This market commentary is provided by Curtis Bosma at HighGround Dairy in Chicago, IL.

Class III Futures

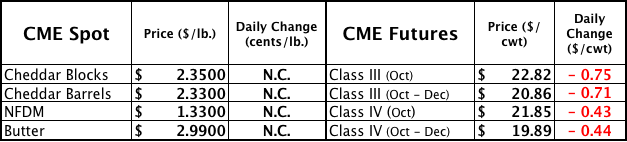

Wednesday brought a massive trend reversal to the entire dairy complex. Class III and cheese futures settled down the limit in Oct and Nov. The spot cheese market has become soft as we have not had much activity over the last two weeks. This could indicate that buyers may have what they need as we enter the holiday season. The steep drop off seen on Wednesday is the result of a ‘perfect storm.’ Reaching new highs on Tuesday may have triggered producers to sell as a hedge. A slight dip may have caused long positions holders to liquidate. Then a panic sell off ensued, causing futures to get annihilated. Spot prices are still holding a hefty premium to futures, but we may see the spot market fall over the next few days.

Class IV Futures

The Class IV market took a one-two punch Wednesday as butter and NFDM futures were extremely bearish. Butter futures experienced a sharp reversal as Sept – Dec contracts settled down the limit (DOWN 0.0500). The Sept – Dec contract average in NFDM futures settled at $1.4181 (DOWN 0.0213). The sell-off in both butter and NFDM brought Sept – May 2015 contracts 8 to 63 cents lower.

CME Spot

The spot market was very quiet again on Wednesday. It could indicate that buyers have all that they need to fill their orders. If this is true I would expect prices to make some large drops over the next few weeks. Butter prices seem to be holding as three loads traded at the high of $2.9900.

Disclaimer: The risk of loss in trading futures and options can be substantial. Past performance is not indicative of futures results.