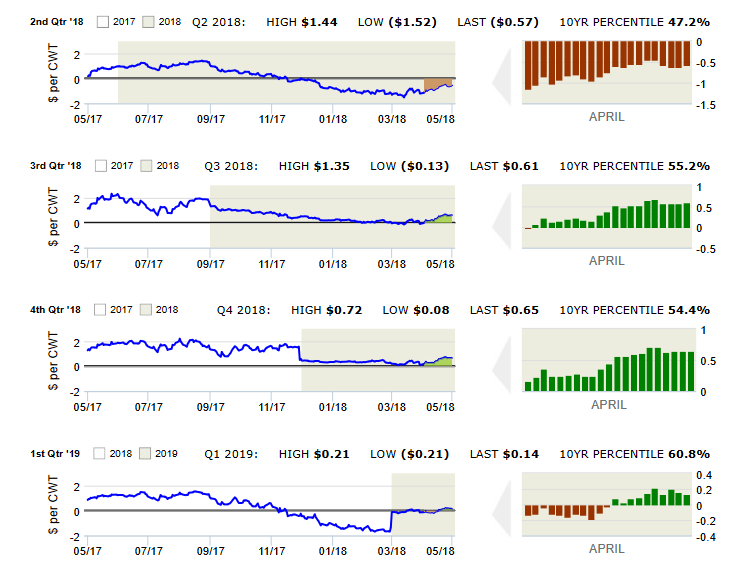

Dairy margins improved slightly over the last half of April as increased milk prices more than offset the impact of rising feed costs. While margins are still only about average from a historical perspective, with the exception of spot Q2, they are projected positive into early 2019. Milk prices are drawing support from a delayed spring flush following unseasonably cold weather in the Upper Midwest while a recent surge in NDM prices has lifted Class IV Milk futures on the CME. USDA reported March Milk Production at 18.987 billion pounds, up 1.3% from last year, with the milking herd estimated at 9.406 million head, down 2,000 from February but 23,000 higher than March, 2017. Production per cow averaged 1,954 lbs. in March, up 1.1% from last year. Meanwhile, USDA Cold Storage data reflected more modest builds in dairy inventories than would seasonally be expected. Butter stocks in cold storage at the end of March totaled 273.6 million pounds, up 2.9% from February and 0.4% higher than last year. The February to March build in supply slightly trailed the 3.8% average based on the past ten years. Total cheese in cold storage on March 31 was 1.328 billion pounds, up 0.8% from February compared to the average build of 1.6% between February and March over the past ten years. Total cheese stocks were also up 5.2% from March, 2017. Feed costs have continued to advance on strong demand amidst ongoing planting delays. USDA reported corn planting progress for the week ending April 29 at 17% complete compared to 32% last year and 30% on average for the end of April over the past 10 years. Soybean planting progress was reported at 5% complete versus 9% last year and 6% on average for this point in the season. Our clients have been mainly focused on strategic adjustments to existing positions, including allocation of milk hedges between Class III and Class IV, and adding flexibility to feed hedges.

The Dairy Margin calculation assumes, using a feed price correlation model, that for a typical dairy 62.4 lbs of corn (or equivalent) and 7.34 lbs of meal (or equivalent) are required to produce 100 lbs of milk (includes dry cows, excludes heifers not yet fresh). Additional assumed costs include $0.90/cwt for other, non-correlating feeds, $2.65/cwt for corn and meal basis, and $8.00/cwt for non-feed expenses. Milk basis is $0.75/cwt and non-milk revenue is $1.00/cwt.

Source: CIH