The Lactanet Robot Feed Margin: Findings and Feeding Strategies workshops evaluated participants’ feeding costs from December 2021 to January 2022 for robotic milking operations. In the 12 months leading up to the winter 2022 workshops, there were significant price fluctuation, resulting in a slight overall increase in total costs. Let’s compare the evolution of feed prices for participants in the spring 2021 robot workshops to those who participated in the fall 2021 and winter 2022 robot margin workshops.

Changes in Food Prices

Grains, minerals, high-fat food prices were increasing. Generally, soybean meal and other protein bases were decreasing. If the proportion of farms that closed a price for soybean meal is higher this year than last, this may have played a factor in keeping the overall price lower. Robotic feed prices, which are heavily influenced by grain prices, also increased but to a lesser extent.

TABLE 1. EVOLUTION OF CONCENTRATE PRICES BETWEEN THE 2021 AND 2022 WORKSHOPS

| Types of Feed | Price ($/ton) (January to March 2021) |

Cost ($/hl)

(January to March 2021) |

Price ($/tonne)

(November 2021 to February 2022) |

Cost ($/hl)

(November 2021 to February 2022) |

| Grains (dry maize, wet maize, barley, wheat, etc.) | 256 | 2.47 | 317 | 2.68 |

| Robot pellet | 487 | 5.82 | 491 | 5.98 |

| Protein (commercial supplements, by-products, soybean meal, urea) | 5.84 | 5.58 | ||

| Soybean meal | 652 | 2.65 | 596 | 2.25 |

| Starter supplement (glycerol feed, chromium, sugar, etc.) | 1,393 | 0.69 | 1487 | 0.64 |

| Fat (all types of fat) | 1,849 | 1.29 | 2573 | 1.47 |

| Mineral + bases (soda, salt, limestone, antitoxins, etc.) | 1.85 | 2.13 |

Less Milk but More Components

A combination of lower production in 2022 and an increase in overall milk components resulted in little change in kilograms of fat of protein per cow compared to spring 2021. There was also a higher increase in the fat test than in production across the country.

However, the price increase in several concentrates (grain, feed, mineral, etc.) has resulted in costs per hectolitre, per kg of fat and per cow, increasing compared to 2021. Therefore, overall margins have decreased slightly. It should also be noted that these are not necessarily the same farms catalogued from one year to the next.

TABLE 2. EVOLUTION OF TECHNICAL AND ECONOMIC DATA BETWEEN THE 2021 AND 2022 WORKSHOPS

| Number of farms | Milk production (l/cow/day) | Fat (kg/ cow/day) | Protein (kg/cow/day) | Fat (kg/hl) | Protein (kg/hl) | |

| Average 2020-21 | 106 | 34.1 | 1.43 | 1.12 | 4.19 | 3.27 |

| Average 2021-22 | 69 | 33.5 | 1.42 | 1.10 | 4.24 | 3.29 |

| Cost of concentrates ($/hl) | Concentrate margin ($/hl) | Cost of concentrates ($/kg fat) | Concentrate margin ($/kg fat) | Cost of concentrates ($/cow) | Concentrate margin ($/cow) | |

| Average 2020-21 | 15.33 | 62.31 | 3.66 | 14.87 | 5.28 | 21.41 |

| Average 2021-22 | 15.95 | 62.09 | 3.77 | 14.65 | 5.38 | 20.91 |

Fortunately, the price of milk was adjusted upwards in February 2022, and this allowed a larger margin to be restored. Thus, for the month of June 2022, down slightly compared to May, the average concentrate cost for robotic farms was $3.89/kg fat and the margin on concentrate cost was $17.01/kg fat.

A Second Good Year for Closing a Price for Soybean Meal

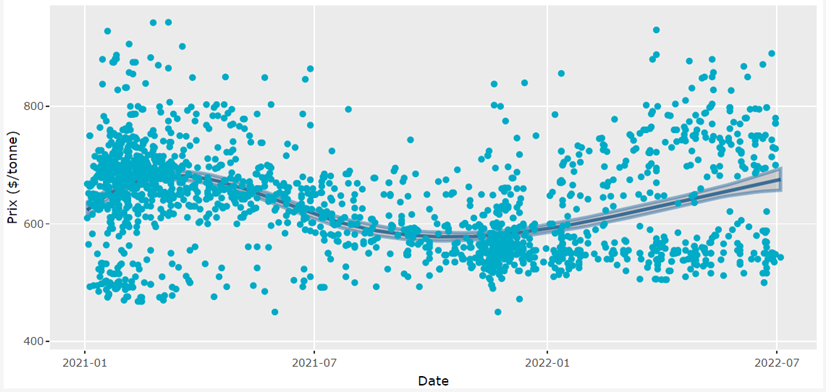

Lactanet has a new tool that allows to follow the cost changes to the main concentrates in recent months1. Here is the graph for soybean meal (Quebec data), which is a bit unusual. Each dot represents the price paid by a farm for the soybean meal included in their ration when doing a margin analysis on concentrate costs. We see the average (dark blue line and standard deviation in grey) with a scatter plot below and a scatter plot well above the average price. The farms with a lower price have closed a price for soybean meal in the fall of 2021 while the others paid the price of the day. The average price at the end of June 2022 was $675/ton.

GRAPH 1. CHANGES IN THE PRICE PAID FOR SOYBEAN MEAL ($/TON)SINCE JANUARY 2021 (QUEBEC DATA)

Free or Guided Robot Traffic

This year, we have combined the type of robot traffic with technico-economical findings. Given the amount of data, we should be careful not to jump to conclusions and judge this as a trend. On average, farms with guided robot traffic serve less feed at the robot and have a higher fat test result. Farms with free traffic have a slight advantage in terms of margin per kg of fat. But guided-traffic farms produce more kg of fat per cow, and therefore need fewer cows to produce the same quota. This will generate savings on variable costs such as feed and replacement needs. In the end, it cannot be said that one type of traffic outranks the other, so the important thing is to optimize the system that YOU have.

TABLE 3. EVOLUTION OF TECHNICO-ECONOMICAL FACTORS ACCORDING TO TRAFFIC TYPE, 2022

| Type of traffic | No. of farms | Kg of feed at the robot | Total conc. at the robot (kg) | Milk Prod (kg/cow

/day) |

Kg fat/

cow |

Fat test (kg/hl) | Conc. cost

($/hl) |

Conc. margin ($/hl) | Conc. cost

($/kg fat) |

Conc. margin ($/kg fat) | Cost conc.

($ / cow) |

Margin on conc. ($/cow) |

| Free traffic | 56 | 4.12 | 4.84 | 33.5 | 1.41 | 4.23 | 16.03 | 61.90 | 3.80 | 14.67 | 5.39 | 20.83 |

| Guided traffic | 13 | 3.90 | 4.39 | 33.8 | 1.46 | 4.31 | 15.63 | 62.91 | 3.63 | 14.60 | 5.33 | 21.29 |

Many thanks to all the producers who have participated in the robot workshops over the last two seasons. We hope you harvest quality forage, as this is always the best way to reduce feed costs.

1 At the time this article was written, this tool is only available to advisors in certain provinces.

Source: Lactanet