Marketing analytics consultants China Skinny are reporting that the dairy category has been one of the largest beneficiaries from the COVID-19 outbreak in China.

State Media and renowned doctors such as Zhang Wenhong from the infectious diseases department at Shanghai’s Huashan Hospital have endorsed drinking milk to boost immune systems and help fend off the coronavirus.

The impact of the official endorsements has been obvious, they report. While many categories have seen flat-to-negative growth since the outbreak, dairy sales growth has been strong.

China’s dairy giants Yili and Mengniu reported +23% and +19% increases in revenue respectively in the June quarter. This is a stark turnaround from the category trend, which saw drinking milk products decline -4.0% on average per year between 2015-2020, according to Euromonitor.

In light of renewed growth in dairy, the category shows strong potential for growth. China’s annual per capita consumption is around 34 litres, just one third of New Zealand rates. Foreign brands should be well placed to take advantage of this opportunity. Although the melamine scandal happened 12 years ago, it is still raised by many of the tens of thousands of Chinese consumers who China Skinny speaks to every year, inferring a trust deficit in domestic dairy brands. This has been further fuelled by an exposé that went viral in China in July, disclosing the “Six Sins of Mengniu and Yili.”

Good marketing beating ‘natural advantages’

China Skinny has been tracking the dairy market for many years, via its Dairy Tracker. And in spite of foreign brands’ natural advantages, their analysis points to performance of foreign dairy brands getting worse in most areas, indicated by the data below.

Using Tmall data,

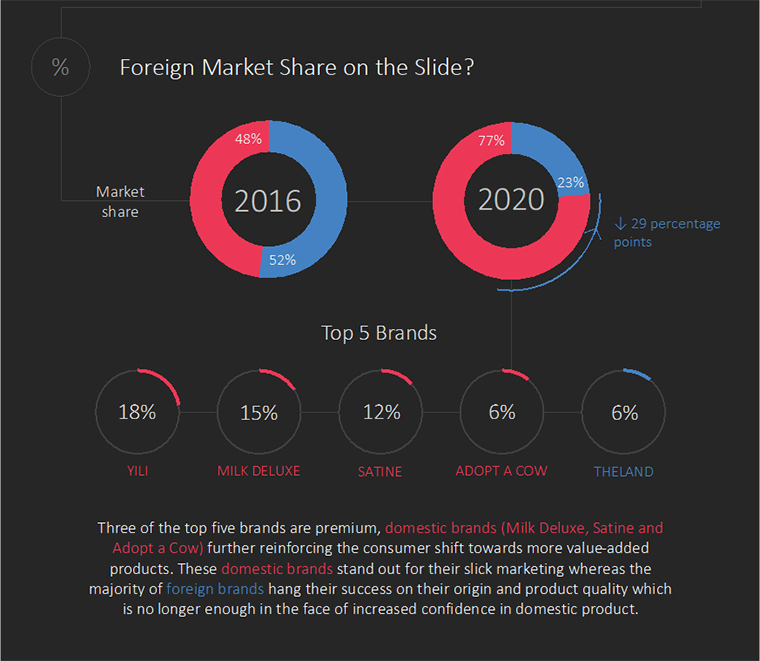

- Foreign brands’ share on Tmall was 35% in December 2019 (pre-outbreak), but over the first eight months of 2020 has averaged just 23%

- In 2016, foreign brands accounted for 52% of sales on Tmall, more than double the 23% in 2020

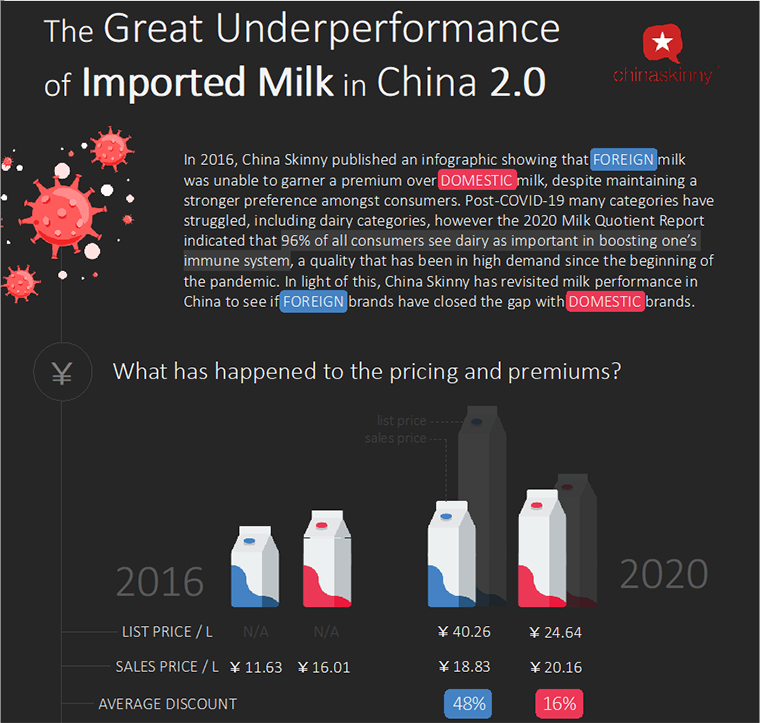

- In 2020, the average price per litre for domestic brands on Tmall is surprisingly 7% higher than foreign brands. This is an improvement from 2016, when domestic brands sold at a 38% premium.

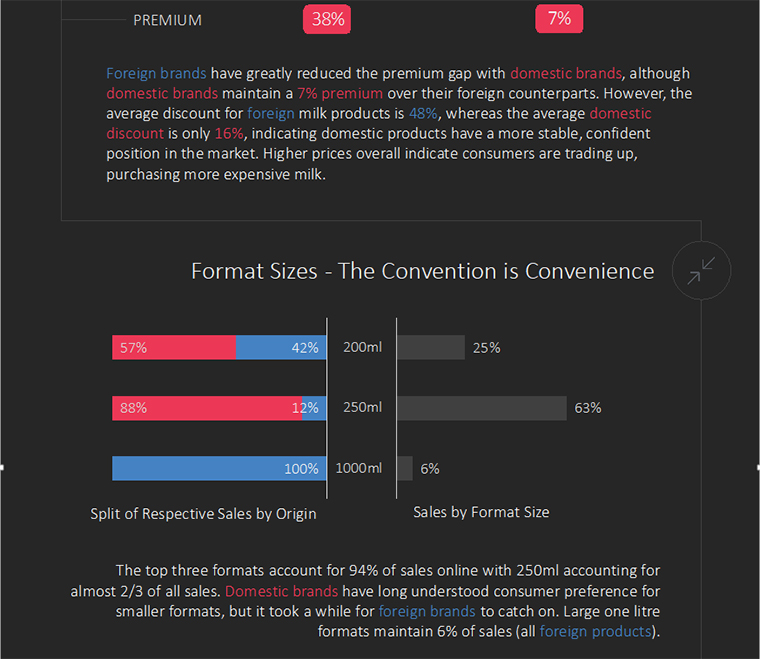

In fact, domestic brands command a premium over foreign milk brands and they have done that by focusing on smaller formats and more targeted segmenting – which typically commands a premium.

“Many foreign brands point to rising nationalism as the reason for declining brand share, whilst this has an impact, the decline can be put more down to poor strategic and tactical marketing decisions. Insight-driven brands such as Nike and Coca-Cola has managed to grow despite rising geopolitical tensions between the US and China,” says China Skinny’s Mark Tanner.

They say marketing claims for foreign brands are also less resonant, and their propensity to discount more often cheapens the brand:

- Foreign brands are missing the popular 250ml format, contributing to just 12% of sales, whereas the format accounts for 63% of sales on Tmall

- Foreign brands continue to pin their hopes on the 1 litre format for dairy, accounting for 100% of the top selling brands in this format, yet the format makes up just 6% of sales overall on Tmall

- Domestic brands have been more likely to adopt timely claims such as ‘healthy’ and ‘nutritious’ which commanded a 38% and 34% premium respectively

- The average discount on Tmall between January to August 2020 was 16% for domestic brands and 48% for foreign brands

- Foreign brands have less control of their marketing on Tmall, with just 18% of sales going through their flagship stores versus 32% for domestic brands.

The following graphic has been supplied by China Skinny.

Source: interest.co.nz