Dairy farmers are eligible for direct support through USDA’s Coronavirus Food Assistance Program (CFAP). CFAP provides direct financial assistance to agricultural producers, providing them the ability to weather the economic uncertainty caused by COVID-19.

USDA is accepting CFAP applications through August 28. Call and set up an appointment with your local USDA Farm Service Agency (FSA) office to determine your eligibility and to apply for assistance.

Am I eligible for assistance under CFAP?

CFAP payments are eligible to all dairy operations with milk production in January, February, and/or March 2020, including any dumped milk production during that period. All farmers who produced milk between January and March 2020, including those who went out of business or otherwise stopped producing milk during this period or after, are eligible. Production enrolled in risk management programs, including Livestock Gross Margin, Dairy Revenue Protection, Dairy Margin Coverage or forward contracts, also qualifies for CFAP payments.

What is the payment level for milk production?

For dairy, a single payment will be made derived from two funding formulas intended to calculate losses caused by the coronavirus. The first and larger component is calculated from a producer’s certification of milk production for the first quarter of calendar year 2020 multiplied by $4.71 per hundredweight. The second component of the payment is based on a 1.014% increase in that first quarter production, multiplied by $1.47 per hundredweight. Overall, the payment amounts to $6.20/cwt. for a farm’s production in January through March of this year.

What other CFAP categories am I eligible for?

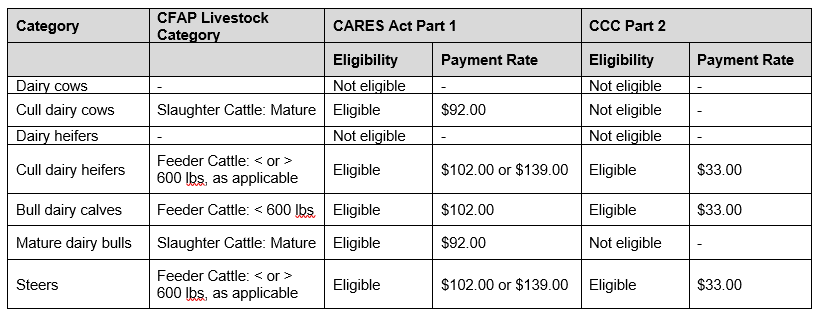

Besides milk production, dairy farmers may be eligible for payments under the following categories. Click here for the full list of eligible commodities.

Livestock: Cull cows, Steers, Bull calves, Mature bulls, Cull heifers

Non-Specialty Crops: Corn (including high moisture corn), Sorghum, Soybeans

How does the livestock payment affect my dairy operation?

Livestock that are no longer used for dairy production and have entered the beef cattle market, if all other eligibility requirements are met, may be eligible for CFAP and would be categorized accordingly. USDA has provided guidance to assist dairy producers in determining eligibility. The payment rates listed below are all per head.

A single payment for livestock will be calculated using the sum of the producer’s number of livestock sold between Jan. 15 and April 15, 2020, multiplied by the payment rates per head, and the highest inventory number of livestock between April 16 and May 14, 2020, multiplied by the payment rate per head. For more information, visit USDA’s CFAP webpage for livestock.

How do payment limits work under CFAP?

CFAP payments are subject to a per-person and legal entity payment limitation of $250,000. This limitation applies to the total amount of CFAP payments made with respect to all eligible commodities. Unlike other FSA programs, special payment limitation rules are applied to participants that are corporations, limited liability companies, and limited partnerships (corporate entities). These corporate entities may receive up to $750,000 based upon the number of shareholders (not to exceed three shareholders) who are contributing at least 400 hours of active personal management or personal active labor.

For a corporate entity:

- With one such shareholder, the payment limit for the entity is $250,000;

- With two such shareholders, the payment limit for the entity is $500,000 if at least two members contribute at least 400 hours of active personal labor or active personal management, or combination thereof, with respect to the operation of the corporate entity; and

- With three such shareholders, the limit is $750,000 if at least three members contribute at least 400 hours of active personal labor or active personal management, or combination thereof, with respect to the operation of the corporate entity.

Does money I’ve received this year through the Small Business Administration’s Paycheck Protection Program (PPP) and/or the Economic Injury Disaster Loan (EIDL) program count against the payment limits in the CFAP program?

No. Small Business Administration’s loan programs, including the PPP and EIDL program, are separate from USDA’s coronavirus payments. Farmers can apply for financial assistance through both agencies, and assistance received from one agency should not affect assistance received from the other.

Are there special provisions for seasonal producers or organic producers?

There are no special provisions for seasonal dairy producers or organic dairy producers under the current program.

How do I apply?

A CFAP Payment Calculator is available to assist with applications. This Excel workbook allows you to enter information specific to your operation to determine estimated payments and populate the application form. Producers interested in filling out the application manually can also download the application form, AD-3114.

Producers self-certify when they apply for CFAP, and documentation is not submitted with the application. But you may be asked for additional documentation to support your certification of eligible commodities, so you should retain the documentation used to complete your application.

FSA staff at local USDA Service Centers will work with farmers to file applications. Applications may be submitted via mail, fax, hand delivery, or via electronic means. Please call your office prior to sending applications electronically. Visit www.farmers.gov/cfap for more information. Applications will be accepted through August 28, 2020.

When should I expect to receive my payment?

To ensure the availability of funding throughout the application period, producers will receive 80 percent of their maximum total payment, up to the payment limit, upon approval of the application. The remaining portion will be paid at a later date as funds remain available.

Should I expect any additional aid in the coming months?

Congress is considering additional legislation to respond to the significant impacts of the COVID-19 pandemic. The House-passed HEROES Act includes a number of beneficial provisions for dairy farmers, including additional direct payments, and we anticipate that the Senate will begin work on a bill in the coming weeks. NMPF will keep dairy farmers updated about any subsequent aid made available.

Dairy farmers and their allies are encouraged to spend a few minutes customizing our call-to-action letter urging Congress to prioritize dairy assistance in its next coronavirus assistance package.

Visit www.farmers.gov/cfap for additional information about CFAP and www.nmpf.org/coronavirus for a full listing of coronavirus resources for dairy farmers and co-ops. Please email info@nmpf.org with questions or comments about CFAP and how it is being administered in your local office.