3 to $4 per hundredweight cost advantages through reduced inputs. The 2024 Dairy Farm Business Summary shows industry feed costs averaging $10.20 to $11.50 per hundredweight. These systems? They’re at $7.80.

Vet expenses run $42 per cow annually versus the $85 to $110 industry average. They maintain a 22% replacement rate when the industry standard exceeds 33%. They’re producing 25% less milk per cow, yet their cost structure keeps them profitable at $18 milk, while others are bleeding red ink.

Research from Wisconsin’s Center for Integrated Agricultural Systems shows that well-managed grazing operations achieve production costs of $14 to $16 per hundredweight, compared to $18 to $21 for conventional confinement.

Sure, they might average 16,000 to 17,000 pounds per cow. Their facilities might look dated. But at any price above $15.50, they’re making money. When milk hit $23 early this year, they banked serious reserves. When did it dropped to $18? Still profitable.

Penn State Extension’s 2024 analysis shows dairy-beef integration programs generating $150,000 to $200,000 annually. Using sexed semen on top genetics and beef semen on lower performers, these operations accept modest production decreases for substantial supplementary income.

USDA Agricultural Marketing Service reports from October 2025 show beef-cross dairy calves bringing $750 to $950at regional auctions, with strong demand continuing. That’s meaningful diversification without new facilities or expertise.

What these farms understand is that volatility kills more operations than low prices. If you need $22 milk to break even, you’re in trouble 40% of the time. If you can profit at $17, you only struggle during true crashes.

The Critical Next 18 Months

Here’s why the period through spring 2027 matters so much…

First, we’re operating under the second Farm Bill extension, as the Congressional Research Service noted in June. When new Dairy Margin Coverage parameters roll out in spring 2026, farms already under stress might not be able to afford meaningful coverage.

Second, environmental compliance intensifies in mid-2026. California’s State Water Resources Control Board’s 2025 dairy regulations estimate compliance costs of $75,000 to $175,000 for facilities that require digesters or advanced nutrient management. Wisconsin’s Department of Natural Resources permit updates require similar investments. That’s hitting right when other pressures are at their peak.

Third—and this one’s flying under the radar—CoBank’s August analysis shows dairy heifer inventories hitting their lowest point in 2026. USDA Agricultural Marketing Service data from July shows current prices at $3,010 per head, up 75% from April 2023. CoBank projects they could reach $4,200 to $4,800 by early 2027.

For a 200-cow operation with typical replacement needs, that’s an extra $100,000 annually. Can you absorb that while everything else is hitting?

Your Action Plan for This Week

Given everything that’s developing, here’s what I’d be thinking about…

Monday-Tuesday: Know Your Position

Pull out your processor contract and read it carefully. Every word. Document your payment patterns over the past year—are checks posting later, even by a day or two? Calculate your actual reserves. Not estimates—real accessible capital.

Wednesday-Thursday: Build Intelligence

Call three alternative processors. Frame it as “2026 planning” rather than jumping ship. Get their pricing, their terms. If your processor has a parent company, check their recent earnings calls. Connect with 5 to 8 operations in your area to exchange information.

Friday: Make Your Decision

Honestly evaluate where you fit. Can you scale? Can you differentiate? Should you build resilience? Or is strategic exit the smartest move for your family?

Questions Worth Asking Your Processor Today

- What’s your capacity utilization at our delivery facility?

- Can you provide monthly competitive benchmarks against regional processors?

- What are your 90-day inventory levels and demand projections?

- What specific costs justify any current or planned deductions?

- What’s your parent company’s debt-to-asset ratio and credit utilization?

If they won’t answer… well, that tells you something too, doesn’t it?

The Bottom Line

What Hormel’s restructuring really tells us is that financial pressure throughout the food supply chain is accelerating. And that pressure flows downstream. Always has, always will.

We’ve navigated similar transitions before—the 1980s, 2009—though current conditions present unique challenges. The farms that survive won’t necessarily be the biggest or most productive. They’ll be the ones that recognized signals early, built flexibility, demanded transparency, and made tough decisions while they had choices.

This isn’t about giving up on dairy. It’s about adapting to reality. And the reality is that processor consolidation, combined with converging pressures over the next 18 months, will fundamentally reshape American dairy.

Success in this environment doesn’t necessarily correlate with scale or production levels. Operations demonstrating financial flexibility, market intelligence, and strategic clarity position themselves best, regardless of size.

In a market that swings from $17 to $24 per hundredweight, the ability to remain profitable across that range beats maximizing profit at the top. As many successful producers have learned, producing less at lower cost can provide greater security than chasing maximum production.

The question isn’t whether change will continue—it will. The question is whether we’ll approach it prepared, with options built and information gathered, or whether we’ll take whatever’s offered because we have no choice.

Each farm’s situation is unique. There’s no universal solution. But there are universal principles: maintain flexibility, understand your market position, and make strategic decisions while you still have options.

You know, the dairy industry has always rewarded those who adapt thoughtfully to changing conditions. This period demands exactly that kind of thoughtful adaptation. And honestly? I think those of us who prepare now, who build those reserves and networks and alternatives… we’ll navigate this just fine.

The early warning signs are clear. What we do in the next 90 days determines whether we walk out of this transition on our own terms or get forced out when market pressures intensify.

I know which option I’d choose. How about you?

Key Takeaways:

- Your 90-Day Action List: Read the processor contract, calculate reserves ($280K for 200 cows), call three alternative buyers, form a 5-8 farm network

- The $1.2 Million Timeline: Strategic exit (months 8-10) = wealth preserved / Forced liquidation (month 18) = devastating losses

- Surprise Winner: Farms producing 25% LESS milk at $7.80 feed costs beat high-producers losing money at $10.50 feed costs

- Pattern Recognition: Corporate layoffs → standardized pricing → $2/cwt deductions → trapped farmers (we’ve seen this 3 times)

- 2026 Convergence: When Farm Bill + $175K compliance + $4,800 heifers hit simultaneously, only prepared farms survive

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Beyond the Milk Check: How Dairy Operations Are Building $300,000 in New Revenue Today – This piece provides the tactical playbook for the “Resilience Strategy.” It details how top producers are generating $300,000 in new revenue from beef-on-dairy, strategic culling, and DMC enrollment to offset processor deductions and market volatility.

- Decide or Decline: 2025 and the Future of Mid-Size Dairies – Reinforcing the main article’s “Strategic Exit” warning, this analysis explores the “mid-size squeeze.” It provides a framework for deciding whether to scale, implement precision technology, or exit while your farm’s equity is still intact.

- Forget Feed Costs: The 3 Survival Strategies Defining Dairy’s Future as 12,000 Farms Face Exit by 2030 – This article details the “Resilience Strategy” in action. It demonstrates how practical, low-cost investments in automation—like feed pushers and monitors—can significantly reduce labor and waste, improving profitability without the need for massive scale.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!