The T.C. Jacoby Weekly Market Report Week Ending April 2, 2021

With milk production expected to stay strong, dairy product production will continue to be robust. This aggressive production threatens to overhang the market unless demand can demonstrate a meaningful and sustained expansion.

Spring has sprung across the United States. As the days lengthen and the temperatures rise, milk production is also growing seasonally. In the Western region of the country, market participants indicate that peak production levels are on the horizon, perhaps just weeks away. Meanwhile, in the Upper Midwest, while seasonally high volumes are a bit further off, market participants continue to report very strong figures relative to prior year. Bottling demand has perked up as students return from spring break, but milk remains readily available for manufacturing needs.

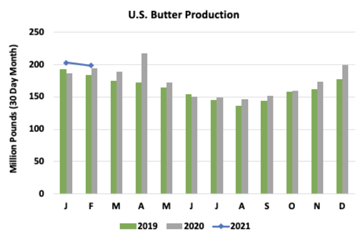

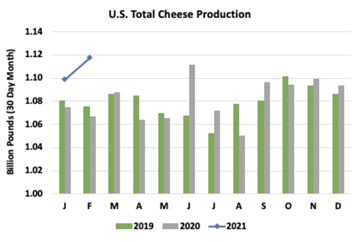

Abundant raw milk has translated into record setting production of dairy products. In USDA’s Dairy Products report released on Thursday, production of butter, cheese, and nonfat dry milk in February was the highest ever seen for that month, at least on an average daily basis. With milk production expected to stay strong, dairy product production will continue to be robust. This aggressive production threatens to overhang the market unless demand can demonstrate a meaningful and sustained expansion.

Abundant raw milk has translated into record setting production of dairy products. In USDA’s Dairy Products report released on Thursday, production of butter, cheese, and nonfat dry milk in February was the highest ever seen for that month, at least on an average daily basis. With milk production expected to stay strong, dairy product production will continue to be robust. This aggressive production threatens to overhang the market unless demand can demonstrate a meaningful and sustained expansion.

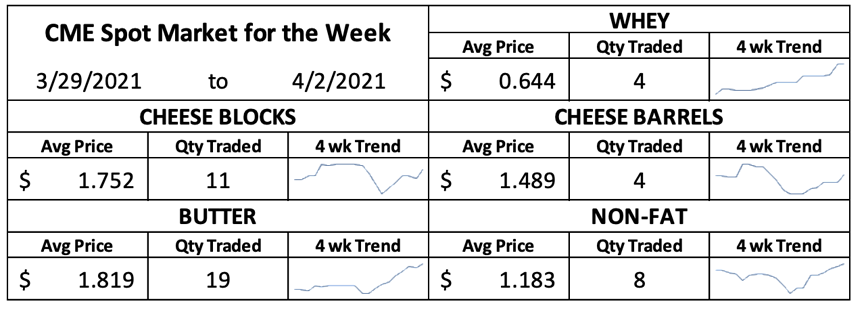

Yet despite supply concerns, the CME spot dairy markets all saw gains over the course of the week. Butter had the biggest weekly rise, adding 7¢ during the short week with 19 loads trading hands. After closing Thursday’s spot session at $1.845/lb., spot butter prices are now the highest they have been since June of last year. Butter demand has improved as spring holiday baking has supported retail purchases while the reopening of restaurants increased the pull from foodservice. New crop butter rules are also likely helping to support some of the spot price increase, since there is no denying that product is readily available. February butter production set a new record for the month. At 185.6 million pounds, butter production was up 2.2% year over year, after accounting for the leap day.

Cheese markets also got a boost this week. Market participants indicate that food service demand for cheese has improved markedly, which is helping to keep some tension in the market. Nevertheless, cheesemakers have been busy, manufacturing a total of 1.043 billion pounds of cheese in February. Representing an increase of 4.7% versus February 2020, cheese production set a record for the month. Production data shows that manufacturers favored the production of American style cheeses during February, though Cheddar output in particular has slipped compared to earlier months. Meanwhile, the production of Italian style cheeses also increased versus prior year, albeit by a slower margin than American style cheeses. Improving restaurant activity should disproportionately benefit Italian cheese demand in the coming months.

Cheese markets also got a boost this week. Market participants indicate that food service demand for cheese has improved markedly, which is helping to keep some tension in the market. Nevertheless, cheesemakers have been busy, manufacturing a total of 1.043 billion pounds of cheese in February. Representing an increase of 4.7% versus February 2020, cheese production set a record for the month. Production data shows that manufacturers favored the production of American style cheeses during February, though Cheddar output in particular has slipped compared to earlier months. Meanwhile, the production of Italian style cheeses also increased versus prior year, albeit by a slower margin than American style cheeses. Improving restaurant activity should disproportionately benefit Italian cheese demand in the coming months.

Cheddar blocks were able to capitalize on the increase in demand, though the spot market was fickle. Price increases on Monday and Thursday counteracted a penny drop on Wednesday, ultimately pushing the spot price up by 5.5¢ to $1.775/lb. Barrels were more consistent, with prices marching upward in three out of the four daily spot sessions, finishing the week at $1.5125/lb., up a nickel from last week.

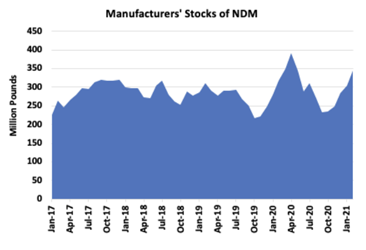

February production data illustrates that during the month dryers held a strong bias for producing nonfat dry milk (NDM) for use in the domestic market or to be shipped to nearby Mexico, versus skim milk powder which would likely be send farther afield. Totaling 186.3 million pounds for the month, NDM production was up by 13.0% year over year. Meanwhile, SMP production slipped by 20.3% to 29.6 million pounds. This preference is likely a reflection of the nagging logistical issues that are preventing U.S. produced SMP from being easily exported. Strong NDM production also translated to a buildup in stocks as manufacturers’ stocks of NDM grew to 345.6 million pounds at the end of February, the highest amount ever recorded at the end of that month. In the spot NDM market, the price rose by a half cent in each of the four trading days of the week, bringing the price on Thursday to $1.19, up two cents from last Friday’s close.

February production data illustrates that during the month dryers held a strong bias for producing nonfat dry milk (NDM) for use in the domestic market or to be shipped to nearby Mexico, versus skim milk powder which would likely be send farther afield. Totaling 186.3 million pounds for the month, NDM production was up by 13.0% year over year. Meanwhile, SMP production slipped by 20.3% to 29.6 million pounds. This preference is likely a reflection of the nagging logistical issues that are preventing U.S. produced SMP from being easily exported. Strong NDM production also translated to a buildup in stocks as manufacturers’ stocks of NDM grew to 345.6 million pounds at the end of February, the highest amount ever recorded at the end of that month. In the spot NDM market, the price rose by a half cent in each of the four trading days of the week, bringing the price on Thursday to $1.19, up two cents from last Friday’s close.

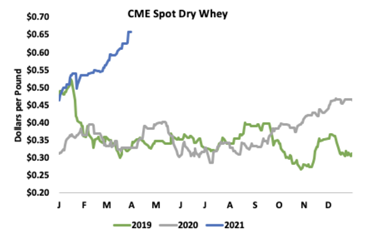

The whey markets continue to move upward, with the spot dry whey price boasting a new record this week. After opening the week unchanged and adding just a quarter cent on Tuesday, the price moved up by 3¢ on Wednesday as three loads traded hands. The market remained unchanged at 66¢/lb. on Thursday. Dry whey production rose by 4.3% year over year in February, as strong cheese production threw off a plentiful whey stream. Yet, dry whey production paled in comparison to the manufacture of higher protein products. Production of whey protein concentrates and whey protein isolates rose by 8.8% and 28.3%, respectively. This preference for higher protein products continues to keep tension on the dry whey market, contributing to the spot price increase.

The whey markets continue to move upward, with the spot dry whey price boasting a new record this week. After opening the week unchanged and adding just a quarter cent on Tuesday, the price moved up by 3¢ on Wednesday as three loads traded hands. The market remained unchanged at 66¢/lb. on Thursday. Dry whey production rose by 4.3% year over year in February, as strong cheese production threw off a plentiful whey stream. Yet, dry whey production paled in comparison to the manufacture of higher protein products. Production of whey protein concentrates and whey protein isolates rose by 8.8% and 28.3%, respectively. This preference for higher protein products continues to keep tension on the dry whey market, contributing to the spot price increase.

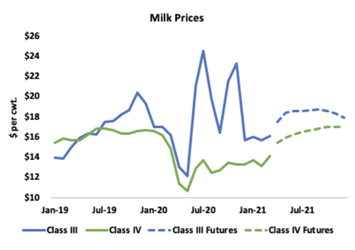

Activity in the spot dairy sessions combined with noise in the grain markets had a significant influence on milk futures over the course of the week. After posting some mixed performance on Monday and Tuesday, Wednesday’s Prospective Plantings report suggesting impending feed price increases contributed to significant gains in the Class III futures market. Several nearby contracts traded as high as limit up before settling off these highs. Some further gains during Thursday’s session pushed prices higher still. The MAY21 Class III contract settled on Thursday a full 95¢ higher than on Monday. Most nearby Class IV milk futures contracts also saw gains over the course of the week, bolstered by increases in the spot butter market.

Activity in the spot dairy sessions combined with noise in the grain markets had a significant influence on milk futures over the course of the week. After posting some mixed performance on Monday and Tuesday, Wednesday’s Prospective Plantings report suggesting impending feed price increases contributed to significant gains in the Class III futures market. Several nearby contracts traded as high as limit up before settling off these highs. Some further gains during Thursday’s session pushed prices higher still. The MAY21 Class III contract settled on Thursday a full 95¢ higher than on Monday. Most nearby Class IV milk futures contracts also saw gains over the course of the week, bolstered by increases in the spot butter market.

A surprising Prospective Plantings report released on Wednesday sent corn and soybean prices skyward. Despite already high prices which were expected to inspire additional plantings, the initial survey data included in the report underwhelmed. Corn plantings for the upcoming market year are estimated at 91.1 million acres. Though up from last year, this figure is a couple million acres shy of most trade estimates. Soybean planting expectations also underwhelmed at 87.6 million acres. The lower-than-expected planted acreage combined with meager carryover stocks sent grain futures limit up on Wednesday and are expected to result in higher feed costs for dairy producers.

Source: Jacoby