Block cheese drops 3¢ to $1.67 while feed costs hold at $4.10 corn—margin decisions define survival

Executive Summary: What farmers are discovering through today’s CME action is that the dairy market’s entering a prolonged adjustment phase that rewards operational efficiency over production volume. Block cheese’s decisive 3-cent drop to $1.67/lb on six trades—double the typical volume—signals institutional conviction that prices have further to fall, with Class III futures at $16.89/cwt already pricing in expectations of sub-$16 milk by November. The silver lining comes from the feed side, where December corn at $4.10/bu and soybean meal at $274.50/ton offer manageable input costs that translate to income-over-feed margins around $7.80/cwt—still above breakeven for efficient operations but leaving little room for error. Research from the Daily Dairy Report (October 2025) indicates farms maintaining 2.35 milk-to-feed ratios can weather this downturn, though Mexico’s displacement of 507 million pounds of U.S. dairy exports and New Zealand’s aggressive SMP pricing at parity with U.S. NDM suggest the pressure’s structural, not cyclical. Here’s what this means for your operation: those who act now to lock in feed costs while optimizing component production for the 10-cent protein premium over butterfat will navigate this market successfully, while operations waiting for prices to “return to normal” risk becoming part of the consolidation statistics we’ll be discussing next spring.

Your October milk check just took another beating. Block cheese dropped 3 cents to $1.67/lb on heavy volume, while butter scraped out a tiny gain that won’t save your Class IV. With feed costs still manageable at $4.10 corn, the smartest play right now is locking in your inputs before this market forces you to feed $16 milk to $5 corn.

When Six Block Trades Tell the Whole Story

You know, I’ve been tracking these markets long enough to recognize when something’s different. Today wasn’t just another down day – it was a day of conviction selling. Six block cheese trades at the CME (Daily Dairy Report, October 13, 2025), versus the typical four, suggests that the big players are positioning for more pain ahead. That 3-cent drop to $1.67/lb? It broke right through the support level that had been held since late September.

“We’re seeing processors work through inventory rather than chase spot loads,” mentioned Tom Wegner, a Wisconsin cheese plant manager I spoke with this morning. “Nobody wants to be holding expensive cheese when the market’s trending like this.”

The interesting aspect here is the barrel-over-block spread, which is currently sitting at 4 cents. That’s backwards from normal market dynamics. Usually, blocks lead and barrels follow, but today’s zero-barrel trades with just one offer hanging out there suggest that buyers figure they can wait this out. Smart money’s betting blocks catch down to barrels, not the other way around.

Today’s Numbers and What They Actually Mean

| Product | Price | Today’s Move | Weekly Average | Your Bottom Line Impact |

| Cheese Blocks | $1.6700/lb | -3.00¢ | $1.7365 | Directly hits Class III – expect 75¢-$1.00/cwt lower checks |

| Cheese Barrels | $1.7100/lb | No Change | $1.7400 | Holding but won’t prop up Class III |

| Butter | $1.6200/lb | +1.50¢ | $1.6440 | Minor relief, but still 24% below last October |

| NDM Grade A | $1.1275/lb | No Change | $1.1445 | Skim solids glut continues |

| Dry Whey | $0.6350/lb | No Change | $0.6310 | Steady, but can’t offset cheese weakness |

Looking at the CME settlement data (Daily Dairy Report, October 13, 2025), October Class III futures closed at $16.89/cwt while Class IV scraped along at $14.34/cwt. That Class IV number should make you wince – we haven’t seen it this low since 2020’s pandemic collapse.

The Global Chess Game Working Against Us

Here’s what farmers aren’t hearing enough about: New Zealand’s hammering us on powder pricing. Their SMP futures at $2,580/MT translate to about $1.17/lb (NZX Futures, October 13, 2025), basically matching our NDM at $1.1275. When the Kiwis can land powder in Southeast Asia at our prices despite shipping costs, we’ve got problems.

The European situation’s equally concerning. EEX butter futures at €5,500/MT (Daily Dairy Report Europe Futures, October 13, 2025) work out to roughly $2.80/lb – that’s 73% above our $1.62 butter. Sure, it makes us competitive for exports, but it also tells you where global butter thinks our price should be heading. Spoiler alert: it’s not up.

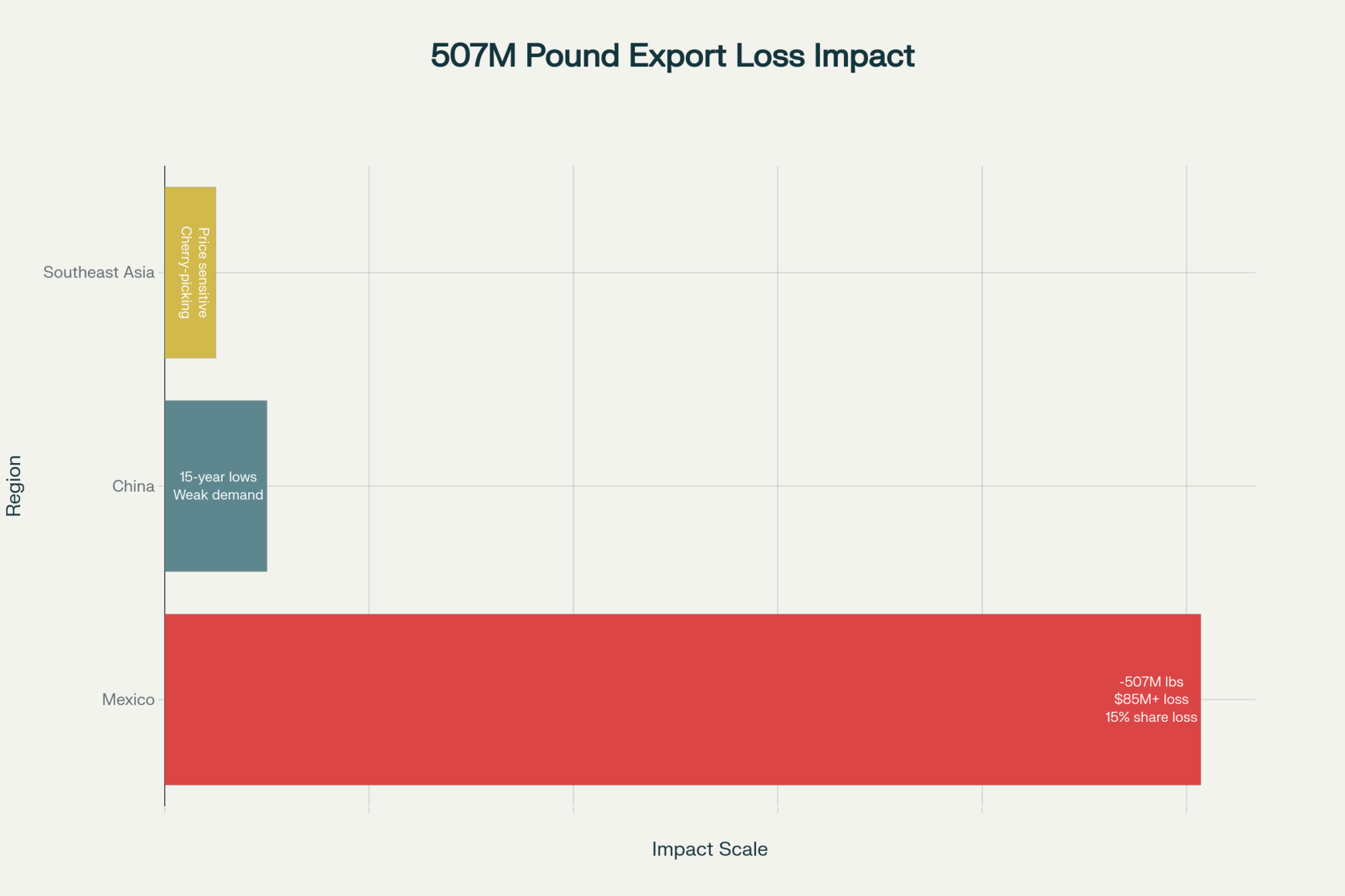

“Mexico’s shift away from U.S. dairy is the elephant in the room nobody wants to acknowledge,” notes Dr. Mary Ledman, dairy economist at Ever.Ag. “We’re talking about 507 million pounds of traditional demand that’s evaporating.” (Industry communication, October 2025)

Feed Markets: Your Only Good News Today

December corn at $4.1050/bu and soybean meal at $274.50/ton (CME Futures, October 13, 2025) gives you breathing room most didn’t have in 2022. I’m currently calculating milk-to-feed ratios of around 2.35 – not ideal, but workable if you’re efficient.

Wisconsin producers I’ve spoken with are seeing slightly better margins, thanks to a local corn basis running 10-15 cents under futures. California residents aren’t as fortunate, as transportation costs them an additional 20-30 cents per delivered feed. The smart operators locked in Q4 needs last month when corn dipped below $4. If you haven’t yet, today’s not terrible, but tomorrow might be.

Income over feed costs pencils out around $7.80/cwt for efficient operations. That’s above the $7 breakeven for most, but barely. And that’s assuming you’re hitting your production targets and not dealing with any health issues in the herd.

Supply Reality: We’re Making Too Much Milk

The USDA’s October report (USDA Dairy Markets, October 2025) estimated national production at 19.3 billion pounds, a 0.7% increase year-over-year. The kicker? The herd expanded to 9.460 million cows – up 41,000 head from last year. Texas and Idaho added 67,000 cows combined, while traditional states like Wisconsin actually contracted by 22,000 head.

What’s interesting here is the regional divergence. Upper Midwest milk flows are running steady to strong as fall weather boosts components. I’m hearing 4.2% butterfat and 3.3% protein from several Wisconsin farms. But those nice components don’t mean much when butter’s in the tank and cheese is falling.

Processing capacity’s the real bottleneck. Plants in the Central region are running at 95-98% capacity (USDA Dairy Market News, October 2025). When you’ve got more milk than processing capacity, spot premiums evaporate. Some producers are currently seeing discounts of 50 cents per class. That hurts.

What’s Really Driving These Markets

Let me paint you a picture of the demand picture, and it’s not pretty. Domestic cheese consumption’s holding steady according to USDA data (USDA Economic Research Service, October 2025), but food service remains 8% below pre-2020 levels. Retail’s picking up some slack, but not enough.

The export story’s worse. China’s imports hit 15-year lows in Q3 2025 while Mexico – our traditionally largest customer – is actively sourcing from Europe and Oceania. Southeast Asian buyers? They’re cherry-picking the lowest global offers, which currently means New Zealand, not us.

“We built this industry on export growth assumptions that aren’t materializing,” one large co-op board member told me off the record. “Now we’re stuck with production capacity sized for markets that disappeared.”

Inventory levels tell their own story. However, butter stocks at 40,052 tonnes (Canadian Dairy Information Center, October 2025) indicate more than adequate supplies, despite the low price. Cheese inventories aren’t publicly reported as frequently, but plant managers tell me they’re holding 10-15% more product than they did this time last year.

Where Markets Head From Here

The futures market’s painting an ugly picture. The November Class III at $16.17 and December at $16.39 (CME Class III Futures, October 13, 2025) suggest that traders don’t expect quick relief. Those aren’t profitable numbers for most operations, especially for newer dairies that carry heavy debt loads.

The technical picture’s equally concerning. Today’s break below $1.70 block support sets up a potential test of $1.65. Below that? The July low of $1.58 comes into play. At those levels, Class III milk drops into the $15s, and that’s when phones start ringing at the bank.

However, consider this: markets often overshoot. Both directions. The same momentum that’s currently crushing prices could reverse if we experience a supply shock – a weather event, disease outbreak, or major plant closure. Problem is, you can’t bank on hope.

Regional Focus: Upper Midwest Feeling the Squeeze

Wisconsin and Minnesota farmers face a unique challenge. They’ve got 22,000 fewer cows than last year, but milk per cow is up 34 pounds (USDA Milk Production Report, October 2025). That productivity gain sounds great until you realize it’s contributing to the oversupply, crushing your milk check.

Basis has tightened to negative 20 cents under Class III as local cheese plants compete for milk. But co-op premiums? They’ve compressed from 75 cents to 35 cents/cwt over the past month. “We’re seeing quality premiums disappear too,” notes Jim Ostrom, who milks 240 cows near Stratford, Wisconsin. “Used to get 50 cents for low SCC. Now it’s 20 cents if you’re lucky.”

The processor’s perspective is different but equally challenging. “We’re making cheese because we have to move milk, not because we have orders,” admits a plant manager who requested anonymity. “Storage is near capacity, and we’re discounting to move product.”

Your Action Plan Starting Tomorrow

First, forget about timing the market bottom. Nobody’s that smart. Instead, focus on what you can control:

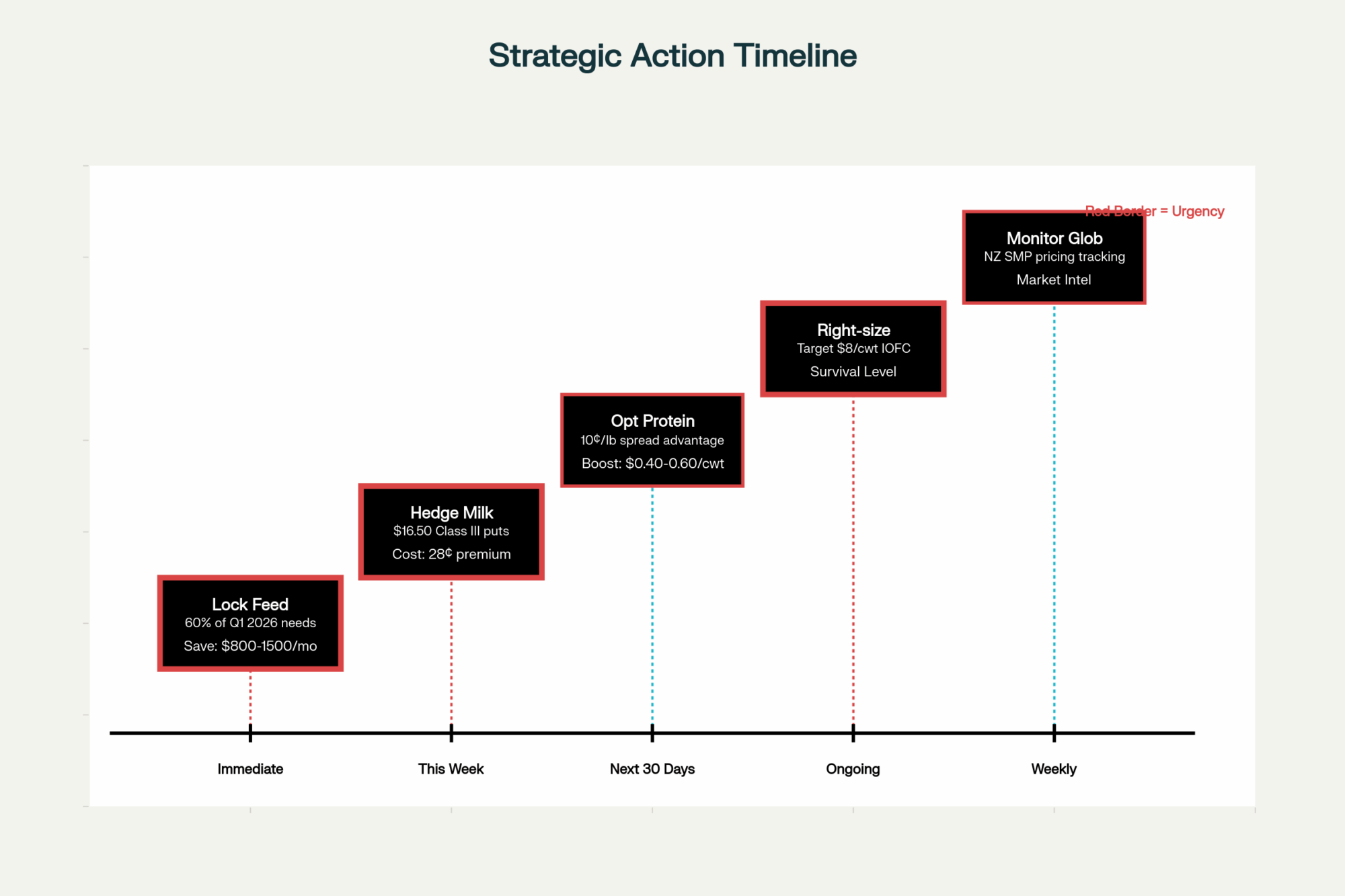

Feed Strategy: Lock in 60% of your Q1 2026 needs at current prices. Corn under $4.25 is a gift in this environment. Don’t get greedy waiting for $3.90.

Hedging Milk: Those $16.50 Class III puts for November-December trading at 28 cents? Cheap insurance. If we break $16, you’ll wish you’d bought them.

Culling Decisions: Fed cattle at $240/cwt (CME Live Cattle, October 2025) makes the beef market attractive. That springer heifer that’s been limping? She’s worth more at the sale barn than in your milk string.

Production Planning: This isn’t the market to push production. Back off the aggressive feeding, focus on component optimization. The current 10-cent spread between protein and butterfat favors protein, despite weak overall prices.

The Uncomfortable Truth About Tomorrow

You want my honest take? Tomorrow’s Tuesday trading will tell us everything. If blocks can’t hold $1.65, we’re looking at an extended period of sub-$16 Class III milk. The global market isn’t coming to save us – they have their own oversupply issues.

The irony is we’re victims of our own success. The U.S. dairy industry has become incredibly efficient at producing milk. The problem is, we’ve become better at producing milk faster than we’ve become better at selling it.

Smart operators are already adjusting. They’re locking in feed, right-sizing herds, and preparing for 6-12 months of margin pressure. The ones waiting for markets to “return to normal”? They’re the ones who’ll be calling the auctioneer next spring.

The Bottom Line

Block cheese at $1.67 triggered the next leg down for milk prices. Class IV’s already in the basement at $14.34, and Class III’s heading toward the $15s unless something changes fast. Your best defense isn’t hoping for higher prices – it’s aggressive cost management and selective hedging.

Lock in those feed costs while corn’s under pressure. Hedge some milk production if you haven’t already. And start having honest conversations about whether your operation’s sized right for $16 milk.

The market’s telling you something. The question is whether you’re listening or just hoping it goes away. Spoiler alert: hope’s not a marketing strategy.

Tomorrow we’ll see if $1.65 holds. If it doesn’t? Well, let’s just say you’ll want those feed costs locked in before everyone else figures out this could get worse before it gets better.

Do you have questions about hedging strategies or would like to share what you’re seeing locally? Reach out at editorial@thebullvine.com. Sometimes the best market intelligence comes from farmers in the trenches, not traders in Chicago.

Key Takeaways

- Lock in 60% of Q1 2026 feed needs immediately – With corn under $4.25/bu and meal below $275/ton, you’re looking at potential savings of $800-1,500 monthly for a 500-cow operation compared to waiting for spring volatility

- Implement defensive milk hedging strategies – November Class III puts at $16.50 strike trading at 28 cents offer cost-effective protection against the 35% probability of sub-$16 milk that futures markets are currently pricing

- Optimize for protein over butterfat production – The current 10-cent/lb spread favoring protein over fat means adjusting rations to maximize protein yield could add $0.40-0.60/cwt to your milk check without increasing feed costs

- Right-size your operation for margin reality – Farms maintaining income-over-feed costs above $8/cwt through efficiency improvements and selective culling will survive; those chasing volume at $7.80 IOFC won’t see 2026

- Monitor global competitive positioning weekly – New Zealand’s SMP at $1.17/lb matching U.S. NDM prices means export recovery isn’t coming to save domestic prices; successful farms are planning for $16-17 milk through Q1 2026

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Feed Cost Squeeze That’s Crushing Dairy Margins — And Why Smart Producers Are Already Positioning for What’s Coming Next – Reveals methods for slashing feed costs by 8-12% through precision ration management and strategic DRP hedging. Learn how to protect your shrinking margin by matching coverage to your actual component check, turning cost pressure into a tactical advantage.

- GDT Reality Check: When the Market Delivered Exactly What We Expected – Provides strategies for building resilience against global price shocks. This analysis explains the 85% correlation between GDT drops and your farmgate price, showing why adaptation—not prediction—is the ultimate survival playbook in 2025’s volatile environment.

- Milk Production Surge Masks $4 Billion Demand Crisis: Why Your Component Strategy Needs an Immediate Overhaul – Demonstrates how prioritizing the protein premium over volume generates $120-180 more per cow annually. Learn to adjust your genetics and feed programs to capture this value, ensuring efficiency trumps production volume in the downturn.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!