The T.C. Jacoby Weekly Market Report Week Ending July 10, 2020

In an environment as fickle as the Chicago Mercantile Exchange, bulls are not typically bred for their stamina. But in the Cheddar block market there is a bull of a different breed.

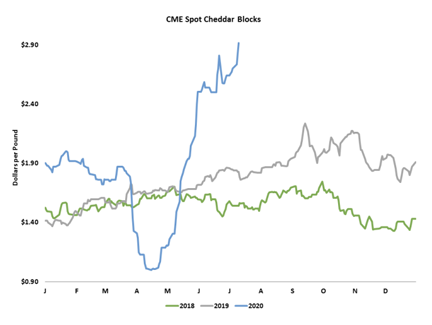

In an environment as fickle as the Chicago Mercantile Exchange, bulls are not typically bred for their stamina. They tend to charge and then pause to catch their breath before attempting another run, and they are not ashamed to retreat to the shade from time to time. But in the Cheddar block market – currently the greenest pasture in the commodity world – there is a bull of a different breed. He is relentless, charging straight uphill with no signs of fatigue. This week the block market leapt from one record to the next, finally resting at an alltime high of $2.915 per pound, up 24ȼ from last week’s already lofty value. The barrels were less energetic. They fell 7.5ȼ this week to a still-lofty $2.34.

In an environment as fickle as the Chicago Mercantile Exchange, bulls are not typically bred for their stamina. They tend to charge and then pause to catch their breath before attempting another run, and they are not ashamed to retreat to the shade from time to time. But in the Cheddar block market – currently the greenest pasture in the commodity world – there is a bull of a different breed. He is relentless, charging straight uphill with no signs of fatigue. This week the block market leapt from one record to the next, finally resting at an alltime high of $2.915 per pound, up 24ȼ from last week’s already lofty value. The barrels were less energetic. They fell 7.5ȼ this week to a still-lofty $2.34.

Near-term demand for blocks remains formidable. USDA’s Dairy Market News reports, “With government buying programs in place, along with steadfast retail demand during grilling season, [Midwestern] buyers are still active and willing to pay prices very few contacts would have expected when markets were near $1 in April.” However, in the Northeast and the West, some cheese buyers question the staying power of such unprecedented prices. Grocers and the food box program are moving a lot of cheese, but orders are starting to slow from restaurants, hotels, and caterers, especially in areas where coronavirus counts are climbing. Meanwhile, cheesemakers are running hard. Despite the heat, there is plenty of milk in the Upper Midwest, and cheesemakers are able to secure spot loads at a discount.

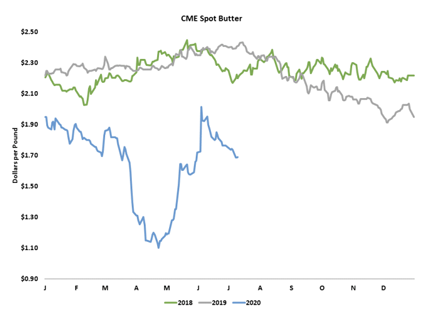

Butter production has slowed as cream heads to other uses, particularly ice cream. Butter demand continues to suffer from the pronounced slowdown in the restaurant and foodservice industry. This week, CME spot butter fell 4.75ȼ to $1.69.

Butter production has slowed as cream heads to other uses, particularly ice cream. Butter demand continues to suffer from the pronounced slowdown in the restaurant and foodservice industry. This week, CME spot butter fell 4.75ȼ to $1.69.

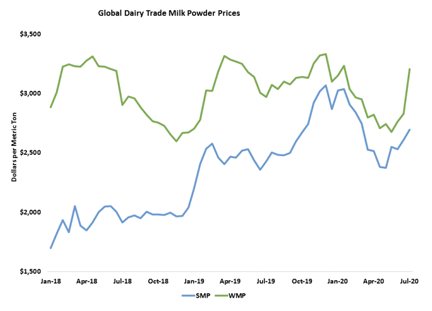

The milk powder market perked up a bit. CME spot nonfat dry milk (NDM) advanced 0.75ȼ to $1.0175. Milk powders made big strides at the Global Dairy Trade (GDT) auction on Tuesday, boosting the GDT index to its largest gain since November 2016, up 8.3% from the previous event. Skim milk powder rallied 3.5% to the equivalent of NDM at $1.30 per pound, after adjusting for protein. Whole milk powder vaulted 14%. Global demand for milk powder has proven surprisingly strong despite the woes of the pandemic, and higher SMP prices are making U.S. milk powder increasingly competitive. On the domestic front, NDM is moving out of warehouses and into cheese vats.

CME spot whey slipped 4.25ȼ this week to 28.75ȼ, the lowest value since last November. Robust cheese production is generating a steady stream of whey, and manufacturers’ are largely eschewing value-added whey products, so whey powder is piling up. With gyms around the country sitting empty, sales of highprotein whey products have slowed. Those who exercise regularly may find ways to incorporate dairy protein into their at-home regimens, but they likely won’t try new products or make an impulse purchase until they’re back in the gym. Dry whey has gotten plentiful and cheap enough to attract a bit more foreign business, but stocks continue to grow. Whey is likely to remain a drag on Class III values.

Class III futures followed Cheddar blocks higher. The July contract rallied $1.23 to $24.20, within shouting distance of the alltime high of $24.40, set in October 2014. August Class III soared $2.09 to $23.04. Over the past month, the August contract has added more than $6 per cwt., a staggering increase. Deferred Class III futures posted double-digit gains. Class IV futures settled in the red, with 30ȼ to 40ȼ losses on the front of the board. Sky-high Class III values are likely encouraging dairy producers to add as much milk as they can, but the heat may stymie their efforts.

Class III futures followed Cheddar blocks higher. The July contract rallied $1.23 to $24.20, within shouting distance of the alltime high of $24.40, set in October 2014. August Class III soared $2.09 to $23.04. Over the past month, the August contract has added more than $6 per cwt., a staggering increase. Deferred Class III futures posted double-digit gains. Class IV futures settled in the red, with 30ȼ to 40ȼ losses on the front of the board. Sky-high Class III values are likely encouraging dairy producers to add as much milk as they can, but the heat may stymie their efforts.

The grain markets rallied early in the week, as a hot, dry forecast raised concerns about yields. The markets got a mid-week boost after USDA reported a sizable sale of U.S. corn to China, and China’s ag ministry projected continued imports. For years, China has relied on its massive corn reserves and done its best to keep out foreign grain. Now the Chinese reserve is dwindling, and China’s rapidly modernizing hog industry requires more feed than its backyard herd did in the past.

USDA published its monthly update to crop balance sheets today, but they held no surprises. The market shrugged and turned its attention to the forecast. Better-than-expected rains dampened the bulls’ earlier enthusiasm. The corn crop will still have to pollinate in the middle of a heat wave, and there are plenty of dry spots. But there is an abundance of grain in the world, and supplies will be ample even if this year’s corn crop falls a little short of its full potential. September corn settled at $3.3625 per bushel, down 7.25ȼ from last Thursday. August soybeans closed at $8.87, down 4.25ȼ.

Original post at https://www.jacoby.com/market-report/cheddar-block-market-the-greenest-pasture-in-the-commodity-world