The T.C. Jacoby Weekly Market Report Week Ending October 15, 2021

Despite some moderation during Friday’s spot session, gains earlier in the week left prices higher than last Friday for both butter and nonfat dry milk (NDM), pushing Class IV milk values upward.

Class IV products continued to garner much attention in Chicago this week. Despite some moderation during Friday’s spot session, gains earlier in the week left prices higher than last Friday for both butter and nonfat dry milk (NDM), pushing Class IV milk values upward.

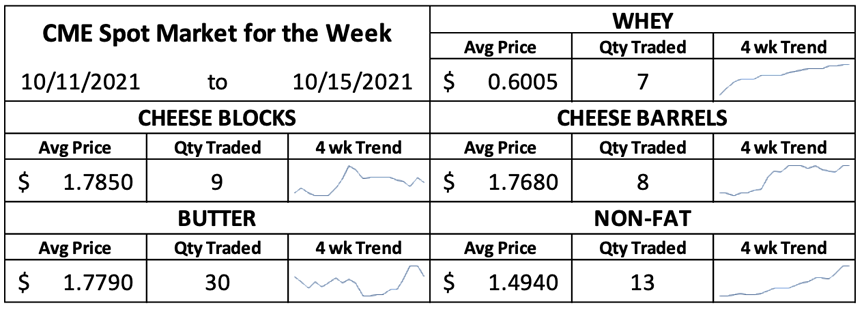

NDM saw the biggest gains during the spot trade this week. A .5¢ decline on Friday did little to counteract the substantive jumps seen on Tuesday and Wednesday. As a result, NDM finished the week at $1.5325 per pound, an increase of 7.25¢ versus last Friday. This represents the first time since 2014 that NDM prices have exceeded $1.50 per pound. 13 loads of product traded hands over the course of the week. Participants describe the NDM market as tight, even though loads of condensed skim are still available. USDA’s Dairy Market News reports that there is more product available in the West, but logistical challenges are preventing buyers from easily moving product from one region to another.

Butter markets also contributing to the Class IV gains. Demand for butter has been robust as the holiday season approaches and buyers, concerned about being caught short due to labor and logistical issues, seem to have front loaded orders. The outlook for butter demand over the rest of the holiday season is mixed but for the moment, product continues to move at a rapid clip. Strong butter demand pushed the CME up to $1.82 per pound on Wednesday, before giving up 4.5¢ during Friday’s trade. Ultimately, the CME spot butter price ended the week at $1.775 per pound, an increase of 5.5¢ compared to last Friday

With the strength imbued by NDM and butter, Class IV futures markets appreciated over the week, with particularly strong gains on Wednesday and Thursday. Futures markets for Class III and Class IV milk are showing remarkable parity through much of 2022. In fact, as of Friday’s settlement, JAN22 through MAY22 Class IV contracts are higher than those of Class III.

The spot cheese markets slid lower during the first half of the week before finding traction and bouncing pack on Thursday. During Friday’s trade, barrels held steady at $1.79 per pound while blocks again lost ground, falling to $1.78 per pound and inverting the block-barrel spread for the first time since June. Blocks finished the week 3¢ lower than last Friday while barrels were unchanged. Holiday demand has also perked up for cheese and processors indicate that given the availability of affordable spot milk, they would happily increase production if they thought they could reliably find enough labor to do so.

Whey markets continued to strengthen this week, adding value to Class III prices. Spot dry whey rose as high 60.5¢ per pound on Thursday before giving up a quarter cent to close the week at 60.25¢ per pound, up .75¢ from last Friday. Whey prices have not exceeded 60¢ per pound since June, when they were on the descent from their record setting rally. Somewhat lighter cheese production has reduced the available whey stream while demand remains robust from both domestic and international sources.

Milk production is beginning to tick upward in most areas of the country with milk availability generally described as good. Class I demand has subsided from a few weeks ago, when the start of school bumped up demand from bottlers, but remains significantly elevated relative to prior year. Labor shortages are pervasive, and a lack of plant operators and truck drivers are creating challenges up and down the supply chain. At the ports, well documented congestion is interrupting dairy exports and causing a buildup of inventories. Yet even as challenges abound, demand for U.S. dairy products remains robust from both international and domestic buyers.

USDA’s World Agriculture Supply and Demand Estimates report, released on Tuesday, held some surprises for the trade. USDA rebuffed analysts’ expectations, increasing production estimates for both corn and soybeans on the back of higher yields. The forecast for corn production during the 2021/22 marketing year was raised by 0.2% to 15.019 billion bushels. Larger production,

an increase in beginning stocks, and a decrease in total use forecasts allowed USDA to increase its corn ending stocks estimate by 92 million bushes. On the soybean balance sheet, a 1.6% increase in soybean production also trickled down to a 135-million-bushel, or 75%, increase in ending stocks. This dramatic change pulled the average farm price down to $12.35 per bushel for the 2021/22 crop year, 55¢ lower than last month’s estimate.

The increase in US corn and soybean production fed into expectations for larger global output, even as other key exporters of both crops saw their corn production expectations cut. The surprising WASDE report sent the futures markets for corn and soybeans tumbling on Tuesday, though they recovered later in the week. Heftier grain supplies should lead to lower grain prices and reduce pressure on dairy producer economics.

Original Report At: https://www.jacoby.com/market-report/class-iv-products-garner-much-attention-in-chicago-this-week/